Berkshire Hathaway

made an enormous wager on different shares within the first quarter, and power was a favourite.

Warren Buffett’s firm purchased $51.1 billion value of equities within the quarter, in accordance with the corporate’s 10-Q submitting. Among the many purchases had been billions of {dollars} value of

Chevron

(ticker: CVX) and

Occidental Petroleum

(OXY).

Berkshire additionally reported Saturday that its first-quarter working earnings after taxes totaled $7 billion within the first quarter, up lower than 1% from the year-earlier interval, as the corporate scaled again the repurchase of its shares because the inventory value rallied.

Berkshire Hathaway (ticker: BRK/A, BRK/B) purchased again $3.2 billion of its personal inventory within the first quarter, down from $6.9 billion within the fourth quarter of 2021. The corporate repurchased $27 billion of inventory in 2021.

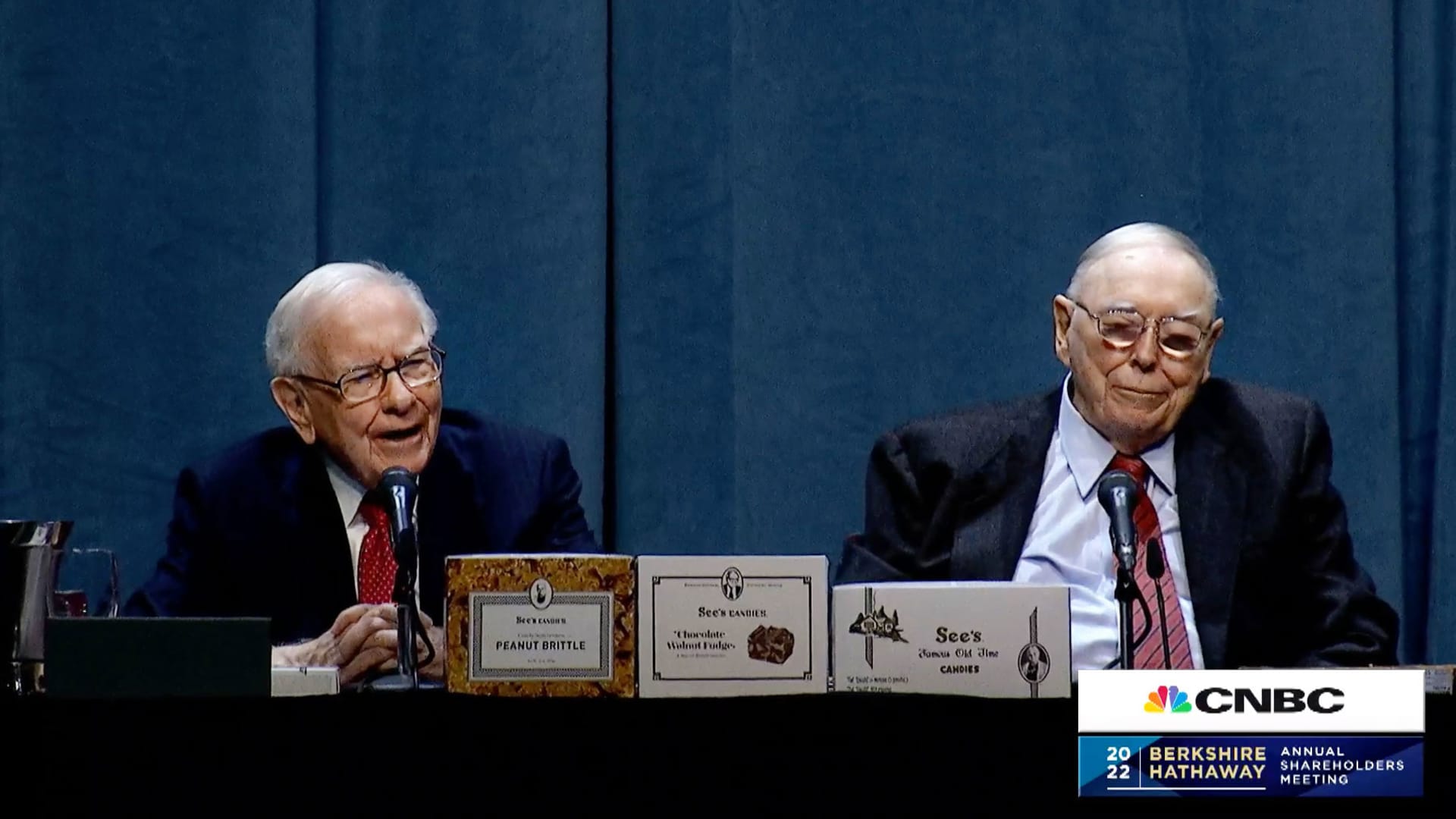

The revenue report was launched earlier than the beginning of Berkshire’s annual assembly in Omaha Saturday when CEO Warren Buffett and vice chairmen Charlie Munger, Greg Abel and Ajit Jain subject a number of hours of questions from Berkshire shareholders.

