Published on October 20th, 2022 by Bob Ciura

Investors looking for higher levels of income should consider high dividend stocks. We define high dividend stocks as those with current yields above 5%. While interest rates are rising, high dividend stocks still provide investors with more income than most alternatives.

With this in mind, we have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all high dividend stocks (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

However, not all high-yield stocks make equally good investments.

Many stocks with extremely high yields are at risk of cutting their dividends if their underlying fundamentals, such as earnings or free cash flow, do not support the dividend payout. This is particularly true during recessions, when many cyclical companies struggle with declining revenue and profits.

Therefore, it is important for income investors to assess whether a high dividend yield is sustainable. The following 7 stocks with high dividend yields above 5%, also have strong business models and established track records of maintaining their dividends, even during recessions.

Table Of Contents

All stocks in this list have dividend yields above 5%, making them very appealing for income investors, and Dividend Risk scores of ‘A’ or ‘B’ to focus on sustainable dividends.

The 7 high dividend stocks are listed in order by dividend yield, from lowest to highest, from the Sure Analysis Research Database.

High Dividend Stock For Decades: Bank of Nova Scotia (BNS)

Bank of Nova Scotia is the third-largest financial institution in Canada behind the Royal Bank of Canada (RY) and the Toronto-Dominion Bank (TD). Scotiabank operates four core business segments – Canadian Banking, International Banking, Global Wealth Management, and Global Banking & Markets.

Scotiabank reported fiscal Q3 2022 results on 8/23/22. In domestic currency, Canadian Banking earnings rose 12% and International Banking earnings rose 28%. Growth came from higher net interest income driven by loan growth of 14% and 12%, respectively.

Global Banking and Markets saw a 26% decline in earnings because of lower capital markets revenue from market conditions and lower advisory fees.

The overall results for the quarter were as follows: adjusted net income rose 2.0% to $2,611 million, adjusted earningsper-share (“EPS”) climbed 4.5% to C$2.10, and the adjusted return on equity (“ROE”) improved 0.3% to 15.4% versus a year ago. The bank’s capital position remains solid with its Common Equity Tier 1 ratio at 11.4%, down from 11.6% a year ago. The fiscal year-to-date results provide a bigger picture. Adjusted net income was C$8,134 million, up 9.1% year over year. Adjusted diluted EPS climbed 11.2% to C$6.43.

Click here to download our most recent Sure Analysis report on BNS (preview of page 1 of 3 shown below):

High Dividend Stock For Decades: Western Union (WU)

