Antonio_Diaz/iStock through Getty Pictures

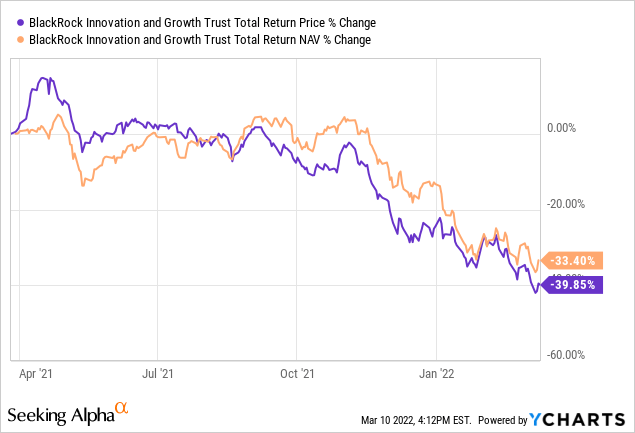

The BlackRock Innovation & Progress Belief (BIGZ) is a closed-end fund that invests in firms acknowledged for his or her revolutionary services or products. The fund launched in early 2021 which proved to be unlucky timing as shares have declined by 40% over the previous yr amid the broader market selloff and specific weak spot within the fund’s core publicity to high-growth tech names. That mentioned, the fund seems to be attention-grabbing on the selloff contemplating its present 11% distribution yield and 10% low cost to NAV. Whereas the technique stays high-risk into ongoing market headwinds, we see worth within the underlying holdings which preserve a optimistic long-term outlook. We anticipate BIGZ to steer larger into enhancing market circumstances going ahead.

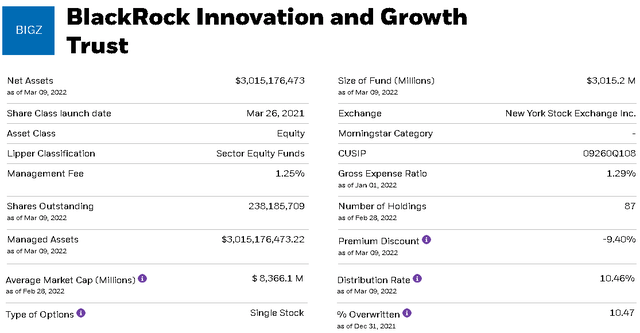

BlackRock

What’s the BIGZ Fund?

BIGZ is comparatively distinctive amongst CEFs contemplating its “thematic” investing technique specializing in mid- and small-caps. Along with its portfolio of shares, the fund additionally holds about 20% of property in non-public investments which represents an alternate asset class. Moreover, BIGZ makes use of a name writing technique that’s meant to help the portfolio administration course of and, in concept, enhance risk-adjusted returns. The fund is actively managed by BlackRock, Inc. (NYSE:BLK), which means it is not meant to trace any index whereas all positions are on the discretion of the funding staff.

The attraction of the innovation theme is the concept that firms with disruptive expertise can generate sturdy progress and seize market share over legacy options. In some circumstances, the businesses that signify goal investments for BIGZ are rising as leaders in utterly new markets.

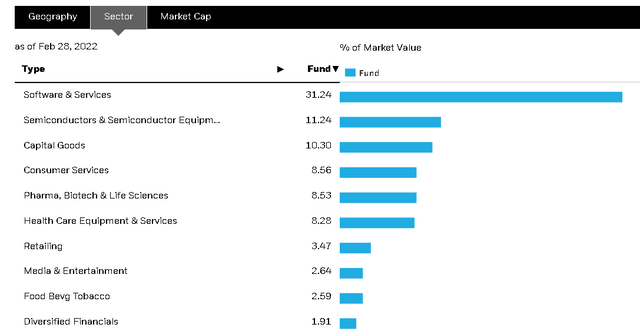

BlackRock

Inside the present portfolio of 87 fairness holdings, the innovation areas coated right here embody cloud computing, cellular funds, biotech, e-commerce, cybersecurity amongst different forms of providers. By sub-industry, software program software names signify 31% of the fund, adopted by semiconductor-related shares at 11%.

