Kameleon007/iStock via Getty Images

On Sunday, March 12th, Janet Yellen, Secretary of the Treasury, Jerome Powell, Chairman of the Federal Reserve and Martin Gruenberg, Chairman of the FDIC put out a joint statement announcing measures to address the recent banking crisis.

The announcement contained two key elements:

1. All depositors at Silicon Valley Bank (SVB) and all depositors at Signature Bank will be made whole.

2. The Federal Reserve will make available additional funding for eligible depository institutions to help assure banks have the ability to meet the needs of their depositors.

This new policy is critical because FDIC insurance only covers deposits up to $250,000.

At year end 2022 SVB had $175 billion in deposits, more than 95% of which were in accounts greater than $250,000. These uninsured depositors were at risk of not having access to their funds, which created a panic.

Implicitly these government agencies are protecting all uninsured depositors in order to prevent contagion across the banking industry and a further old-fashioned run on the banks, whereby many depositors rush to withdraw their funds.

Bank Term Funding Program

The new Fed facility, the Bank Term Funding Program (BTFP), is to lend for periods of up to one year on a collateralized basis. The collateral is anything that is eligible for the Fed to purchase under open market operations. This is primarily US Treasury securities, agency debt and mortgage-backed securities.

An important element of BTFP is that collateral will be valued at par. The significance of this is that much of the current collateral held at banks has a market value of less than par, as it was purchased during the recent period when interest rates were much lower than they are now. By using par value, the Fed is allowing the banks more leniency in their borrowing. The Fed is deviating from their historical practice by not requiring at least 100% collateral backing their loans.

The market decline in their bond holdings is what got SVB in trouble in the first place. Because they owned long duration Treasuries and MBS which had declined in market value as interest rates rose, when depositors withdrew their funds, SVB needed to raise cash to meet the withdrawals and their only quick option was to sell their bonds at a loss, which wiped out their capital.

By allowing borrowing under BTFP with collateral valued at par, the banks will not be forced to sell their underwater securities and recognize losses to meet their liquidity needs.

Banks will pay the Fed the one-year overnight index swap rate plus 10 basis points for their loans under BTFP. Currently this rate is 4.75%.

Total Bank Borrowing

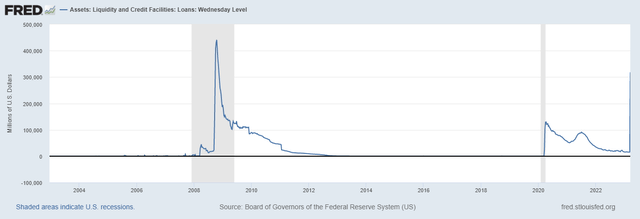

During the chaos of the past week, troubled banks tapped the Fed for $303 billion in new borrowing.

FRED

At $318 billion, the loans extended by the Fed are at the highest level since October 2008, following the failure of Lehman Brothers.

The banks used three lending facilities. The first was the primary credit facility, or the discount window. This is the traditional route for emergency borrowing, but the discount window only provides loans for up to 90 days. Discount window borrowings increased by $148.2 billion. The second facility was the newly created BTFP, which offers loans for up to one year. As it was getting started, banks borrowed $11.9 billion in the first three days of its operation. The final facility was the $142.8 billion extended to the FDIC as it began the process of taking over the failed Silicon Valley and Signature Banks.

Fed Policy Dilemma

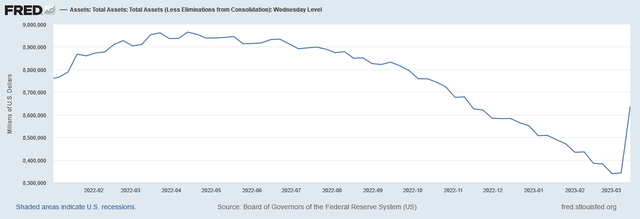

The increase in BTFP borrowings caused the Fed balance sheet to grow by $297 billion in just one week, putting a damper in the Fed’s policy normalization program. Total assets grew to $8.6 trillion, the highest level since November 9th, 2022. This essentially reversed the past four months of quantitative tightening.

FRED

The Fed is now faced with the dilemma of continuing their policy of raising rates and quantitative tightening to combat inflation, or of pausing to maintain stability in our financial institutions.

The irony of the Fed stepping up to meet their mandates of stable prices and financial institution stability, is that the Fed itself is in exactly the same situation as SVB.

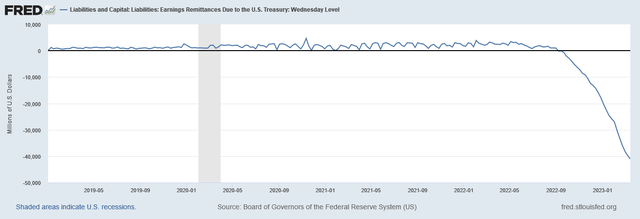

As of March 15th the Fed’s deferred asset account, which is their creative accounting way of hiding their operating losses, grew to -$41.1 billion, virtually wiping out the Fed’s total capital of $42.5 billion.

FRED

As we’ve written about previously click here, the Fed has made the same errors that caused SVB to collapse.

-They have an asset-liability mismatch, with fixed rate long term assets funded by variable rate short term liabilities.

-They have inadequate capital.

-They can hide their weakness with lenient accounting procedures.

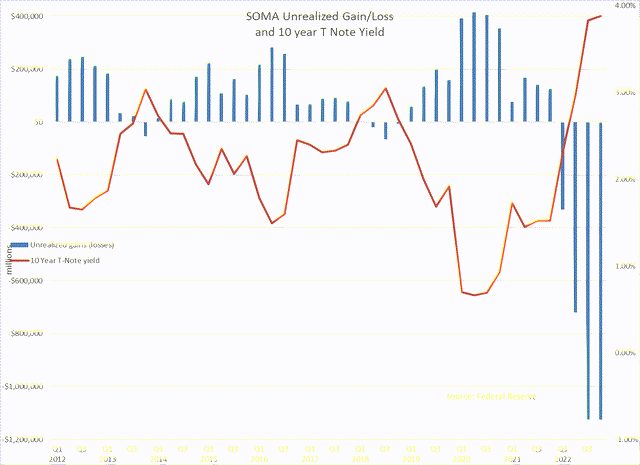

In addition to the Fed’s operating losses that are hidden in their deferred asset account, the Fed also has an unrealized $1.1 trillion loss in their SOMA bond portfolio. The Fed carries their SOMA holdings at amortized cost, while their market value is hidden in a footnote on their balance sheet.

Federal Reserve

The Fed is in the difficult position of trying to provide strength and stability in the markets as they themselves are suffering in the same environment.

The Fed’s weakness compromises their ability maintain control of their policy in two ways. First, as their operating losses and unrealized portfolio losses become more widely known, they risk losing the independence they require to be effective. Second, they risk losing the confidence of the market in their ability to be the backstop. As we’ve seen with the banking crisis, confidence once lost is extremely difficult to win back.