RiverNorthPhotography/iStock Unreleased via Getty Images

Verizon Communications (NYSE:VZ) dropped another 4.5% following their Q3FY22 earnings release last Friday. This brought shares to a new 52-week low and their YTD losses to over 30%, which is significantly worse than both the S&P 500 and the Dow Jones Industrial Average (“DJIA”), which are each down 21% and 14.5%, respectively over the same period.

Headlines continue to focus on weak net postpaid phone additions. Though the metric is indeed a weakness, especially when compared against their peers, the company is still growing their average revenues per account (“ARPA”) through increased penetration in their premium plans.

Continued strength in their Business segment and Broadband and Value markets also provides an adequate counterbalance against the weakness in the Consumer unit. A newly announced cost savings initiative should also improve their bottom line results in the coming periods, in addition to both operating and EBITDA margins, which are already exhibiting some sequential improvement.

For investors, VZ continues to offer one of the highest risk/reward opportunities in the market today, with a highly attractive dividend payout that is backed by a superb track record of continuous growth and share price upside potential that can reward shareholders with long-term outsized gains.

Improving Margins On 4% YOY Consolidated Revenue Growth

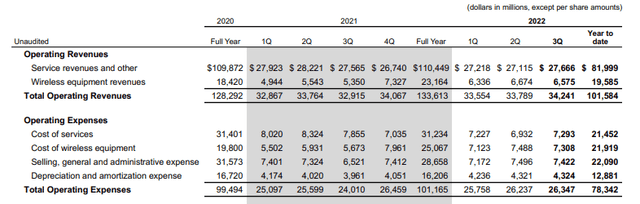

In the third quarter ended September 30, 2022, VZ reported total consolidated revenues of +$34.2B. This was up 4% from the same period last year and +$410M better than expected. Service revenues, however, which represent approximately 80% of total revenues through the first nine months of the year, were up just 40 basis points (“bps”) on the quarter and are down 2% YTD. Consolidated revenue growth is instead being driven by wireless equipment, which was up 22.9% on the quarter and is now up nearly 24% YTD.

Similar to Q2, operating expense growth continues to outpace operating revenues, driven primarily by increases in the cost of wireless equipment. In the current quarter, there was also a double-digit YOY increase in selling, general, and administrative (“SG&A”) expenses, with the line item representing approximately 21.7% of total operating revenues this year versus 19.8% last year. This, however, is down about 30bps on a sequential basis.

Q3FY22 Investor Presentation – Historical Summary Of Operating Revenues And Expenses

More effective operating expense control did improve consolidated margins during the quarter, however. At 23.1%, it’s still down from 27.1% from last year, but it is up from the 22.4% reported at the end of the second quarter.

Of the two business units, Consumer and Business, Consumer revenues, which account for approximately three-quarters of total consolidated revenues, were up 10.8% on the quarter, while the Business segment reported growth of 1.9%. In addition, both operating and EBITDA margins exhibited some sequential improvement, with each up about 50bps. Margins in the Business segment similarly held steady from Q2.

8K Net Phone Additions, Driven By The Business Segment

Consumer postpaid phone gross adds were up 1.3% YOY, which is up significantly from the 11% decline reported in Q2. And overall, the Consumer segment reported 2.6M retail postpaid phone gross additions, which is up about 5% YOY. In addition, they experienced continued growth in postpaid upgrades, which contributed favorably to the reported 3.8% YOY growth in ARPA.

Churn, however, did tick higher, due to the company’s earlier pricing actions, resulting in an ultimate net loss of 189K retail postpaid phones in the Consumer segment. With certain increases still being phased-in throughout the third quarter, churn is expected to carry over into Q4, though phone net additions are expected to turn positive in the final quarter of the year.

Losses on the Consumer side were fully offset by a 197K gain in the Business side across their three customer groups, with Enterprise reporting record net performance and double-digit increases from both Small Business Solutions (“SMB”) and the public sector. Including the gains from Business, net phone additions during the quarter were 8K.

Strength In The Broadband And Value Markets Serve As An Adequate Counterweight To Weakness In Mobility

Offsetting weakness in the Mobility market was their Broadband and Value markets. Broadband net additions during the quarter were 377K, 342K of which were from fixed wireless access (“FWA”). This is up about 35% from Q2. In addition, VZ reported 61K Fios Internet net additions during the quarter, driven by both strong gross additions and strong retention levels.

And further gains are expected as household coverage continues to expand. Already, total fixed wireless household coverage surpassed 40M during the quarter, including over 30M covered by 5G Ultra Wideband. Fios open-for-sale is also at 16.9M, which represents a YTD increase of 410K or about 75% of their full-year target.

In the Value market, performance is highlighted by TracFone, who experienced positive net additions for the first time since Q1FY21. This is a significant milestone in the continued integration of this newly acquired value unit.

