valio84sl/iStock via Getty Images

Investment Thesis

Ardmore Shipping Corporation (NYSE:ASC) is one of the most promising companies in its industry, with perhaps overly modest Street expectations about its earnings potential. I rate it as a Strong Buy.

Tanker Market Outlook

In this market outlook, I will refer to several sources – first, the recent HSBC’s webinar [November 23, 2022] hosted by Burak Cetinok, Head of Research at Arrow. Special thanks to E. Finley-Richardson for making a thread of presentation materials from that particular webinar. The second very important source of information is the research of BIMCO’s Chief Shipping Analyst, Niels Rasmussen, who was Global Head of Research at Maersk Broker for six years, focusing on key shipping segments such as containers, dry bulk, and tankers. In general, the information has been gathered gradually from various sources – where appropriate, I have included links to specific articles from the public domain.

The situation that has developed because of the war in Ukraine has reshaped the market for the sale and distribution of energy commodities in Europe – the denial (or simply the attempt to deny) of Russian oil has resulted in tankers becoming perhaps the only alternative for supplying hydrocarbons to Western oil importers.

Just 2 years ago, the tanker market’s historically low backlog – the future supply of ships – was not the reason for the growth in tanker shipping rates because oil demand was too weak. SA fellow Robert Boslego wrote about this in October 2020, referencing a study from BP. At that time, in 2 out of 3 forecast scenarios, they concluded that oil demand had peaked.

But “the morning sun does not last a day,” as the saying goes – a combination of years of underinvestment in the oil and gas industry and buoyant post-pandemic demand has sent oil and other commodity prices skyrocketing.

However, the market was in no hurry to buy tanker companies in a big way – the consequences of the pandemic were reflected in the TTM financial figures, which misled the general public. An additional catalyst was the war in Ukraine, which began on February 24, 2022. Since then, the market has recognized that tanker companies have probably finally and irrevocably entered their new bull cycle.

A typical cyclical trend lasts from 4 to 5 years on average, according to PringTurner. What we see today in various sub-segments of the tanker market is, in my opinion, just the beginning of a trend that will continue for at least a few more months – 2023 will definitely bring tanker companies a lot of money.

The above-mentioned Burak Cetinok comes to this conclusion – he talks about super profits for at least the next 12-18 months. In his opinion, several factors point to this.

First, as I mentioned earlier, the low orderbook has not disappeared and remains at historic lows to this day. You only need to open an IR presentation from any company in the industry to see this for yourself – I like the infographic from Scorpio Tankers (STNG) that shows the orderbook at just 5% with a declining product tanker net fleet in 2-3 years ahead (under different scenarios):

STNG’s presentation [November 1, 2022]![STNG's presentation [November 1, 2022]](https://static.seekingalpha.com/uploads/2022/12/7/49513514-16703942386241884.png)

Second, Burak uses ton-days as an indicator of demand – by this measure, demand is currently at unprecedented levels:

HSBC’s webinar [November 23, 2022]![HSBC's webinar [November 23, 2022]](https://static.seekingalpha.com/uploads/2022/12/7/49513514-16703945102460296.png)

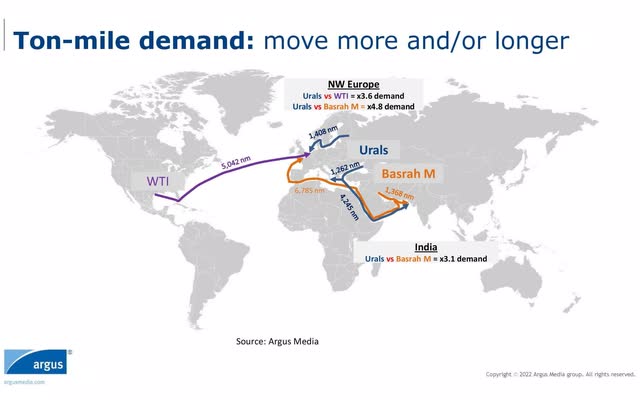

The third point is the growing tonne miles. The “geopolitically unpleasant” Russian energy in Europe is displaced by the supply from the Middle East (Saudi Arabia), West Africa, and the USA. So without the necessary infrastructure (pipelines), demand for tanker shipments is rapidly increasing – and so is the number of miles traveled by those tankers.

