Key Takeaways

- Bitcoin and Ethereum have dipped by greater than 15% over the previous 4 days.

- Bitcoin might dive to $28,060 if it breaches the $32,850 assist stage.

- Ethereum should maintain above $2,500 to keep away from a downswing to $1,720 or decrease.

Share this text

Bitcoin and Ethereum are nonetheless trending downwards whereas concern surrounding the worldwide macroeconomic setting escalates. Losses might speed up as each cryptocurrencies seem to breach very important demand zones.

Bitcoin and Ethereum Face Hazard

Roughly $110 billion have been worn out of the cryptocurrency market over the weekend, placing each Bitcoin and Ethereum in a good spot.

The primary cryptocurrency has taken a 15.5% nosedive over the previous 4 days, dropping from a excessive of $39,850 to a low of $36,665. The downswing allowed Bitcoin to slice via a vital space of assist. Because the promoting stress seems to be accelerating, Bitcoin could possibly be certain for additional losses.

From a technical perspective, Bitcoin has sliced via the decrease boundary of a parallel channel on its every day chart. Such market conduct anticipates a steep correction as vital because the sample’s width, which tasks a goal between $29,620 and $28,060. Nonetheless, the Jan. 25 low of $32,850 might function a assist zone, so solely a sustained breach of this stage would verify the pessimistic outlook.

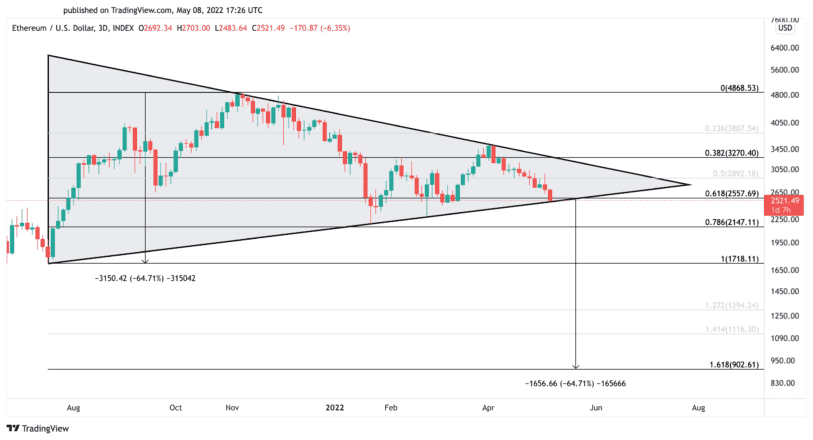

Ethereum has additionally seen its value drop by greater than 15.5% over the previous 4 days, shedding over 500 factors in market worth. The second-largest cryptocurrency by market cap is now holding above the essential $2,500 assist stage. A sustained three-day shut under this demand space may end up in vital losses.

The formation of a symmetrical triangle on Ethereum’s three-day chart suggests {that a} break of the $2,500 assist stage might result in a 64.7% downswing. A breach of the 78.6% Fibonacci retracement stage at $2,150 could possibly be the primary signal of affirmation for the bearish outlook. Then, Ethereum might hover round $1,720 earlier than a capitulation close to the $900 stage.

The present technical situations recommend that Bitcoin and Ethereum are certain for steep corrections. Nevertheless, given the excessive volatility within the cryptocurrency market, the bearish thesis could possibly be invalidated. Bitcoin must reclaim $38,000 for an opportunity to make increased highs, whereas Ethereum would want to slice via the $3,270 resistance stage to stage a bullish breakout.

Disclosure: On the time of writing, the creator of this piece owned BTC and ETH.