Galeanu Mihai/iStock by way of Getty Photos

“A nickel ain’t price a dime anymore.” -Yogi Berra

To My Companions and Mates:

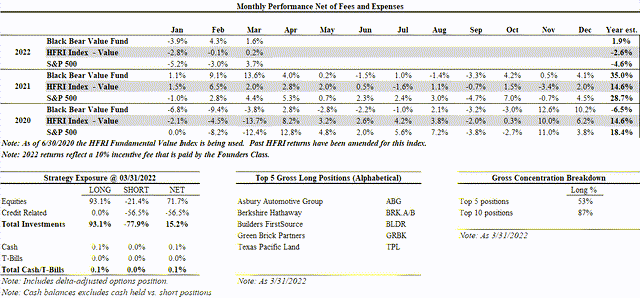

- Black Bear Worth Fund, LP (the “Fund”) returned +1.6% in March and +1.9% YTD.

- The S&P 500 returned +3.7% in March and -4.6% YTD.

- The HFRI Index returned +0.2% in March and -2.6% YTD.

- We don’t search to imitate the returns of the S&P 500 and there can be variances in our efficiency.

- Be aware: 2022 returns mirror our decreased 10% incentive charge.

Be aware: Extra historic efficiency may be discovered on our tear-sheet.

I write to you amidst a risky market with a superb dose of geopolitical and international financial uncertainty. Whereas Black Bear is up on the 12 months, I need to warning everybody that on this surroundings, markets can act irrationally, and I might not count on our partnership to at all times be immune. That stated, as I’ll talk about beneath, we’re positioned to do nicely on this surroundings each when it comes to the investments now we have and our skill to deploy capital when others are retreating.

Sometimes I’m requested the next query: “What’s the market telling you?” It may be disappointing and even offensive after I say, “looks as if extra sellers than patrons” or “the market tells me folks haven’t modified an excessive amount of.” Shares SHOULD be considered as proportional shares of companies no completely different than the dentist down the road or your native financial institution. Nevertheless, as a result of auction-driven inventory market, shares function an extension of individuals’s feelings which may be fairly risky. On their very own, shares wouldn’t do something…PEOPLE do issues and folks may be excessive of their opinions and behaviors. Because of this, shares simply inform me how folks could also be feeling within the second unbiased of the enterprise. That is the chance for the basic investor. Usually when folks get scared, they promote to keep away from future mark to market losses unbiased of enterprise fundamentals. We’re invested primarily based on what the enterprise is telling us…not the inventory…and make the most of opportune reductions out there to our benefit.

Transient Dialogue on Homebuilding/Housing

Ceaselessly folks appear intent on preventing yesterday’s battles. Housing led the final multi-year downdraft inflicting many at this time to try to paint parallels. The valuations in homebuilding and homebuilding-adjacent companies are extraordinarily low cost and incorporate a number of unhealthy information. This theme is a significant portion of our portfolio. Whereas mortgages are costlier at this time than they have been 3 months in the past, they’re nonetheless low cost in absolute and historic phrases. Whereas greater mortgages price scale back affordability, elevated wages can assist mitigate that situation. Underwriting requirements have improved for the reason that monetary disaster. In reality, it isn’t that simple to get a mortgage with all of your documentation so as.

The business is more healthy each when it comes to working efficiencies/scale and wholesome steadiness sheets. If enterprise slows down, it won’t be a 2008 redux.

Proper now, there’s 1.7 months of provide of current properties. That’s not quite a bit. Folks have a option to lease or purchase. Present rental vacancies are ~5.6% which matches the multi-decade lows and contrasts with ~10% vacancies within the lead as much as the GFC. Moreover, the 0.9% house owner emptiness price ties the bottom stage on file and is beneath the 1.6% long-term common and peak of two.9% in 2008 (Due to the crew at Credit score Suisse for this information.)

Dwelling costs are up as a result of folks want locations to stay and now we have had power underbuilding for a decade. We want extra properties, and we’d like them within the places persons are shifting. Nationwide averages usually are not useful as we personal a builder in particular areas of the nation. Moreover, averages obfuscate the economics to every mover. For instance…properties in Florida could also be costlier relative to previous properties in Florida…however to not properties in New York/New Jersey/Connecticut. Affordability is relative.