HSBC’s webinar [November 23, 2022]![HSBC's webinar [November 23, 2022]](https://static.seekingalpha.com/uploads/2022/12/7/49513514-16703979114978907.png)

Let me remind you that the end customers pay tanker companies daily rates. So if a vessel spends more days on- its way, that’s the customer’s problem.

But at the same time, we have to remember that Russian oil can’t just disappear – it has to go somewhere. Russia’s problem is the lack of tankers. So the news is already surfacing that Russia is building its own shadow fleet to get around the sanctions by buying up ships available on the open market at prices above the market. It thereby creates new market prices – this is going to be reflected in the revaluation of tanker companies’ assets.

“There’s been a sharp rise in the tanker trading since the war and in the run-up to the Dec. 5 deadline by undisclosed entities based in countries such as Dubai, Hong Kong, Singapore and Cyprus,” said Anoop Singh, head of tanker research at Braemar. Many are older ships and will find their way to the shadow fleet, with Russian shipowner Sovcomflot PJSC supplying some tankers as well.

Source: Bloomberg

In search of alternative markets, this shadow fleet – and not only it – will be forced to ship Russian oil and its byproducts to India, China, and Latin America. Thus, tonne miles will also only increase. Companies that make their ships available for these purposes – and there are still such among Western public industry players – will receive noticeable tailwinds for their profits.

As for specific types of ships, Burak pays special attention to diesel carriers. In 2021, about 55% of the EU’s diesel will be produced in Russia – a huge amount that will need to be replenished in any case, regardless of the severity of the recession in Europe in 2023. The inaccessibility of Russian raw materials will lead to

a) the destruction of demand – the manufacturing activity will be interrupted because of limited supply and higher prices; and

b) an increase in demand for product tankers, which will meet the demand for diesel through increased supplies from the Middle East, India, and the US.

Russian distillate will go to Africa, Latin America, and elsewhere.

Argus

Speaking of recession, yes, it is most likely inevitable. I wrote about this in more detail in my recent article, “How To Position Your Portfolio For 2023.“

However, all is not so clear here, specifically concerning tanker companies – the drop in energy prices will most likely have the opposite effect, it will only boost demand for tanker companies’ services, as dwindling stocks of various commodities mean they urgently need to be replenished. Given the volume of today’s deficits, this replenishment will take more than a just couple of months – tankers will be utilized at or near full capacity.

HSBC’s webinar [November 23, 2022]![HSBC's webinar [November 23, 2022]](https://static.seekingalpha.com/uploads/2022/12/7/49513514-16704013292215304.png)

I think that product tankers, which are generally smaller than crude oil tankers (with DW < 70,000), will have an advantage over large vessels (VLCC/ULCC). VLCCs will come under pressure due to the economic slowdown in China – the aforementioned Niels Rasmussen wrote in mid-September that growth in China is expected to hit its lowest level since 1990, at 3.3% in 2022 and 4.6% the following year. At the same time, 85% of all Chinese seaborne crude oil imports depend on VLCCs. Pareto Shipbrokers analysts come to a similar conclusion when talking about the recent correction in tanker stocks:

Pareto [provided by E. Finley-Richardson], author’s notes![Pareto [provided by E. Finley-Richardson], author's notes](https://static.seekingalpha.com/uploads/2022/12/8/49513514-16705020359655693.jpg)

So from this outlook, you will understand why I have chosen the company you see in the title of this article.

Why am I choosing Ardmore Shipping to ride this cycle?

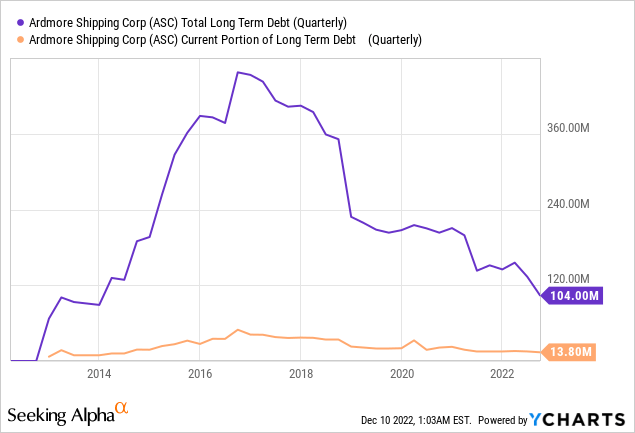

Ardmore Shipping is a $600-million cap product tanker shipping company, operating a fleet of 27 vessels, 20 of which are owned by the company (i.e., 74%, while 2 quarters ago it was 44%). The fleet of ASC consists of MR product and chemical tankers ranging from 25,000 to 50,000 deadweight tonnes – Panamax and Aframax, mid-size tankers [by definition].

