Kwarkot

Introduction

Earlier this month, Arbor Realty Trust (NYSE: NYSE:ABR) released its Q3 2022 earnings. The company performed well and the market reacted accordingly, with the company’s share price having risen by over 10% in the week or so since the results were announced.

Over the years, I have written about the company several times, with my first article on it back in 2018. Back then, coverage in the stock was low, and there were only a total of 5 articles on the company throughout the whole of 2018. However, coverage (and interest) in the company has risen substantially in the years since, with the number of articles on the company having more than tripled this year alone, with possibly more articles still to come in the final 2 months. I view this as a sign that people are developing an interest in dividend paying stocks – most probably an interest in a steady flow of income.

As mentioned above, there has been a substantial increase in coverage of the company by authors on Seeking Alpha. Hence, for this article, I would like to focus on only one aspect of the company – and probably also the key reason why people are interested in the company – its dividends.

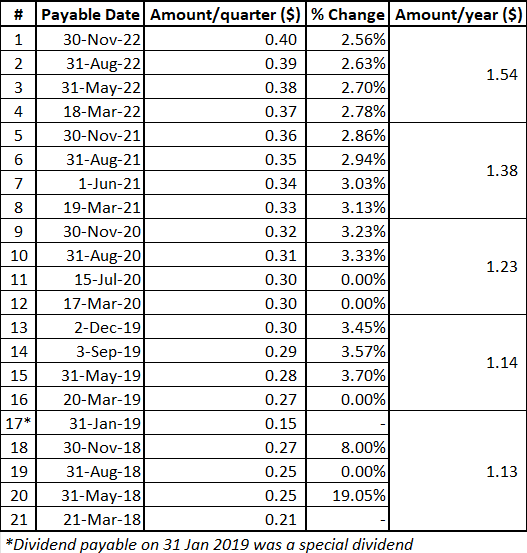

Together with the release of the company’s Q3 2022 earnings came the news that the company had increased its dividends for a 10th consecutive quarter. To provide some context, this extends all the way back to 2020, right in the middle of the COVID-19 pandemic. In fact, it is very possible that if not for COVID-19, the number of consecutive increases would be even higher given that the company had already started increasing dividends for several consecutive quarters prior to the start of COVID-19.

When I first heard the news on the dividends, my first thought (apart from calculating how much additional dividends I would be getting) was whether such an increase was sustainable for the company. After all, the company had been increasing its dividends for a while now. Apart from whether the company could maintain such a rate, would paying out such a dividend come at the cost of the company’s growth?

The Business

Before delving into the company’s dividends, it is important to first understand how the company derives its income in order to pay these dividends.

Arbor Realty Trust is a mortgage REIT, meaning the company’s revenue comes largely in the form of interest income from its investments, which are generally loans. The company’s profit comes from the spread between the interest income earned on the loans and the cost of financing these loans. The company has two business segments – Structured Loan Origination (“Structured Business”) and Agency Loan Origination and Servicing Business (“Agency Business”).

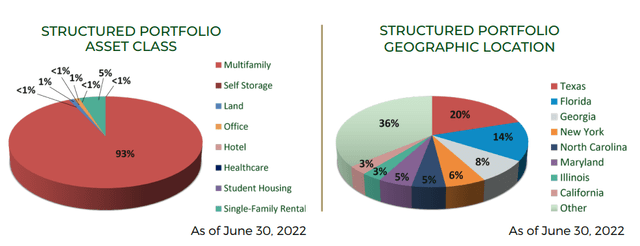

Under its Structured Business segment, the company focuses on commercial bridge loans in the multifamily market – virtually all of its loans are bridge loans, with the bulk of it in the multifamily market. Its borrowers are typically those seeking short-term capital to use in an acquisition of property. Owing to the short duration, such loans tend to have higher interest rates. These loans are largely secured by first mortgage liens on the properties. It’s important to note the “first” in the mortgage lien, as this gives the company priority over all other liens or claims on a property in the event of a default. At the end of the quarter, the company’s Structured Business had a $15 billion portfolio with a 7.19% yield, compared to a 5.82% yield the previous quarter. The increase in yield was predominantly due to the recent increase in interest rates.

While the company’s focus is on the multifamily market, the company does diversify its loans geographically. The loans are spread out across the country, with only Texas and Florida taking up more than a 10% share of the loans. Do note that while the below image is taken from the Q2 fact sheet (the Q3 fact sheet is not available yet), management has not indicated any significant change for Q3 thus it is safe to assume the breakdown remains largely the same.

ABR’s Investor Relations

Source: ABR Q2 2022 Fact Sheet

Apart from the Structured Business segment which provides the company with interest income, the company has a separate business segment from which it derives additional revenue. Under its Agency Business, the company underwrites, originates, sells and services multifamily mortgage loans across the country through various programs such as Fannie Mae and Freddie Mac. The company originated and sold $1.1 billion in loans for the third quarter, just under the $1.2 billion originated and sold in the previous quarter. At the end of the quarter, the company’s Agency Business had a $27 billion portfolio, a slight increase on the $26.7 billion the previous quarter. Perhaps more importantly, this portfolio has a weighted average life of 8.9 years, which helps ensure a recurring source of revenue for the company for the foreseeable future.

