kynny

Geopolitical turbulence and the fragile and volatile nature of the critical raw-material supply chain could curtail planned expansion in battery production – slowing mainstream electric vehicle (EV) adoption and the transition to an electrified future.

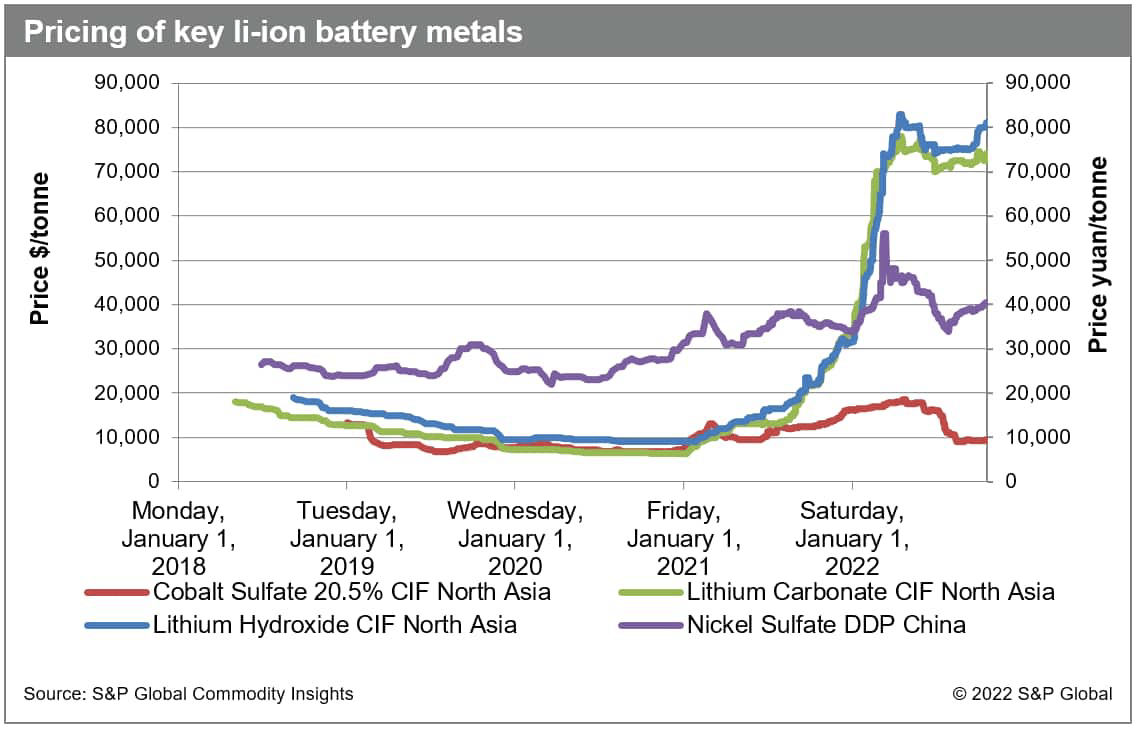

Soaring prices of critical battery metals, as observed in the following chart from S&P Global Commodity Insights, are threatening supplier and OEM profit margins. This situation has quickly translated into increased component and vehicle prices, according to a new analysis from S&P Global Mobility Auto Supply Chain & Technology Group.

Trade friction and ESG concerns are also affecting the development of the raw materials supply chain between markets. These collective developments add to the challenges of the electric vehicle transition.

Achieving its volume goals will require a steep growth curve for a burgeoning industry. For OEMs to hit their BEV and hybrid sales aspirations, S&P Global Mobility forecasts market demand of about 3.4 Terawatt hours (TWh) of lithium-ion batteries, annually, by 2030. This figure excludes the medium- and heavy-duty, and micro-mobility spaces, as well as consumer electronics and burgeoning demand for stationary energy storage. The 2021 output for the auto industry: 0.29 TWh.

