joebelanger

One gold and silver mining stock getting little positive attention in the second half of 2022 is Coeur Mining (NYSE:CDE). Expensive mining costs vs. major miners, share issuance earlier in the year to help finance its Rochester mine expansion, and sliding precious metals pricing have hammered the share price back near the lows of 2019-20.

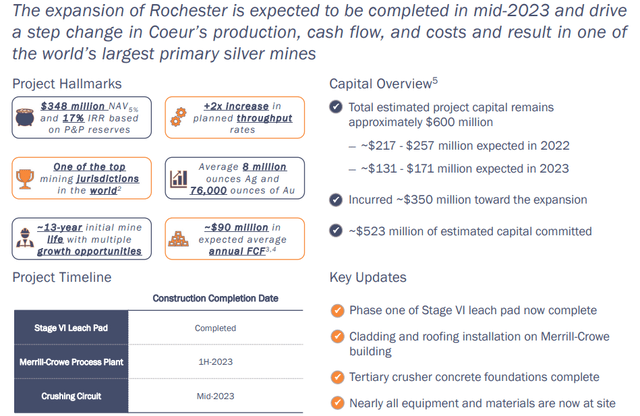

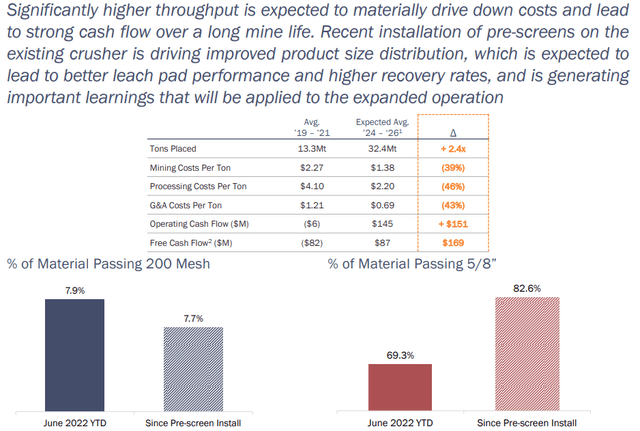

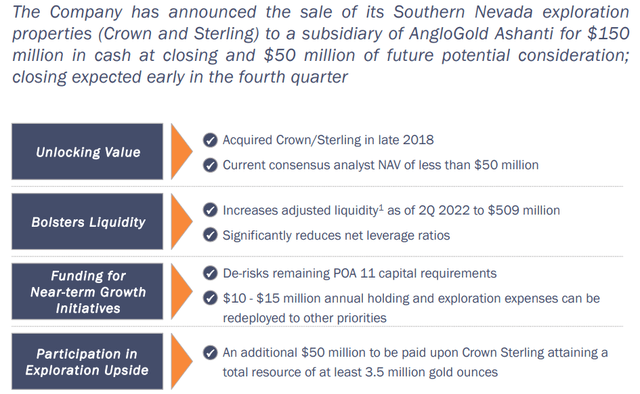

However, I find plenty to like about the company including a diversified list of mines in the top mining jurisdictions of the U.S., Canada and Mexico. Other attention grabbers are silver production is expected to jump by a 50% company rate after next summer, as Rochester’s capital investment starts to pay out generous free cash flow, and a recent Nevada land/resource sale to AngloGold (AU) with $150 million upfront and the opportunity for another $50 million down the road (on a discovery milestone) should neatly clean up its balance sheet.

Honestly, when you get down to the nuts and bolts of valuing its reserves (around 10 years at current production rates) and resources (another 5-10 years if higher gold/silver prices appear soon), Coeur has perhaps the best “immediate” leverage vs. peers to rising precious metals under a 2023 spike scenario. Because I have been turning quite bullish on silver since July (an explanation of my bullish silver view here), now may be a great time to consider buying a small Coeur stake in portfolio construction as an outlier catastrophe hedge idea. In the end, a deep recession or appearance of a new war in the world involving U.S. troops and military assets could force another round of record money printing by the Federal Reserve. Negative outcomes in the world could easily shoot investor demand/pricing for monetary metals through the roof.

The Business

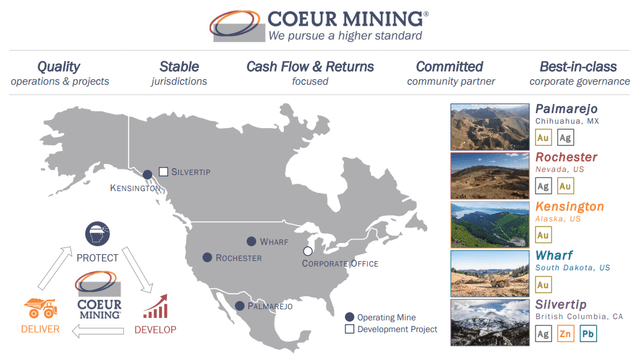

Coeur Mining has been in business for nearly a century (1928). Today it is producing at four properties – Palmarejo located in Chihuahua, Mexico; Kensington in Alaska; Wharf in South Dakota; and Rochester in Nevada; with one late-stage development Silvertip in British Columbia, Canada, owning one of the highest-grade silver-zinc-lead deposits in the world. A nice summary of operations, goals, mining costs, production levels and reserves is found in the September Presentation released at the Gold Forum Americas conference. I have included some of the slides below.

