AscentXmedia/iStock through Getty Photographs

Although not for everyone, spending time within the outdoor can have a optimistic influence on one’s way of life. Naturally, there are a number of merchandise which have been developed over time that assist to enhance the out of doors expertise. And people merchandise have been developed by quite a few corporations, some public and others personal. Of the publicly traded gamers on this market, one which warrants some consideration from buyers is Clarus Company (NASDAQ:CLAR). Lately, the corporate has exhibited vital income progress and its money flows have usually improved over time. The draw back to that is that the market calls for a hefty premium as a way to half with shares. But when administration can achieve rising the corporate on the price they’ve forecasted, the inventory may be pretty valued or barely underpriced.

A various participant within the out of doors house

Clarus operates as of late as a ‘world main designer, developer, producer and distributor’ of outside tools and way of life merchandise geared toward each out of doors and shopper lovers. The corporate has constructed its enterprise mannequin round figuring out and buying, after which subsequently rising, what it dubs ‘tremendous fan’ manufacturers within the out of doors house. This has led to a various portfolio of product choices. One instance can be Black Diamond Tools, which acts as a vendor of climbing, snowboarding, and mountain sports activities tools that is primarily based out of Salt Lake Metropolis. This falls underneath the agency’s Outside section which, in 2021, generated 58.8% of the corporate’s gross sales and 32.1% of its optimistic section working income.

The corporate additionally has a second section referred to as Precision Sport that features two totally different companies. One in all these is Sierra, which produces bullets and ammunition for each sport and looking lovers. These merchandise are used for precision goal taking pictures, looking, and protection functions. And the manufacturers beneath it embrace Sierra MatchKing, Sierra GameKing, Sierra BlitzKing, GameChanger, PrairieEnemy, Outside Grasp, and Sport Grasp. The opposite model underneath the section is known as Barnes, and it focuses on producing all copper bullet know-how merchandise. These are technologically superior lead-free bullets, in addition to looking, self-defense, and tactical ammunition. Model names underneath this section embrace, however should not restricted to, Barnes TSX, X Bullet, Varmint Grenade, and VOR-TX. Throughout the agency’s 2021 fiscal 12 months, this section accounted for 29.2% of general income and for 67.9% of optimistic section working income.

Along with the aforementioned merchandise, the corporate additionally operates one other section referred to as Journey. That is the latest section the corporate has added to its portfolio and it contains two major companies. The primary of those is Rhino-Rack, which offers aftermarket automotive roof racks and equipment to its prospects. Its equipment embrace baggage carriers, shade awnings, kayak carriers, bike carriers, and different associated choices. The opposite enterprise underneath this section is MAXTRAX, which produces what the corporate calls a car restoration board. Within the occasion {that a} car will get caught within the mud or within the sand, or in another related environmental state of affairs, these boards can be utilized as a agency basis for his or her tires to realize traction to ensure that the car in query to turn out to be dislodged. In 2021, this section accounted for 12% of gross sales however generated an working lack of $2.2 million. In fact, neither of those operations inside this section had a full fiscal 12 months with the corporate. As an example, Rhino-Rack was acquired in July of 2021, whereas in early December of final 12 months the corporate bought MAXTRAX.

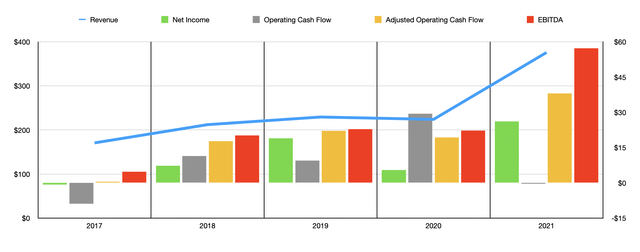

Lately, acquisitions, mixed with natural progress, have had a major optimistic influence for shareholders. The corporate has grown its income in most years, rising gross sales from $170.7 million in 2017 to $375.8 million final 12 months. You will need to word that if all of its acquisitions had been accomplished initially of every fiscal 12 months, gross sales in 2021 would have been even greater at $441.6 million. Due to this, mixed with continued natural progress, administration does have excessive hopes for the enterprise. Excluding different attainable acquisitions, the agency expects gross sales for 2022 to come back in at round $470 million.