Inflation/Credit score Shorts/Pricing Energy

As a reminder we’re brief ~ 57% of the fund in numerous credit score devices. The funding is predominantly however not solely in choices so 57% of our portfolio just isn’t in danger.

With inflation rearing its head and proving to not be a brief visitor, the price of cash, AKA rates of interest, has develop into an en vogue dialogue subject. Is inflation transitory? No clue. However you typically don’t roll again wages when you may have elevated them. A few of the inflation will stay right here and set a brand new baseline for the longer term. As provide chains normalize inflationary pressures ought to lower. Nevertheless, the world is one huge chain response and if wheat just isn’t flowing from Ukraine and pure fuel/oil just isn’t flowing from Russia to the EU, the dominoes can hit in unpredictable methods each in magnitude and length.

Whereas credit score devices have widened it nonetheless doesn’t make sense {that a} honest value for credit score is within the low-mid single digits. Moreover, there appears to be an enormous push domestically for elevated compensation for labor.

It will harm working margins for a lot of corporations and impair their credit score profile. In a much less accommodating rate of interest surroundings we may even see one thing that now we have not shortly…corporations defaulting! Individuals are accepting a awful return contemplating inflation and default dangers. The actual return of those investments is detrimental.

Because of this, we stay brief credit score devices that vary from US Junk to Funding Grade to Rising Markets. I’m nonetheless doubtful that ETF’s can orderly deal with a large sell-off in credit score. If the federal government had not stepped into the market in March 2020 these devices would have had liquidity points.

We personal companies which have pricing energy and restricted/no dependence on the necessity for exterior funding. That is vital as a result of as enter and wage prices stress profitability of many corporations, our companies ought to be capable of climate the storm and capitalize through each natural market share beneficial properties and/or acquisitions of corporations that won’t have had a wholesome steadiness sheet or working construction.

In a vertical market, the place cash dropping corporations can seize in the marketplace’s creativeness and lift countless funds, the staid and true companies appear quite a bit much less fascinating. Occasions could also be altering and people companies that may endure will profit those that personal them.

High 5 Companies We Personal

Asbury Automotive Group (ABG)

Asbury has many comparable qualities to AutoNation, which we held for the final 5+ years. I don’t sometimes talk about portfolio exercise however given the long-holding and sure questions, I figured I’d handle the change in our holdings right here.

Whereas I like the AutoNation enterprise there was a administration change and an accompanying change in strategic and capital allocation priorities. It was painful to promote the enterprise because it had been one in all our core investments and I believed they have been on an awesome observe. Administration’s technique could wind up being profitable, however it’s completely different than what I underwrote and consequently a change was wanted for our portfolio. I categorical my because of the crew at AutoNation as our Partnership has benefited out of your stewardship.

Asbury had been within the portfolio earlier than. Getting into COVID, I made a decision to pay attention our auto supplier investments into AutoNation. ABG is run by extremely succesful administration who’ve made 2 accretive and sizeable acquisitions up to now 18 months. The basics of each companies are comparable although there are some variations of notice.

First a pair negatives. AutoNation has a reputation model, whereas Asbury doesn’t. Whereas it’s arduous to worth what a model is price there’s worth connected to the AutoNation title that we’ll not have at a company stage with Asbury. Nevertheless, on the dealership/shopper stage I’m not certain there’s a lot of a distinction.

Second, Asbury has a good quantity of debt (2.8x proforma for acquisitions). I might count on this quantity to say no each because the working enterprise performs and debt is decreased.

One of many positives of Asbury is their current acquisition of the Larry H. Miller Group. Sometimes, most auto sellers obtain a fee when a service or guarantee plan is offered with the acquisition of the automobile. The Miller Group has constructed an inside enterprise that operates these plans that are each excessive margin (20+%) and sticky all through the lifetime of a buyer. As ABG rolls these plans out to their current dealerships there is a chance for significant will increase in cashflow for each buyer transaction.