Coeur Mining, September 2022 Presentation

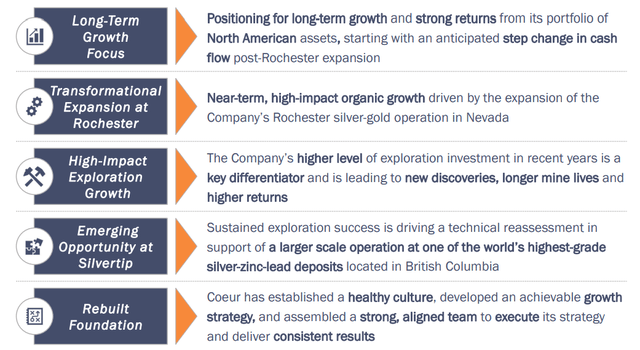

Coeur Mining, September 2022 Presentation

Coeur Mining, September 2022 Presentation

Coeur Mining, September 2022 Presentation

Coeur Mining, September 2022 Presentation

Upside Target Potential

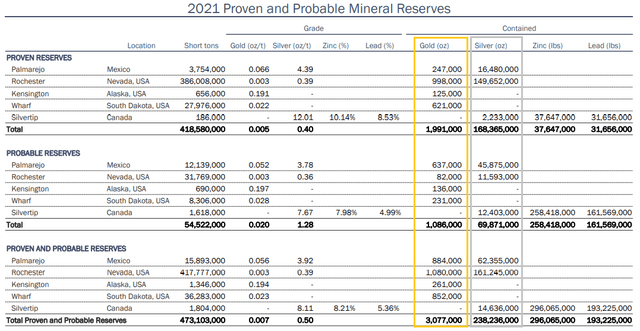

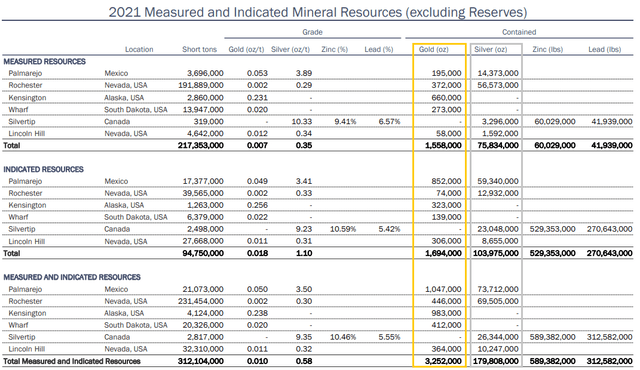

Using gold, silver, zinc and lead numbers at the end of 2021 for reserves and resources, we can compare Coeur to peer mining concerns for underlying value, although each uses different price cutoffs for categorizing economic reserves and mineral resources. In addition, different locations on the planet and production-cost setups play into the risk/reward valuations of mining results and reserves. But for this exercise I will focus on notational reserve values, basically multiplying current metals pricing by likely ounces and pounds to be recovered in future decades (owned in the ground today).

When you consider the safest political and tax jurisdictions (the U.S. and Canada) are those where Coeur mostly operates, a premium valuation is usually part of the equation. However, offsetting this positive is the fact company reserves are lower-grade (at several mines as little as 1/20th the amount of metal per ton of ore dug and processed elsewhere), with smaller deposit sizes overall vs. the major global, highly-profitable mining enterprises.

When I calculate Coeur’s adjusted enterprise value ($1 billion in current equity market value at $3.45 per share, plus $550 million in existing debt and leases, minus adjusted cash levels including the $150 million AngloGold payment), notational proven & probable reserves at today’s market pricing are sitting at a sum 7.5x larger. In addition, reserves plus measured & indicated resources together are valued at 14.3x EV (the rough number to buy out the company, pay off all net debt and achieve total ownership). These numbers include gold, silver, zinc and lead measured resources based on drilling and third-party modeling of deposits, with about 90% of company worth related to gold and silver.