S&P Global Commodity Insights

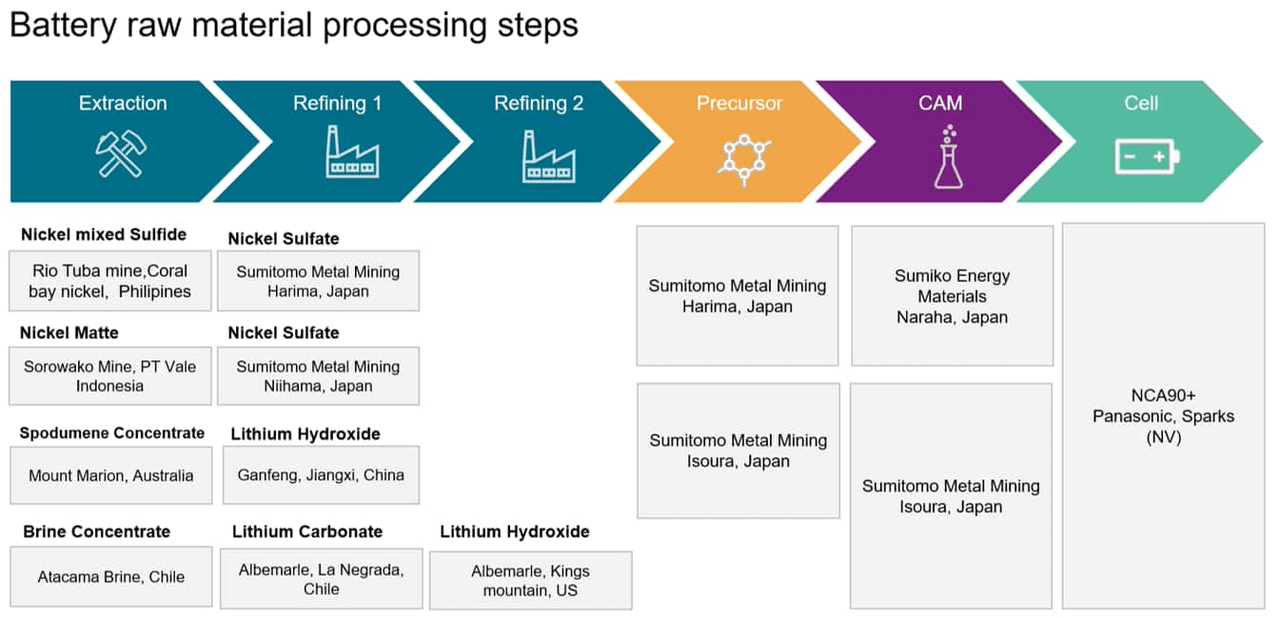

Elements such as lithium, nickel, and cobalt do not just magically appear and transform into EV batteries and other components. The development chain is lengthy and complex, from their difficulty to extract to their complicated refining. The intermediate steps between excavation and final assembly are a particular choke point in terms of expertise and market presence. Currently, China is the clear leader in materials refining, as well as the packaging and assembly of battery cells. At issue is which other nations will step up to facilitate this industry transformation.

In terms of accessing battery raw materials, the equation boils down to: Who needs what, where will it come from, who will supply it, and who is best placed to benefit from this increased dependency on a handful of critical elements?

The latest S&P Global Mobility research evaluates the battery raw material supply chain from extraction to vehicle, identifying:

- A number of unfamiliar companies will play a major role in the processing and development of battery-electric vehicle (BEV) technology that will underpin the light passenger vehicles of the coming decade and beyond;

- Potential trade friction could represent difficulties for major auto companies in extricating themselves from an established, nimble, and cost-effective supply of processed materials coming from or via mainland China;

- Some OEMs are seeking the value and reassurance of “locked in” supply chain relationships straddling mine to vehicle, lessening the reliance on volatile spot markets and/or a need to work with less established industry partners.

