Updated on February 6th, 2023 by Samuel Smith

Air Products & Chemicals (APD) may not be the most well-known Dividend Aristocrat. The company is primarily a business-to-business manufacturer and distributor of industrial gases.

However, Air Products & Chemicals is an elite dividend stock as a member of the Dividend Aristocrats, a group of reliable dividend stocks with 25+ years of consecutive dividend increases.

We believe the Dividend Aristocrats are among the best dividend growth stocks to buy for the long run. With that in mind, we created a list of all 68 Dividend Aristocrats, along with important metrics like price-to-earnings and dividend yields.

You can download a copy of our Dividend Aristocrats list by clicking on the link below:

Air Products & Chemicals’ dividend history – 41 years of consecutive dividend increases – indicates that the company is a model of consistency.

The company has reinvented itself in recent years. A spinoff and a separate significant divestiture were implemented with the goal of streamlining the company’s business model and focusing on its core industrial gas operations. Air Products & Chemicals appears poised to continue raising its dividend for many years to come.

Business Overview

Air Products & Chemicals is one of the largest producers and distributors of atmospheric and process gasses in the world. Its customers include other businesses in the industrial, technology, energy, and materials sectors. Air Products & Chemicals was founded in 1940 and has a current market capitalization of ~$63.3 billion.

It also has a significant international presence. Roughly 40% of the company’s annual sales are generated in the U.S. and Canada, with the remainder spread across Latin America, Europe, and Asia.

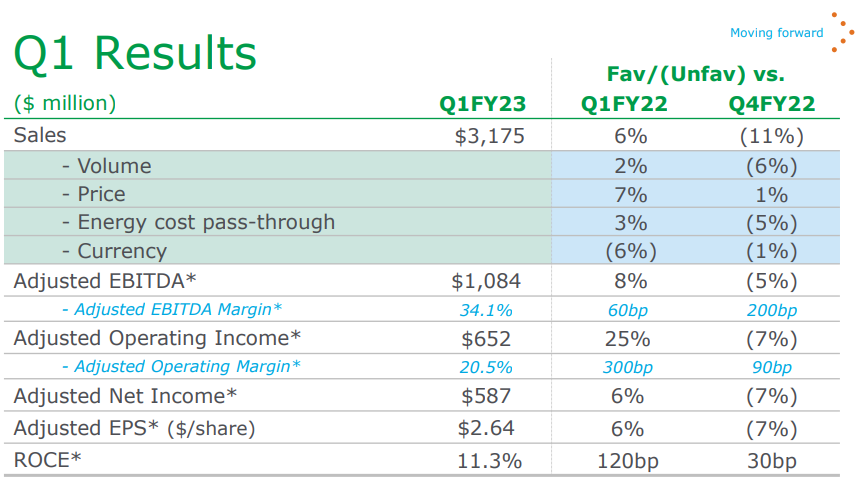

Air Products & Chemicals released financial results for the fiscal 2023 first quarter on February 2nd.

Source: Investor Presentation

The company generated revenues of $3.2 billion during the quarter, which was up 6% year-over-year. Adjusted EPS was $2.64, up 6% year-over-year, adjusted EBITDA was $1.1 billion, up 8% year-over-year, and adjusted EBITDA margin was 34.1%, up 60 basis points year-over-year.

Air Products expects full-year fiscal 2023 adjusted EPS of $11.20 to $11.50, up 9% to 12% over prior year adjusted EPS.

Recent highlights include announcing the financial close and transfer of the second group of assets for the $12 billion gasification and power joint venture with Aramco, ACWA Power and Air Products Qudra in the Jazan Economic City, Saudi Arabia, continuing to advance mega-scale hydrogen energy projects globally, and increasing the quarterly dividend by 13 cents per share to $1.75 per share. This extended their dividend growth streak to 41 consecutive years.

Growth Prospects

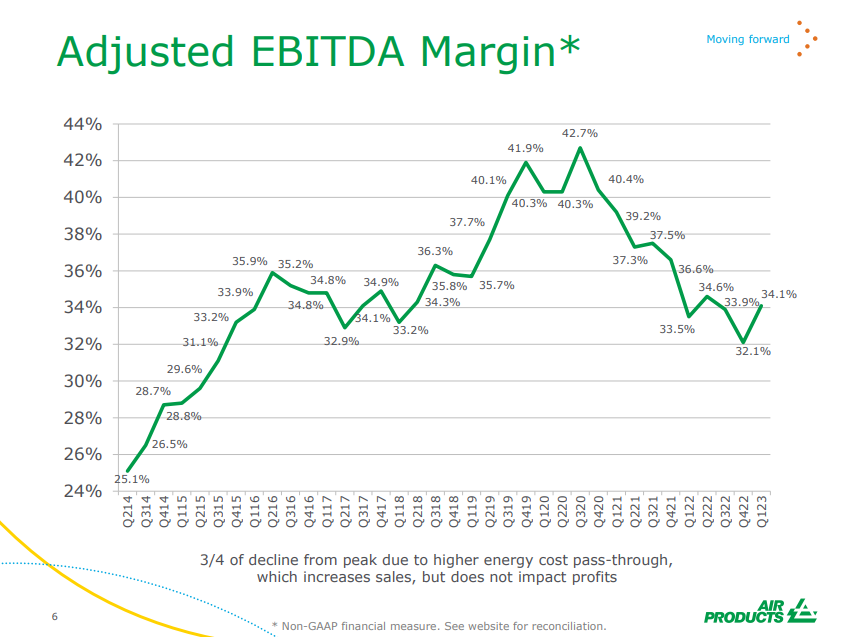

The streamlining initiatives undertaken by Air Products & Chemicals in the past several years have led to significant profitability improvements for the industrial gas giant. The company’s EBITDA margin trend over the last several years can be seen below:

Source: Investor Presentation

Air Products & Chemicals has expanded its adjusted EBITDA margin by 900 basis points since the second quarter of 2014 – a significant improvement, which has combined with growing adjusted EBITDA to drive higher earnings-per-share and dividends.

