MF3d/iStock by way of Getty Pictures

Wall Avenue noticed shares plummeting and Dow dropping greater than 1,000 factors whereas Nasdaq declined ~4% after Federal Reserve Chairman Jerome Powell’s hawkish remarks on the Jackson Gap Financial Symposium, warning that the struggle towards inflation may result in “some ache” for the economic system.

Whereas Enovix was the highest gainer on constructive feedback from analysts, delivery shares led the losers’ listing.

For the week ending Aug. 26, the S&P 500 was within the crimson for the second week in a row (-3.99%) with 10 out of the 11 sectors within the within the crimson. YTD, SPY is -14.66%. The Industrial Choose Sector SPDR (XLI) additionally declined for the second week straight (-3.36%). YTD, XLI is -9.72%.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +5% every this week. Nonetheless, YTD, just one out of those 5 shares is within the inexperienced.

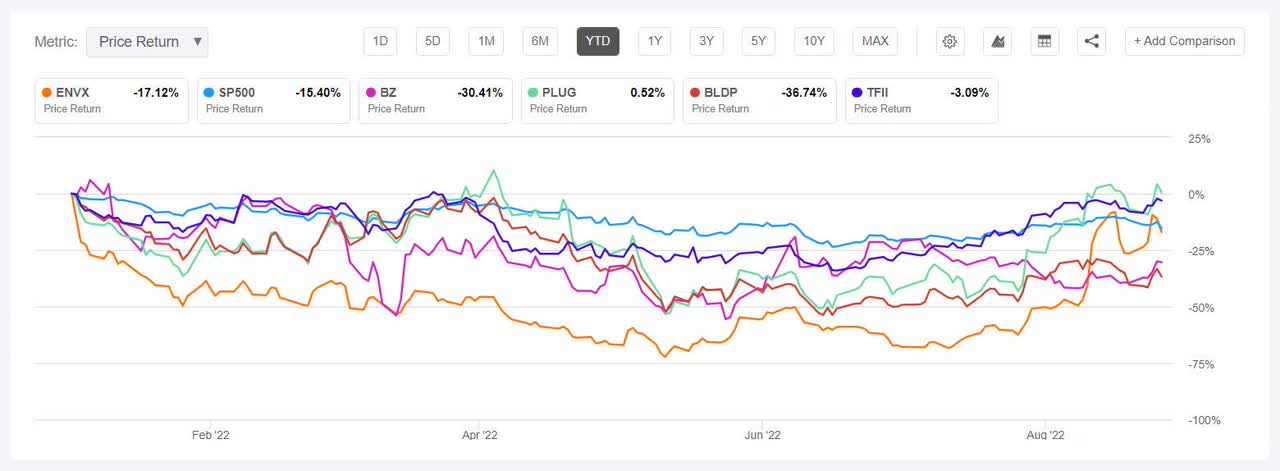

Enovix (NASDAQ:ENVX) +18.10%. The Fremont, Calif.-based lithium-ion battery maker was again as the highest gainer after two weeks, shrugging off the loser tag from final week. The week noticed Loop Capital doubled its worth goal on the corporate to $100 from $50 whereas retaining a Purchase ranking on the shares; and Cowen setting a brand new worth goal to $36 from $19 and sustaining an Outperform ranking. Loop analyst Analyst Ananda Baruah sees progress potential and stated that Enovix is coming into manufacturing and have entry to seemingly “limitless” demand. In the meantime Cowen analysts famous that ENVX shares have been rising greater after its earnings whereby Enovix stated its Automotive alternative looms giant as the corporate was simply getting began with early promising quick cost information and improved volumetric vitality density and security by way of BreakFlow.

The common Wall Avenue Analysts’ Ranking on ENVX is Robust Purchase, whereby 5 out of 6 analysts tag the inventory as a Robust Purchase. The ranking is in distinction to the SA Quant Ranking of Maintain, which takes into consideration elements equivalent to Valuation and Profitability, amongst others issues. YTD, the inventory has declined -17.49%.

Kanzhun (BZ) +15.11%. The Chinese language on-line recruitment platform was again among the many gainers after being the worst decliner three weeks in the past. The corporate additionally reported its Q2 outcomes which noticed income beat estimates. Nonetheless, the inventory has continued its volatility, it was additionally amongst high decliners in every week in July. BZ gained effectively in June (+30%) and was among the many high 5 (on this section). However, the inventory was among the many worst 5 decliners within the first week of Might, having made to the highest within the final week of April. Related developments had been seen in March.

YTD, BZ has declined -30.53%. The SA Quant Ranking on the inventory is Maintain, with Profitability having an element grade of D+ whereas Progress having an element grade of C+. The common Wall Avenue Analysts’ Ranking differs and tags BZ as Robust Purchase, whereby 8 out of 11 analysts give the inventory a Robust Purchase ranking.

The chart under reveals YTD price-return efficiency of the highest 5 gainers and SP500:

Plug Energy (PLUG) +7.90%. The Latham, New York-based firm’s inventory has additionally seen some sizeable beneficial properties (and at occasions loses) in these previous two months. The inventory gained this week pushed by a inexperienced hydrogen provide cope with Amazon. PLUG was amongst high gainers (on this section) within the first week of August, and noticed ups and downs in July and, some beneficial properties in June.

The SA Quant Ranking on the inventory is Maintain, with Profitability and Valuation each having an element grade of F. The ranking is in distinction to the common Wall Avenue Analysts’ Ranking of Purchase, whereby 14 out of 28 analysts give the inventory a Robust Purchase ranking. YTD, PLUG has risen +2.52%, the one inventory amongst this week’s gainers which is within the inexperienced for this era.

