Bitcoin: There’s No Straightforward Approach Out

Nice Ones, Bitcoin’s (BTC) not indestructible. Child, higher get that straight.

I believe it’s unbelievable how crypto gave in to the palms of destiny. However some issues are value combating for. Some investments by no means die. I’m not asking for an additional foreign money — I simply wanna know why!

There’s no straightforward manner out! There’s no shortcut residence!

Final week, Nice Stuff declared that bitcoin’s digital gold comparability was “Kaput. Irrelevant. Achieved-zo.” And I stand behind that evaluation.

When the markets ran from the Russian invasion, bitcoin was left within the lurch whereas gold costs soared. What extra proof do you want that bitcoin ≠ gold?

However that doesn’t imply that bitcoin and cryptos aren’t value investing in. In reality, because it seems, that little bitcoin dive was a wonderful shopping for alternative. BTC is up greater than 25% from its post-invasion lows and is now sitting just under $44,000.

What’s extra, the present rally has legs. Lengthy legs.

So, if bitcoin isn’t a safe-haven funding like gold, why is the main cryptocurrency rallying? Shouldn’t Wall Road traders deal with BTC like all the opposite “threat off” tech investments on the market?

Effectively, “threat off” was definitely the explanation BTC plummeted within the first place, however then traders realized one thing slightly elementary about bitcoin and cryptocurrencies…

They’re decentralized. No central financial institution on the planet immediately controls their worth, utilization, storage or buying and selling.

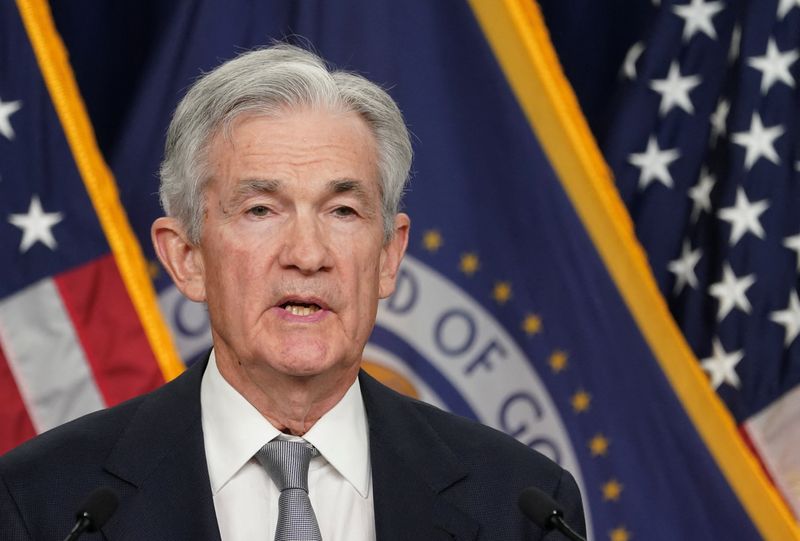

Positive, many central banks world wide have tried to regulate cryptos. China and Russia all however banned them. The U.S. Federal Reserve is trying to closely prohibit and regulate them. However nobody really controls them … and that’s by design.

Many fashionable crypto traders don’t keep in mind or care why cryptocurrencies had been invented within the first place — to get your cash out from beneath direct authorities management, and to take action securely in a manner that chilly exhausting money and gold by no means might. That’s each capitalist’s and libertarian’s dream, proper?

Don’t tread on my money!

Effectively, because the saying goes: Watch out what you want for.

The Russia/Ukraine disaster uncovered a core aspect of crypto’s design that would have international penalties.

Particularly, the unregulated design of cryptocurrencies might permit Russia to get round monetary sanctions.

Since central banks don’t management cryptocurrencies like bitcoin, they will’t cease cryptos from altering palms in sanctioned international locations. That responsibility falls to the crypto exchanges, and whereas a few of these exchanges are taking part in ball with central banks … many usually are not.

Take in style crypto alternate Kraken, for instance. Kraken CEO Jesse Powell tweeted the following earlier this week:

I perceive the rationale for this request however, regardless of my deep respect for the Ukrainian individuals, @krakenfx can not freeze the accounts of our Russian purchasers with no authorized requirement to take action.

Moreover, a Kraken firm spokesperson stated the next in an electronic mail to Barron’s:

Freezing entry to digital property of residents from a whole nation doesn’t essentially punish those that are literally accountable and who could have already ready for the potential of blanket sanctions.

Binance, the biggest crypto alternate on the planet, additionally weighed in on the sanctions state of affairs:

We aren’t going to unilaterally freeze hundreds of thousands of harmless customers’ accounts. Crypto is supposed to offer better monetary freedom for individuals throughout the globe. To unilaterally resolve to ban individuals’s entry to their crypto would fly within the face of the explanation why crypto exists.