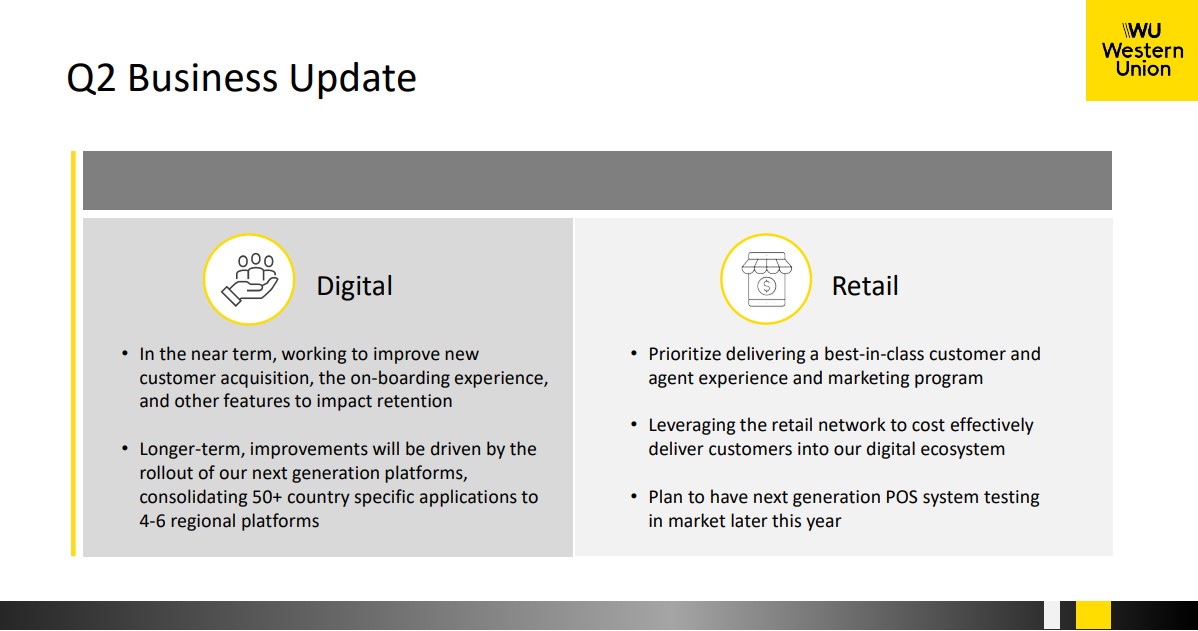

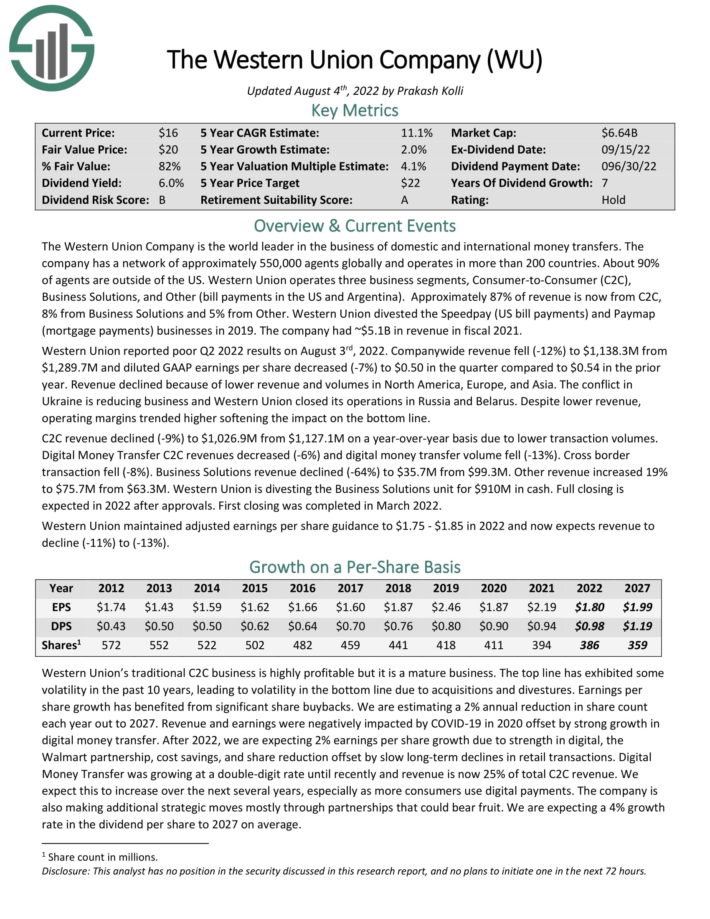

The Western Union Company is the world leader in the business of domestic and international money transfers. The company has a network of approximately 550,000 agents globally and operates in more than 200 countries. About 90% of agents are outside of the US. Western Union operates three business segments, Consumer-to-Consumer (C2C), Business Solutions, and Other (bill payments in the US and Argentina).

Approximately 87% of revenue is now from C2C, 8% from Business Solutions and 5% from Other. The company had ~$5.1B in revenue in fiscal 2021.

Western Union reported Q2 2022 results on August 3rd, 2022. Company-wide revenue fell 12% and diluted GAAP earnings per share decreased 7% year-over-year.