Inventories for automobiles stay tight and the unit profitability remains to be unusually excessive. I underwrite the enterprise on a “steady-state” foundation eradicating the advantages from decreased stock. Two adjustments from this pandemic will probably stay within the business.

First, OEM’s and sellers have traditionally been in a PUSH mannequin the place OEM’s ship numerous stock that sits on sellers’ heaps. Each have witnessed that with decreased stock, everybody wins (nicely possibly not the client as a lot.) Working capital wanted for stock is decrease and returns on capital and absolute profitability have elevated dramatically. It stands to purpose that supplier heaps won’t be caught with 60-90 days of stock when provide chains normalize.

Second, as digital enterprise continues to develop, the necessity for headcount on the dealership declines. Most dealerships have managed to develop their companies with out a lot progress in workers. This working leverage ought to proceed to extend as dealerships develop into extra success facilities than showrooms/promoting areas.

ABG ought to be capable of generate steady-state free-cash per share of $20-$30 implying we personal the enterprise at a 12-20% free-cash circulation yield on quarter-end pricing. We should always do nicely with or with out a lot progress within the enterprise.

Berkshire Hathaway (BRK.A)

Beneath is the tough Berkshire on-a-napkin valuation I love to do periodically. Not too long ago BRK acquired Alleghany for $11.6BB. I assume a discount in money for this quantity and a rise of $550MM in working earnings. I don’t give profit to the elevated float nor any synergies. Once more, it is a tough train to sanity test our assumptions.

- Money of ~$103,000 per class A Share (vs. $104k 1 12 months in the past)

- Down/Base/Up marks money at e-book worth to an 8% premium (vs. to 10% a 12 months in the past)

- Investments primarily based on December costs ~$248,000 per class A share (vs. $194k a 12 months in the past)

- Presume a spread of inventory costs that lead to:

- Down = $149,000 per class A share (-40%- assumes portfolio is overpriced)

- Base = $211,000 per class A share (-15% – assumes portfolio is overpriced)

- Up = $285,000 per class A share (+15%)

- Presume a spread of inventory costs that lead to:

- Working companies that ought to generate ~$17,000 of pre-tax earnings per Class A share (vs. $15k)

- Down = 9x = $153,000 per share – equates to ~8% FCF yield

- Base = 12x = $204,000 – equates to ~6% FCF yield

- Up = 12x = $204,000 – equates to ~6% FCF yield

- General (vs. $529,000 at quarter finish)

o Down = $413,000 (-28%)

- Base = $526,000 (pretty priced)

- Up = $600,000 (13% underpriced)

Going ahead I count on Berkshire to compound at good, not nice returns. The probably query is why personal it in any respect if we count on modest returns…

BRK is a set of high-quality companies, wonderful administration, and a superb quantity of optionality of their money place. If the money have been to be deployed accretively the true worth can be better than an 8% premium (as talked about above). The mix of a pie that’s rising, an rising share of stated pie as a consequence of inventory buybacks, upside optionality from money and a decent vary of probably enterprise outcomes that span a wide range of financial futures provides me consolation in persevering with to personal Berkshire.

Builders FirstSource (BLDR)

Builders FirstSource is a provider and producer of constructing supplies for skilled homebuilders, subcontractors, remodelers, and shoppers. Their merchandise embody factory-built roof and ground trusses, wall panels and stairs, vinyl home windows and customized millwork.

The basic dialogue about homebuilders applies to BLDR. As extra properties are constructed throughout the nation, there can be an elevated want for scaled sourcing of merchandise to homebuilders. There’s a considerable amount of fragmentation within the provide chain which gives BLDR an extended runway for acquisitions and real looking synergies.

The administration crew has been utilizing their prodigious free money circulation to each purchase new companies and purchase of their inventory. Whereas I traditionally at all times appreciated their enterprise, their historic high-debt ranges gave me pause. They’ve proper sized their steadiness sheet and are taking a really considerate view on capital allocation on behalf of shareholders.

BLDR ought to be capable of generate $7-$10 a share in money within the medium time period with vital upside if they’ll scale by means of acquisition and/or additional penetrate current markets. We personal it at a 11-15% free-cash circulation yield so little progress is required for us to compound worth at excessive charges.

