William_Potter

AMZN inventory: Q2 outcomes met market selloff

I final lined Amazon.com, Inc. (NASDAQ:AMZN) inventory a couple of month in the past (on July 10, 2024, to be precise). At the moment, I revealed an article entitled “Amazon: Swimming In Catalysts.” Because the title suggests, the purpose of that article was to supply an total view of the varied catalysts afoot on the firm. Extra particularly, I argued that:

I see a mess of catalysts that may drive the corporate’s earnings. To recap, the highest 3 catalysts in my thoughts are the enhancements of its success facilities, AWS, and its huge and sticky consumer base. Moreover driving EPS, these catalysts, particularly the synergies amongst them, can additional solidify its aggressive moat in the long run.

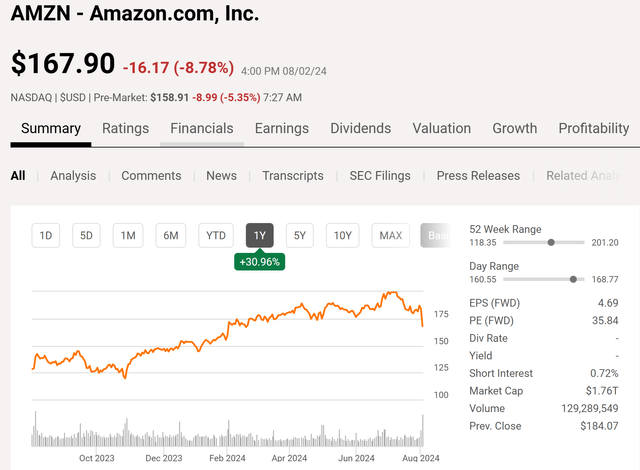

Since that writing, the inventory has launched its 2024 Q2 earnings report (“ER”). The ER confirmed some combined outcomes, however was total strong in my opinion (extra on this in a minute). The share costs went down by ~7% throughout after-hours buying and selling after the ER, as illustrated by the chart beneath. Within the the rest of the week for the reason that ER launch, the inventory was caught up in an total market selloff and its costs stored trending downward. The market’s concern (over a potential AI bubble burst and exhausting touchdown) brewed extra over the weekend, and the promoting stress additional intensified at present. In Monday’s pre-market buying and selling, Nasdaq futures are down greater than 5% and AMZN inventory costs are down greater than 5.3% as you may see within the chart.

These developments have jogged my memory of the timeless knowledge of being grasping when others are fearful. Within the the rest of this text, I’ll argue a purchase thesis for AMZN inventory, with a give attention to its Q2 outcomes and earnings outlook. I’ll clarify A) regardless of the AI bubble baked into its pre-ER costs has already deflated, and B) the inventory now affords a really skewed return/danger profile.

Looking for Alpha information

AMZN inventory: Q2 recap and AI bubble

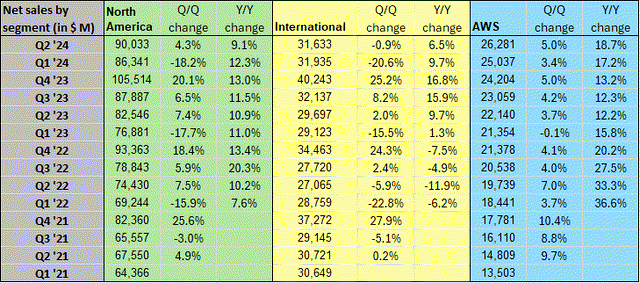

Total, the corporate reported a stable quarter in my opinion, though the Q2 outcomes contained some unevenness. When it comes to EPS, AMZN earned $1.26 per share, nearly doubling the $0.65 determine a 12 months in the past and exceeding market expectations. Income got here in at $148B, barely lacking market consensus by $760M. Notably, AWS grew 18.7% YOY to a $26.3B phase, as demonstrated by the chart beneath. The expansion charges exceeded Wall Avenue steerage of +17.6%.

Looking for Alpha information

The market, nevertheless, was (has been) on excessive alert lately because of the concern over a possible AI bubble. The present state of affairs definitely reveals a couple of key bubble indicators contemplating the mixture of valuation premium, combined progress outcomes (e.g., Microsoft simply reported disappointing Azure outcomes earlier than AMZN’s ER), and the continued requirement of enormous CAPEX investments.

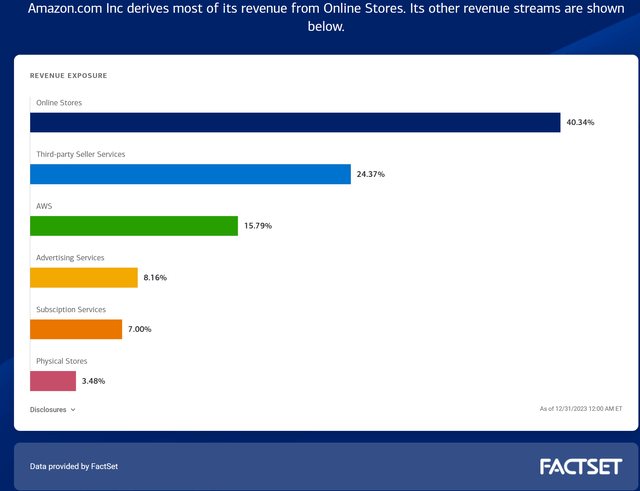

My view is that AMZN has a well-balanced set of income streams and thus is the least delicate to the AI bubble. The chart beneath reveals Amazon’s income breakdown as of December 31, 2023. As seen, On-line Shops generated probably the most income, accounting for 40.34% of the overall. Third-party Vendor Companies got here in second and contributed 24.37%. The highest 2 sources thus contributed about ¾ of its whole revenues. AWS got here in third with a contribution of 15.79%, sizable however not dominant in any means.