Revenue declined because of lower revenue and volumes in North America, Europe, and Asia. The conflict in Ukraine is reducing business and Western Union closed its operations in Russia and Belarus. Despite lower revenue, operating margins trended higher softening the impact on the bottom line.

C2C revenue declined 9% due to lower transaction volumes. Digital Money Transfer C2C revenues decreased 6% and digital money transfer volume fell 13%. Cross border transaction fell 8%.

Western Union is divesting the Business Solutions unit for $910M in cash. Full closing is expected in 2022 after approvals. First closing was completed in March 2022.

Western Union maintained adjusted earnings per share guidance to $1.75 – $1.85 in 2022. With a dividend payout ratio of 54% expected for the current fiscal year, Western Union’s dividend appears covered.

Click here to download our most recent Sure Analysis report on WU (preview of page 1 of 3 shown below):

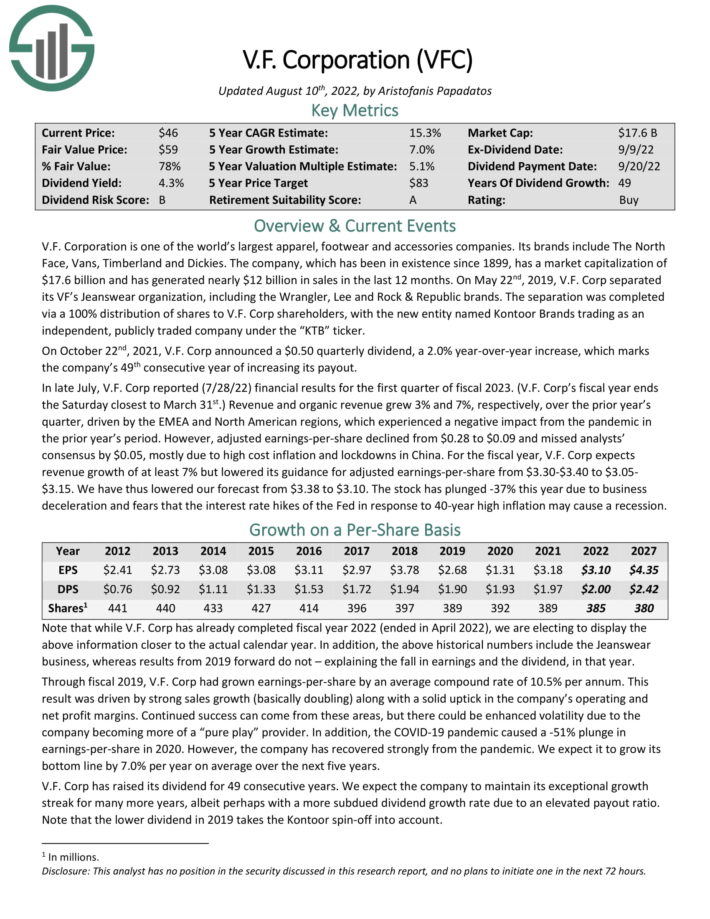

High Dividend Stock For Decades: V.F. Corp. (VFC)

V.F. Corporation is one of the world’s largest apparel, footwear and accessories companies. The company’s brands include The North Face, Vans, Timberland and Dickies. The company, which has been in existence since 1899, generated over $11 billion in sales in the last 12 months.

In late July, V.F. Corp reported (7/28/22) financial results for the fiscal 2023 first quarter. Revenue of $2.26 billion rose 3.2% year over year and beat analyst estimates by $20 million. The North Face brand led the way with 37% currency-neutral revenue growth in the quarter.

However, inflation took its toll on margins and profits. Gross margin of 53.9% for the quarter declined 260 basis points, while operating margin of 2.8% declined 640 basis points. As a result, adjusted EPS declined 68% to $0.09 per share.

Adjusted earnings-per-share grew 67%, from $0.27 to $0.45, but missed analysts’ consensus by $0.02. For the new fiscal year, V.F. Corp expects revenue growth of at least 7% and adjusted earnings-per-share of $3.30 to $3.40.

