Bridgewater Associates’ Rules And Tradition

Bridgewater makes use of a principle-based strategy designed by its founder, Ray Dalio.

Dalio purchased his first inventory within the then-Northeast Airways on the age of 12, tripling his cash upon the airline’s following merger. He labored as a dealer on the NYSE ground, earlier than ultimately main Bridgewater to develop into the world’s largest hedge fund.

In 2011, he self-published “Rules”, a 123-page quantity that sketches his funding and company administration philosophy primarily based on a lifetime of remark.

With a internet value of $20 billion and the world’s largest establishments in his clientele, Dalio’s rules have confirmed their utility.

Whereas Mr. Dalio’s rules are higher learn as a complete to totally grasp them, we’ve summed up what we consider are 5 key takeaways that needs to be fairly related to any investor.

Takeaway #1: Follow Actual Diversification

The ‘holy grail’ of diversification is to seek out a number of investments with constructive anticipated returns which are uncorrelated from each other. Most asset lessons are extra correlated to 1 one other than one would possibly guess.

Bridgewater’s strategy to diversification is the ‘All Climate Portfolio‘. A well-diversified portfolio is prone to have decrease commonplace deviation for a given stage of return. This permits one to ‘leverage up’ the portfolio to match a extra risky asset, to be able to generate superior returns.

Associated: See our modified Everlasting Portfolio for an additional tackle a extremely diversified portfolio.

By way of clever diversification, Bridgewater has been capable of obtain superior risk-adjusted returns.

Take into account that Bridgewater doesn’t essentially attempt to “beat the market.” The fund has shoppers like Authorities entities, that are extra all in favour of maintaining with inflation and the economic system. Danger-adjusted returns are extra necessary on this case.

Takeaway #2: Keep away from False Dichotomies In Danger/Reward Tradeoffs

Ray Dalio emphasizes that selections don’t at all times have an either-or final result. There may be often an answer simply out of view that enables each objectives to be achieved.

Takeaway #3: Systematize & Codify Your Resolution Making

Every investor has completely different standards that they use to make funding selections.

In his funding technique (and that of Bridgewater Associates), Dalio explains how he’s an advocate of documenting decision-making standards in order that profitable actions could be replicated sooner or later.

Takeaway #4: Maintain An Funding Resolution Log

That is fairly much like the third takeaway above, however as a substitute of replicating previous profitable methods, it goals to create new ones.

By writing down your current rationale for selections you make, it’s going to let you get a much less distorted view of your views and views later. This may enhance your strategy of reflecting on previous selections and might help you in sharpening your future decision-making.

Associated: Funding Thesis Template | Monitor & Enhance Your Investing Selections.

Takeaway #5: Be Cautious Of Pondering An Funding Is A Assured Success

Investing in equities at all times bears a specific amount of threat… Many corporations that appear as if “assured wins” might fail, and companies that appear laughable and determined might go on to be enormous successes.

Realizing that nothing is a very ‘can’t miss’ wager is a good psychological asset to have. Moreover, utilizing the ache of previous failures to develop as an investor also needs to be extremely valued.

Bridgewater Associates’ Portfolio & 10 Largest Public-Fairness Investments

Bridgewater Associates’ portfolio appears to be following carefully Dalio’s diversification precept. The portfolio could be very diversified, numbering 641 particular person equities. Its high 10 holdings account for 40.7% of the full capital invested.

Supply: 13F submitting, Creator

he Procter & Gamble Firm (PG):

The patron staples sector has gained elevated investor curiosity over the previous few quarters, as its elements have been delivering resilient outcomes throughout a moderately unsure market atmosphere. That is the case with Procter & Gamble, which at present contains a close to all-time excessive LTM (Final Twelve Month) internet revenue of $14.51 billion.

The inventory is buying and selling at 34.9 instances its ahead internet revenue, which is on the excessive facet when taking a historic perspective of Procter & Gamble’s price-to-earnings ratio.