Air Products & Chemicals’ growth over the coming years will be driven by continued recovery from the coronavirus pandemic, which negatively impacted the U.S. economy last year. It will also grow due to international expansion, as the company’s Gases Asia business has delivered the highest growth rate in the recent past, although its American business remains the largest segment.

Air Products & Chemicals has a number of growth projects either recently completed or scheduled to be completed in the coming months. Some of these investments around the world include building a second liquid hydrogen plant in California, a new air separation unit (ASU) in Minnesota, an ASU plant in India, and helium investments in Algeria. Air Products & Chemicals separately announced that it will build the first hydrogen fuel cell vehicle fueling station in Saudi Arabia, along with oil giant Saudi Aramco.

Air Products & Chemicals has also announced several more projects that will come online during the next couple of years, including a major $3.5 billion joint venture with Yankuang in China. In recent years, Air Products & Chemicals announced a new $7 billion Carbon-Free Hydrogen joint venture with ACWA Power and NEOM that will drive its green energy exposure. These investments, coupled with margin growth initiatives, should lead to meaningful earnings growth for the company over the coming years. We expect 6% annualized EPS growth over the next five years.

Competitive Advantages & Recession Performance

Air Products & Chemicals has a number of competitive advantages. The first and primary advantage the company has is its size and market share.

Moreover, the industrial gas distribution business benefits from high switching costs. These costs may not necessarily be financial – instead, customers are unlikely to switch once their gas needs are being met by a particular supplier because it would be difficult to find a competitor that offers identical services in a particular geographic region. To that end, Air Products & Chemicals’ size also benefits the company.

The company’s recent divestitures and asset sales have given it an infusion of cash, bolstering its corporate finances in a way that should help it endure any upcoming economic downturns. Moreover, Air Products & Chemicals has a track record of performing reasonably well during past recessions. Consider the company’s performance during the 2007-2009 financial crisis for evidence of this:

- 2007 adjusted earnings-per-share: $4.40

- 2008 adjusted earnings-per-share: $4.97 (13% increase)

- 2009 adjusted earnings-per-share: $4.06 (18.3% decline)

- 2010 adjusted earnings-per-share: $5.02 (23.6% increase)

Air Products & Chemicals experienced an 18.3% decline in adjusted earnings-per-share in 2009 during the financial crisis, but the company’s bottom line surged to a new high by 2010.

The company also remained highly profitable in 2020, a difficult year for the global economy due to the coronavirus pandemic. The U.S. economy entered a recession as a result of the pandemic, but Air Products & Chemicals experienced only a mild dip in earnings, which allowed it to continue raising its dividend. We expect a similar level of recession resiliency to be demonstrated during future periods of market turmoil.

Valuation & Expected Total Returns

With a 6% expected growth rate, in addition to a 2.5% dividend yield, one might anticipate high single-digit annual returns from the security. However, it is imperative to consider how valuation can impact future returns.

Using $11.35 as the expected fiscal 2023 adjusted earnings-per-share, and a share price of $282, the security is currently trading hands at 24.8 times expected earnings. For context, the stock has traded at an average earnings multiple closer to 18 over the last 10 years.

We believe that 19 times earnings is a fair valuation estimate for Air Products & Chemicals. Mean reversion to a price-to-earnings ratio of 19 could introduce a significant 5.2% annualized valuation headwind over a 5-year time horizon.

As such, we expect total annual returns to consist of the following:

- 6% earnings-per-share growth

- 2.5% dividend yield

- -5.2% P/E multiple compression

Granted this could be too conservative if shares were to continue trading with a P/E ratio in the mid-to-high 20’s, or if growth formulates faster than anticipated. Still, we expect total annual returns of 3.3% per year through 2028.

Final Thoughts

Air Products & Chemicals is a strong dividend growth stock, having raised its dividend each year for the past 41 years.

The company has de-risked its business model and that business transformation allows it to focus on its core business of industrial gases. Moreover, it has a large slate of new projects to help stay on track for growth in the coming years. This should benefit shareholders in the form of continued dividend increases on an annual basis.

That said, these positive factors cannot outweigh the significant premium that the market is placing on these shares at the present time. Valuation contraction could reduce Air Products & Chemicals’ expected returns over the next five years significantly. As a result, we rate the stock as a hold and think investors could probably find better returns elsewhere until a significant decline in the share price brings its valuation back to fair value.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected]

rn

rn

Source link ","author":{"@type":"Person","name":"Index Investing News","url":"https://indexinvestingnews.com/author/projects666/","sameAs":["http://indexinvestingnews.com"]},"articleSection":["Investing"],"image":{"@type":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/10/Dividend-Aristocrats-Image-150x150.png","width":1920,"height":0},"publisher":{"@type":"Organization","name":"","url":"https://indexinvestingnews.com","logo":{"@type":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link