Click here to download our most recent Sure Analysis report on V.F. Corp. (preview of page 1 of 3 shown below):

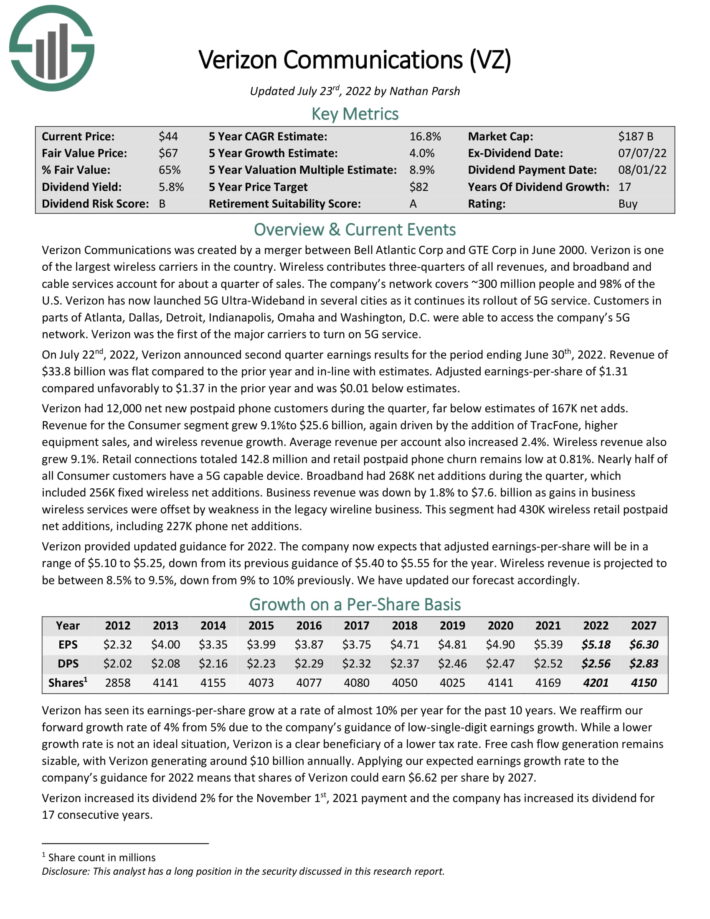

High Dividend Stock For Decades: Verizon Communications (VZ)

Verizon Communications is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On July 22, 2022, the company reported the fiscal year’s second-quarter and first six months results. Revenue was flat year over year (YoY) at $33.8 billion for the quarter compared to the second quarter in 2021. Earnings came in at $1.24 per share, a decrease of 11.4% compared to the $1.40 per share the company made in 2Q201.

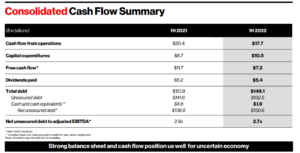

Source: Investor Presentation

The company had a net addition of 268,000, including 256,000 fixed wireless net additions. Total broadband net additions increased by 39,000 from first-quarter 2022, and fixed wireless net additions increased by 62,000 from first-quarter 2022.

The cash flow from operations was down for the year’s first half from $20.4 billion to $17.7 billion. While capital expenditures were up $2.4 billion to $10.5 billion in the first half. Free cash flow for the quarter was down from $11.7 billion to $7.2 billion for the first half of the year.

Verizon stock is also appealing for risk-averse investors due to its low volatility. With a Beta value of 0.34, Verizon is a low beta stock.

