Alfio Manciagli

Introduction

It is incredibly telling building an expose on West Africa’s premier gold miner in the wake of a crypto fall-out rocking the digital space. Youngsters chastised more senior investors, the ones interested in gold, as being out of touch and ignorant of the digital revolution taking place.

Ok, I know – I am a boomer. But crypto had been touted as the digital gold, the inflationary hedge, the new store of value. Hard to buy that narrative following the implosion of FTX. The scandal now appears to encompass mega leverage, abuse of customer funds, woeful risk management and a frat-party like corporate culture.

Billions are likely to have gone up in smoke, dampening investor appetite for crypto assets. It appears Sam Bankman Fried – the digital messiah – will come crashing to earth, forcing investors to scramble for new investment vehicles.

Maybe Sam would have been better served placing money into Endeavour Mining’s Sabodala project. Its rock star project financials, project life cycle, and economics are compelling enough to build a small position in the miner alone. Yet the West Africa portfolio covers 6 assets across Senegal, Ivory Coast, Guinea, Mali & Burkina Faso.

My outlook for the West African gold miner is bullish. You see, if Endeavour Mining were a professional running back, you would be throwing it some skittles, given its track record, project pedigree, cost structure, and financial performance. Let’s find out more.

Outlook for Gold

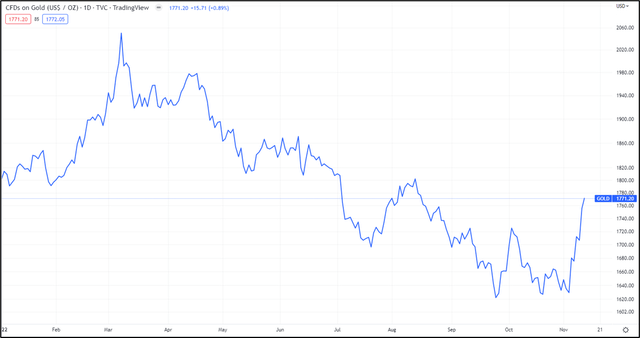

2022 have been anything but ordinary for gold prices. Given the strong correlation with miner fortunes and price action of the yellow metal, any investment needs to be backed by buoyant gold prices.

The conflict in Ukraine initially did generate a flight to traditionally safer asset classes. But momentum has slowly rolled over, with the full effects of monetary tightening wreaking havoc with commodity prices.

Trading View

Year to date price action for the precious metal

Expect some changes into the new year. Central banks are likely to gently step on the brakes in terms of restrictive monetary policy. This is likely to provide renewed positive sentiment for equities but also a reversal in dollar fortunes. The combination of the two are likely to provide buoyancy for commodity prices.

Endeavour Mining

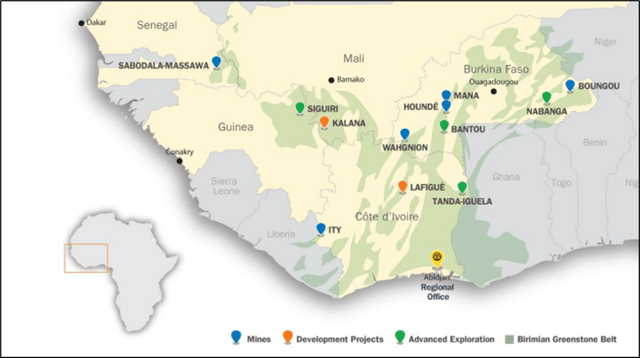

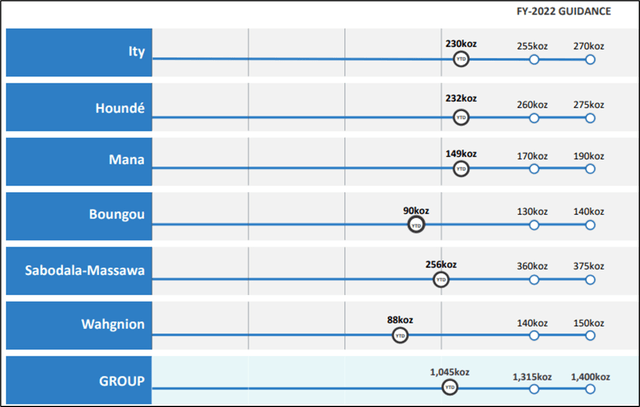

Endeavour Mining is West Africa’s largest producer with 6 gold mines churning out more than 1.3 million ounces yearly.