Coeur Mining, September 2022 Presentation

Coeur Mining, September 2022 Presentation

Using the same formula, Hecla Mining (HL) is perhaps the closest peer mid-tier miner operating in the same super-safe jurisdictions. Notational metal values for Hecla are standing at 4.2x EV for underground reserves and 9x measured & indicated totals (including proven and probable), representing a 60% premium to the valuation of Coeur, despite mining the same metals in slightly different percentages.

The strongest jurisdiction, major gold miner with high ore grades, solid profitability and longer mine life is Agnico Eagle (AEM). Comparison shopping puts an underlying notational metals value of 3.5x EV for gold reserves and 6.5x measured resources at AEM. Such is around DOUBLE the underlying metals valuation vs. Coeur (but is arguably worth the premium).

Estimated long mine life (20 to 30 years) at low mining cost, with extra jurisdiction risk (holding mines all over the world, including third-world nations) are the story behind Newmont (NEM) and Barrick Gold (GOLD). Similar calculations put metals value (including gold/silver/copper) for Newmont at 5.9x EV for reserves and 11.1x resources. Barrick reserves (including gold/silver/copper) sit at 6x EV and 9.2x for resources. Again, these numbers point to a real discount in how Coeur is valued, meaning dramatically better leverage to rising metals quotes is present.

Bottom Line Leverage

So, if all other variables (like extraction and processing costs, overhead expense, and projected production levels) remain the same, a spike to US$2,500 an ounce gold and US$30 an ounce silver would generate a monster increase in Coeur’s worth to investors. My back-of-the-envelope math estimates Coeur is now selling at 3x after-tax earnings under this rosy monetary-metal future, on today’s $3.45 stock quote.

In comparison, our 50% spike scenario in gold and silver would generate a Hecla P/E of 6x future 2023 results, Agnico Eagle at 6x, Newmont at 5.5x, and Barrick at 4.5x. My research absolutely identifies Coeur Mining as owning material leverage to immediate metals price gains. In the end, I figure the 2x leverage to rapid “percentage” gains witnessed on average in gold/silver by major miners over the decades I have traded, could be closer to 3x or 4x in Coeur shares today. For example, a 50% gold/silver price jump in 2023 could generate returns of 150%+ next year on the $3.45 CDE quote (with a share price target around $10).

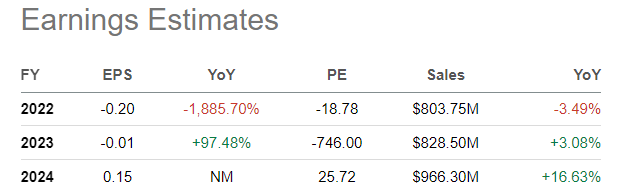

Using current Wall Street estimates and management forecasts for material cash flow improvement at Rochester starting next summer, just flat gold/silver prices should allow earnings to dig out of the hole in 2022. You can review current EPS and sales estimates into 2024 below. Remember, these projections are made using precious metal pricing around $1700 gold and $20 silver.

Seeking Alpha – Coeur Mining, Analyst Estimates for 2022-24, October 19th, 2022

Chart Pattern Reversal?

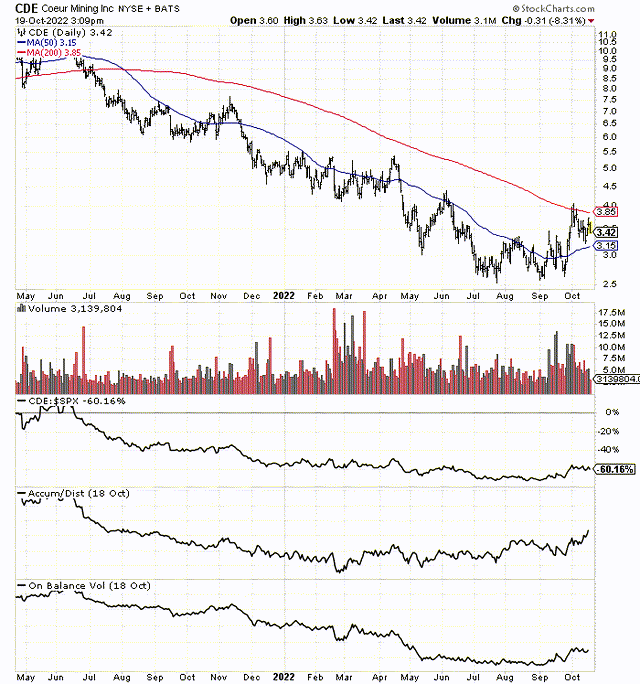

If I am right about my bullish outlook for gold and silver, Coeur should be bottoming now and preparing for a sharp reversal higher soon. The good news is price did reach a low in July and has been zigzagging higher for months. It has conquered and reversed into an uptrend the 50-day moving average, while the 200-day is sitting slightly higher around $3.85, pictured below.