Click here to download our most recent Sure Analysis report on VZ (preview of page 1 of 3 shown below):

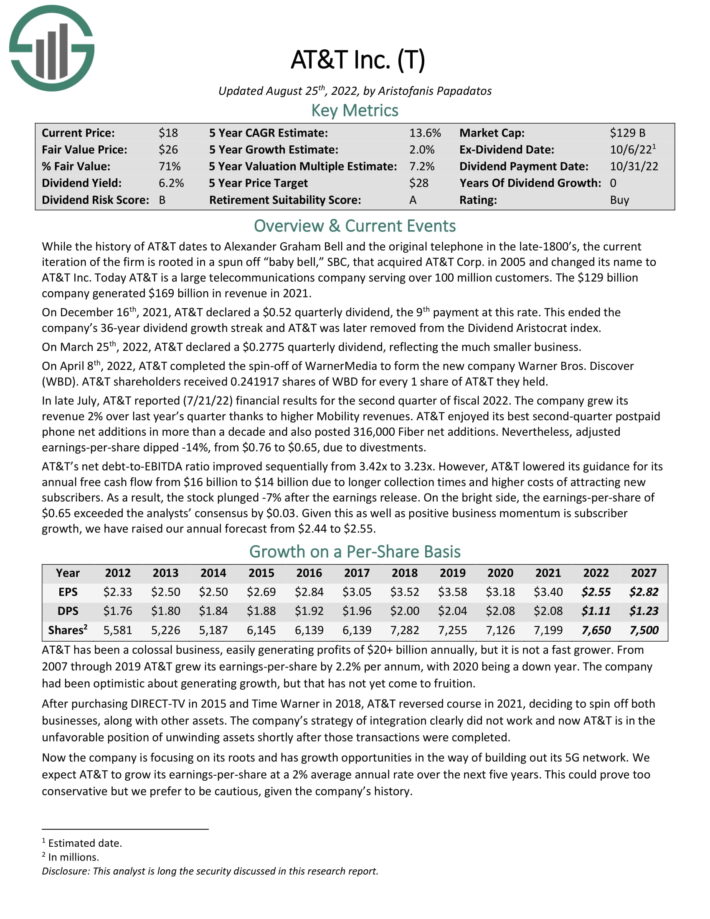

High Dividend Stock For Decades: AT&T Inc. (T)

AT&T is a large telecommunications company serving over 100 million customers. The company generated $169 billion in revenue in 2021.

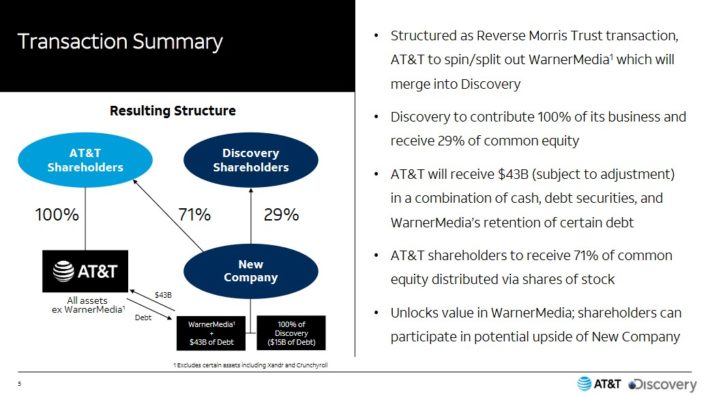

In April 2022, AT&T completed the spin-off of WarnerMedia to form the new company Warner Bros. Discovery (WBD). AT&T shareholders received 0.241917 shares of WBD for every 1 share of AT&T they held.

Related: Communication Services Stocks List | The 5 Best Now

Source: Investor Presentation

In late July, AT&T reported (7/21/22) financial results for the second quarter of fiscal 2022. The company grew its revenue 2% over last year’s quarter thanks to higher Mobility revenues. AT&T enjoyed its best second-quarter postpaid phone net additions in more than a decade and also posted 316,000 Fiber net additions. Nevertheless, adjusted earnings-per-share dipped -14%, from $0.76 to $0.65, due to divestments.

