The Institute for Provide Administration’s Manufacturing Buying Managers’ Index was unchanged at 52.8 % in August, holding modestly above the impartial 50 stage. August is the twenty seventh consecutive studying above fifty, however the stage is down sharply from the March 2021 peak (see the primary chart). A number of key part indexes have been additionally near impartial in August, together with the prices-paid index and the provider deliveries index, that are down from excessive ranges not too long ago. Based on the report, “The U.S. manufacturing sector continues increasing at charges just like the prior two months. New order charges returned to growth ranges, provider deliveries stay at acceptable pressure ranges and costs softened once more, reflecting motion towards provide/demand stability.”

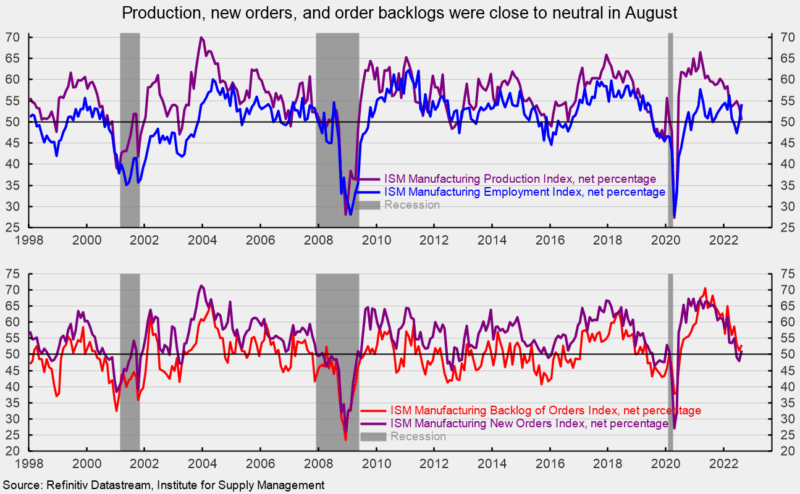

The Manufacturing Index registered a 50.4 % end in August, dropping 3.1 factors from July (see the highest of the second chart). The index has been above 50 for 27 months however is on the lowest stage since September 2020.

The Employment Index posted a robust achieve in August, shifting solidly above the impartial threshold. The 54.2 % studying suggests payrolls expanded within the manufacturing sector in August (see the highest of the second chart). The report states, “Labor administration exercise improved in August: A bigger share of feedback (11 % in August, up from 7 % in July) famous larger hiring ease, and amongst respondents whose firms are hiring, 18 % expressed issue in filling positions, down from 35 % in July. Turnover charges eased, with 33 % of feedback citing backfill and retirement points, a lower from 39 % in July. Employment features in August ought to translate into stronger growth in manufacturing progress in September.” The report provides, “Based on Enterprise Survey Committee respondents’ feedback, firms continued to rent at sturdy charges in August, with few indications of layoffs, hiring freezes or head-count reductions by way of attrition. Panelists reported decrease charges of quits, a constructive pattern.”

The Bureau of Labor Statistics’ Employment State of affairs report for August is due out on Friday, September 2, and expectations are for a achieve of 300,000 nonfarm payroll jobs, together with the addition of 20,000 jobs in manufacturing.

The brand new orders index rose by 3.3 factors to 51.3 % in August, following two consecutive readings under impartial. The consequence suggests orders expanded for the month (see the underside of the second chart). The brand new export orders index, a separate measure from new orders, fell under impartial to 49.4 % versus 52.6 % in July. The most recent studying is the primary under 50 following 25 consecutive months of growth.

The Backlog-of-Orders Index got here in at 53.0 % versus 51.3 % in July, a 1.7-point rise (see the underside of the second chart). This measure has pulled again from the record-high 70.6 % end in Could 2021 however has been above 50 for 26 consecutive months. The index suggests producers’ backlogs proceed to rise, however the growth tempo is modest general.

Buyer inventories in August are nonetheless thought of too low, with the index coming in at 38.9 %, off 0.6 factors from July (index outcomes under 50 point out clients’ inventories are too low). The index has been under 50 for 71 consecutive months. Inadequate stock is a constructive signal for future manufacturing.

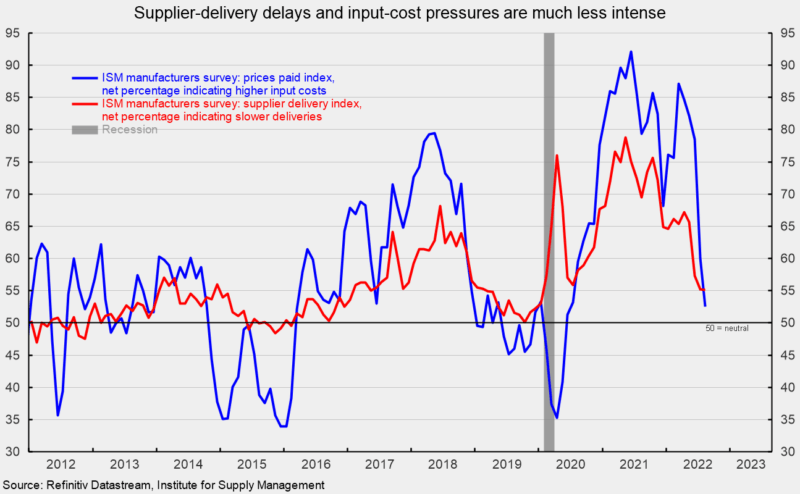

The provider deliveries index registered a 55.1 % end in August, down 0.1 factors from July. The index was at 78.8 % in Could 2021. The easing pattern over the previous 15 months recommend supply lead occasions are slowing at a a lot slower charge (see third chart).

The index for costs for enter supplies sank once more, dropping one other 7.5 factors to 52.5 in August and is the fifth consecutive month-to-month decline (see third chart). The index is down from 87.1 % in March 2022 and is on the lowest stage since June 2020. The consequence suggests worth pressures have eased considerably. The report notes, “Costs growth eased dramatically in August, which — when coupled with lead occasions easing — ought to carry patrons again into the market, bettering new order ranges.”

General, the report famous, “Sentiment remained optimistic concerning demand, with 5 constructive progress feedback for each cautious remark.” Nonetheless, the report additionally states, “Panelists proceed to precise unease a few softening financial system, with 18 % of feedback noting concern about order guide contraction. Twelve % of panelists’ feedback replicate rising worries about complete provide chain stock.”

The manufacturing sector continues to see stable demand and is progressing in the direction of a greater provide/demand stability. Nonetheless, financial dangers stay elevated because of the influence of inflation, an intensifying Fed tightening cycle, continued fallout from the Russian invasion of Ukraine, and waves of recent Covid-19 instances and lockdowns in China. The outlook stays extremely unsure. Warning is warranted.