Florent Molinier

Current Suggestions of S&P 500

Right here is my current document on S&P 500 (NYSEARCA:SPY) (SP500) (SPX):

- After being a long-term bull, I turned bearish and advisable a promote on SPY on March twenty fifth 2022, at 451 on SPY. My bearish thesis was quite simple: I anticipated that the Fed would improve the rates of interest aggressively to fight the rising inflation, which can trigger a recession and the recessionary bear market.

- On April 22, I reiterated the expectation that the Fed would aggressively increase rates of interest in 2022, once I advisable a promote on SP500 with the index worth at 4271.

- On Might third, I identified that the liquidity danger as a consequence of expectations of financial coverage tightening is easing and that financial coverage expectations are priced in (the height Fed hawkishness) and I recommended protecting brief positions and going impartial on SPY at round 415.

- On Might 30, I advisable to begin shopping for S&P 500, with SPY at 413, and continued to advocate shopping for S&P 500 on June 27 with SPY at 388, and July 18 with SPY at 388. The bullish thesis was additionally quite simple: we had been previous the height inflation and anticipated to be previous the height headline inflation given the falling commodity costs, and thus, previous the Fed hawkishness. Additional, given the nonetheless constructive yield curve unfold between the 10Y Treasury Bond and the 3-month Treasury Invoice, the chance of an imminent recession was very low. Thus, I anticipated a minimum of a pleasant (and important) counter-trend summer season rally.

