Revealed on February twenty fifth, 2022 by Bob Ciura

PepsiCo (PEP) just lately elevated its dividend by 7%. This implies 2022 would be the firm’s fiftieth consecutive 12 months of elevated dividends paid to shareholders.

Consequently, it has joined the record of Dividend Kings.

The Dividend Kings are a bunch of simply 40 shares which have elevated their dividends for no less than 50 years in a row. We imagine the Dividend Kings are among the many highest-quality dividend progress shares to purchase and maintain for the long run.

With this in thoughts, we created a full record of all 40 Dividend Kings. You possibly can obtain the complete record, together with vital monetary metrics akin to dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

PepsiCo is a recession-proof firm with a management place within the meals and beverage trade. It’s a dependable dividend progress inventory that may improve its dividend, even throughout recessions.

On the identical time, the inventory has a market-beating 2.7% dividend yield. Whereas the inventory seems overvalued proper now, PepsiCo stays a high-quality holding for revenue traders.

Enterprise Overview

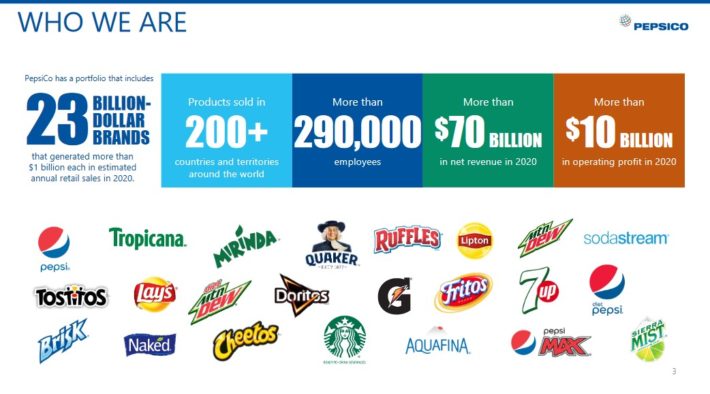

PepsiCo is a serious shopper staples inventory. It has a big portfolio of high quality manufacturers, together with 23 particular person manufacturers that every generate $1 billion or extra in annual gross sales. Just some of its core manufacturers embody Pepsi, Frito-Lay, Quaker, Gatorade, Bare, and lots of extra.

Supply: Investor Presentation

Its enterprise is sort of equally break up between its meals and beverage segments. Additionally it is balanced geographically, between the U.S. and the remainder of the world.

PepsiCo introduced earnings outcomes for the fourth quarter and full 12 months 2021 on 2/10/2022. Income improved 12.4% to $25.3 billion, topping expectations by $1 billion. Adjusted earnings-per-share of $1.53 was a 4% improve from This fall within the prior 12 months. For the complete 12 months, income grew 12.9% to $79.5 billion whereas adjusted EPS of $6.26 was 13.4% greater than $5.52 in 2020.

Unit volumes for meals and snack elevated 4%. Beverage quantity elevated 7%. Income for PepsiCo Drinks North America improved 12% with a 7% improve in volumes. Frito-Lay North America’s income grew 7% and volumes have been up by 2%. Lastly, Quaker Meals North America income was flat with a 7% lower in volumes.

Together with offering quarterly outcomes, the corporate elevated its dividend by 7%. This implies 2022 will probably be PepsiCo’s fiftieth consecutive 12 months of dividend will increase.

The corporate owes its lengthy dividend historical past to its constant progress through the years.

Development Prospects

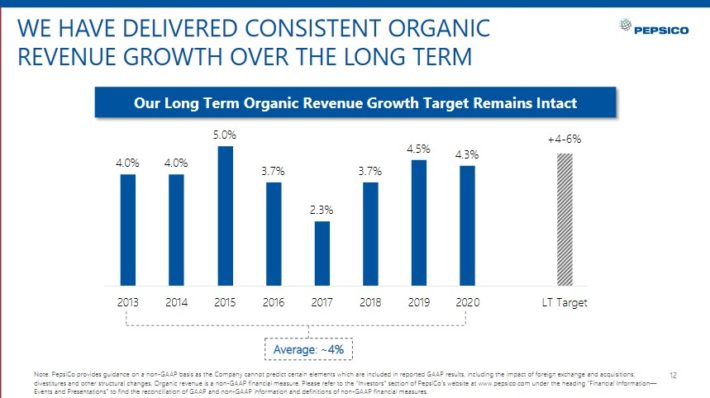

PepsiCo has an extended historical past of regular progress. Even in a difficult setting for soda, PepsiCo has continued its constant progress. An illustration of the corporate’s efficiency from 2013 could be seen within the beneath picture.