Sustainability

Having established how Arbor Realty Trust derives its revenue (mainly through interest income), we now turn our attention to the dividends itself. As mentioned above, the company has increased its dividends for 10 consecutive quarters, and this streak might be even longer if not for COVID-19, with the company even being able to pay out a special dividend back in 2018.

In fact, the company’s dividend has increased substantially year on year, having increased by over 30% in the past 4 years. Based on a share price of around $15, the company currently has a dividend yield of approximately 10.6%.

ABR’s Investor Relations

Source: Figures retrieved from Arbor’s Investor Relations

While a high dividend yield is certainly appealing, it means nothing if this high yield is a result of a depressed share price or if the company has a high dividend payout ratio. After all, by virtue of how dividend yield is calculated, a stock with a depressed share price may have a high dividend yield and become a dividend trap for potential investors. While the company’s share price has fluctuated significantly in the past few years, this was mainly due to COVID-19 and the share prices of other companies experienced similar fluctuations. COVID-19 notwithstanding, the company’s share price does not tend to fluctuate much, and the company’s current share price is currently at pre-COVID-19 levels. Thus, the concern of a depressed share price does not hold water here.

Next, a high dividend payout ratio is also not ideal for potential investors. The dividend payout ratio is the ratio of the total amount of dividends paid out compared to the company’s net income. If the company has a high dividend payout ratio, such as greater than 1, it means that the company might be overreaching by paying out more than it earns, possibly even tapping into its existing cash balances to pay out its dividends in order to maintain the appearance of an attractive stock. Even if the dividend payout ratio is less than 1, a sufficiently high figure would mean that the company has allocated virtually all of its income to paying dividends and may not have sufficient cash left over to grow the company.

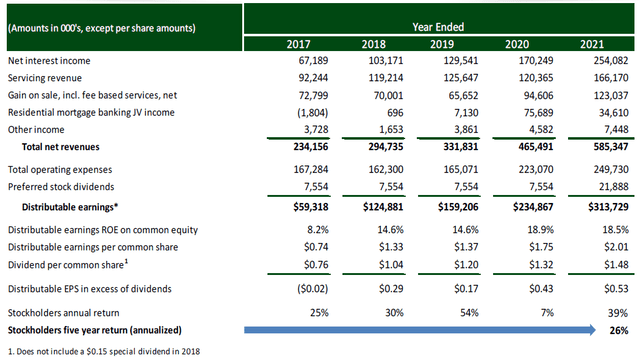

In the latest quarter, Arbor Realty Trust reported distributable earnings of $0.56/share. This amount, coupled with the declared dividend of $0.40/share, equates to a 71% dividend payout ratio. According to the company, this is the lowest payout ratio in the industry, though I have been unable to verify this statement. Perhaps more importantly, the company’s dividend growth has not been driven by an increase in its payout ratio. In fact, the opposite is true – based on the results for the first half of the year, the company reported distributable earnings of $1.06/share and a dividend of $0.77/share (Q1 and Q2), which equates to a 72.6% dividend payout ratio. Compared to the current dividend payout ratio of 71%, the company is clearly able to maintain its dividend payout ratio at the very least to meet its dividend payments, with additional buffer room (almost a third of its income) for any unexpected circumstances.

Risks

As with any investment, there are certainly risks to investing in Arbor Realty Trust. With most of the company’s revenue coming in the form of interest income, the company is especially vulnerable to fluctuations in interest rates. Part of the company’s outperformance in recent times has come as a result of an increase in interest rates – 97% of its loans are floating rate, with a comparatively smaller 88% of debt being floating rate. All things held constant, a 1% increase in interest rates will produce an additional $0.10/share in earnings. While interest rates have been rising, they will eventually come down and the company is aware of that. Management has been looking at converting some of its floating rate loans to fixed rate. The company has also built up its liquidity position, with approximately $500 million in cash and liquidity to take advantage of favorable conditions in the market.

ABR’s Investor Relations

Source: ABR Q4 2021 Investor Presentation

One other potential risk comes in how the company is focused predominantly on the multifamily market. Any downturn in the sector will affect the company significantly. However, I choose to view this as a positive, with the company having the expertise to operate in this niche area. After all, the company has shown time and again that its experienced team has been able to navigate various market conditions, from the 2008 housing crisis to the recent COVID-19 crisis.

Conclusion

I have owned Arbor Realty Trust for a number of years now. While there have been significant fluctuations in the company’s share price in recent years as a result of market conditions, the company has managed to rebound quite well in terms of share price – most REITs which saw a sharp drop in share prices have yet to recover. Additionally, the company has been paying a dividend throughout this period and instead of cutting its dividend like many other REITs have done, the company has instead increased its dividends. This increase has also not come at the expense of the company’s future, with management holding on to a significant cash position and ready to deploy where necessary.

While the company is unlikely to make you rich when it comes to capital growth (unless you bought at the low of $4 in 2020, in which case kudos to you), it does provide a stable source of recurring income, which is why I choose to invest in the company. Of course, each individual’s risk tolerance is different and I encourage you to take into account your own circumstances when considering if you should invest in the company. I view the company as a long-term hold (years, if not decades) and I continue to add to my position where possible.