Downgrade from purchase to impartial

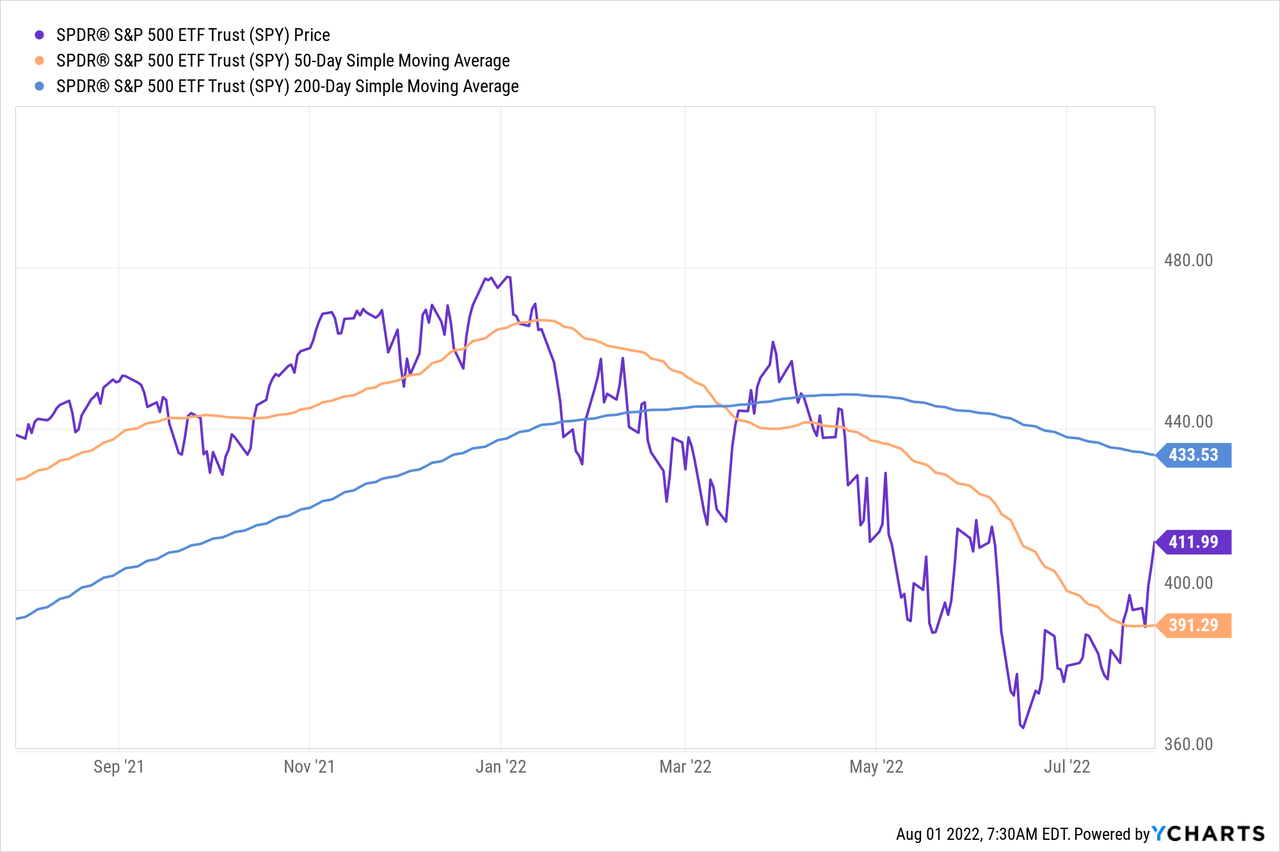

Since reaching the (cycle) backside on June sixteenth, S&P 500 is up virtually 13%, and SPY is at present at 411 close to the breakeven of my Might thirtieth shopping for level, and considerably increased than my June twenty seventh and July 18th shopping for factors. I’m keen to take earnings on these lengthy positions. Right here is the SPY chart that illustrates the numerous countertrend bounce to the highest vary:

I’m downgrading SPY to impartial for these causes:

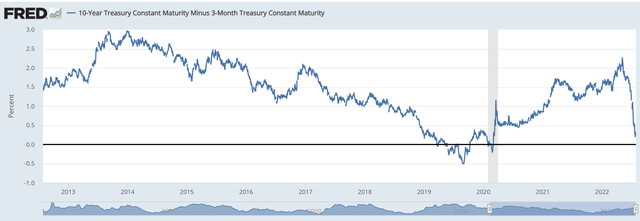

1) The 10Y-3mo unfold has considerably narrowed to 0.26%, which is though nonetheless constructive, getting actually near inversion. Thus, the chance of an imminent recession is simply too excessive to disregard now. Right here is the chart;

FRED

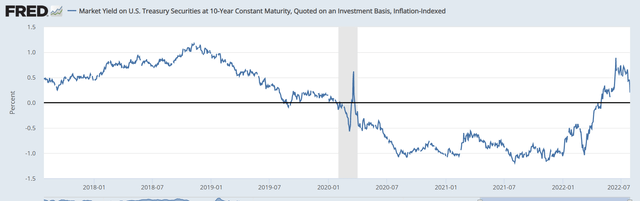

2) Much more problematic is that the narrowing of the 10Y-3mo can be created by the falling 10Y yields, which indicators the financial slowdown. Extra importantly, the 10Y yields are falling as a result of falling actual charges, which is signaling a doable flight to high quality and expectations on coverage easing (not tightening). Right here is the chart of 10Y TIPS (actual rates of interest), which have fallen in direction of the zero p.c degree (0.20%):

FRED

3) The credit score danger is rising. The unfold between BBB-10Y is reaching the cyclical excessive at 2.42%. Though this unfold continues to be modest and requires the rise above 3% to be thought-about excessive, the development is to the upside.

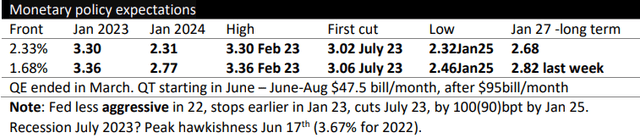

4) The market is now pricing that the Fed would begin reducing rates of interest in July of 2023, which signifies the expectations of a doable recession in 2023. Listed here are the present financial coverage expectations, based mostly on World Educational View report:

World Educational View

Contemplating the purpose 2 (falling actual rates of interest) and 4 (expectations on rate of interest cuts), the market is prone to reply negatively to slowing financial knowledge and begin pricing the Section 2 of the bear market – an imminent recession selloff.

Thus, I’m keen to take revenue on the summer season rally bounce and consider what precisely the market is pricing subsequent and provoke the brand new positions accordingly.

The Bearish case

The bearish case is now the baseline expectations, so long as the 10y-3mo spreads invert, and the 10Y continues to fall. The bearish case is the Section 2 of the total bear market – the pricing of an imminent recession, the place the financial knowledge slows and company earnings get downgraded.

