Justin Sullivan/Getty Images News

Co-produced with “Hidden Opportunities”

Value investors see share buybacks as a gift. Companies use excess cash on their balance sheet to reduce the supply of shares. With the concentration of shares, per-share financial metrics like EPS get a boost, and investors feel they have more ownership in the company. How can this be a bad thing?

The reality is that the average investor will not have any decision-making authority and has no say in the company’s next steps. Owning a larger portion of the company is unlikely to make a difference in voting power for retail investors.

In theory, fewer shares trading in the market would lead to higher prices. And sometimes it does as valuations climb. However, that only benefits me if I want to sell shares. If it is a good company, I’m not interested in selling.

The only thing I like about share buybacks is that they allow the distributable cash flow (‘DCF’) to be divided among fewer shares, which might lead to dividend raises. Yes, I view dividends as the ultimate form of capital return to shareholders because it empowers us to do what we choose with the payments. Depending on the stage you are at in your financial journey, you could use these dividends towards your streaming services, utility bills, or all your living expenses.

Looking at the past 20 years of market performance, we can see that buyback activity is often high near market peaks and tends to shrink during bear markets. I am looking for some steadiness in the returns, and dividends have done that for me repeatedly. The chart below shows that dividends have exhibited less volatility in varying market conditions.

Yardeni Research

Buybacks are not free of cost

The share buyback process is time-consuming and requires disclosures to stock exchanges and approvals from regulatory bodies. It also involves hiring investment bankers, which becomes an expensive affair for the company.

There has always been a debate on dividends vs. buybacks, with dividends criticized for being inefficiently taxed twice. This is about to change. The Biden Administration’s Inflation Reduction Act will impose a 1% excise tax on corporate stock repurchases after December 31, 2022.

Twitter

Billionaire Mark Cuban clearly doesn’t like buybacks and calls them a tool for financial shenanigans. Moreover, with this new tax on buybacks, he calls them more inefficient since most Americans generally pay no tax on qualified dividends.

The old concept of tax buybacks are more dividend advantaged really doesn’t apply to most shareholders. And so I think dividends become a better way of putting money in your shareholder’s pockets, particularly the shareholders that commit to you. – Mark Cuban

2022 has been an excellent year for dividend investors, and we expect tailwinds for this trend from the newly announced tax on buybacks. Today, we will discuss two picks with up to 11% yields to make the best of this paradigm shift.

Pick #1: BIZD – Yield 11%*

Business Development Companies (‘BDC’) are popular among income investors due to their structural design to sustain high yields. These companies support the backbone of the American economy by funding early-stage, small and midsize businesses. They provide debt financing to these borrowers, and their investment yields and net investment income (‘NII’) are well-positioned to benefit from this rising rate environment. Most BDC portfolios (their assets) have predominantly floating-rate investments, while funding profiles (their liabilities) have a larger fixed-rate component.

