Within the newest Crypto Asset Fund Flows Weekly Report, CoinShares detailed how digital asset funding merchandise skilled a turbulent week, with an preliminary $530 million outflow final Monday brought on by issues associated to the DeepSeek information.

This sell-off rapidly reversed, with the market later recovering greater than $1 billion in inflows by week’s finish. The report highlighted that regardless of this volatility, year-to-date (YTD) inflows stay robust at $5.3 billion, contributing to the $44 billion complete seen in 2024.

Bitcoin Leads the Pack; Ethereum Struggles

Bitcoin emerged as final week’s dominant performer, attracting $486 million in inflows. Even short-Bitcoin merchandise recorded $3.7 million in inflows, signaling continued curiosity from traders hedging in opposition to worth actions.

Ethereum, in distinction, noticed no internet inflows, with earlier losses seemingly stemming from its ties to the know-how sector and world progress issues, in accordance with James Butterfill, Head of Analysis at CoinShares

The report additionally pointed to notable exercise in altcoins, with XRP remaining a standout. XRP’s robust efficiency over the yr introduced its YTD inflows to $105 million, together with $15 million simply final week, making it the second-best-performing altcoin when it comes to inflows.

Blockchain equities additionally drew investor consideration, recording $160 million YTD as many noticed latest worth drops as a shopping for alternative.

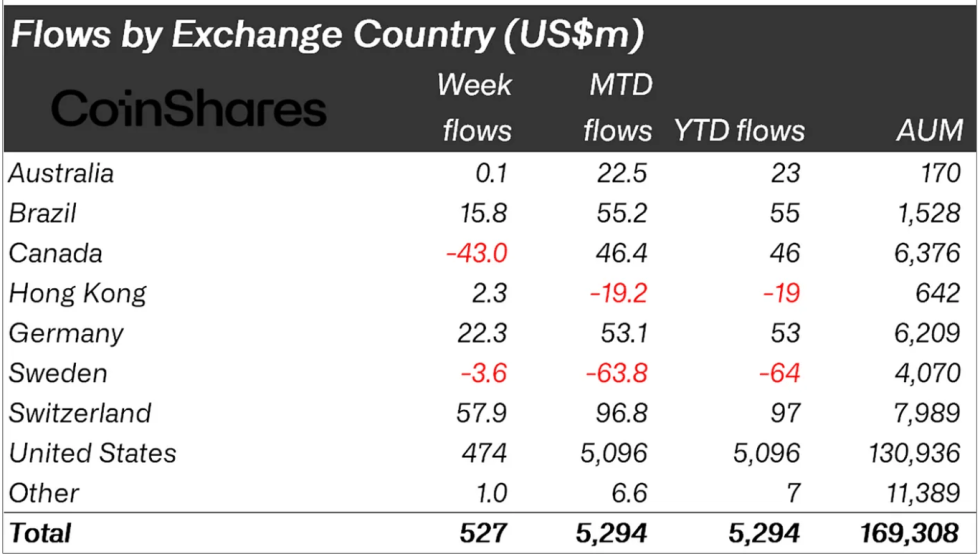

How Regional Fund Flows Fared

Whereas the U.S. reported $474 million in full-week inflows and $5 billion YTD, Europe noticed $78 million final week, bringing its YTD complete to $93 million. Canada, nonetheless, confronted $43 million in outflows, a growth probably tied to US commerce tariff issues.

James Butterfill famous that this back-and-forth within the general inflows isn’t “sudden,” given the numerous worth positive factors digital property have achieved this yr. He emphasised that regional variations additionally formed fund circulation dynamics. The CoinShares Head of Analysis wrote:

Given the $44bn in inflows seen in 2024, US$5.3bn inflows year-to-date (YTD) and important worth positive factors, the present sell-off shouldn’t be sudden.

Based on newest knowledge, the crypto market has seen fairly an sudden downturn pushed largely by macroeconomic components, notably within the US. To date, the worldwide crypto market has seen a major plunge dropping by practically 10% in worth previously day.

Information from CoinGecko exhibits that the worldwide crypto market valuation now stands at $3.22 trillion, a roughly $500 million drop from $3.7 trillion seen final week. Notably, this plunge within the crypto market has not solely been a results of the macroeconomic components but additionally the sudden plunge in BTC.

In the course of the weekend, US President Donald trump signed three govt orders putting tariffs of 25% on all items from Canada and Mexico, and a ten% tariff on each Canadian oil exports and Chinese language items.

Featured picture created with DALL-E, Chart from TradingView