By Michael Lebowitz

Inflation is operating scorching, and the Fed is projecting seven fee will increase this yr alone. As if that isn’t regarding sufficient for bond buyers, the Fed hints at draining liquidity by way of stability sheet discount, i.e., Quantitative Tightening (QT).

At Jerome Powell’s post-March 16, 2022, FOMC press convention, he acknowledged: “it’s clearly time to lift rates of interest and start the stability sheet shrinkage.” Primarily based on additional feedback, Powell desires to begin normalizing the Fed’s stability sheet and drain liquidity as early as Might.

Since March of 2020, the Fed has purchased about $3.5 trillion in U.S Treasury securities and $1.5 trillion in mortgage debt. The gush of liquidity from the Fed’s QE program helped the U.S. Treasury run large pandemic-related deficits. Shopping for over half of the Treasury’s debt issuance in 2020 and 2021 restricted the availability of bonds available on the market and upward stress on rates of interest.

Equally necessary to the Fed, QE comforted buyers in March of 2020 and additional boosted many asset costs all through its existence.

With QE completed and QT on the horizon, we reply a couple of questions that will help you higher recognize what QT is, the way it will function, and focus on how the Fed draining liquidity will have an effect on markets.

What are QE and QT?

Quantitative Easing (QE) is the method through which the Fed purchases Treasury and Mortgage bonds from banks. In change, the banks obtain reserves from the Fed. These reserves will not be money however are the idea by which banks can lend cash. All cash is lent into existence. As such, there’s an oblique connection between QE and cash printing.

Through QE operations, the Fed removes property from the markets. The provision discount creates a supply-demand imbalance for the property they purchase and all the pool of economic property. Consequently, QE tends to assist most asset costs. Because of this, QE has develop into the Fed’s most necessary instrument for combating market instability and thereby boosting investor confidence.

For extra on how QE helps asset costs, we recommend studying our article- The Fed is Juicing Shares.

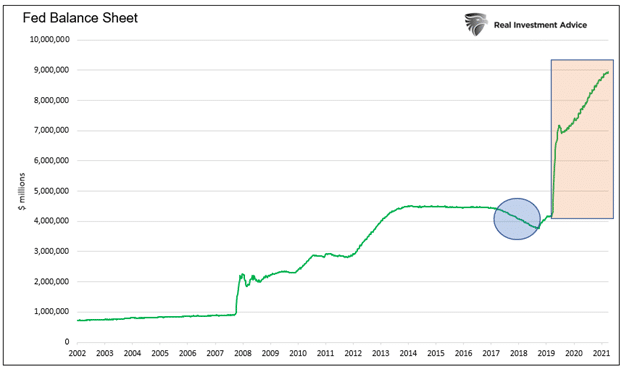

Quantitative Tightening (QT) is the other of QE. Throughout QT, the Fed shrinks its stability sheet. QT has solely been tried as soon as. In 2018, the Fed launched into QT, as circled within the graph under. On the time, they in the end decreased the stability sheet by $675 billion. Sarcastically, the liquidity drain pressured the Fed to return to QE in 2019 as hedge funds bumped into liquidity issues. QT uncovered the fragility of our overleveraged monetary system and its reliance upon simple cash.

Perspective on QE 4

Earlier than we progress, it’s value offering perspective on how large the pandemic spherical of QE (QE4) was in comparison with prior rounds of QE. Eric Parnell sums it up properly:

- For instance, it took the Fed greater than a yr to deploy $300 billion in Treasury purchases as a part of QE1. In response to COVID, the Fed bought $300 billion in Treasuries in simply three days.

- It took the Fed almost eight months to hold out $600 billion in Treasury purchases as a part of QE2. Through the COVID outbreak, the Fed made $600 billion in Treasury purchases in six days.

- And it took the Fed 22 months to hold out $1.5 trillion in Treasury purchases as a part of QE3, which till COVID was thought of the epic QE program. However throughout COVID, they matched this $1.5 trillion in Treasury purchases in simply over a month.

- And then they continued gobbling up Treasuries at a fee of $80 billion per thirty days, or almost $1 trillion a yr, for the following yr and a half by means of late 2021 earlier than FINALLY beginning to wind this system down.

How A lot QT Would possibly The Fed Do?

The rectangle within the graph above highlights the large $5 trillion improve within the Fed’s stability sheet during the last two years. With the Fed Funds fee now on the rise and inflation the primary enemy of the Fed, quite a few Fed members have made it clear they need to normalize the Fed’s stability sheet.

Does “normalizing” imply they are going to scale back the $5 trillion they not too long ago elevated it by?

To assist us guesstimate what normalization entails, we lean on Joseph Wang and his weblog Fed Man. Joseph was a senior dealer on the Fed’s open market desk chargeable for executing QE and QT. As such, he understands the mechanics of QE and QT higher than simply about anybody else.