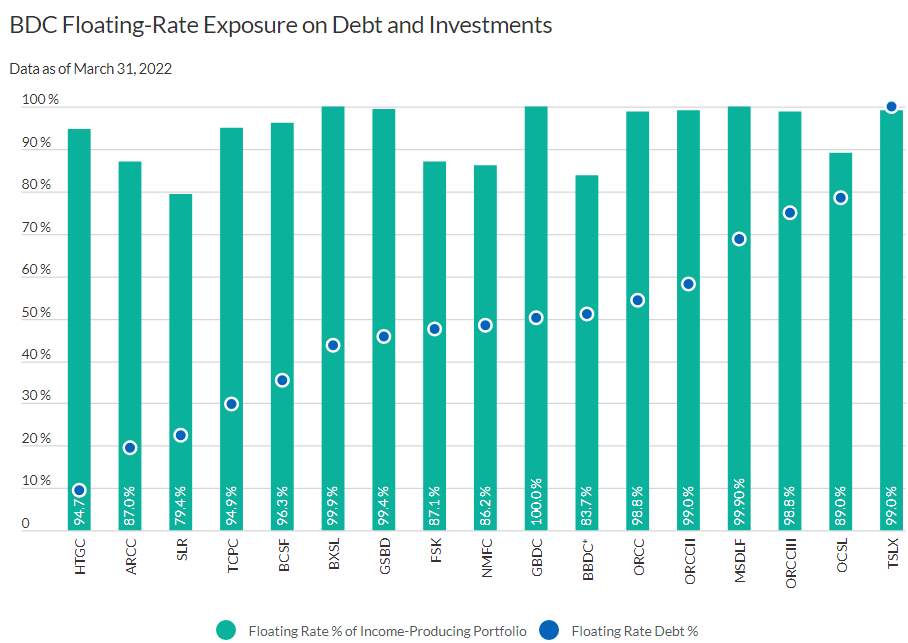

The chart below shows that floating-rate investments accounted for 94% of performing BDC debt instruments (assets), on average (for Fitch-rated BDCs). Approximately 49% of the average outstanding BDC debt (liabilities) had floating rates. (Source: Fitch Ratings)

Fitch

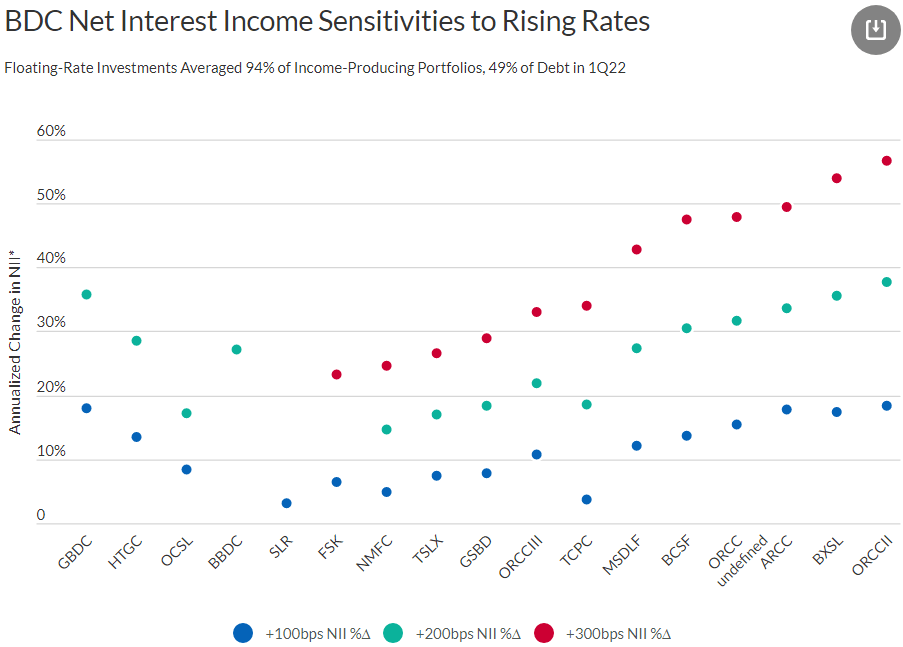

Large public BDCs like Ares Capital (ARCC) and Owl Rock Capital Corporation (ORCC), among other leading BDCs, are set to benefit with up to 50% higher NII as the Fed continues its hawkish pursuits to arrest inflation.

Fitch

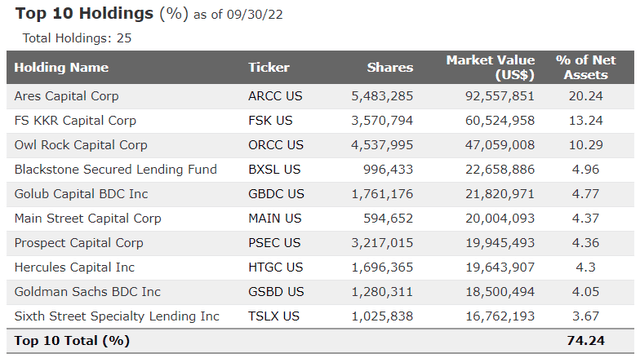

We like BDCs for their income potential and overall importance in the U.S. economy. While we hold several high-quality BDCs in our model portfolio, we particularly like the following ETF for its high yield through sector diversification. VanEck Vectors BDC Income ETF (BIZD) is an ETF that holds 25 BDCs, weighted by market cap.