Lengthy-time Berkshire shareholders carefully observe the assembly to listen to the newest from the investor who has helped them to very large returns through the years.

Berkshire’s working earnings, which exclude paper beneficial properties or losses on the corporate’s large fairness portfolio, totaled about $4,773 per class A share within the first quarter, up 4% from the identical interval, Barron’s estimates. The earnings topped the consensus estimate of $4,277 per class A share. The per share achieve in working income mirrored Berkshire’s buybacks which have diminished its share depend up to now yr.

General earnings totaled $5.5 billion, or $3,702 per class A share, down from $11.7 billion, or $7,638 per share within the year-earlier interval. Complete earnings had been decrease than working revenue within the first quarter due to paper declines in Berkshire’s massive fairness portfolio in a weaker inventory market. Within the year-earlier interval, there have been paper income within the fairness holdings.

Buffett tells traders to concentrate on working income, not total earnings, since complete earnings embrace paper beneficial properties and losses in Berkshire’s fairness portfolio and don’t mirror the corporate’s core earnings energy.

The $3.2 billion of buybacks within the interval aren’t a shock to Berkshire watchers as a result of repurchases totaled an estimated $2 billion within the first two months of the yr primarily based on the share depend listed within the firm’s proxy assertion launched in March. Buyers concentrate on the buybacks as a sign of Buffett’s view on the attractiveness of Berkshire shares.

The small improve in working income within the first quarter mirrored increased income at Berkshire’s railroad enterprise—the corporate owns the Burlington Northern Santa Fe—in addition to its massive utility and power enterprise, Berkshire Hathaway Power. Income additionally rose on the firm’s huge manufacturing, service and retail companies however insurance coverage underwriting income had been down sharply.

Berkshire shares have been sturdy this yr with the Class A inventory rising 7% to $484,340 on Friday. That’s approach forward of the S&P 500 index, which is down about 13%. Berkshire’s Class B shares completed at $322.83. Berkshire’s inventory was hit throughout Friday’s market selloff with the B shares down 3.7%.

The online buys in shares of different corporations had been $41.4 billion after fairness gross sales within the interval. This possible was the biggest quarterly buy of shares ever by Berkshire and included a roughly $7 billion buy of Occidental Petroleum inventory within the interval.

Berkshire was additionally a big purchaser of Chevron, buying what seems to be about $21 billion of the power big. Berkshire’s holding in Chevron totaled $25.9 billion on March 31, in accordance with the 10-Q, up from $4.5 billion on Dec. 31.

The ten-Q doesn’t point out what number of Chevron shares that Berkshire held on March 31 however Barron’s estimates the overall at 160 million shares, an 8% stake.

The massive purchases possible will shock many Berkshire traders since Buffett had been much less enamored of shares in 2021 as Berkshire was a internet vendor of $7 billion of shares. With the large purchases, the fairness portfolio swelled to a report $390.5 billion on March 31, up $40 billion from Dec. 31, 2021.

With the large fairness purchases, Berkshire’s complete holdings of money and equivalents fell to $106 billion on March 31 from $147 billion on Dec. 31.

E-book worth stood at $345,000 per class A share on March 31, Barron’s estimates, up from about $343,000 a share at year-end 2021.

Berkshire now trades for 1.4 occasions its estimated March 31 guide worth. Present guide worth possible is decrease than the March 31 determine due the drop within the inventory market since then.

Apple

(AAPL), which is Berkshire’s largest fairness holding, is down 9% thus far within the second quarter.

It doesn’t seem that Berkshire purchased an considerable quantity of its personal shares from March 31 to April 20, primarily based on the share depend as of April 20 proven within the 10-Q. The share depend proven for April 20 is about the identical because the 1.47 million class A equal shares excellent on March 31, Barron’s calculates. Buffett mentioned later on the annual assembly that the corporate didn’t repurchase any of its personal shares in April.

Berkshire inventory was buying and selling at near-record ranges within the first three weeks of April and Buffett apparently determined to carry off on buybacks. Repurchases slowed in March relative to February because the inventory value rose. Buffett has instructed Berkshire traders that he will probably be value acutely aware in share repurchases.

Berkshire’s Geico auto insurance coverage unit had a weak quarter because it recorded an underwriting lack of $178 million, in contrast a revenue of $1 billion within the year-earlier interval.

“GEICO’s pre-tax underwriting loss within the first quarter of 2022 mirrored elevated claims severity, primarily because of vital value inflation in vehicle markets, which accelerated within the second half of 2021,” Berkshire mentioned. Different auto insurers are being squeezed by the identical tendencies. Geico’s written premiums had been up 2.6% within the interval.

Pre-tax income at Burlington Northern rose 9% to $1.8 billion within the interval, whereas manufacturing income had been up 16% to $2.8 billion.

Write to Andrew Bary at [email protected]