Published by Josh Arnold on December 9th, 2022

There are many examples of conglomerates in the stock market. These companies believe that, over time, owning many different types of businesses will offer better and more stable shareholder returns than focusing on a more narrow set of objectives. However, sometimes conglomerates look to sell or otherwise divest parts of the business if the portfolio has become too cumbersome, or parts of it simply don’t fit the company’s strategic priorities.

In situations like these, we often see spinoffs as the preferred strategy of the parent company. This allows the parent company to essentially split off part of the business to existing shareholders, giving those shareholders the option to continue to hold both parts of the business, one, or none. It also allows the management teams of both the parent company and the spun-off entity to be more focused on the business, given scope narrows in spinoffs.

Dividend Aristocrat Brookfield Asset Management (BAM) very recently underwent a spinoff as it distributed 25% of its asset management business in early December 2022.

You can download an Excel spreadsheet with the full list of all 65 Dividend Aristocrats (with additional financial metrics such as price-to-earnings ratios and dividend yields) by clicking the link below:

In this article, we’ll take a look at the parent company, as well as the impact that this spinoff will have on Brookfield Asset Management shareholders, and our recommendation looking forward.

Asset Management Spinoff

Brookfield is a leading global alternative asset manager, and its focus is somewhat unique in that it owns so-called “real” assets. These include things like real estate, renewable power generation, infrastructure assets, and some private equity investments. Brookfield not only has a sizable business of its own, but it also manages three publicly-traded partnerships: Brookfield Infrastructure Partners (BIP), Brookfield Renewable Partners (BEP), and Brookfield Business Partners (BBU). In addition, it will now have the relationship of owning 75% of the asset management business, with the other 25% owned by shareholders following the distribution of those shares in the spinoff.

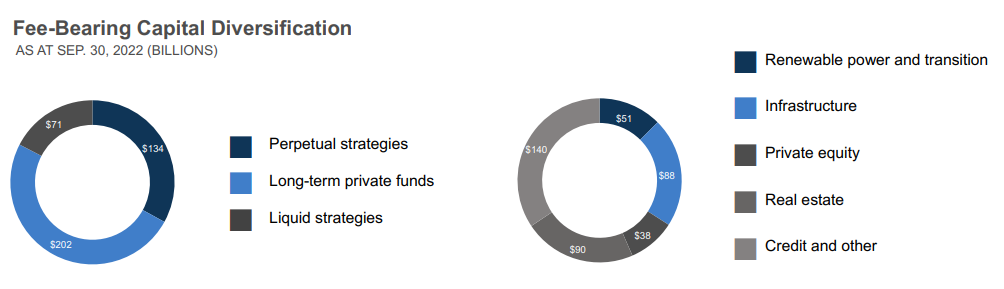

Source: Q3 supplemental information

The current capital allocation in terms of fee-bearing capital, which is how the asset management business is using its capital, is above. The company focuses on a mix of long-term and “perpetual” strategies, with only about 17% of fee-bearing capital in liquid strategies. That means that at any one time, roughly $83 of every $100 is invested in some sort of long-term project that the company intends to hold for years. While that makes disposition earnings lumpy, it also means the company has more stable operating earnings from its holdings.

The transaction is to distribute a 25% interest in the asset management business of Brookfield Asset Management, which results in two publicly-traded companies. The parent company, Brookfield Asset Management, will be call Brookfield Corporation. The “Manager”, which is the spun-off portion of the business, will be a pure-play global alternative asset management business.

Brookfield Corporation, which is the parent company, will own 75% of the asset management business, while shareholders will receive the other 25%. The parent company’s ticker will be changed from BAM to BN, while the asset management spinoff will take over the ticker of BAM. The spinoff is being made on a tax-deferred basis for shareholders in the U.S. and Canada, the latter of which being where Brookfield’s family of companies is based. Each shareholder will receive one share of the asset management business for every four shares of the parent company held.

How Will the Spinoff Impact Growth?

Prior to the spinoff, we projected Brookfield to have 8% average annual earnings-per-share growth over the medium term. That’s a strong number, but guidance from management suggests that could be understated. Indeed, Brookfield’s management believes the company can produce a 17% annualized return through 2027, which is quite an ambitious goal. That includes shareholder distributions, but even so, we’re not prepared to assume such a lofty target will be achieved.

The good news for shareholders of the parent company is that we see a minimal impact to growth from the asset management spinoff.

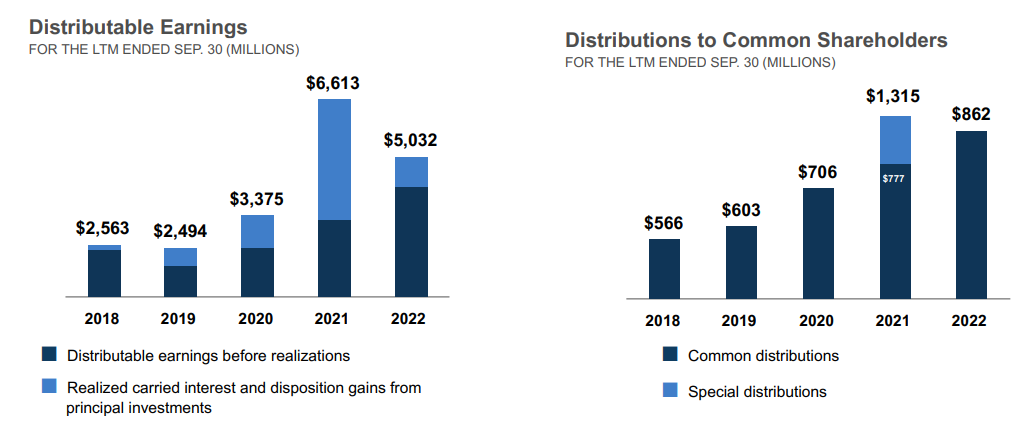

Source: Q3 supplemental information

We can see that Brookfield’s growth has been lumpy, but that is to be expected given the unusual nature of many of its investments. Distributable earnings are a key metric, and as we can see, the realized carried interest and disposition gains are most of the company’s earnings from the past few years. These earnings occur when Brookfield sells an asset for a gain, but these earnings are unpredictable in both timing and size. The distributable earnings before realizations are a more traditional form of operating earnings, and we believe this should be largely unchanged following the spinoff.

The parent company, ticker BN following the spinoff, will still own 75% of the asset manager. Thus, even if the asset management business takes with it some measure of growth, the parent company is ceding control of only 25%, not the entire business. With this in mind, we believe the impact to the growth profile of the parent company to be minimal as it is not spinning off the entirety of the asset management business.

How Should Shareholders React?

Prior to the spinoff, we believed Brookfield was trading at a premium to its fair value, and we therefore placed a hold rating on the stock. Given that the combined valuation of the parent company and the spun off company should be the same as it was pre-spinoff, at least initially, and the fact that we don’t believe Brookfield’s growth profile will be materially altered, we continue to rate shares a hold. After the companies have time to trade on their own, the market may produce differing fair values, and we will reassess accordingly. For now, given the small percentage of the asset management business being spun off, we don’t believe the outlook for the parent company’s shares has changed materially.

Final Thoughts

While spinoffs can sometimes be transformative for certain companies, we find this one to be a relatively minor event. Brookfield is spinning off a minority stake in one part of its business, and we therefore believe the outlook for the parent company’s shares is relatively unchanged. Given that, we believe shares of both the parent company and those of the asset manager are a hold. Both companies should have robust growth outlooks following the separation, and we like the fact that the parent company will retain a large majority of the asset management business, meaning its outlook should be relatively unchanged.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].