The corporate is a Dividend King, that includes 65 years of consecutive annual dividend will increase. Dividends have grown at a 5-year CAGR of 4.94%, however the newest DPS improve was by 10%. The acceleration in dividend development is probably going as a result of administration aiming to compensate traders for the elevated inflation ranges.

Bridgewater boosted its place by 10% in its newest submitting. The inventory at present accounts for 7.1% of the fund’s whole holdings. It’s its largest holding.

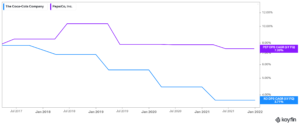

Coca-Cola Co. (KO) & PepsiCo, Inc. (PEP):

Coca-Cola and PepsiCo collectively account for round 9.0% of Bridgewater’s whole holdings. The patron staples giants are each Dividend Aristocrats, boasting 59 and 50 years of consecutive annual dividend will increase, respectively. Each corporations possess a big moat of their respective classes. Consequently, their predictable enterprise mannequin and operations make them glorious sources for revenue technology.

By way of dividend development, PepsiCo contains a considerably increased improve tempo over the previous few years, displaying a 5-year DPS CAGR of seven.39% towards Coca-Cola’s 3.71% throughout the identical interval.

PepsiCo’s and Coca-Cola’s money movement stability are an amazing benefit to reaching robust returns over the long run, which is a helpful high quality for funds catering to such a various consumer base like Bridgewater.

Coca-Cola yields near 2.8%, whereas PepsiCo yields near 2.6%, probably as a result of its barely increased DPS development prospects. Each yields are moderately stable in immediately’s ultra-low yield atmosphere. Their valuation multiples are related, that includes a ahead P/E of roughly 25.

Bridgewater’s positions in Coca-Cola and PepsiCo have been elevated by 3% and 13%, respectively, in accordance with its newest filings.

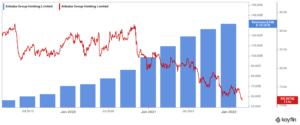

Alibaba Group Holding Restricted (BABA):

Mr. Dalio has been an fanatic in regard to China’s investing potential for years. Alibaba, the Chinese language tech behemoth, has been in Bridgewater’s portfolio since 2018 and has since grown to its largest place. The corporate not too long ago reported its This autumn outcomes, delivering robust revenues of $38.3 billion, an 11.2% development year-over-year.

Whereas Alibaba stays a extremely worthwhile firm, displaying internet revenue margins that always surpass the 30%+ ranges, its shares have been not too long ago lagging as a result of ongoing issues surrounding Chinese language equities. The Chinese language authorities’s potential involvement in directing the corporate’s regulation has additionally been elevating questions amongst traders. That is the rationale the inventory’s P/E ratio has slid to a low of simply 11.4.

Therefore, whereas those that are all in favour of investing in China’s tech world are prone to discover Alibaba one of the vital engaging investments on the market, they need to additionally think about the underlying dangers concerned. Bridgewater hiked its Alibaba place by 29% in the course of the quarter.

Johnson & Johnson (JNJ):

Following the theme of holding credible Dividend Aristocrats, Bridgewater has allotted round 4.5% of its belongings to the healthcare sector large, Johnson & Johnson. The corporate not too long ago posted quarterly revenues of $24.8 billion, 10.3% increased YoY, and third-quarter EPS of $2.13, implying a rise of 14.5% YoY.

The corporate’s outcomes have been stable in the course of the 12 months, ensuing within the firm elevating its quarterly dividend as soon as once more by ~5% to $1.06 per share. J&J is on the unique Dividend Kings record, a gaggle of simply 40 shares with 50+ consecutive years of dividend will increase.

Having already delivered 59 years of consecutive annual will increase, traders are shopping for right into a high-quality firm with a extremely competent administration group. The inventory is buying and selling at a comparatively truthful valuation at 16 instances its ahead internet revenue, presenting an honest entry level for present traders.

The latest Johnson & Johnson place adjustment implied a 12% stake improve.

Costco Wholesale Company (COST):

Costco’s distinctive client tradition has been a robust driver within the firm’s long-term income development. Whereas the enterprise itself is a low-margin one, Costco’s economies of scale are large, leading to vital internet revenue.