The process flow below identifies a well-understood and well-documented supply chain to provide the required nickel and lithium for Tesla’s (TSLA) NCA-based cylindrical cells produced in its “Gigafactory” near Sparks, Nevada, US.

Author

Now extrapolate that across the entire auto industry – and expand EV market share to encompass the bullish projections made for 2030 and beyond.

The greatest quantity of nickel required by any given vehicle brand for 2030 production is forecast to be Tesla – deemed to be some 139,000 metric tons (MT). However, in assessing the existing structure of their broader manufacturing bases, we expect each of Volkswagen (OTCPK:VWAGY), General Motors (GM), and Stellantis (STLA) to surpass this requisition amount. Developing modular battery packs that can be configured to fit multiple vehicle segments and can accommodate a variety of battery chemistry choices will ensure a degree of resiliency against raw material supply constraints and price fluctuations.

“We have identified a total of 28 extraction sources of battery-grade nickel over the coming 12 years to serve the light passenger-vehicle market, located in 15 countries worldwide,” said Dr. Richard Kim, Associate Director with S&P Global Mobility’s Supply Chain & technology team. “However, the supply base for the upstream material processing steps and formation of the fundamental battery cell cathode chemistries presents a challenging lack of geographic diversity.”

S&P Global Mobility research suggests that, while the process of either smelting or high-pressure acid leaching (HPAL) is typically done at the nickel extraction site, that is not the case for the process of conversion to nickel sulphate.

Of the 16 companies that can perform this process at present, 11 are in mainland China. By 2030 we expect the number of companies to increase to at least 24, of which 14 will likely be in mainland China. We forecast mainland China to process 824,000 mT of nickel sulphate annually by 2030, with Chinese mining giant GEM’s supply of nickel sulphate to key Tesla supplier CATL expected to be the largest supply contract by tonnage. By contrast, we forecast North America and Europe to process just 146,000 mT.

We must also consider risk in calculating access to cobalt – a material well understood for its limited sources of origin and concerns regarding ethical supply. Battery-grade cobalt bound for electrified light passenger vehicles currently originate from just 18 mines, totalling 52,000 mT – of which 29,000 mT is forecast to be mined in the Democratic Republic of Congo (DRC) in 2022. The United Nations has cited the DRC’s “deteriorating security situation,” its humanitarian crisis affecting 27 million people, as well as child labor practices and the ongoing guerrilla campaign being waged over the exploitation of resources and food security.

Despite the conflicts ravaging the DRC, we still estimate that nation’s output bound for OEMs and suppliers to increase to 37,000 mT by 2030. However, reliance on the DRC will decrease from 56% to 17% in terms of total tonnage. We expect near-tenfold increases in supply from countries such as Australia and Indonesia, while countries such as Vietnam, Finland, and Morocco will by then weigh in with meaningful contributions. Given the dynamics of the supply market, even for an OEM with locked-in cobalt contracts with miners, a portion of several automakers’ supply remains unknown at this stage.

“Geopolitics has coupled with a desire for supply chain dominance and independence in the battery raw material supply chain evolution to date,” said Dr. Kim. “China has established a firm head start. The evolution of their Belt and Road initiative clearly had one eye on the automotive industry transition to electrification, with broad strategic and logistical investments in Africa as well as Southeast Asia.”

S&P Global Mobility research clearly indicates that established battery raw material supply and processing operations under mainland Chinese ownership will continue to deliver much of the world’s supply of lithium-ion batteries and their constituent key elements.

However, the imposition of nationalistic policies such as the United States Inflation Reduction Act (and the automotive implications of it) look to belatedly redress some of this imbalance by promoting the setup of domestic supply chains, in return for lucrative subsidies to both the suppliers and the purchasing consumers.

The battery will be the defining technological and supply chain battleground for the industry in the next decade, and access to their constituent raw materials will be crucial. S&P Global Mobility will continue to assess the changing landscape of the battery raw materials market in real-time, incorporating the latest industry developments and research.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.