Supply: Investor Presentation

We imagine PepsiCo will generate round 5%-6% adjusted earnings-per-share progress per 12 months over the following 5 years. Going ahead, two of PepsiCo’s most promising catalysts are progress in more healthy meals and drinks, and within the rising markets.

Gross sales of soda are slowing down in developed markets just like the U.S., the place soda consumption has steadily declined for over a decade.

Consequently, giant soda corporations like PepsiCo have needed to adapt to a extra health-conscious shopper. To do that, PepsiCo has shifted its portfolio towards more healthy meals which can be resonating extra strongly with altering shopper preferences.

As well as, PepsiCo has an enormous progress alternative in rising markets like China, Africa, India, and Latin America. These are under-developed areas of the world, with giant shopper populations and excessive financial progress charges.

Rising markets have been a progress driver as soon as once more final quarter. Income for the Africa/Center East/South Asia was up 8% primarily as a consequence of quantity progress and productiveness financial savings, however meals and snack volumes have been greater by 3.5% with drinks rising 12%.

The Asia Pacific/Australia/New Zealand/China area was PepsiCo’s additionally carried out effectively, rising 13% as a consequence of 16% good points in meals and snack and seven% good points in beverage.

Aggressive Benefits & Recession Efficiency

PepsiCo has quite a few aggressive benefits. Amongst them, are sturdy manufacturers, and world scale. In all, PepsiCo has 23 particular person manufacturers that every acquire no less than $1 billion in annual income. Robust manufacturers give PepsiCo optimum shelf house at retailers and provides the corporate pricing energy.

PepsiCo’s monetary power additionally permits the corporate to put money into analysis and growth, in addition to promoting, to retain its aggressive benefits.

For instance, PepsiCo invests billions annually in analysis and growth, to innovate new merchandise and packaging designs. As well as, PepsiCo frequently spends greater than $2 billion annually on promoting, to take care of market share and construct model fairness with customers.

PepsiCo’s aggressive benefits and robust manufacturers enable the corporate to be extremely worthwhile, even throughout recessions. Meals and drinks all the time retain a sure degree of demand, which is why the corporate held up so effectively throughout the Nice Recession.

Associated: See detailed evaluation of one of the best beverage shares.

PepsiCo’s earnings-per-share all through the Nice Recession of 2007-2009 are listed beneath:

- 2007 earnings-per-share of $3.34

- 2008 earnings-per-share of $3.21 (3.9% decline)

- 2009 earnings-per-share of $3.77 (17% improve)

- 2010 earnings-per-share of $3.91 (3.7% improve)

As you possibly can see, PepsiCo’s earnings-per-share declined solely modestly in 2008. The corporate proceeded to develop earnings by almost 20% in 2009, which could be very spectacular. Earnings continued to develop as soon as the recession ended.

The corporate reported sturdy progress in 2020 and 2021, when the coronavirus pandemic despatched the U.S. economic system right into a recession. Subsequently, PepsiCo is a recession-resistant enterprise.

Valuation & Anticipated Returns

PepsiCo is anticipated to generate earnings-per-share of $6.67 for 2022. Primarily based on this, the inventory trades for a price-to-earnings ratio of 25.1. Our honest worth estimate is a price-to-earnings ratio of 21. Thus, the inventory seems overvalued. A declining price-to-earnings ratio may scale back annual returns by 3.5% annually over the following 5 years.

Consequently, future returns will possible be comprised of earnings-per-share progress, and dividends. We anticipate PepsiCo to develop earnings-per-share annually by 5.5%, consisting of natural income progress, acquisitions, modest margin enlargement, and share repurchases.

As well as, PepsiCo additionally has a 2.7% present dividend yield. Nonetheless, the overvaluation will probably be tough for the inventory to beat. The mix of valuation adjustments, earnings progress, and dividends ends in whole anticipated returns of 4.6% per 12 months over the following 5 years.

We at the moment charge PepsiCo inventory a maintain.

PepsiCo has a safe dividend, with a projected dividend payout ratio of ~69% for 2022. This provides PepsiCo sufficient room to proceed rising the dividend at charge in-line with the expansion charge of its adjusted EPS.

Remaining Ideas

PepsiCo is a high-quality firm with a various portfolio of sturdy manufacturers. Its long-term progress will probably be fueled by its snacks enterprise, and by advancing in creating markets.

The corporate has elevated its dividend for 50 years in a row, and the inventory at the moment yields 2.7%. It subsequently meets our definition of a blue-chip inventory, and it ought to proceed to ship regular dividend will increase annually.

In case you are excited by discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].