TexBr/iStock by way of Getty Photographs

February noticed a welcome stabilisation of producing manufacturing in mainland China, suggesting the well being restrictions imposed to regulate the Omicron variant have induced far much less financial disruptions to provide chains than prior COVID-19 waves. Worth pressures additionally remained muted, offering leeway for policymakers so as to add extra stimulus to deal with the general weak spot of the financial system and a continued drop in employment.

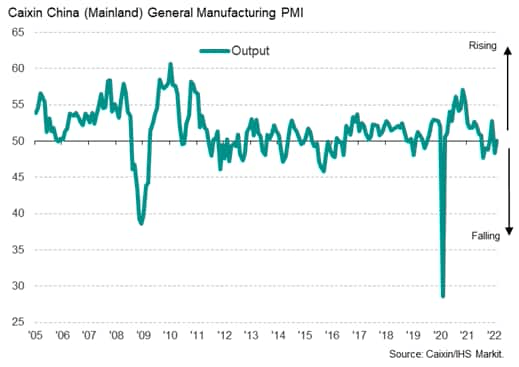

Output steadies as demand rises

Manufacturing manufacturing in China stabilised in February, in response to PMI survey information produced for Caixin by IHS Markit, in a welcome signal of the financial impression of the Omicron wave ebbing.

Manufacturing development in mainland China

Caixin/IHS Markit

The survey information pointed to a marginal enhance in manufacturing after output had fallen into decline at the beginning of the yr as a consequence of well being restrictions having been ramped up in prior months within the face of the Omicron and Delta waves. Having risen final November to the tightest since March 2020, China’s pandemic-related restrictions have been eased barely in February, serving to forestall an extra decline in manufacturing unit output.

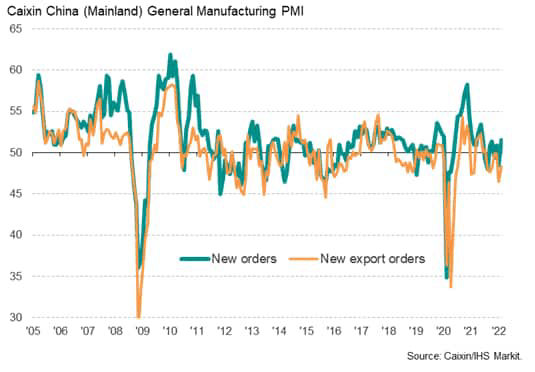

New orders rose, climbing on the quickest price since final June, hinting at a extra strong enhance in manufacturing in March. Nevertheless, new export orders continued to fall sharply, albeit much less so than in January (which had seen the most important drop in abroad demand for 20 months), suggesting the manufacturing sector stays closely reliant on home demand as exports proceed to behave as a drag.

China’s new order inflows

Caixin/IHS Markit

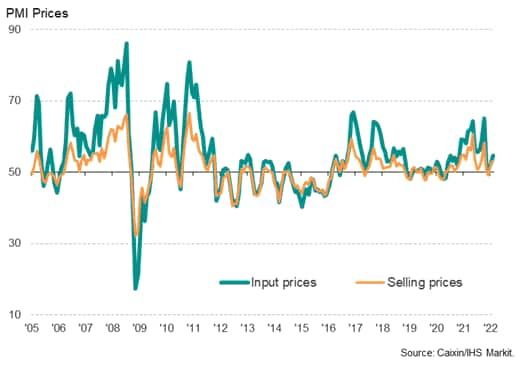

Subdued worth pressures

An additional lengthening of provide chains was reported because of the continuing pandemic, although the incidence of delays fell in comparison with January and delays remained far much less prevalent than seen within the US, Japan, and Europe in current months. These fewer provide constraints, mixed with authorities interventions in commodity markets, helped hold enter worth inflation decrease than within the US and Europe, in flip feeding via to comparatively muted promoting worth inflation.

China’s uncooked materials and manufacturing unit gate costs

Caixin/IHS Markit

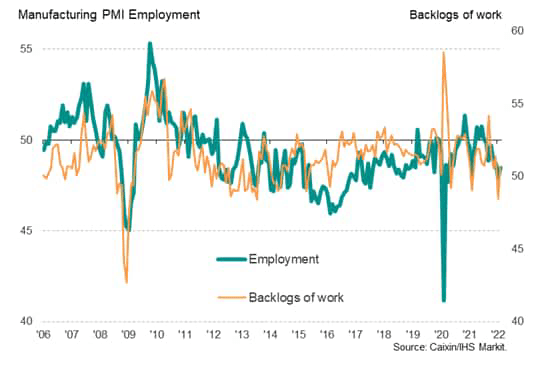

Job losses proceed amid depleting backlogs of labor

The renewed development of latest orders reported in February helped stabilise producers’ backlogs of orders – the quantity of labor in hand obtainable to maintain manufacturing in coming months – which had fallen sharply in January. Nevertheless, the modest rise in backlogs of labor seen in February did little to discourage corporations from downsizing. Producers lowered their workforce headcounts once more at one of many sharpest charges seen throughout the pandemic, albeit barely much less so than in January (which had been the biggest fall recorded since April 2020).

Manufacturing jobs and order e-book backlogs in mainland China

Caixin/IHS Markit

Outlook

The newest PMI survey information present additional reassuring information on inflation in China after shopper costs rose simply 0.9% on an annual foundation in January, down from 1.5% in December. Nevertheless, the subdued output and export orders gauges assist IHS Markit’s current decreasing of China’s actual GDP development forecast to five.3% for 2022 and 5.2% for 2023, down respectively from 5.4% and 5.3% forecasts made in January.

Coverage in China is in the meantime anticipated to be loosened additional over the following few months to assist financial development and, maybe extra importantly, stem the decline in employment.

From a broader perspective, the steadying of manufacturing in China throughout February, and the avoidance of a drop in manufacturing as a result of Omicron wave, might be welcome information for policymakers in different nations, boding effectively for world provide chains emanating out of mainland China. The prospect of additional stimulus ought to likewise assist allay worries of an extra manufacturing or demand deterioration.

Unique Put up

Editor’s Be aware: The abstract bullets for this text have been chosen by Looking for Alpha editors.