Continuous investment in the fleet helps Ardmore optimize its performance – the more ships the company owns, the more it earns if freight rates remain stable at a high level. At the time of the Q3 2022 report, the company already had 2439 revenue days for Q4 2022 and 9093 days for the full year 2023 – or about 93.4% of 2022 (taking into account projected Q4 data). That is, the demand for tankers is obvious – low inventories of various commodities will lead to replenishment demand next year. So the management is making the right move to buy their vessels at this part of the bullish cycle, in my opinion.

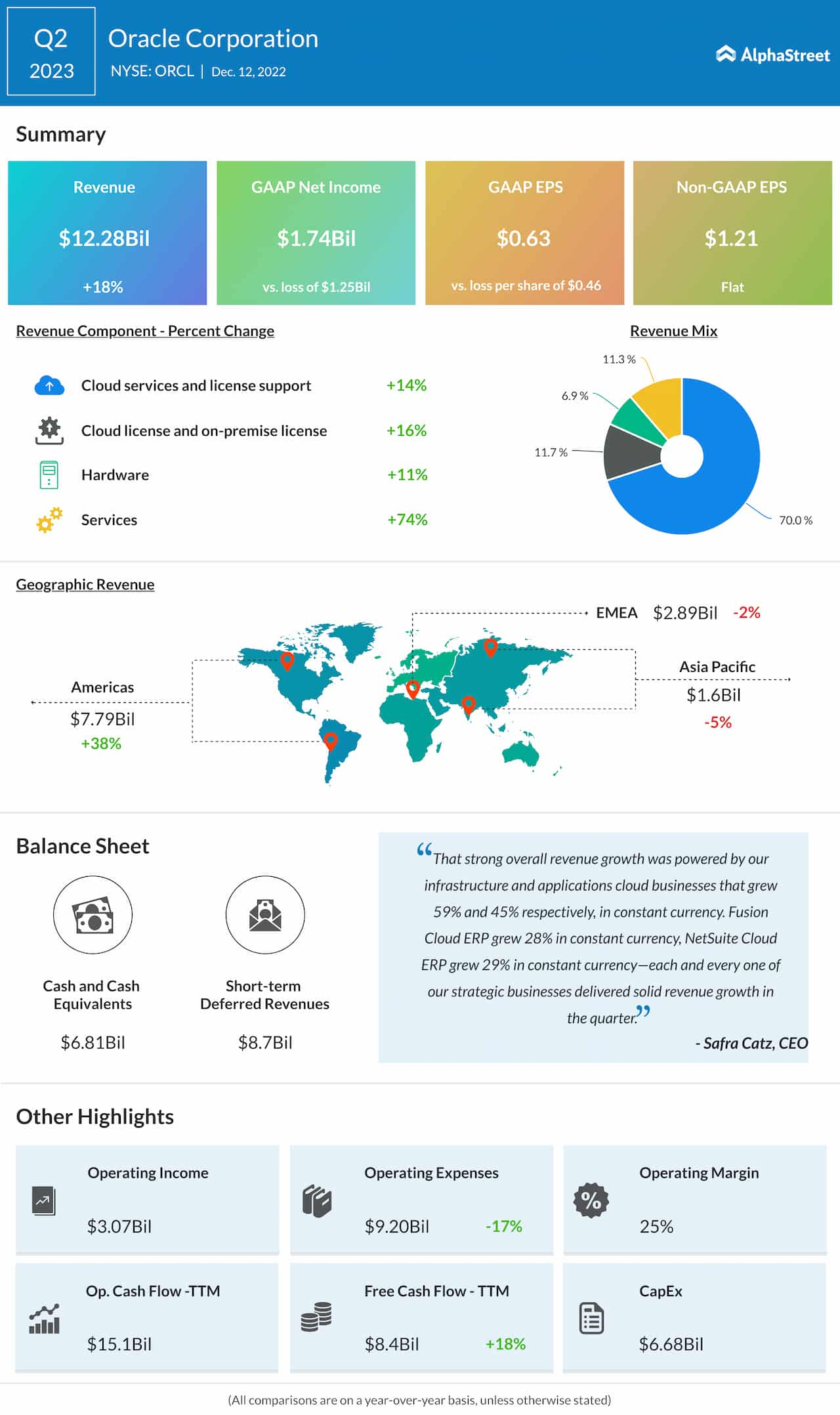

Today’s cycle is unlike last time [in 2015]. Then, when the cycle was coming to an end, the company had a much worse debt profile:

Now, with the cycle still in full swing, a sharp reduction in balance sheet debt is guaranteed to drive up net profits, even as rates creep down. The $308 million debt refinancing ASC completed at end of 2Q22 resulted in reduced cash breakeven levels of approximately $14,500/day. To give you an idea, TORM plc (TRMD), the nearest peer, expects to have a TCE breakeven of $15K in FY2022.

In Q4, ASC expects to complete a dry dock and install a ballast water treatment system [CAPEX = $1.7 million], while in FY2023 it expects to complete another 7 dry docks and 7 ballast water installations [CAPEX = $13.6 million]. In theory, this should increase capacity, and while rates are above historical averages (which I expect for the next few years), the company should print money