For those of you unfamiliar with prolific West African miners, Endeavour Mining (OTCQX:EDVMF) is a major proponent of regional gold production, posting ~1.3M ounces annually.

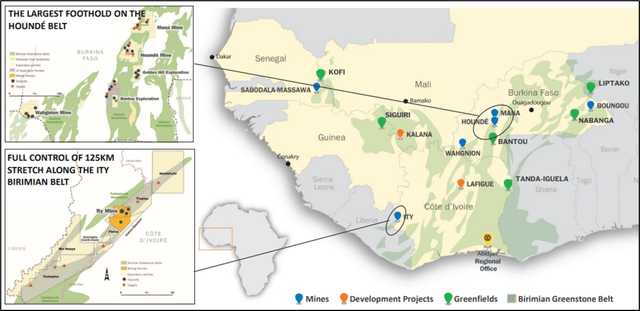

The company showcases 6 operating assets including Boungou, Hounde, Mana, Wahgnion (Burkina Faso), Ity (Ivory Coast) and Sabodala-Massawa (Senegal). The firm has actively started de-risking its dependence on Burkina Faso with exploration and development works in Ivory Coast and Guinea.

Operating Model

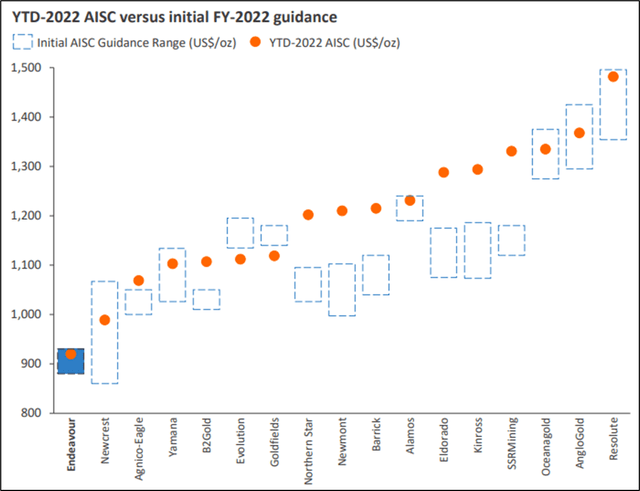

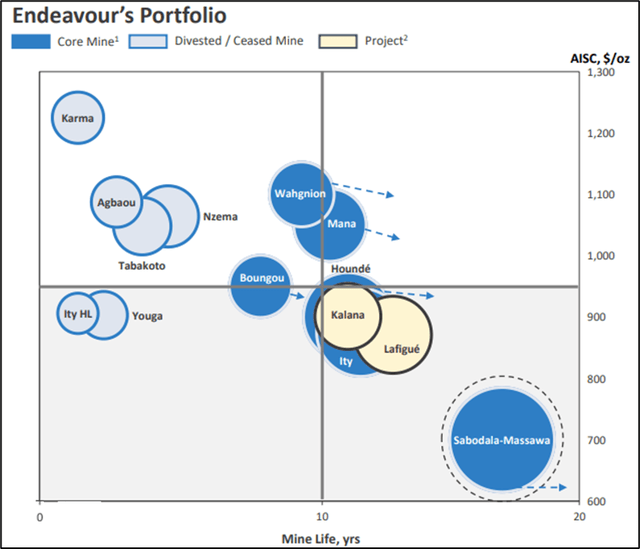

Endeavour Mining’s cost structure provides the gold mining venture with significant competitive advantage. Its sites are among the most cost competitive in West Africa with AISC (all-in sustainable costs) printing just South of $1,000/ oz.