Click here to download our most recent Sure Analysis report on AT&T (preview of page 1 of 3 shown below):

High Dividend Stock For Decades: Enbridge Inc. (ENB)

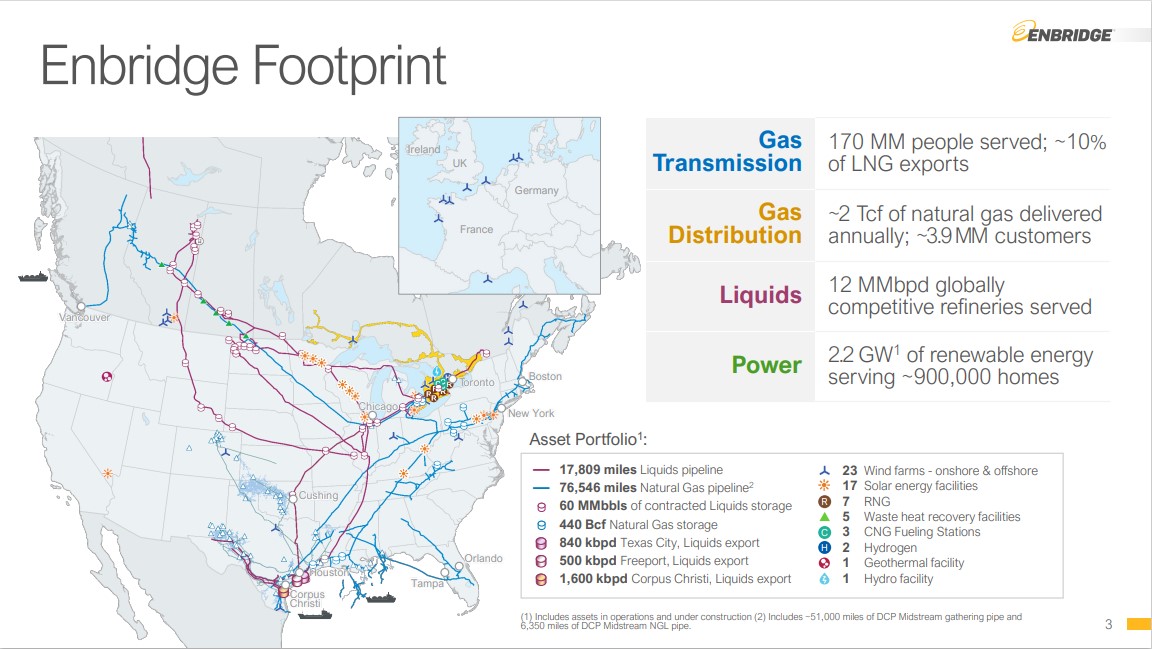

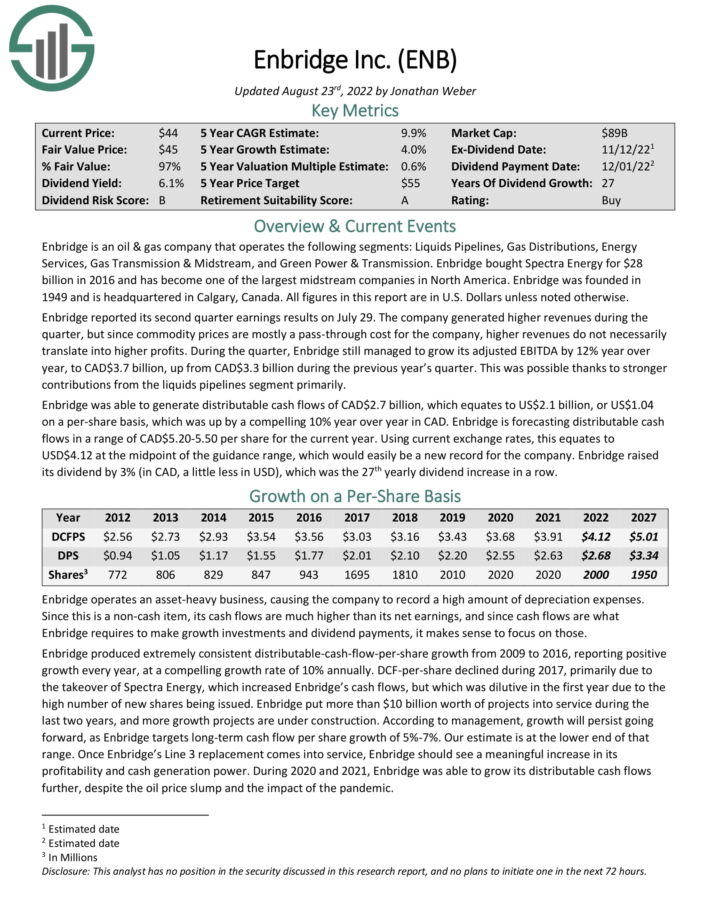

Enbridge is an oil & gas company that operates the following segments: Liquids Pipelines, Gas Distributions, Energy Services, Gas Transmission & Midstream, and Green Power & Transmission.

You can see an overview of the company’s business footprint in the image below:

Source: Investor Presentation

Enbridge reported its second quarter earnings results on July 29. During the quarter, Enbridge still managed to grow its adjusted EBITDA by 12% year over year, to CAD$3.7 billion, up from CAD$3.3 billion