like a machine. The fact is that the orderbook situation for mid-size tankers as a sub-segment of the tanker business is even more deplorable – 2023-24 will add only 0.5% of supply in the product tanker market and 0.2% in the chemical tanker market, well below the demand growth that will be there even under conditions of a highly likely recession.

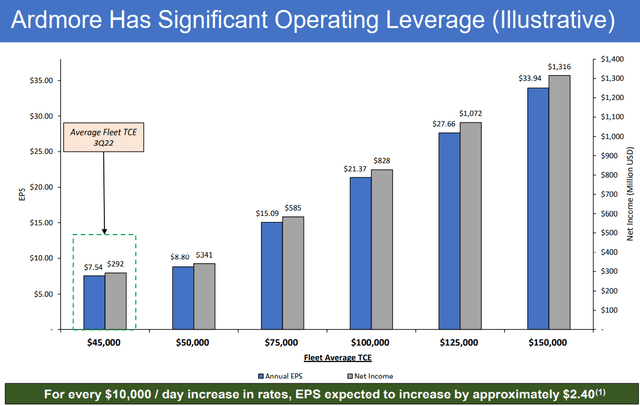

Ardmore looks like one of the most attractive plays among the other tanker companies because it has a huge operating leverage, thanks to which the company will extract the maximum possible profit in case the thesis of a possible increase in tanker rates in the future [restocking, China reopening, milder than an expected recession, etc.] is realized:

ASC’s most recent IR materials

Many may be wary of the fact that ASC has raised equity faster than the rest of the industry. However, according to management, the ATM issuance program is over for the foreseeable future [there will be no more dilution because it is no longer needed].

Thanks to the strengthened balance sheet, ASC can now pay a quarterly dividend starting in 4Q22 [according to the latest quarterly presentation], which equates to $0.50 per share at current market levels and an annual yield of 13.8% [share price as of Dec. 12].

Valuation & Expectations

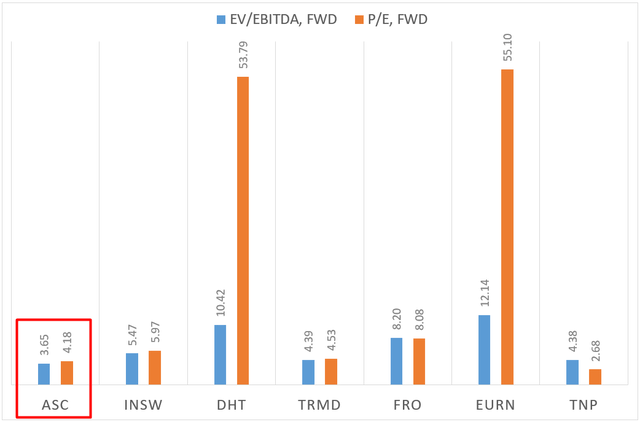

Looking at the absolute values of forwarding P/E and EV/EBITDA multiples, ASC is one of the most undervalued stocks [compared to its peers at least]:

Seeking Alpha data, author’s calculations

Why so?

