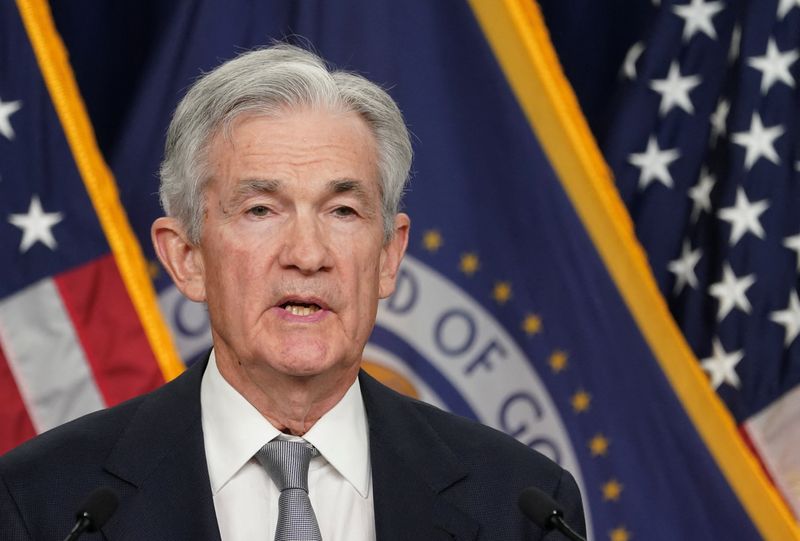

Federal Reserve officers gained’t have the ability to commerce a slew of belongings together with shares and bonds — in addition to cryptocurrencies — beneath new guidelines that grew to become formal Friday.

Following up on rules introduced in October, the policymaking Federal Open Market Committee introduced that many of the restrictions will take impact Might 1.

The foundations will cowl FOMC members, regional financial institution presidents and a raft of different officers together with employees officers, bond desk managers and Fed staff who usually attend board conferences. In addition they prolong to spouses and minor youngsters.

“The Federal Reserve expects that further employees will turn into topic to all or components of those guidelines after the completion of additional overview and evaluation,” a launch saying the foundations said.

The foundations “goal to help public confidence within the impartiality and integrity of the Committee’s work by guarding in opposition to even the looks of any battle of curiosity,” the assertion additionally stated.

Central financial institution officers acted after disclosures final 12 months that a number of senior Fed officers had been buying and selling particular person shares and inventory funds simply earlier than the time the central financial institution adopted sweeping measures aimed toward boosting the financial system within the early days of the Covid unfold.

Regional presidents Eric Rosengren of Boston and Robert Kaplan left their positions following the controversy.

Crypto ban

The announcement Friday prolonged the ban to cryptocurrencies like bitcoin, which weren’t talked about within the authentic announcement in October.

Below the rules, officers nonetheless holding market positions will nonetheless have 12 months to shed prohibited positions. New Fed officers could have six months to take action.

Sooner or later, officers lined by the brand new guidelines should give 45 days’ discover earlier than making any permissible asset purchases, a restriction that can go into impact July 1. They then should maintain these positions for at the least a 12 months and will likely be banned from any buying and selling throughout “intervals of heightened monetary market stress.” There isn’t any set definition of the time period, which will likely be decided by the Fed chair and the board’s common counsel.

Together with shares, bonds and crypto, the ban extends to commodities, foreign exchange, sector index funds, derivatives, quick positions and company securities or utilizing margin debt to purchase belongings.

Congress has been debating a measure that additionally will prohibit its members from proudly owning particular person shares, although it has not been adopted but.