Subsequent, I’ll argue that regardless of the AI bubble baked into its pre-ER valuation multiples has already been deflated by the current worth corrections.

FACTSET information

AMZN inventory: valuation and return projection

On the pre-market inventory worth as of this writing (about $153), AMZN’s FWD P/E is about 33.1x, definitely not low cost by any commonplace. Nonetheless, as detailed in my earlier articles, accounting P/E ratios are deceptive for AMZN’s valuation on account of its substantial use of lease accounting and progress CAPEX funding.

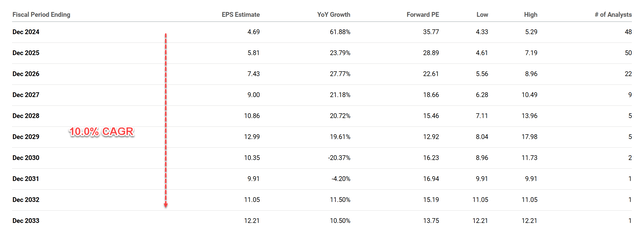

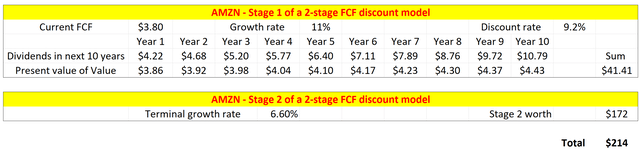

Thus, right here, I’ll depend on its FCF (free money move) for valuation functions. Extra particularly, I’ll apply a two-stage discounted FCF mannequin to evaluate its honest worth and return potential. On this mannequin, the first stage captures its progress within the subsequent 10 years and the 2nd stage captures the terminal progress charge after that. For the expansion charge within the 1st stage, I’ll depend on the consensus EPS estimates for AMZN, as proven within the chart beneath. As seen, the estimates mission a notable progress trajectory regardless of the market’s issues over its Q2 outcomes, with EPS anticipated to rise from $4.69 in 2024 to $12.21 in 2033. Total, the forecasted Compound Annual Development Fee (CAGR) is 10.0% for this era.

Looking for Alpha

For the terminal progress charges, my technique is detailed in my early articles, and right here I’ll simply quote the outcomes immediately:

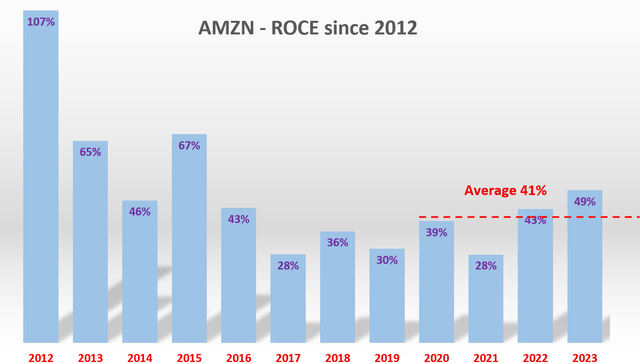

The strategy includes the return on capital employed (ROCE) and the reinvestment charge (“RR”). The ROCE for AMZN is round 41% as seen within the chart beneath. AMZN’s reinvestment charge is about 10% on common, increased than the common for different main tech companies largely on account of its aggressive use of lease obligations. With these inputs, AMZN’s perpetual progress charge could be ~4.10% (41% ROCE x 10% reinvestment charge = 4.10%). Notice this quantity is the true progress charge with out inflation. To acquire a notional progress charge, I added an inflation escalator of two.5%, leading to a notional progress charge of 6.6%.

Creator

Lastly, for the low cost charge, I exploit the WACC (weighted common value of capital). The WACC is the common charge {that a} enterprise pays to finance its belongings, together with each fairness and debt. For AMZN, my calculation signifies that the WACC has been on common 9.2% previously 3 years.

With all these above inputs, the next desk reveals the outcomes. As seen, my estimate of its honest worth is round $214, about 40% above its present share worth of $153 as of this writing and providing a large margin of security.

Creator

Different dangers and closing ideas

As aforementioned, the market has good motive to fret in regards to the return on the huge AI capital investments made by AMZN (and different tech giants as properly) lately. Extra particularly, the chart beneath compares the working money move and capital expenditures for AMZN inventory previously few quarters. The chart presents Amazon’s money move from operations and capital expenditures from December 2021 to June 2024.

As seen, its capital expenditures have sharply surged lately. Its capital expenditures reached the 2nd highest stage of file stage of $17,620 million in Q2 since 2021 (when it reported a capital expenditure of $18,935 million. Q2’s capital expenditures are a whopping 54% above the determine a 12 months in the past ($11,455 million). The excellent news right here is that its money from operations additionally grew at about the identical tempo in tandem. To wit, its Q2 working money totaled $25.28 billion, about 53% increased than the determine a 12 months in the past ($16.47 billion).

Trying forward, the return on capital funding in AWS could be unsure because of the early stage of AI deployment. Nonetheless, I’m optimistic in regards to the return of its different segments, such because the success middle and varied membership packages (the main focus of my final article).

All advised, my conclusion is that the Amazon.com, Inc. upside dangers far outweigh the draw back dangers underneath present situations. My thesis is that the selloff triggered by the market’s concern in regards to the AI bubble is overblown within the case of AMZN.

And to recap, the important thing issues behind my thesis are threefold. First, its Q2 outcomes proceed to indicate a steady moat and a superiority of its e-commerce. Second, AMZN boasts a well-balanced assortment income stream. Lastly, the current worth correction has created a large margin of security relative to its honest worth.

Looking for Alpha