That positions the firm not only within forecast guidance, but also allows it financial flexibility for capital deployment to exploration or even distributions to shareholders.

Endeavour Mining

Endeavour Mining’s cost structure is robust, providing the firm with a discernible advantage against its competitors.

Project Portfolio

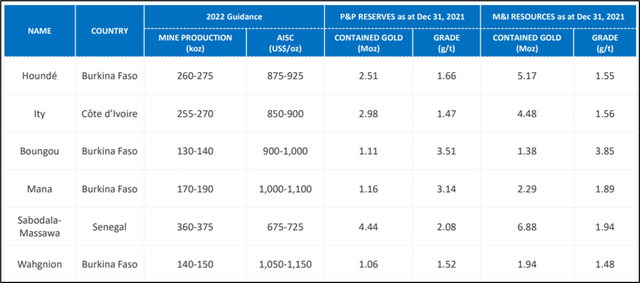

Endeavour Mining also has a world class project portfolio. Its mine sites provide good grades in terms of gold per ton, improving transformation and recovery costs. The company’s reserves have a relatively even spread with standouts from Sabodala-Massawa (Senegal), Ity (Ivory Coast) and Hounde (Burkina Faso)

Endeavour Mining

Project overview Endeavour Mining

The fact that 2 of the company’s biggest projects are outside of Burkina Faso provides a natural hedge against recent domestic geo-political volatility. Even if most projects are in Burkina Faso, the biggest reserves are fortunately outside of the country’s infamous red zone, reputed for Islamic terrorism and lawlessness.

The cost of that violence and lawlessness is reflected in the production prices, with Wahgnion (AISC ~$1,050) and Mana (~$1,000) being among the portfolio’s highest.

A noteworthy portfolio standout is Sabodala. Not only does it hold the biggest reserves, project life and produced volumes, but it is also the most efficient producer among the assets (AISC ~$675). This here is Endeavour Mining’s indisputable cash cow.

Endeavour Mining

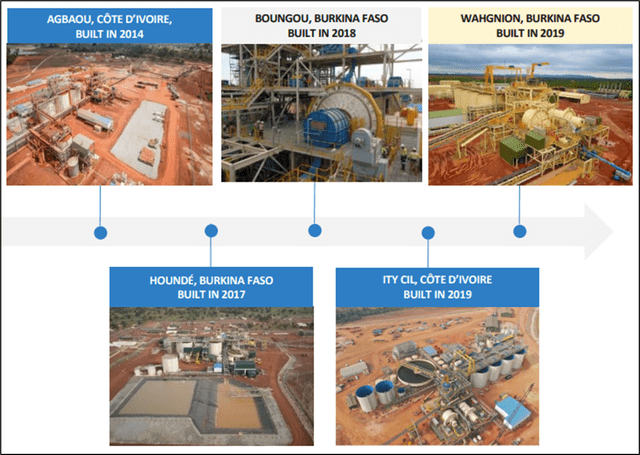

5 construction builds have been recently integrated into Endeavour Mining’s business, some of which were legacy projects built by SEMAFO (Boungou) and Teranga Gold (Wahgnion).

Endeavour Mining

Not only does Sabodala produce rock star volumes, but it also has some of the most competitive costs in the region and a life of mine neighbouring 20 years!

Exploration Overview

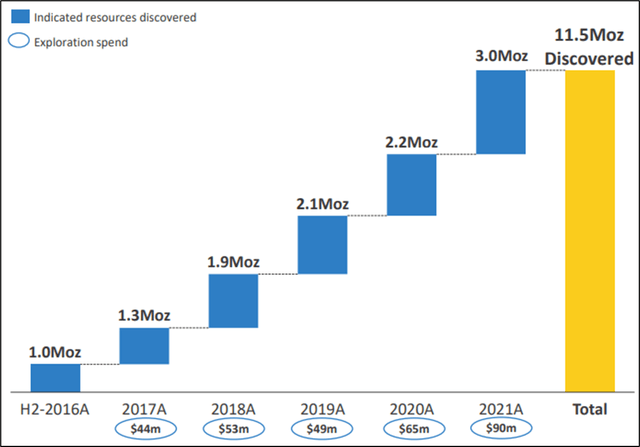

Constant renewal of assets is always a critical issue to factor in when appraising gold mining operations. Endeavour Mining’s competitive cost base, big volumes and solid reserves allow the company to pour money back into exploration efforts. Such efforts have paid dividends with the company discovering roughly 11.5M ounces over the past 5 years.

