On-chain information reveals exchanges have acquired an enormous Bitcoin influx spike from long-term holders, an indication that could possibly be bearish for the worth of the crypto.

Traders Holding Bitcoin Since 12 Months To 18 Months In the past Switch A Enormous Quantity To Exchanges

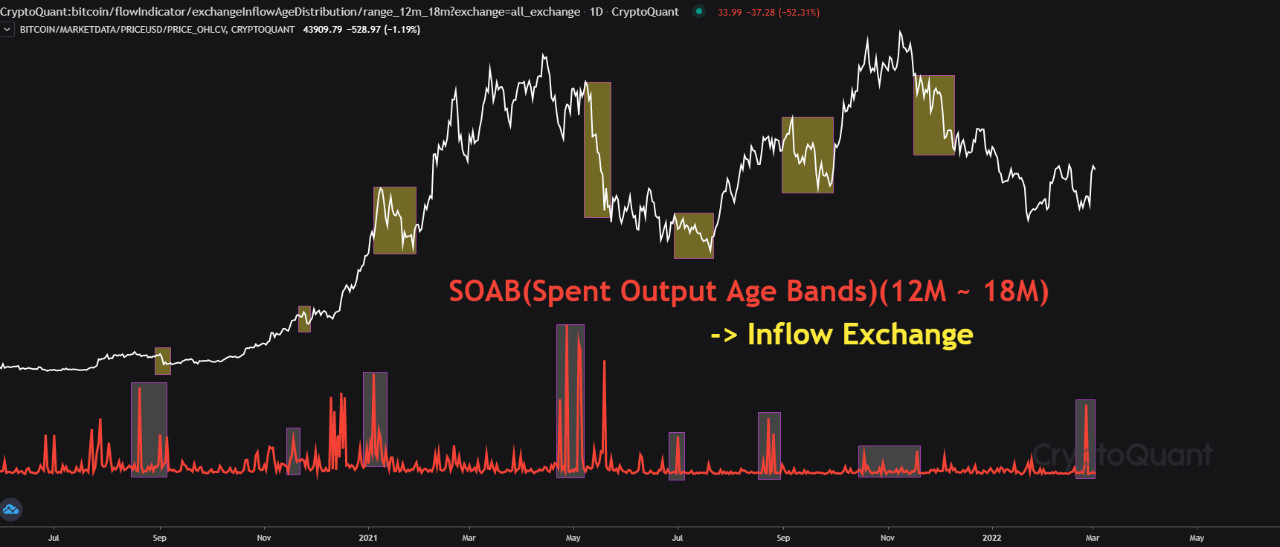

As identified by an analyst in a CryptoQuant submit, some long-term buyers holding on to their cash since between a yr to a yr and a half just lately despatched huge inflows to exchanges.

The related indicator right here is the “change influx,” which measures the overall quantity of Bitcoin transferring to centralized change wallets.

When the worth of this indicator reveals a big spike, it means buyers have simply deposited loads of cash to exchanges. Such a development is often bearish for the worth of the crypto as holders often switch to exchanges for promoting functions.

Then again, small values of the metric might present regular market conduct and that there isn’t largescale dumping happening in the meanwhile.

Associated Studying | Bitcoin Taker Purchase/Promote Quantity Exhibits “Purchase” Sign As BTC Gears Up For Rally

A modified model of the Bitcoin change influx reveals solely transfers from these buyers who had been holding on their cash since 12 months to 18 months in the past. Right here is the chart for it:

Appears to be like like a considerable amount of cash have been deposited by these long-term holders just lately | Supply: CryptoQuant

As you’ll be able to see within the above graph, the worth of the indicator noticed an enormous spike only recently. Which means that long-term holders inside the age vary of 12 to 18 months transferred an enormous variety of cash to exchanges, presumably for promoting them.

Within the chart, the quant has additionally marked the earlier occasions this type of development passed off. It appears like shortly following such a spike, the worth has at all times noticed a decline.

Associated Studying |Bitcoin Closes 1st Inexperienced Month After 3 Reds, What Historical past Says Could Occur

Since a spike has additionally occurred just lately, the worth of Bitcoin could also be in for the same plunge quickly, if the sample continues to carry.

Nevertheless, in sure circumstances, it’s additionally doable the worth of the coin doesn’t see any results from this. An instance of such a scenario can be if an outflow of comparable or bigger quantity passed off quickly.

BTC Worth

On the time of writing, Bitcoin’s worth floats round $43.3k, up 23% within the final seven days. Over the previous month, the crypto has gained 17% in worth.

The beneath chart reveals the development within the worth of the coin over the past 5 days.

Following the sharp surge a couple of days again, the worth of Bitcoin appears to have moved sideways | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com