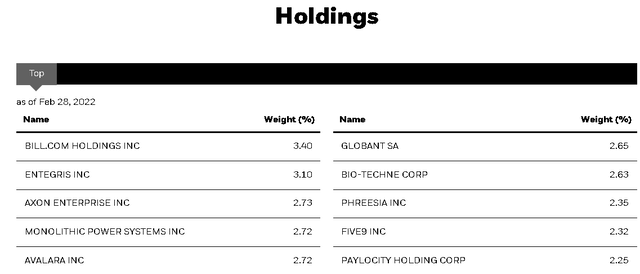

The highest present holdings embody Invoice.com Holdings, Inc. (BILL), Entegris, Inc. (ENTG), Axon Enterprise, Inc. (AXON), Monolithic Energy Techniques, Inc. (MPWR), Avalara, Inc. (AVLR), Globant, S.A. (GLOB), and Bio-Techne Corp. (TECH) which all have an approximate 3% weighting. The comparatively low focus among the many prime holdings within the fund offers significance to the smaller positions as a measure of diversification.

BlackRock

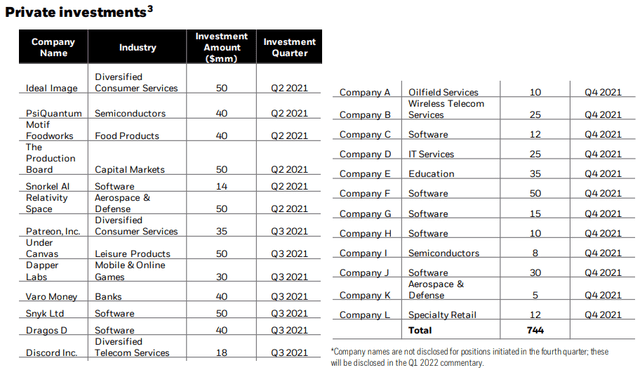

We talked about non-public investments. These are sometimes pre-IPO firms which have raised capital by means of funding rounds. On the finish of This fall 2021, BIGZ disclosed investments totaling $744 million, roughly 20% of the online property on the time. Feedback from administration have famous an intention of reaching a goal allocation to this section of 25%. The problem right here is that these positions aren’t sometimes marked to market day by day, so there may be some uncertainty as to the worth of the holdings. The understanding is that they’re typically correlated to comparable publicly traded equities, though the inclusion right here provides a layer of diversification to the fund.

BlackRock

BIGZ Efficiency

We talked about the fund’s efficiency has been poor. Certainly, BIGZ has misplaced a cumulative 40% at its market worth and 33% at NAV on a complete return foundation for the reason that fund’s inception. This goes again to what was doubtless excessive exuberance out there throughout Q1 2021 with BIGZ launching close to peak valuations for a lot of high-growth tech names. Following an enormous second-half of 2020 the place many firms obtained a lift of demand in the course of the pandemic, outcomes over the previous yr have been typically not been capable of preserve the identical momentum. Individually, the mix of elevated inflation and climbing rates of interest have labored to stress sentiment in the direction of extra speculative and momentum corners of the market.

Remember the fact that as a thematic fund, BIGZ shouldn’t be essentially anticipated to outperform a broad market index just like the S&P 500 (SPY) in all environments, however as an alternative, supply focused publicity to a selected profile of firms.

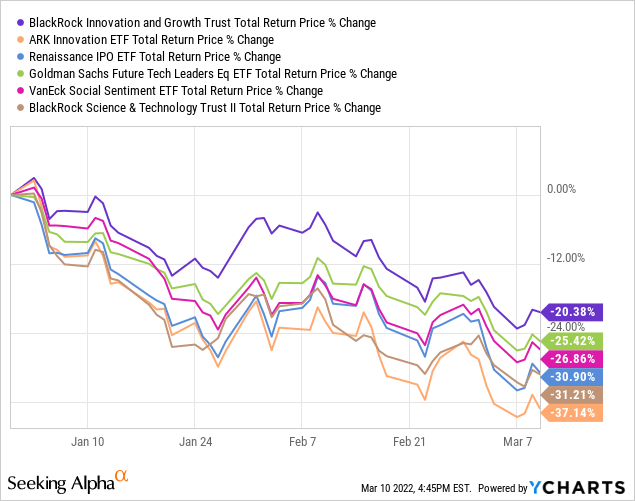

12 months thus far, BIGZ’s 20% decline has been extra resilient in comparison with deeper losses from comparable “high-growth momentum tech funds” just like the ARK Innovation ETF (ARKK), Renaissance IPO ETF (IPO), Goldman Sachs Future Tech Leaders ETF (GTEK), VanEck Vectors Social Sentiment ETF (BUZZ), and even the BlackRock Science and Expertise Belief II (BSTZ) CEF that are all down by greater than 25% in 2022. Every of the funds above has completely different methods. Our level right here is to not say that one fund is best than one other, however merely to put BIGZ’s efficiency in context.