A number of momentum indicators appear to have bottomed already. You can review on the 18-month chart of daily trading, the Accumulation/Distribution Line hit its low point in February, while On Balance Volume bottomed in August, as did relative price strength vs. the S&P 500. My read of the technical picture is price is just waiting for an upturn in gold/silver quotes to support another round of buying interest and a sustained jump above $4 per share.

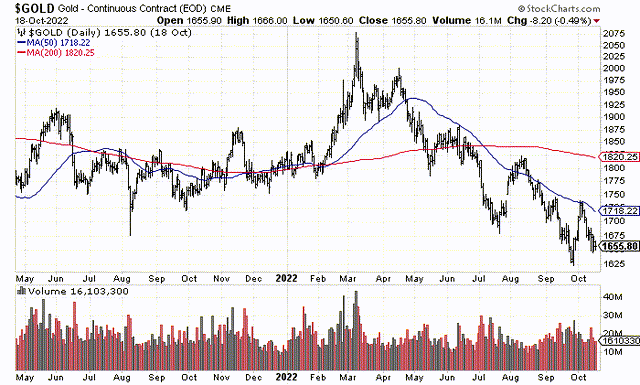

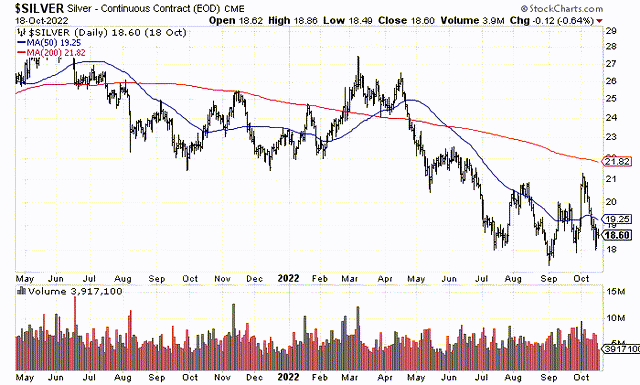

StockCharts.com – Coeur Mining, 18 Month Chart of Daily Changes StockCharts.com – Nearby Gold Futures, 18 Month Chart of Daily Changes StockCharts.com – Nearby Silver Futures, 18 Month Chart of Daily Changes

Final Thoughts

Of course, Coeur’s added upside potential vs. other miners comes with added risk. It’s a double-edged sword for investors. Lower grades and higher mining costs than industry averages mean the company will struggle with operating income until metals pricing climbs into a higher range. If gold/silver flatline or decline next year, Coeur will likely not be a great investment to hold (barring a takeover bid).

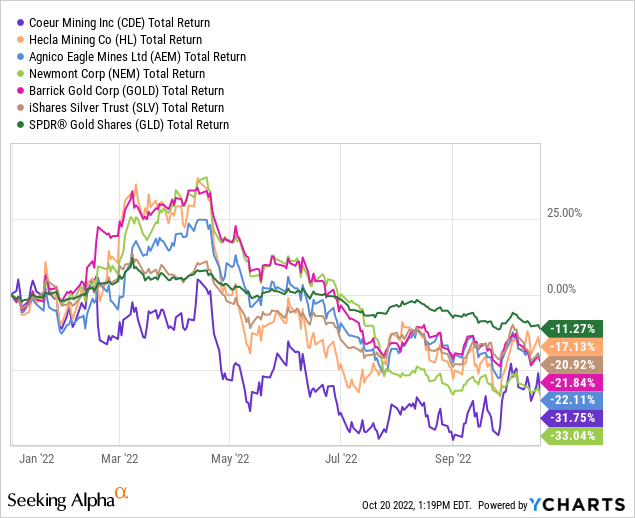

YCharts – 2022 Precious Metal Trading, Total Returns

Yet, the company is so unloved and under-owned today, I am very willing to own a small stake in my brokerage account as part of my metals holdings (mainly precious metals) of about 20 names in October 2022. It is a hedge idea without an expiration, and hopefully without any share dilution in 2023-24, as Rochester’s expansion flips company cash flow numbers, adding a net $100 to $150 million annually by 2024 vs. 2022. If the world falls apart (economically/politically) or America’s individual fortunes turn sour, everyone will flock to assets not related to U.S. dollar stability. The biggest beneficiaries would be the monetary metals of gold and silver, with a decent chance Coeur will be leading the pack for miner performance.

I am initiating a Buy rating, with potential reward to $10 a share in 12 months (given $2500 gold and $30 silver) vs. theoretical risk to $2 in the event of lower gold/silver pricing during 2023. Because of Coeur Mining’s higher-than-typical risk profile vs. major mining firms, I suggest keeping position size on the lower end of the spectrum in portfolio designs. I am confident of the upside story, but want to sleep well at night if proven wrong.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.