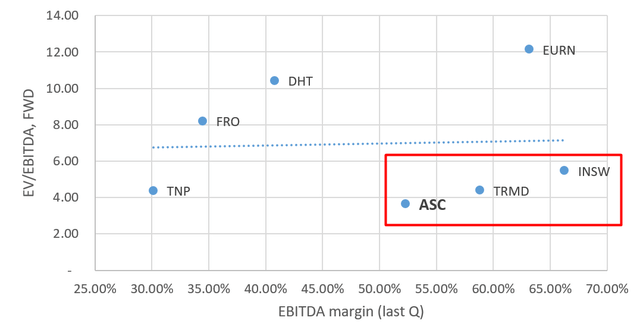

This is most likely due to a more modest margin – in any case, this applies to the EBITDA margin (last quarter) and the EV/EBITDA multiple:

Seeking Alpha data, author’s calculations

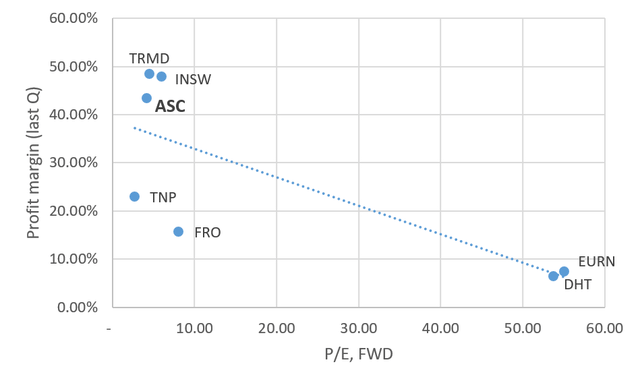

You can see how ASC is keeping up with its other closest competitors – TORM and International Seaways (INSW). These are the companies that cluster together in another chart comparing forwarding P/E ratios and net profit margins:

Seeking Alpha data, author’s calculations

I expect ASC to improve its margins relative to peers due to its operating leverage and improving debt profile, and the market will have to revise its valuation upward.

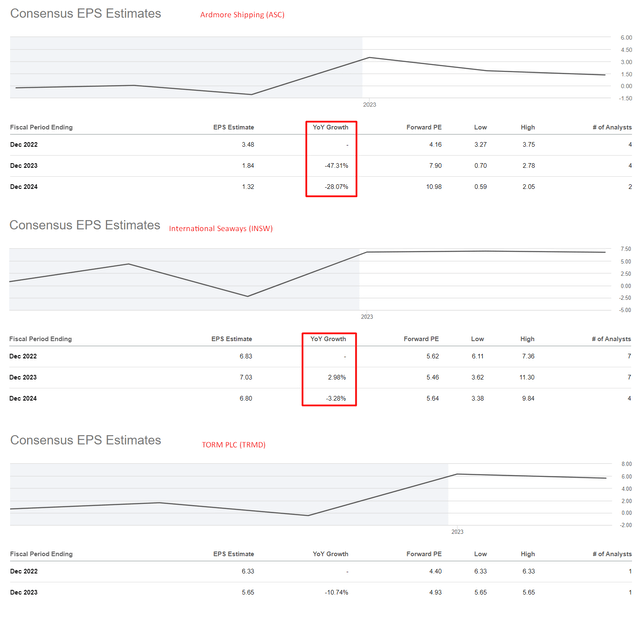

By the way, a small observation I discovered while analyzing various tools from Seeking Alpha. ASC has the most depressing EPS growth forecasts for next year compared to its closest peers – and this is despite the fact that Wall Street analysts have raised them 4 times in the last 3 months.

Seeking Alpha data, author’s notes

Given the discontinuation of the ATM program and a reduction in debt payments in 2023 – how is a 47.31% decline (YoY) in EPS in 2023 even possible?