Each are laudable standpoints from a place of non-public monetary freedom, however the price of this freedom is a loophole in sanctions towards Russian aggression.

On the alternative finish of the spectrum, Nice Stuff Picks holding Coinbase (Nasdaq: COIN) is enacting new measures for “sanctions screening” as a part of its buyer protocols. In layman’s phrases, Coinbase has taken it upon itself to observe crypto exercise for something that skirts sanctions.

The corporate additionally instructed Barron’s:

We proactively use blockchain analytics to observe wallets to establish further illicit exercise.

It’s essential to recollect right here that Coinbase is a publicly traded firm within the U.S., and never taking part in ball with U.S. monetary regulators comes with a really hefty price ticket.

Now, I don’t wanna pacify you. I don’t wanna drag you down.

However there’s no must really feel like a prisoner or a stranger on this crypto city. I see all of the offended faces in my inbox, afraid that could possibly be you and me.

You’re talkin’ about what might need been, whereas I’m thinkin’ about what I was…

There’s no straightforward manner out!

Effectively … there is a manner out. And it’s as much as you the way straightforward this goes!

For the final a number of months, Paul Mampilly and his crew have been perfecting their technique to offer YOU an opportunity to reap the advantages from this thrilling new market…

A brand new world of blockchain, cryptos and this revolution of “Forex 2.0.”

In response to Paul: “Our world is about to get a severe improve… And so that you don’t get left behind, in the present day we’re going to point out you commerce cryptocurrencies the Daring Income manner.”

Click on right here to study extra!

The Good: Proper On Goal

In a sea of pink reviews, Goal’s (NYSE: TGT) stellar earnings announcement stands out for all the precise causes.

The corporate simply posted earnings per share totaling $3.19, in contrast with expectations for $2.86.

Income additionally leapt to $31 billion from the year-ago interval, coming in only a smidge beneath analyst estimates for $31.39 billion.

That may sound like a slim victory till you contemplate the corporate’s $106 billion full-year income determine, which destroyed the $77.1 billion Goal made again in 2020 — when individuals had been nonetheless getting recent rounds of stimulus checks and the worldwide provide chain hadn’t fully collapsed.

Goal stated a part of this progress could be attributed to a killer vacation season, which noticed digital gross sales up 9.2% 12 months over 12 months. I simply surprise what number of of these digital consumers had been in a position to snag a PS5 … and what number of goats they needed to sacrifice to appease the click-bot gods.

Whereas Goal stated it expects earnings and income to extend “at a slower tempo than 2021,” TGT traders had been nonetheless heartened by huge pink’s wholesome vacation quarter.

As such, they kicked their full-year steering fears additional down the street and rallied Goal inventory 12% greater.

The Unhealthy: Zoom & Gloom

“All I wanna do is Zoom-a-Zoom-Zoom-Zoom … however my boss needs me again within the workplace.” — Each work-from-home worker, most likely.

Nice Ones, all of us knew that ongoing distant work was unsure post-pandemic.

Now, after two years of freedom from early morning commutes, white-collar employees in every single place are slowly being beckoned again into their beige workplace areas … and one firm particularly is sharing their ache: Zoom Video Communications (Nasdaq: ZM).

Zoom grew to become the go-to communication instrument through the top of the pandemic due to its handy videoconferencing — to not point out one of many inventory market’s largest progress tales.

However now that workplaces are opening again up once more, Zoom’s cracks as a progress firm are beginning to present.

For one, Zoom’s year-over-year gross sales progress climbed simply 21% within the newest quarter, which is the slowest interval on file for the renegade video host.

Moreover, though Zoom’s $1.07 billion in gross sales did prime analysts’ expectations this quarter … the corporate’s 2023 fiscal forecast of income between $1.07 billion and $1.08 billion got here in beneath the Road’s $1.1 billion steering.

Therefore ZM inventory’s 4% slide this morning.

Whereas I’ve little doubt that Zoom will proceed to dominate the videoconferencing market … the query on everybody’s thoughts is: How huge will that market be now that everybody goes again to the workplace?

Share your prediction with me right here: [email protected].

The Ugly: Lucid Comes Up Missing

Lucid Group (Nasdaq: LCID) traders had been barely lucid this morning after the electrical automobile (EV) virtuoso slashed its 2022 automobile manufacturing forecast by a brutal 40%.

Including to the anguish, Lucid additionally reported a lack of $1 billion through the fourth quarter on income of $26.4 million, bringing Lucid’s losses to a grand whole of $4.8 billion in 2021.

However hey, the automotive firm stated its manufacturing issues didn’t stem from semiconductor shortages like a lot of its EV companions, as an alternative citing “commodity components comparable to glass and carpet” as the primary slowdown perpetrator. So … progress?