In his newer article The Nice Steepening he states:

“Chair Powell has sketched out the contours of the upcoming QT program by means of a collection of appearances. He famous at a latest Congressional listening to that it might take round 3 years to normalize the Fed’s $9t stability sheet. The Fed estimates its “normalized” stability sheet based mostly on its notion of the banking system’s demand for reserves. A conservative estimate based mostly on the pre-pandemic Fed stability sheet measurement and considering progress in nominal GDP and foreign money, arrives at a normalized stability sheet of round $6t. This may indicate QT at fee of ~$1t a yr, roughly twice the annual tempo of the prior QT.”

How Will They Do QT?

The Fed has two choices to empty liquidity and scale back its stability sheet. It might probably let bonds mature. It might probably additionally promote bonds to the market.

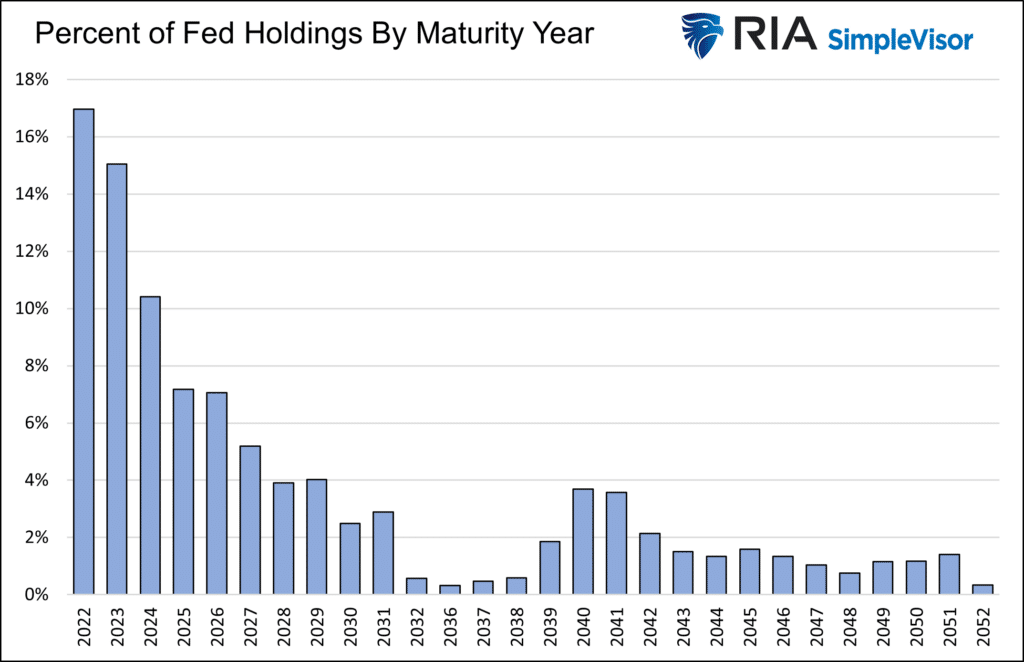

The graph under exhibits that over half of the Fed’s bond holdings mature inside 4 years. The preponderance of shorter maturity bonds permits the Fed to depend on maturation simply. Solely 25% of the bonds mature in ten years or extra. Additionally, observe the x-axis is lacking the years 2033-2035. It’s because they don’t maintain any bonds with these maturities.

Regardless of many brief, dated bonds, the Fed may as an alternative choose to promote bonds. Doing so would permit them to handle the yield curve. As an example, in the event that they introduced a program to exchange all maturing points with new short-term bonds and as an alternative promote longer-term bonds to assist them drain liquidity, longer maturity yields would rise and shorter maturity yields would fall.

Making a steeper yield curve, as such an motion may do, could be advantageous to banks that are inclined to lend lengthy and borrow brief. It might additionally assist the federal government with decrease borrowing charges. The Treasury depends closely on shorter-term bonds to fund its deficits. As of the top of 2021, over half of the Treasury debt excellent matures in three years or much less.

The Fed is Restricted What It Can Do

Some Fed watchers say the Fed might promote bonds and use QT to have an effect on the yield curve. Whereas we might put nothing previous them, the restricted variety of longer-term bonds they’ve on the market makes any significant yield curve management unlikely.

We expect they are going to keep away from promoting longer-term bonds. Yields have risen considerably over the previous few months. With mortgage charges close to 5% and company yields rising sharply, the fed will possible need to restrict any further financial hurt larger charges will trigger.

Can they solely depend on bond maturities to perform $1 trillion a yr of QT?