Inexperienced Brick Companions (GRBK)

Inexperienced Brick Companions is a residential land developer and homebuilder. Most of their operations are in Texas, Georgia, and Florida. GRBK was previously a non-public partnership between Jim Brickman and entities associated to Greenlight Capital (managed by David Einhorn). David is presently the Chairman of the Board.

As mentioned earlier, there’s a long-term elementary provide/demand imbalance in housing stock. It is a direct results of underproduction of recent properties amid a difficult mortgage financing surroundings over the past 10+ years for the reason that Nice Monetary Disaster. Wanting ahead we must always have elevated housing demand from millennials as they enter the family-phase of life and need more room.

It’s uncommon to have the ability to associate with a superb operator and a very good capital allocator. As evidenced by our funding in AutoNation, if you marry these 2 ideas you may wind up with an exquisite consequence. GRBK has been reinvesting their cashflow in extra heaps/land stock. This masks the earnings energy of the corporate. The corporate is valued someplace between 5-8x steady-state earnings and probably even cheaper than that. I are typically extra conservative given the potential for price rises and inflationary will increase in growth prices. We’ve got high-quality stewards at each the working and Board stage.

Texas Pacific Land (TPL)

TPL had fallen out of our prime 5 in our previous letter as a result of enhance in worth of different investments and a modest discount in our holdings. Moreover, I used to be cautious as there have been some company governance points to be addressed. We admire and categorical our because of administration in addition to a few of our fellow shareholders for resolving one of many issues and having the unqualified Board Member exit the Board of Administrators.

As a reminder, TPL is a royalty firm with 100% of their acreage situated within the Texas Permian Basin. In a nutshell they generate income when drilling exercise happens however DO NOT have the capital wants as they merely present entry to land.

The incremental quantity of labor on TPL’s half is minimal because the extraction and motion of the oil/pure fuel is undertaken by others. They’re merely a toll collector with Returns on Capital of 80+%.

In an inflationary surroundings, companies which have decrease capital depth each in capital belongings and folks stand to profit. In different phrases, if oil goes up quite a bit, the incremental price to TPL is near 0 so it’s all incremental revenue. It is a enterprise that ought to profit in a large manner if now we have power inflation. Within the meantime, we probably personal it at a 3-4% free money circulation yield with huge upside.

Ukraine

A part of this job is continually studying the information and staying abreast of each nationwide and world occasions. On daily basis I learn the tragic tales concerning the unneeded bloodshed in Ukraine. As arduous because it is perhaps for us all to learn it, it’s vital to bury our nostril in it and contemplate how we’d really feel if it was our household and pals. It’s in that mild that I made a decision to donate our February administration charges to varied Ukrainian efforts to assist youngsters. I might implore you to not ignore unhealthy information. Throughout our good days we have to stay sober and empathize with these much less lucky. Thanks to our companions who’ve each contributed by means of their administration charges and on their very own to those causes. I hope that as our enterprise grows, we are able to collectively do extra.

Fund Updates

Because the Fund has grown, now we have needed to make extra filings with numerous regulatory companies. Throughout Q1 we filed with the SEC to develop into an exempt reporting advisor.

2021 Okay-1’s ought to have been acquired. In case you are not in receipt, please let me know. This was a higher-tax 12 months than the earlier 4. It appeared like there was a risk for greater capital-gain charges in 2022 so I made the willpower to appreciate some beneficial properties in 2021.

Our portfolio and enterprise construction are set as much as thrive in rocky waters. I’m discovering high-quality/cheap companies to personal and really feel that now we have some draw back insurance coverage safety from our fairness and credit score shorts. We won’t chase or use our creativeness when investing our capital. If we are able to keep sane when others are appearing reckless, we are able to defend capital throughout robust occasions and benefit from dislocations. Over the past 5- 10 years there was a number of foolishness and artistic investing which gives us a aggressive benefit over the approaching years.

Thanks to your belief and help.

Unique Put up

Editor’s Be aware: The abstract bullets for this text have been chosen by Searching for Alpha editors.