LaylaBird/E+ by way of Getty Photographs

By Anu Ganti

After the distinctive efficiency of large-cap shares in recent times, focus considerations naturally come to thoughts.

There are a lot of methods to measure focus. A easy methodology is so as to add up the burden of the highest names, however the disadvantage with this strategy is it doesn’t incorporate all of the constituents in an index. The Herfindahl-Hirschman Index (HHI), outlined because the sum of the squared index constituents’ share weights, is extra favorable from this facet and is extensively used.

However the HHI faces a problem, which is that even for fully unconcentrated equal weight portfolios, the HHI worth is inversely associated to the variety of names. If we need to use the HHI to look at the historical past of focus inside an index or to make cross-sector comparisons, we have to modify for the variety of names. In our paper Focus inside Sectors and Its Implications for Equal Weighting, we outline the adjusted HHI because the index’s HHI divided by the HHI of an equally weighted portfolio with the identical variety of shares.

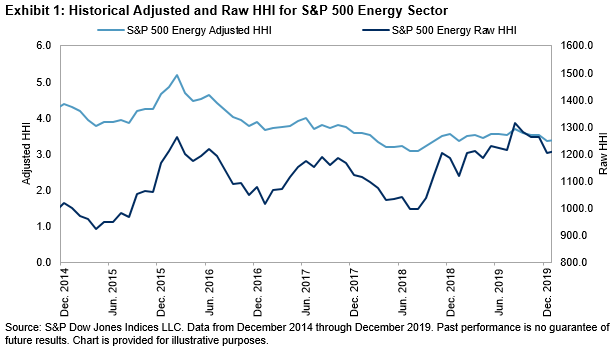

A better adjusted HHI signifies that an index is turning into extra concentrated, impartial of the variety of shares it incorporates. Exhibit 1 reveals that the adjusted HHI for the Power sector decreased from 2014 to 2019, regardless of a rise in its uncooked HHI. It is because the variety of constituents within the sector decreased from 43 in 2014 to twenty-eight in 2019.

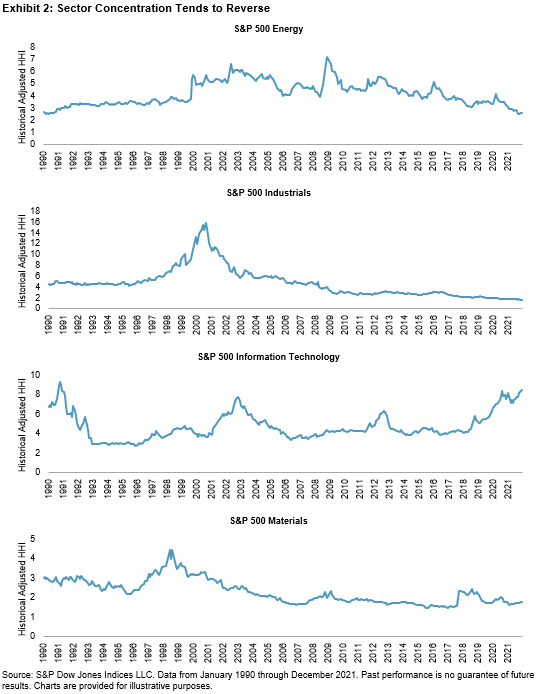

Focus tends to mean-revert in most sectors. That is significantly noticeable in Power, Industrials, Data Expertise, and Supplies, as we see in Exhibit 2. These information suggest that when focus is comparatively excessive, as we see for Data Expertise presently, it subsequently tends to say no. In the meantime, when focus is comparatively low, as we see for Industrials, Power, and Supplies, it subsequently tends to extend.

Rising sector focus implies that larger-cap names are outperforming smaller caps and {that a} cap-weighted index ought to outperform its equal-weighted counterpart. Falling focus implies the other. Since focus tends to imply revert, utilizing relative focus to alternate between cap-weighted and equal-weighted sector exposures is a possible supply of worth added.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P World. All rights reserved. This materials is reproduced with the prior written consent of S&P DJI. For extra data on S&P DJI please go to www.spdji.com. For full phrases of use and disclosures please go to www.spdji.com/terms-of-use.

Unique Put up

Editor’s Be aware: The abstract bullets for this text have been chosen by In search of Alpha editors.