Factor is, on this inflationary surroundings, earnings misses and hovering prices are one thing that Wall Road has come to anticipate. Buyers may not be completely happy about it … however in addition they perceive the strain automotive firms have come beneath in latest months.

Nevertheless, reducing manufacturing amid hovering prices is one thing solely totally different. Buyers most likely would have shrugged off the fee calamity if manufacturing wasn’t punished as nicely. However reducing manufacturing at a time when prices hold rising? That’s no bueno, and traders notice it.

Given in the present day’s 15% plunge, Wall Road clearly isn’t prepared to drive down Lucid’s lengthy and winding path to profitability … regardless of what number of meeting crops it plans to construct for vehicles it might probably’t presently make.

And herein lies the issue with investing in EV startups: You by no means know which automotive firms are gonna cruise down straightforward road and which is able to wind up wrecked.

That’s why my colleague Ian King suggests EV fans look beneath the hood of the EV market and put money into pick-and-shovel firms that may revenue regardless of who dominates the market.

Take this little-known firm, as an illustration.

It’s the one firm in the complete Western Hemisphere with the capability to supply the one materials each EV wants. And but hardly anybody is aware of about it.

That’s why Ian says now’s the time to purchase this under-the-radar inventory … earlier than extra EVs clog the roadways and everybody learns its title.

Click on right here now for the total story.

Pssst… Hey, Nice One. Come ‘ere a sec…

Wanna purchase some NFTs? No? Ha, alrighty then. How about a complete NFT market? Now we’re cooking with fuel!

Not will you NFT followers need to trawl digital darkish alleys and doubtful itemizing websites to get your repair of blockchain-based Bored Ape NFTs…

In its bid to remain “with it” and “in contact with in the present day’s youth,” Salesforce (NYSE: CRM) simply introduced its plan to start out up a brand new NFT market the place one might create and promote NFTs.

And sure … we’re speaking about that Salesforce. The cloud-software stalwart Salesforce.

And never everybody at Salesforce is ‘bout-it ‘bout-it in relation to the corporate’s nifty NFT initiatives:

Greater than 400 workers have signed on to an open letter which was penned after the corporate’s announcement, and is being shared in inside messaging channels. The worker letter enumerates how the NFT market would possibly undercut every of Salesforce’s 5 said core values: belief, buyer success, innovation, equality, and sustainability.

“The quantity of scams and fraud within the NFT house is overwhelming,” it reads, additionally criticizing the carbon footprint of NFTs and citing analysis exhibiting the monetary advantages of NFTs are inconsistently distributed.

The place oh the place can we begin with this mess? How about … all of it?

So we now have a stodgy previous software program firm getting right into a questionable market that no person really needs, debuting a platform that no person needs … for what?

So grifters can hyperlink up with gullible NFT patrons to pawn off extra artificially “restricted” digital monkey photographs? No thanks.

If we had been at some extent the place NFTs had extra makes use of than mere bragging rights to impress different NFT followers, then positive, Salesforce ought to begin up that market. However as an alternative of making certain the validity of, say, in-game purchases for video players, NFTs presently serve the function of glorified baseball playing cards.

And by the best way, do any of y’all do not forget that huge to-do final month about NFT fraud? When scores of digital artists had their artwork ripped and offered as NFTs … with out their information? Pepperidge Farm remembers.

‘Twas mere weeks in the past {that a} “firm” known as HitPiece arrange a digital storefront that actually pulled whole albums off of Spotify, reselling them as NFTs. Once more … with none permission or communication with the precise artists.

I imply, do you need the Recording Business Affiliation of America (RIAA) to bury you beneath a litigation $#!^-storm? As a result of that’s the way you get the RIAA to bury you beneath a litigation $#!^-storm.

This ain’t successful piece on HitPiece (they managed that simply wonderful themselves), however I do surprise: How would Salesforce confirm that every little thing offered on its hypothetical NFT market was really from the creator and never simply, you understand, blatantly ripped artwork from the web?

HitPiece is done-for, however the truth that it managed such a cash-grabbing stunt will be replicated all around the web … and it’s all due to NFTs. What’s Salesforce’s plan there?

Frankly, I don’t know if Salesforce even is aware of what it’s moving into with the NFT house because it stands in the present day … however its workers appear to get the gist.

I offered my soul to make this NFT, and then you definately … purchased … one!

What do you suppose, Nice Ones? Is a cloud-based NFT platform an precise good thought … or does this sound kinda Salesforced to you?

Drop me a line at [email protected] anytime. We’d love to listen to from you!

And guess what? In the event you hit all the precise buttons (together with the one that claims “ship”) your electronic mail would possibly even be featured on this week’s version of Reader Suggestions! We gained’t flip your electronic mail into an NFT, both. Promise.

Within the meantime, right here’s the place else yow will discover us:

Till subsequent time, keep Nice!

Regards,

Joseph Hargett

Editor, Nice Stuff