Ballard Energy Programs (BLDP) +6.11%. The Canadian gas cell methods developer leapfrogged from the decliners’ listing it discovered itself in final week to take a spot among the many gainers this week. The inventory shot up probably the most on Aug. 24 (+8.81%). Nonetheless, YD, BLDP has fallen -36.39%, probably the most amongst this week’s gainers. The common Wall Avenue Analysts’ Ranking and SA Quant Ranking each have a Maintain ranking on the inventory.

TFI Worldwide (TFII) +5.19%. The corporate is promoting its Contract Freighters non-dedicated U.S. dry van and temperature-controlled truckload enterprise and CFI Logistica operations in Mexico to Heartland Specific for an enterprise worth of $525M. YTD, the inventory has fallen -4.26%. The SA Quant Ranking on TFII is Robust Purchase, whereas the common Wall Avenue Analysts’ Ranking is Purchase.

This week’s high 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -9% every. YTD, all these 5 shares are within the crimson.

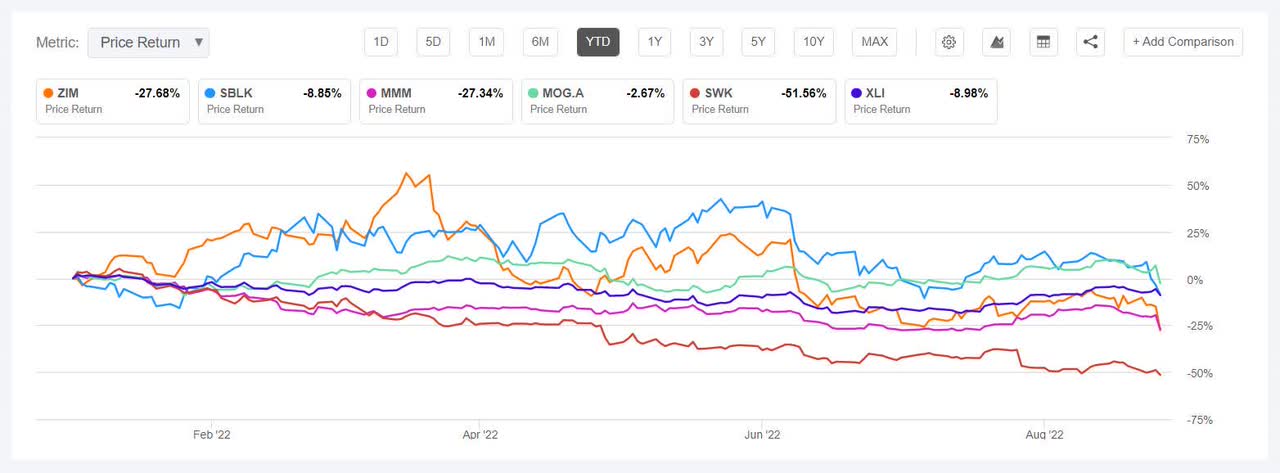

ZIM Built-in Delivery Providers (NYSE:ZIM) -16.43%. Sure delivery shares fell on the finish of the week after experiences that delivery carriers continued to quote congestion at U.S. and Canadian ports the rationale for canceling sailings in September. The inventory fell probably the most on Aug. 26 (-14.94%). ZIM additionally introduced updates on withholding tax procedures on September 2022 money dividend. Earlier within the week, ZIM was downgraded at Citi to Impartial/Excessive Danger with finish of freight charge upcycle.

ZIM was among the many worst 5 decliners in June. YTD, ZIM has sunk -30.26%. The SA Quant Ranking on the inventory is Maintain, with Profitability having an element grade of A+ and Progress with an element grade of F. The common Wall Avenue Analysts’ Ranking concurs and tags the inventory as Maintain, whereby 5 out of seven analysts see it as Maintain.

Star Bulk Carriers (SBLK) -13.85%. The Greece-based delivery firm’s inventory slumped probably the most on Aug. 24 (-8.21%). Star Bulk — which was amongst 2021 high 5 industrial shares (on this section) — has shed -5.03% YTD. The SA Quant Ranking on SBLK is Maintain, with Profitability and Valuation each having an element grade of A+. The ranking differs with the common Wall Avenue Analysts’ Ranking of Purchase, whereby 4 out of 6 analysts tag it as Robust Purchase.

The chart under reveals YTD price-return efficiency of the worst 5 decliners and XLI:

3M (MMM) -11.06%. The inventory slumped probably the most on Aug. 26 (-9.58%) after the corporate misplaced its effort to dam greater than 230K lawsuits accusing it of injuring U.S. troopers. Based on a report final week, 3M may face greater than $100B in losses and even chapter resulting from lawsuits. The SA Quant Ranking on the shares is Maintain, with Profitability having an element grade of A+ and Progress with a rating of F. The common Wall Avenue Analysts’ Ranking concurs with a Maintain ranking, whereby 13 out of 21 analysts take into account the inventory as a Maintain. YTD, 3M has shed -27.30%.

Moog (MOG.A) -9.15%. The aero-defense firm’s inventory fell probably the most on Aug. 26 (-8.84%). YTD, the inventory has declined -3.40%. The common Wall Avenue Analysts’ Ranking for MOG.A is Purchase, whereas the SA Quant Ranking is Robust Purchase.

Stanley Black & Decker (SWK) -9.01%. The New Britain, Conn.-based firm fell to hit a 2-1/2-year low. The inventory was again among the many worst 5 decliners after a few month. YTD, SWK has shed -52.25%, probably the most amongst this week’s worst performers. The SA Quant Ranking on the inventory is Promote, which is in distinction to the common Wall Avenue Analysts’ Ranking differs of Maintain.