BIZD

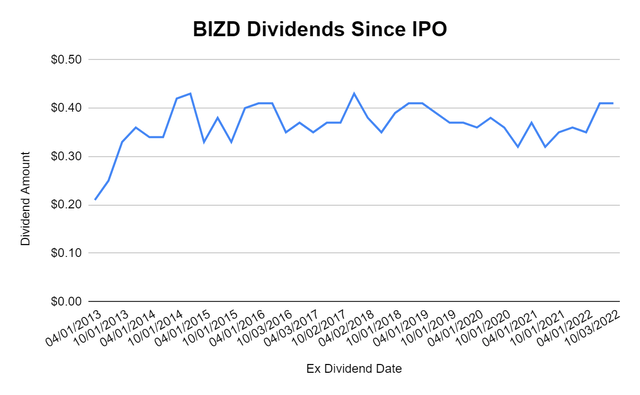

BIZD pays quarterly dividends that have been moderately stable since the fund’s inception in 2013.

Data Source: BIZD

*Due to variability in quarterly payments, BIZD’s yield is calculated from the trailing twelve months (‘TTM’) for a whopping 11.0%.

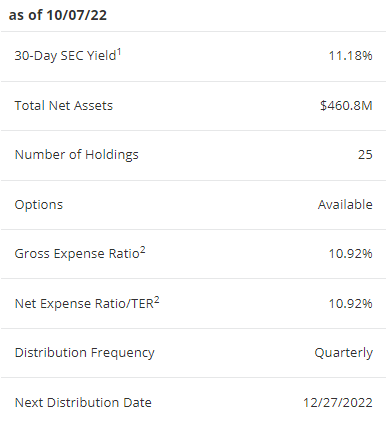

Most investors look at BIZD’s expense schedule and move on after seeing the eye-watering 10.9% expense ratio. Allow me to explain why it is not what it looks like.

BIZD

Many BDCs are externally managed, requiring the entity to pay the management company based on agreed-upon compensation plans. There is an SEC requirement for a fund of funds (such as an ETF like BIZD) to report a total expense ratio in its prospectus fee table that accounts for the expense ratios of the underlying funds, including the BDCs in which it invests, as an expense item called acquired fund fees and expenses (‘AFFE’). Thus, these AFFEs are indirect fund expenses. They are not accrued daily or paid directly from the fund’s net assets – they are actually paid by the BDCs. The expense ratio reflects the fund’s pro rata share of fees and costs incurred by the BDCs. The only expense off the BIZD income statement is the 0.41% management fee.

In recent years, BDC portfolios have shifted into more service-oriented businesses and software and technology companies, which are typically less dependent on input costs. Some BDCs have also moved up-market to larger, more established companies. With better quality borrowers whose businesses are less sensitive to economic pressures, a largely floating-rate asset portfolio, and a fixed-rate debt structure, BDCs are suitable for this rising rate environment. BIZD provides an opportunity to invest in a basket of public BDCs, providing instant diversification to this essential sector and yields as high as 11.4%.

Pick #2: UTF – Yield 8.5%

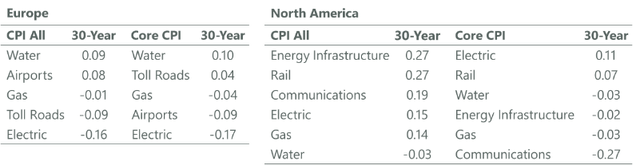

Due to Mr. Market’s myopic vision of market conditions, utilities and infrastructure stocks are selling off. A quick peek into historic performance tells us more about their economic fundamentals. Rising rates and above-average inflation tends to have negligible impact on these entities in the medium to longer term since these regulated assets can directly or indirectly pass on rising costs to customers.

Clearbridge studied North American and European infrastructure assets over the past 30 years to examine the correlation of infrastructure assets to core and headline inflation, they found the correlations to have a minimal linear relationship.

Inflation, Rising Rates and Their Impact on Infrastructure

Cohen & Steers is an investment management firm with a team of experts specializing in tangible assets and alternative income. When it comes to long-term inflation outperformance, tangible assets’ pricing power and their cash flows’ sustainability are unparalleled. We will now look at the Cohen & Steers Infrastructure Fund (UTF), a closed-end fund (‘CEF’) managed by this firm with a stellar track record of paying large sustainable income to shareholders since its inception in 2004.

