onuma Inthapong/iStock through Getty Photographs

Equitrans Midstream Company (NYSE:ETRN) is a pure fuel midstream enterprise that owns a moat-worthy footprint within the Appalachian basin. On prime of that, it gives buyers a really engaging 7.93% dividend yield that’s anticipated to be coated by practically 3.7x by distributable money circulate this 12 months.

Nevertheless, its greatest upside catalyst can be its greatest threat: its MVP undertaking has been always plagued with price overruns and regulatory hurdles. Administration stays dedicated to the undertaking and nonetheless believes it’ll get accomplished. If profitable, ETRN is extraordinarily low-cost and will ship huge upside to shareholders. Nevertheless, if it fails to achieve success, the corporate will endure a serious setback and long-suffering shareholders may endure additional draw back. Given the uncertainty right here, it’s unsurprising that ETRN is arguably the most affordable C-Corp midstream alternative there may be.

Equally, Enbridge (NYSE:ENB) additionally owns a formidable array of midstream belongings that give it important scale and diversification throughout oil and pure fuel, finally rendering it an indispensable a part of the North American vitality {industry}.

Not like ETRN, nevertheless, ENB has a a lot decrease upside and draw back profile, as its money circulate profile is rather more secure, and its development initiatives are much less important relative to its current belongings than ETRN’s are. Given its {industry} sturdy place and elite dividend development inventory standing with 27 consecutive years of rising its dividend payout, it’s unsurprising that it’s the most costly C-Corp midstream alternative proper now.

On this article, we are going to look additional at each of those midstream firms and share why we view ENB as a Maintain and ETRN as a speculative Robust Purchase proper now.

Asset Portfolios

ETRN has prime quality gathering, transmission, and water infrastructure within the area and is actually one of many largest pure fuel gatherers in the USA. Moreover, it advantages from a symbiotic relationship with EQT Company (EQT) that provides it important capital and operational efficiencies, together with economies of scale within the Appalachian Basin for its gathering and processing belongings.

Over half of its present income is derived from mounted price take or pay contracts with common durations of 14 years on its gathering belongings and 13 years on its transmission and storage belongings. Because of this, its present money circulate profile is fairly stable. If/when the MVP is accomplished and positioned into service, its income from mounted price take or pay contracts ought to soar to over 70%.

ENB in the meantime boasts an much more spectacular asset profile. It owns North America’s largest crude oil pipeline community by way of which it strikes 25% of crude oil consumed by the continent. The corporate additionally has an more and more significant renewable energy era portfolio and plans to increase this for years to return as a part of its vitality transition efforts.

Along with its oil and renewable energy portfolios, ENB is a serious pure fuel participant. It owns the second longest pure fuel transmission pipeline community in the USA by way of which it strikes 20% of the U.S.’s pure fuel. It additionally has the excellence of being the most important pure fuel distributor on the continent.

The results of all that is that ENB not solely has monumental economies of scale and well-positioned and diversified infrastructure, however it additionally generates extraordinarily secure money flows. 98% of its money flows are backed by both take-or-pay, fee-based, or hedged contracts and 95% of its clients are funding grade or equal.

Whereas ETRN has a stable midstream portfolio, ENB clearly has a superior collective asset portfolio.

Stability Sheets

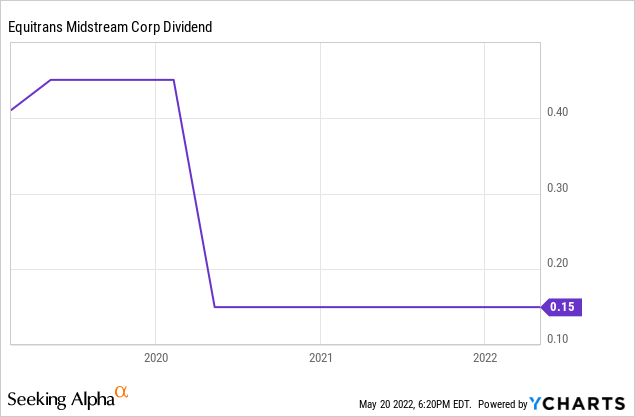

Whereas the MVP price overruns have actually strained the stability sheet and compelled the corporate to slash its dividend, the corporate is presently producing free money circulate above dividends which it’s utilizing to pay down debt and likewise has over $2 billion of accessible liquidity on its revolver line. Subsequently, it needs to be in stable monetary form for the foreseeable future.