The Bullish case

The bullish case is the mushy touchdown case, the place the Fed makes the total dovish pivot and doesn’t improve rates of interest above the 10Y yields.

The Impartial case

The very fact is, we nonetheless haven’t got sufficient info with respect to the bearish case or the bullish case. We do not understand how is the Fed reacting to the potential rising unemployment, with nonetheless elevated inflation. Will the Fed tolerate the next inflation to stop a rising unemployment? Will the Fed particularly acknowledge that the 10Y yields are the celling for the Federal Funds charge?

The Fed Chair Powell indicated that the Fed is at present within the impartial, but additionally that additional rate of interest hikes are warranted. Properly, it will invert the 10y-3mo curve and certain trigger a recession.

Extra importantly, the S&P500 is now rising, and lots of are prone to begin shopping for, whereas the shorts are prone to be compelled to cowl. So, the summer season rally might proceed – regardless of the worsening fundamentals.

I view this technical image extra as a possibility to provoke brief positions (if the bear case prevails). Thus, at this level, the impartial place means, I’m not shopping for the summer season rally anymore, and taking earnings and tactical longs. It additionally means, I’m ready to provoke new positions, as the brand new arrange emerges.

Be aware on current SPY efficiency

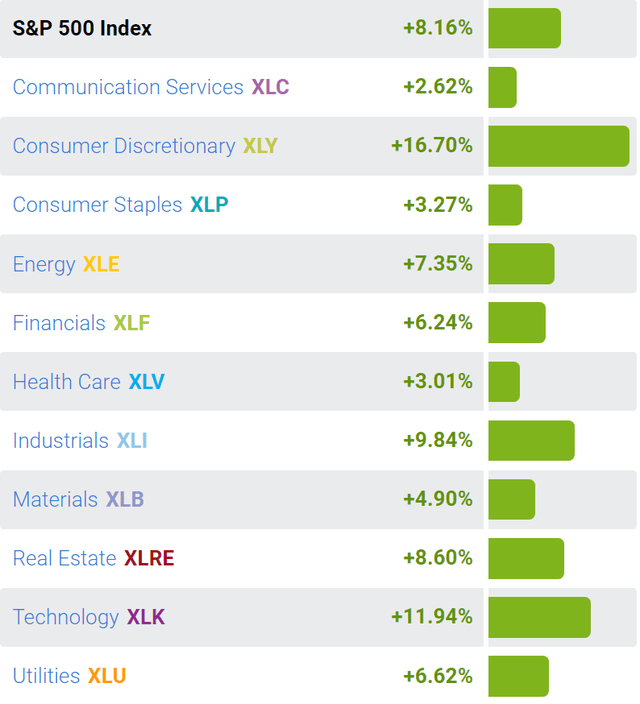

During the last month, SPY, which is the ETF that tracks S&P500, is up by 8.16%, led by Client Discretionary sector (XLY) up by 16.7% and Know-how (XLK) up by 12%. Each of those are cyclical sectors which have bounced from the deep sell-offs, however given the expectations of an imminent recession, the efficiency of those sectors is unsustainable. It’s seemingly that the current efficiency is only a bounce, that means, because the economic system begins to visibly decelerate, these cyclical sectors usually tend to proceed to unload, dragging the SPY to the following leg decrease.

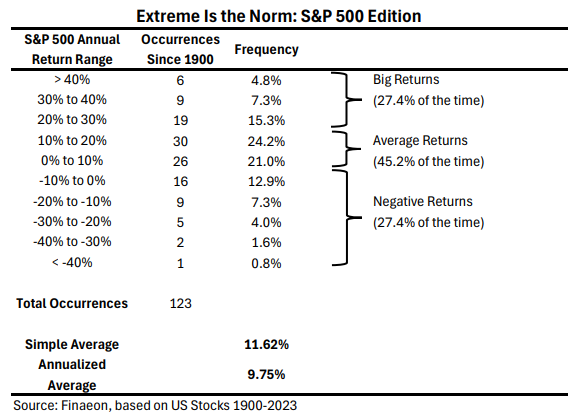

SelectSectorSPDR