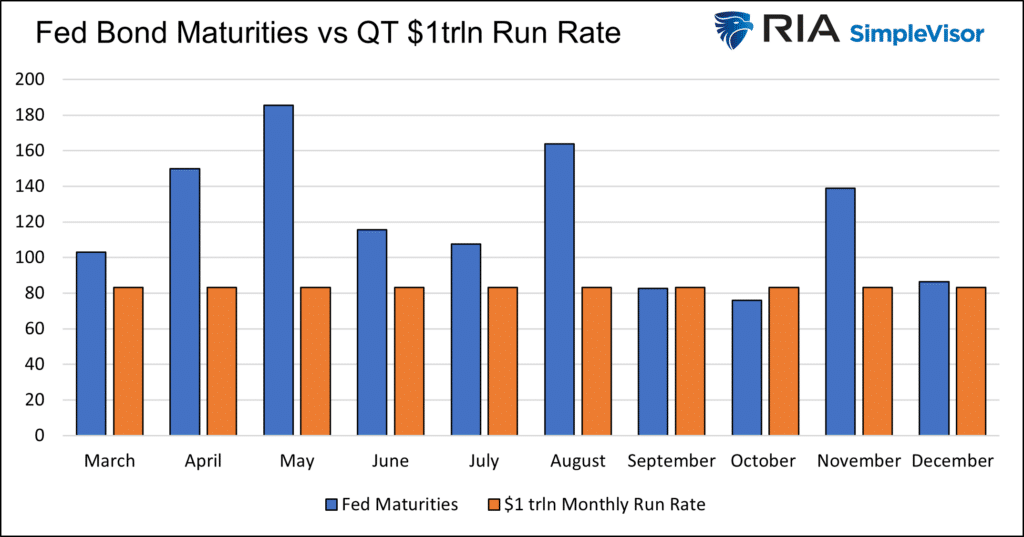

The graph under compares a $1 trillion QT run fee ($83.33 bn per thirty days) versus the Fed’s bond maturities for the rest of 2022.

As we present, there are solely two months, September, and October, through which the quantity of bonds maturing is lower than the $1 trillion run fee. In each instances, the variations are minimal. Additionally, observe that the Fed must purchase bonds within the remaining months.

For instance, in April 2022, $150 billion in bonds will mature. If the Fed limits stability sheet discount to $83 billion, they must purchase about $67 billion in bonds.

In 2023, assuming they’re nonetheless doing QT, there are 5 months through which they might want to promote bonds. The biggest being $20 billion. That stated, purchases in 2022 may simply cowl these gaps by 2023.

What are the Penalties?

Probably the most appreciable impact of QT will possible be on Treasury provide and monetary markets.

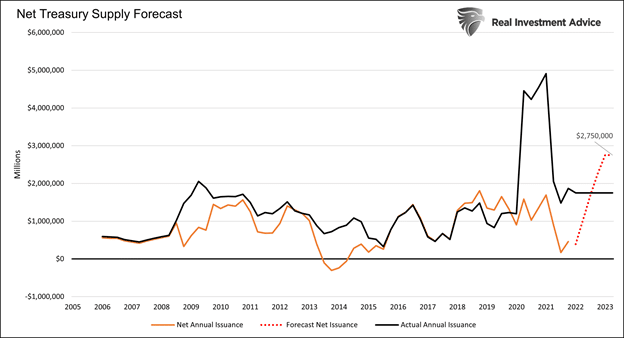

The graph under exhibits that if the Fed follows a $1 trillion per yr QT path, the online provide of Treasury debt can be vital. The black line plots annual issuance. The orange line subtracts Fed purchases to reach at a internet issuance/provide quantity. The web issuance (after Fed purchases) was about $1.5 trillion through the Pandemic. The Fed absorbed a big portion of the large fiscal stimulus.

The purple dotted line tasks the online provide/issuance sooner or later. Assuming $1.75 trillion in annual borrowing and $1 trillion a yr of QT, buyers must soak up $2.75 trillion of Treasury bonds. That’s effectively above the degrees of 2020 and 2021 and almost 3x the quantity within the years earlier than the Pandemic. By itself, such a bounce in provide is a recipe for larger yields.

The Fed might need to normalize its stability sheet, nevertheless it might not be doable with out inflicting issues within the Treasury market.

QT may even be problematic for a lot of different asset markets. As mentioned earlier, eradicating property from the worldwide asset pool helped improve asset costs. The additional bonds available on the market by way of the Fed and new Treasury provide require draining liquidity from different property to fund the U.S. Treasury. Simply as QE helped asset costs, QT ought to equally damage them.

Abstract

The Fed tried QT in 2018 in what is usually thought of a failed try to normalize the stability sheet. As they realized, the markets are too overleveraged to empty sufficient liquidity to normalize the Fed’s stability sheet.

Right this moment, the Fed has grander QT plans regardless of larger asset valuations than in 2018 and extra monetary leverage all through the financial system. The chances of the Fed absolutely normalizing the stability sheet by $3 trillion are slim to none. It’s extra possible the monetary markets cry uncle, and the Fed involves the rescue as soon as once more.

QE 5 is nearer than most buyers suppose!