As soon as once more, nevertheless, ENB is in significantly better form with an industry-leading BBB+ credit standing, stays on observe to attain a web debt to adjusted EBITDA of underneath 4.7x, and has loads of liquidity.

Dividend Profiles

ETRN’s dividend yield of seven.93% is 199 foundation factors larger than ENB’s dividend yield of 5.92%. ETRN’s dividend protection of three.7x can be considerably higher than ENB’s, although ENB’s dividend protection continues to be fairly conservative at 1.56x.

ENB’s dividend security profile is additional strengthened when making an allowance for its very secure money circulate profile and far stronger stability sheet relative to ETRN. On prime of that, ENB lately achieved 27 consecutive years of dividend development, whereas ETRN has no dividend development streak and actually slashed its dividend and needed to slash its dividend considerably again in 2020:

Because of this, we really contemplate ENB’s dividend to be safer than ETRN’s. So far as dividend development goes, ENB is prone to obtain higher dividend development within the close to time period, but when ETRN is ready to efficiently full its MVP undertaking, it may see giant upside to its dividend payout.

Development Profiles

Just like the outlook for his or her respective dividend development profiles, ETRN’s total money circulate development profile largely hinges on the result of the MVP. If profitable it ought to increase EBITDA by 30% ($315 million of annual incremental adjusted EBITDA), which might make it a terrific midstream development funding. Nevertheless, if this undertaking falls quick, development will probably dry up as the corporate should pour its retained money circulate into paying down debt to proper dimension the stability sheet.

ENB, in the meantime, has a really promising development outlook with loads of capital and alternatives to spend money on development in addition to accretive M&A. Administration has guided for a 5-7% DCF per share CAGR by way of 2024, which we view as very achievable.

Dangers

ETRN is clearly a a lot riskier wager proper now given its heavy dependence on the result of the MVP undertaking.

Past that main threat, each firms face the standard operational dangers that include working pipelines and different midstream infrastructure. Provided that ENB is a a lot greater participant and is concerned in each Canada and the USA, its threat of working into regulatory or political bother is probably going larger than ETRN’s is (aside from the MVP undertaking).

A remaining consideration when evaluating the chance elements is the influence of the alternate fee between Canadian and U.S. {Dollars}. ENB – as a Canadian firm – declares its dividends in Canadian {Dollars} whereas ETRN declares its dividends in U.S. {Dollars}.

Nevertheless, on condition that ENB’s money flows come from a way more various array of sources, its stability sheet is stronger, and its contract phrases and counterparties are stronger than ETRN’s, ENB is unquestionably decrease threat.

Valuations

Valuation is the one level the place ETRN actually stands out relative to ENB. Along with its 199 foundation factors larger dividend yield, ETRN trades at a 2.78 flip decrease EV/EBITDA a number of and likewise boasts a value to DCF a number of of simply 3.44x in comparison with ENB’s which is considerably larger at 8.29x.

Investor Takeaway

Evaluating these two shares is troublesome to do as a result of ETRN is extraordinarily low-cost and has a a lot larger yield than ENB does, but in addition has appreciable threat between its much less stable stability sheet and unsure outlook for its huge MVP undertaking. ENB in the meantime, generates utility like money flows and has a really secure development outlook alongside a good yield. That stated, its valuation multiples make it seem a bit stretched for the time being.

For buyers who need to hit a house run within the midstream house and are optimistic / consider administration’s narrative about ETRN’s probabilities of getting the MVP accomplished and in-service comparatively near the present schedule and price estimate, ETRN is a powerful purchase right here. Nevertheless, we’d warning buyers that it stays a speculative funding and failure to put MVP in service at an affordable price and timeline may end in a further dividend minimize.

ENB, in the meantime, seems to be like a secure place to cover through the present macroeconomic and geopolitical storm, however the valuation is just not very interesting. Because of this, we fee it a maintain, however a worthwhile portfolio holding for conservative dividend development buyers.

:max_bytes(150000):strip_icc()/Health-GettyImages-1316868294-4b916ceb61054eafa4fdbe1906c18962.jpg)