Not like its rivals, the inventory has at all times attracted a premium valuation. At a ahead P/E of 39.8, the inventory is unquestionably not low-cost. Nonetheless, with its resilient money flows and natural development, Costco’s premium valuation a number of might be justified.

In its newest quarterly report, internet gross sales elevated by 15.9%, to $51.9 billion, whereas EPS grew to $2.95, 36.2 increased YoY, comprising one other report of fantastic efficiency. We are able to see the inventory retaining its dear valuation, and consequently, its dividend yield to remain at lower than 1%.

The latest Costco place improve was by simply 7%.

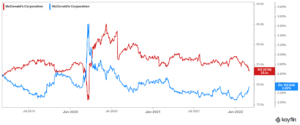

McDonald’s Company (MCD):

With McDonald’s, we are able to see as soon as once more how a lot Mr. Dalio and his funding group worth corporations which have confirmed their potential to ship sustainable long-term returns to their shareholders.

McDonald’s enterprise mannequin and model worth have remained resilient for many years, with the corporate elevating its dividend yearly for 46 consecutive years.

McDonald’s is on the unique Dividend Aristocrats record, a gaggle of 66 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase.

The inventory needs to be comparatively recession-proof as properly, as quick meals holds up very properly even throughout financial downturns. At round 23.3 instances its ahead earnings, the inventory will not be low-cost however might make for a stable long-term holding.

Bridgewater raised its stake in McDonald’s Company by 15% in the course of the quarter.

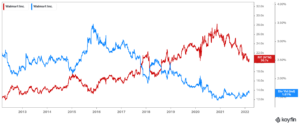

Walmart Inc. (WMT):

Walmart is the biggest firm on the earth by revenues, producing over $570 billion in annual gross sales. Its inventory is Bridgewater’s eighth-largest holding, accounting for simply over 3.3% of its whole portfolio. Regardless of having such a excessive publicity to the corporate, Bridgewater initially purchased into Walmart very not too long ago, in Q3 of 2020. Bridgewater is probably going betting on Walmart’s e-commerce gross sales increasing within the quick time period, as the corporate leverages its enormous logistics community to compete with Amazon (AMZN).

The fund’s conviction appears to be remaining robust general, as Bridgewater has grown its positions persistently by way of the 12 months. Nevertheless, it did trim its holding by round 43% as of its newest submitting.

The inventory is buying and selling at 20.7 instances its ahead internet revenue, correcting from its price-to-earnings ratio round a 12 months in the past. Walmart is a Dividend Aristocrat, counting 49 years of consecutive annual dividend will increase.

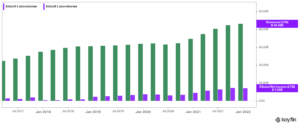

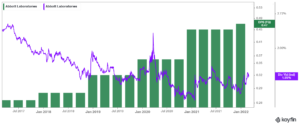

Abbott Laboratories (ABT):

Abbott Laboratories is Bridgewater’s ninth-largest holding, accounting for two.3% of its whole portfolio. The healthcare behemoth’s newest outcomes have been very robust. Particularly, in This autumn the corporate generated $11.468 billion in gross sales (58% outdoors of the U.S.) representing a 7.2% improve in comparison with This autumn-2020. Outcomes have been up throughout the board with Diagnostics, Established Prescription drugs, Medical Gadgets, and Diet gross sales rising 2.9%, 4.9%, 15.1%, and 5.5% respectively.

Adjusted earnings-per-share for the 12 months equaled $5.21, forward of prior steerage, in comparison with $3.65 in 2020.

The corporate’s outcomes have been strong in the course of the 12 months, ensuing within the firm elevating its quarterly dividend as soon as once more by ~4.4% to $1.88 per share. Abbott Laboratories is on the unique Dividend Kings record, a gaggle of simply 40 shares with 50+ consecutive years of dividend will increase.

Bridgewater raised its stake in Abbott Laboratories by 16% in the course of the quarter.