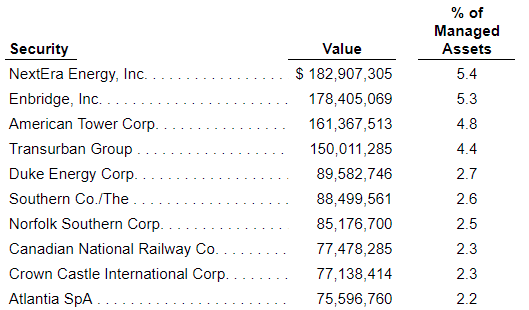

UTF’s portfolio comprises some of the biggest names in the electric utility, midstream, telecom, railroads, toll roads, and other vital services.

Cohen & Steers Infrastructure Fund

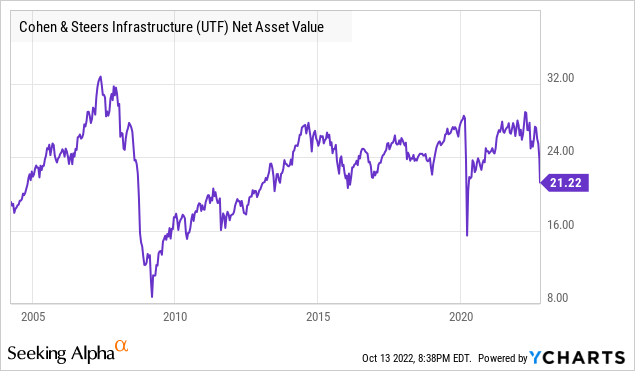

UTF is a monthly payer with no Return of Capital (‘ROC’) component in the past ten years. Its current monthly payout of $0.155/share calculates to an attractive 8.5% yield. This CEF currently trades at par with Net Asset Value (‘NAV’), presenting a lovely opportunity to build a position in a well-managed fund that earns its distributions. It is noteworthy that UTF has maintained a steadily growing NAV since its inception, indicating the long-term sustainability of shareholder distributions.

UTF is built with companies from a sector where inflation is a pass-through, directly or indirectly. Infrastructure assets will have a limited impact on profitability, and Mr. Market’s reaction is short-sighted. This panic is an opportunity for long-term investors, and UTF presents the best of the breed to invest in quality infrastructure assets and collect high yields.

Shutterstock

Summary

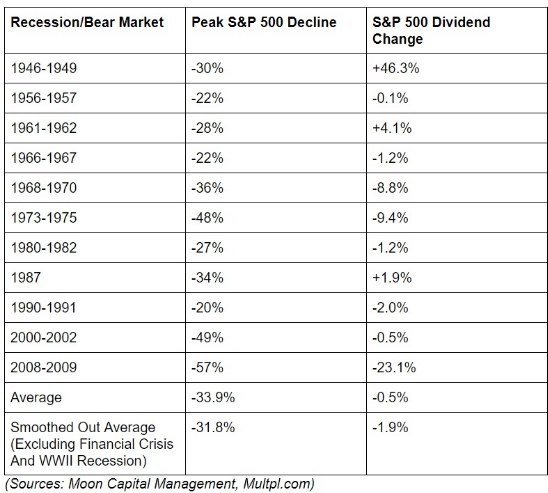

Main Street thinks dividends will be first to get slashed when market conditions get tricky, but they are mistaken. Past bear markets have caused unrealized gains to transform into unrealized losses, and investors have succumbed to fear to make them permanent. Corporate share buybacks, too, have shrunk considerably or disappeared entirely since companies do their best to protect their cash flows.

Dividends have remained less volatile and have even increased during past recessions. In 2022, despite fearful market conditions, we saw U.S. dividends reach record levels. The taxation on share buybacks is likely to keep this momentum in 2023. From time to time, the financial markets may experience sharp and uncomfortable declines; but a well-diversified portfolio will keep chugging dividend income even if corporate buybacks disappear.

Moon Capital Management

I prefer hard cash dividends from my portfolio picks rather than the perception of increased company ownership due to buybacks. We should use this sell-off to buy quality dividend payers at lower prices. This way, you build a sizable reliable income stream to provide you with much-needed financial freedom.