Endeavour Mining

Drilling spend has continued to be strong, with the firm investing $90M last year in the hunt for new deposits. The company has a range of exploration targets it is investing in, underscoring its commitment to the region.

Endeavour Mining

Endeavour Mining boasts huge presence in the Hounde Belt (Burkina Faso) along with a sizable stretch along the Ity Birimian Belt (Ivory Coast)

Financials

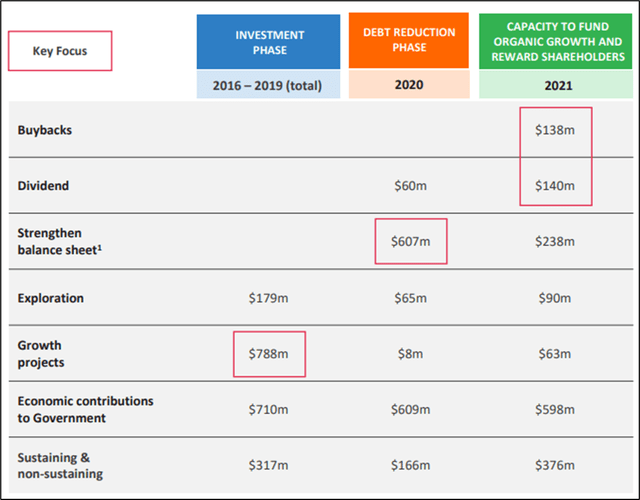

Endeavour Mining’s financials have essentially matched its project profile, tracking distinguishable phases. The organization had invested heavily in exploration and growth projects from 2016 – 2019. Capital deployment in those projects has allowed the venture to build positive cash flows and start a cycle of deleveraging in 2020.

Endeavour Mining

Project cycle financials – Endeavour Mining

Following on from this, the gold mining venture has managed a steady state in its project life cycle, deploying capital in the form of share buy backs or distributions to the company’s backers.

As the US dollar eases into 2024 and project life extensions come online, a period of upside is most likely in store. A pause in monetary tightening is likely to be bullish for not only equities, but also gold, providing organizations like Endeavour Mining with sizable upside.

Endeavour Mining’s income statement shows cost discipline and positive trends in revenue growth. From $694M (FY 2019) to $2,694M (LTM) revenues have grown prolifically. Cost of revenues have remained well managed while interest expense on debt obligations have continued to be manageable.

The gold miner has continued to post strong EBIDTA numbers over the past 3 years, from $252.9M (FY 2019) to $1,411.8M (FY 2021). Guidance continues to be positive for the organization overall.

Current cash on hand is roughly $832M with debt obligations in the $500M range. Efforts have been made by the company to de-lever following a period of restrictive monetary policy.

Goodwill of $134M is worth keeping an eye on – while it does not have the potential of being catastrophic for a firm with a $4.8B market cap, its ultimate impairment will have an impact on the value of equity.

Endeavour Mining

With just under 2 months to go before year end, the group looks set to hit guidance of 1.3M ounces gold produced.

Key Takeaways

Considering all the digital scandals going about, maybe looking at more conventional asset classes is worthwhile. And what better way to do so than by considering Endeavour Mining. The 1.3M ounce West African gold pioneer has managed to carve out a niche, allowing it to develop best in class mines with rock-bottom operating costs and sizable returns.

The future remains bright for the firm – life extension work into its Sabodala cash cow is continuing its course. The firm has navigated a period of deleveraging and budgetary discipline only Sam Bankman Fried could have wished he had undertaken.

Macro-forces into the new year, for both gold prices and for a weakening of the US dollar, are likely to be big positives for investors staking money, not crypto, in the firm.