Free Cash Flows Are Down But Still Greater Than Dividend Payments

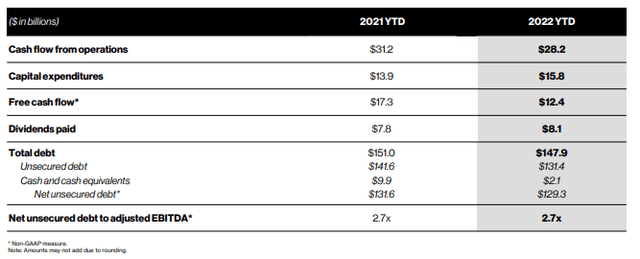

Through the first nine months of the year, VZ has generated +$28.2B in cash from operations. This is down about 10% from last year due to negative working capital adjustments pertaining to increased inventory levels. In addition, capital expenditures (“capex”) are also up, driven by C-band spending, which totals about +$4.5B YTD.

Q3FY22 Investor Presentation – YTD 2022 Cash Flow Summary

Though free cash flow (“FCF”) is down for the year, it is still sufficient to fully cover their dividend payout. In addition, their debt load remains stable at 2.7x, which represents a sequential improvement of +$1.3B.

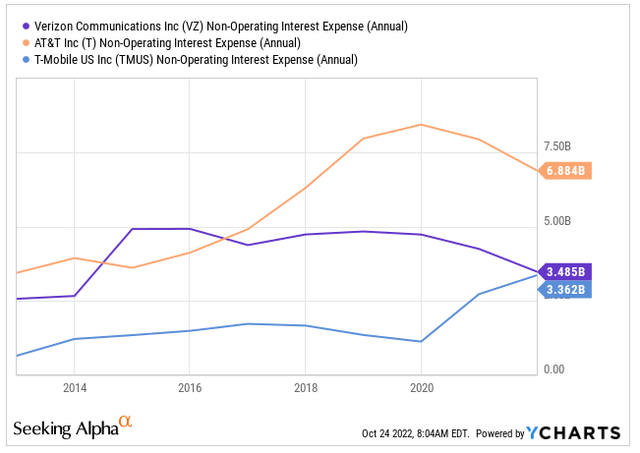

While full-year interest expense is expected to come in +$400M higher than management expected at the beginning of the year, overall interest costs have remained fairly flat over the years even as debt has gone up.

YCharts – Chart Of VZ’s Reported Interest Expense Compared To T And TMUS

Post-Earnings Insights

Though total consolidated revenues were up 4% during the period, overall net income was down 24% due to higher overhead costs and interest expenses. These results, however, still topped market expectations.

Nevertheless, management still announced a new cost-cutting program that is expected to save between +$2.0B and +$3.0B a year through 2025. While explicit details weren’t provided on the conference call, the initiative should still provide a boost to both margins and bottom-line figures in the periods ahead.

Already, margins have exhibited some sequential improvement, though they are still down significantly from the prior year. Easier comparisons beginning in the fourth quarter, however, should provide a tailwind that will become even more pronounced as additional savings are realized.

While the 8K net phone additions appear dismal compared to the 708K reported by AT&T (T), VZ is still reporting respectable YOY growth rates in ARPA through continued penetration into their premium plans, which continues to be a promising aspect of VZ’s growth strategy in their Mobility market.

In the current period, the penetration level increased to approximately 42% at quarter end, which is in line with sequential increases in prior quarters. In addition, they ended the quarter with 81% of their base on unlimited plans, with approximately 60% of their new customers choosing premium unlimited directly from inception.

Net weakness in the Consumer segment is being offset by robust strength in their Business segment and Broadband markets. The 197K postpaid gains in Business, for example, fully offset the losses reported on the Consumer side, and it was the fifth consecutive quarter with reported gains in excess of 150K. In addition, total broadband net additions were up 40% on a sequential basis, which is indicative of the value of VZ’s premium network, despite rising rates.

VZ’s quarterly results weren’t strong, but they didn’t warrant new share price lows following their release either. After all, they did come in ahead of expectations. While it’s true higher pricing is driving some customers away, other customers are opting in to upgraded plans, which is resulting in continued strength in their ARPA metrics.

At just 6.8x forward earnings, shares are trading at a significant discount to their five-year average of 11.3x. Even if one were to slash the five-year multiple to the 9.0x level, which is a target in-line with my prior estimates, shares would still have an upside of over 30%. And this doesn’t include the 7% yields obtained from the current dividend payout. For investors seeking to add a quality Dow component to their long-term portfolios, VZ remains a top holding in this challenging market environment.

:max_bytes(150000):strip_icc()/Health-GettyImages-1190344849-fa128f3151504835963cac1e35b1df27.jpg)