Either the analysts are wrong and we are in for a huge EPS beat, or they should revise everyone else’s EPS downward while revising ASC’s numbers upward. But most likely they will just revise their forecasts upward. This will be an important catalyst for potential investors who have been watching price growth from the sidelines all along. In addition, the aforementioned initiation of dividends could encourage the income-seeking public to go long. So Ardmore Shipping has a bunch of positive catalysts that tell us the stock is likely to push its rally into 2023.

Risks to keep in mind

Every investment thesis carries risks, and my thesis is no exception.

First, as I said earlier, the recession is indeed a major headwind for all shippers – and tankers are no exception here. We remember how the single-digit drop in oil demand in 2020 caused futures to fall into negative territory. Of course, 2023 will be different than 2020 – demand will most likely really decline, but I do not expect the same decline as during the pandemic. The tanker market will be in strong condition even in the midst of a new recession because that recession (if any) will be primarily due to a shortage of commodity resources (especially energy resources). So that risk exists, but I would not avoid tanker stocks because of that.

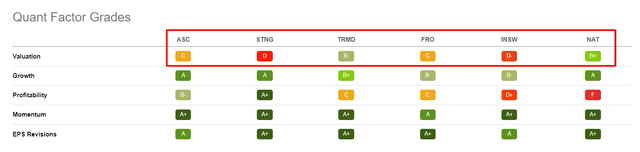

Secondly, despite its low multipliers, ASC does not look the cheapest among its closest analogs – this is evidenced by valuation stores given by Seeking Alpha’s Quant Ranking System:

Seeking Alpha, author’s notes

ASC’s lag behind other companies in the sector [Energy] is explained by poor sales-based valuation multiples – forwarding EV/Sales and P/S ratios are 63.21% and 63.34% higher than the sector average, respectively. But again, the exaggerations in individual multipliers do not give a complete picture. ASC has a fairly low TCE breakeven rate and a share of over 74% of the total fleet ownership, which may ultimately drive the company’s margins even higher – I mentioned this above. Therefore, the valuation risk is not very critical for me, although it certainly exists.

The third risk is that ASC stock is technically showing signs of weakness after reporting record earnings in early November. The RSI indicator has been falling since then, although the stock itself had risen 18% to its high by December 5. This divergence has kept me from publishing this article earlier, as timing is important after an extraordinary 300% rally since the beginning of the year.

Seeking Alpha’s Advanced Charting [TradingView], author’s notes![Seeking Alpha's Advanced Charting [TradingView], author's notes](https://static.seekingalpha.com/uploads/2022/12/10/49513514-1670658692847768.png)

I think that in the next few weeks, the ASC is in danger of seeing a continuation of the mean-reversion that has begun.

Conclusion

Despite the above risks, I still tend to believe that the ASC’s rally should continue in 2023, mainly due to fundamental factors. The global tanker market itself – especially the product and chemical tanker markets – favors the company to further increase its earnings potential while improving its balance sheet and making investments for a sustainable future after the peak of the cycle is behind us.

The company is currently going through a classic mean reversion, which may take some time. However, the initiating of a double-digit-% dividend will help the stock attract new audiences and increase demand in the medium term – I think there is no doubt that the company will pay generous dividends throughout 2023 and possibly 2024.

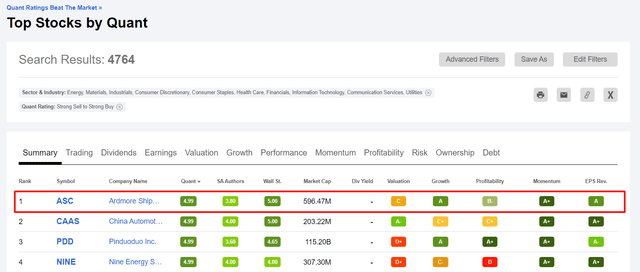

For this reason, I rightly consider Ardmore Shipping’s stock to be in first place in Seeking Alpha’s Top-Quant Stocks Rating (out of a total of 4764 stocks) and recommend this company as a strong buy for 2023.

Seeking Alpha’s Top-Quant Stocks Rating, author’s notes

So I think it’s reasonable to buy Ardmore Shipping Corporation stock from its current levels and possibly increase the allocation if it drops lower.

Thanks for reading!

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!