Creator – SEC EDGAR Knowledge

Relating to profitability, the image has usually improved over time. In 2017, the corporate incurred a web lack of $0.7 million. This quantity improved in most years, finally climbing to a revenue of $26.1 million final 12 months. However as soon as once more, had its acquisitions been accomplished in the beginning of every fiscal 12 months, the online revenue for the corporate in 2021 would have been much more spectacular at $46.9 million. In fact, there are different profitability metrics for buyers to contemplate. Working money circulation, as an example, has been everywhere in the map because the chart above illustrates. But when we regulate for adjustments in working capital, it will have risen in most years, climbing from simply $0.5 million in 2017 to $38.1 million final 12 months. In the meantime, EBITDA for the enterprise would have grown from $4.8 million to $57.2 million. Administration has supplied no professional forma monetary estimates for these money circulation objects. But when we assume that they might have elevated by the identical p.c that income would have, then adjusted working money circulation would have been $68.5 million, whereas EBITDA would have been $102.8 million.

For the 2022 fiscal 12 months, administration has supplied some steering. At current, the corporate anticipates EBITDA coming in at about $78 million. In the meantime, free money circulation ought to are available in at between $50 million and $60 million. With capital expenditures forecasted at $9 million, the corporate ought to see working money circulation, on the midpoint, of about $64 million in complete. The corporate has not given any steering in the case of web income. But when we assume the same progress price for earnings as what we must always see for EBITDA, then buyers ought to anticipate earnings for the 12 months of about $35.6 million.

Creator – SEC EDGAR Knowledge

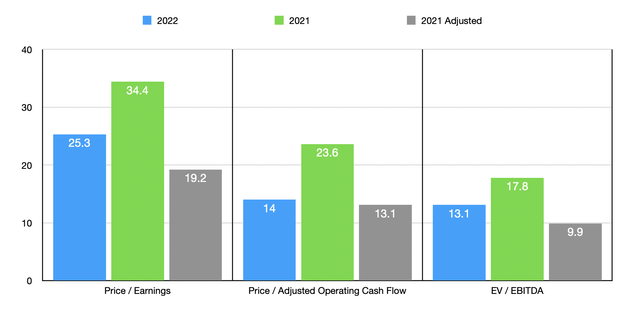

Taking all of those figures, we are able to successfully worth the enterprise. Utilizing the agency’s 2021 outcomes, we see that it’s buying and selling at a price-to-earnings a number of of 34.4. This drops to 19.2 if we depend on the corporate’s professional forma calculations for the 12 months. The value to adjusted working money circulation a number of can be 23.6, with that determine dropping to 13.1 on an adjusted foundation. And the EV to EBITDA a number of can be 17.8, with a decline to 9.9 if, once more, we depend on my professional forma estimate. In the meantime, if we rely as a substitute on the corporate’s 2022 forecasts, in addition to my estimate for income for that 12 months, these multiples can be 25.3, 14, and 13.1, respectively.

To place in perspective how the corporate is valued right now, I made a decision to check it to 5 related companies. On a price-to-earnings foundation, these corporations ranged from a low of three.3 to a excessive of 18.2. In all three valuation eventualities that I used for the price-to-earnings a number of of the corporate, it’s the costliest of the group. I then priced the businesses primarily based on the worth to working strategy, leading to a spread of three.5 to 123.8 for 4 of the 5 companies. The opposite one had a detrimental studying. Of the 4, three have been cheaper than our prospect in every of the three eventualities. And at last, I appeared on the firm by way of the lens of the EV to EBITDA strategy, with a spread of 1.8 to 11. Utilizing each the 2021 outcomes and 2022 forecast, our prospect was the costliest of the group. And utilizing the adjusted estimate for 2021, 4 of the 5 corporations have been cheaper than our prospect.

| Firm | Worth / Earnings | Worth / Working Money Move | EV / EBITDA |

| Clarus Company | 19.2 | 13.1 | 9.9 |

| Johnson Open air (JOUT) | 11.3 | 123.8 | 5.7 |

| Smith & Wesson Manufacturers (SWBI) | 3.3 | 3.5 | 1.8 |

| AMMO, Inc. (POWW) | 18.2 | N/A | 11.0 |

| MasterCraft Boat Holdings (MCFT) | 8.4 | 10.0 | 5.9 |

| Sturm Ruger & Co. (RGR) | 8.3 | 7.6 | 4.5 |

Takeaway

All issues thought-about, Clarus strikes me as an fascinating firm that has succeeded in rising at a speedy tempo. If administration can proceed to develop the corporate as they’ve, it might very nicely respect significantly. At current, shares are undoubtedly expensive relative to related companies. However primarily based on the adjusted 2021 outcomes and the forecasted 2022 outcomes, I would not essentially say they’re overpriced. Given the expansion the corporate has achieved, I’d say that they’re both pretty valued or barely underpriced if we assume progress will proceed.