You may not be planning to expertise surprising monetary shocks in retirement. However you need to be in line with the outcomes of a survey just lately printed Society of Actuaries Analysis Institute’s Ageing and Retirement Strategic Analysis Program.

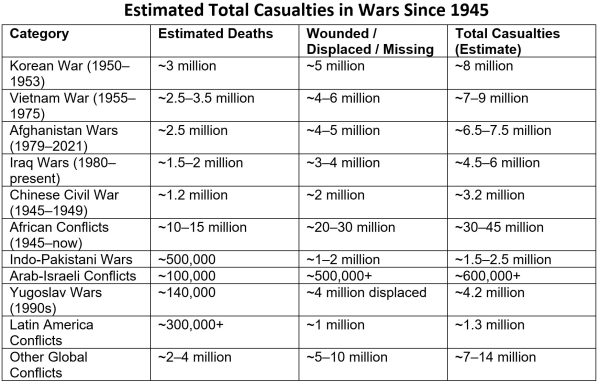

Based on a latest SOA survey, about half of the pre-retirees report experiencing some kind of surprising monetary shock, in addition to greater than 4 in 10 retirees. And, one in 5 pre-retirees report that these shocks have lowered their property by 25% or extra and lowered their spending by 10% or extra.

The excellent news is that far fewer retirees report these reductions, in line with the 2021 Retirement Danger Survey Report of Findings. For instance, only one in 10 retirees (11%) report that shocks lowered their property by greater than 25%.

SUBSCRIBE TO OUR NEWSLETTER: The Each day Cash delivers our high private finance tales to your inbox

Pre-retirees least ready for a disaster

Different key findings: When requested what they might afford to spend out of pocket on an emergency with out jeopardizing their retirement safety, half of pre-retirees report that they might solely afford to spend $10,000 or much less and greater than half of retirees may afford not more than $25,000. Black/African American pre-retirees (61%) are extra probably than pre-retirees usually (40%) to be impacted by an surprising expense of as much as $10,000.

Amongst retirees, Black/African American respondents (58%) and Hispanic/Latino (52%) mentioned they don’t seem to be in a position to spend $10,000 with out it affecting their retirement safety. This was a lot better than the final retiree response (32%), in line with the SOA.

So, what to make of all this? How would possibly you, be you a pre-retiree or retiree, higher put together for surprising monetary shocks?

Construct an emergency fund

Most monetary planners suggest that you’ve got not less than three to 6 months of dwelling bills put aside for, nicely, emergencies or a monetary shocks, reminiscent of a brand new roof or dental work.

“Early in my profession, I had a 90-plus-year-old shopper say to me relating to monetary property, ‘You by no means know what it’s going to take to get you out of this world,’” mentioned Invoice Harris, a licensed monetary planner with WH Cornerstone Investments. “Her life knowledge was spot on. I exploit that quote to inform pre-retirees with ‘constrained’ or under-funded retirement property that life has its surprising turns. We additionally inform pre-retirees, ‘You possibly can by no means ever save sufficient for retirement. An emergency fund is all the time wanted.’”

SMART STRATEGY: Give attention to emergency fund and wiping out high-interest debt

Construct a reserve fund, too

Sudden spending shocks are a actuality at any age, mentioned Roger Whitney, host of the “Retirement Reply Man” podcast. “Once they occur in retirement – after revenue from work ends – they aren’t as simply absorbed or labored by way of,” he mentioned. “To be higher ready, create choices in your future self to take care of a shock. Constructing money reserves above a standard emergency fund, eliminating debt to decrease mounted month-to-month funds or working part-time may also help create monetary slack that can assist you be agile as your retirement life unfolds.”

RETIRED? Be sure you have these 4 types earlier than you file your taxes

What different funds do you’ve got?

To higher put together for an surprising monetary shock, pre-retirees want a way of different funds they could have entry to reminiscent of residence fairness line of credit score or 401(ok) loans, mentioned Nicole Sullivan, the co-founder and director of monetary planning at Prism Planning Companions.

In case you do plan to borrow cash to cowl any monetary shocks, Sullivan recommends making a plan to pay again any borrowed funds. “It’s a should,” says Sullivan. “All of us have ‘fluff’ in our budgets and trimming is useful.

In case you can’t borrow cash to pay for a monetary shock otherwise you don’t need to borrow cash, Sullivan says “arising with artistic “facet hustles” to herald additional revenue is a good choice. “Aspect work may additionally assist pre-retirees discover what they could need to do as soon as they’ve retired,” she says.

WORKING IN RETIREMENT: Is it a good suggestion? Weigh these execs and cons.

Robert Powell, CFP®, is co-founder of finStream.television and editor of TheStreet’s Retirement Each day. Received questions on cash? E-mail [email protected]

This text initially appeared on USA TODAY: Retirement: The best way to put together for a sudden monetary hardship