BIGZ Dividend

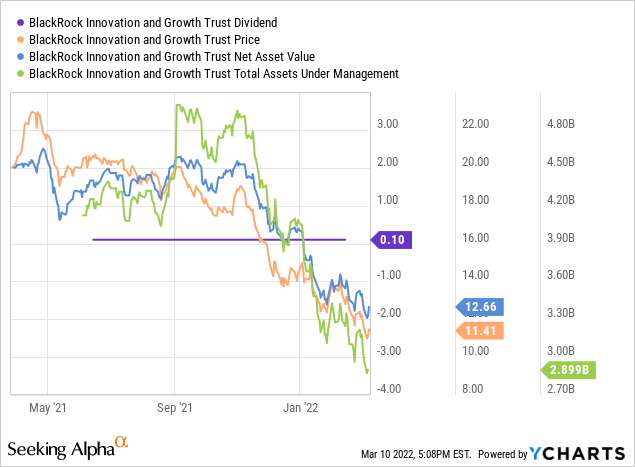

BIGZ stands out with its distribution yield of 11% on the present market worth primarily based on a month-to-month payout of $0.10. Over the previous yr, 100% of the distribution has been within the type of the return of capital (ROC), which isn’t primarily based on realized features or underlying dividend revenue. ROC is untaxed to buyers however works to scale back the unique value foundation of shares, successfully deferring the tax legal responsibility till the place is finally bought. Some CEF buyers respect ROC for its potential tax-efficiency methods.

There’s a reputable query if the dividend is liable to being reduce contemplating the decline within the web asset worth over the previous yr. The distribution represents an annualized money fee of $290 million to shareholders in comparison with roughly $2.9 billion in AUM, down from a peak degree nearer to $5 billion. Our take is that the payout is probably going sustainable this yr however would doubtless must be “adjusted decrease” if market circumstances do not enhance going ahead. It is truthful to imagine that when the fund launched with a yield nearer to six%, the technique didn’t anticipate this sort of motion.

The problem is that the month-to-month payout at this dimension finally ends up holding again the efficiency of the fund on a possible rally as a result of BIGZ is pressured to commerce out of positions to fund the distribution whereas the money would doubtless be higher served reinvesting into new alternatives or averaging down on holdings. The Q1 shareholder replace shall be necessary to see any steering on this regard; we will additionally sit up for updates on the non-public investments and their valuations.

BIGZ Value Forecast

Getting bullish on this section of high-growth tech is a tough name contemplating it has been a falling knife. That mentioned, we consider there may be room on the present degree to begin accumulating shares for a long-term holding. The potential for a turnaround coupled with the compelling yield on the fund as an revenue alternative can generate sturdy returns going ahead.

Looking for Alpha

The market will want some readability on a decision for the Russia-Ukraine disaster to regain optimistic sentiment and get away larger. The surge of commodity costs together with oil has added to issues that the macro circumstances can weaken and stress broader financial exercise. This stays the important thing danger to look at that may open the door for an additional leg decrease out there.

The upside for BIGZ is a way that the selloff has doubtless already priced in a number of the worst-case situations whereas serving to to steadiness the valuation. Among the many prime holdings of the fund, the takeaway is that the majority are anticipated to generate spectacular progress this yr and are at present worthwhile. Getting previous the near-term headwinds, these firms are well-positioned to get better.

| Prime 10 Holdings BIGZ – Consensus Estimates | ||

| 2022 Gross sales Progress y/y | FWD PE | |

| Invoice.com Holdings, Inc. (BILL) | 149% | n/a |

| Entegris, Inc. (ENTG) | 17% | 30x |

| Axon Enterprise, Inc. (AXON) | 21% | 67x |

| Monolithic Energy Techniques, Inc. (MPWR) | 28% | 42x |

| Avalara, Inc. (AVLR) | 22% | n/a |

| Globant S.A. (GLOB) | 36% | 45x |

| Bio-Techne Corp. (TECH) | 18% | 53x |

| Phreesia, Inc. (PHR) | 42% | n/a |

| Five9, Inc. (FIVN) | 24% | 81x |

| Paylocity Holding Corp. (PCTY) | 31% | 73x |

Supply: Looking for Alpha

There’s a case to be made that tech shares and software program software names are going to be comparatively much less uncovered to inflationary value pressures. We are able to additionally argue that the continued geopolitical points inflicting provide chain disruptions can find yourself being optimistic for the long-term outlook of revolutionary applied sciences throughout the underlying holdings of BIGZ.

Remaining Ideas

We charge BIGZ as a Purchase with an expectation that enhancing circumstances going ahead and extra optimistic sentiment in the direction of danger property can enable this one to commerce larger over the following a number of months. The mix of high-yield and publicity to high-growth shares is exclusive out there. Regardless of the fund’s early historical past of shortcomings, the technique can find yourself outperforming going ahead.