during the previous year’s quarter. This was possible thanks to stronger contributions from the liquids pipelines segment primarily.

Enbridge was able to generate distributable cash flows of US$2.1 billion, or US$1.04 on a per-share basis, which was up by 10% year over year in CAD. Enbridge is forecasting distributable cash flows in a range of USD$4.12 at the midpoint of the guidance range, which would easily be a new record for the company.

Enbridge has increased its dividend for 27 consecutive years. It is a high-yield Dividend Champion.

Click here to download our most recent Sure Analysis report on Enbridge (preview of page 1 of 3 shown below):

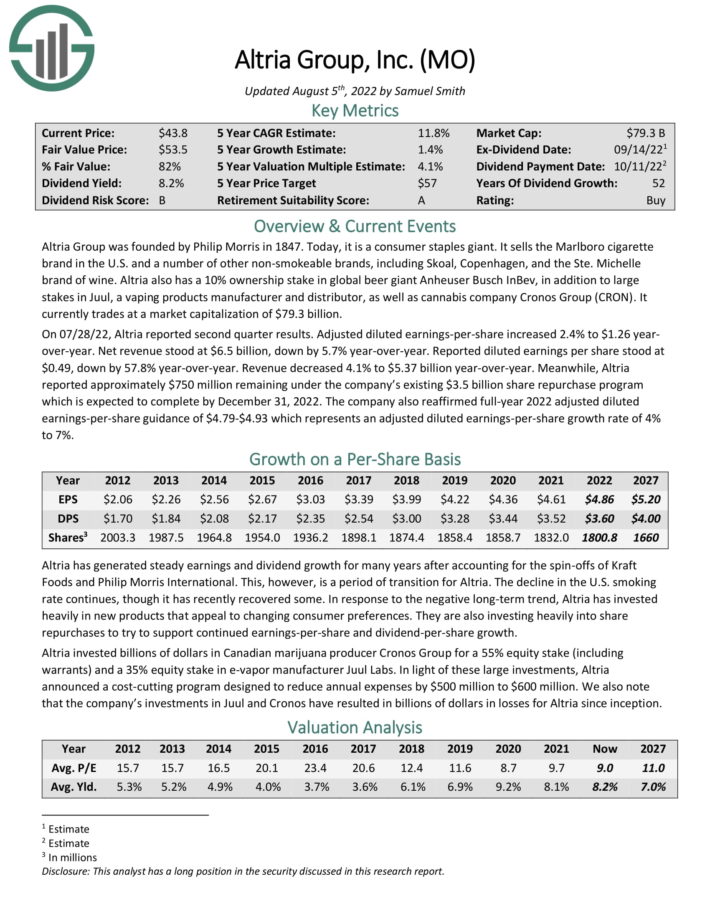

High Dividend Stock For Decades: Altria Group (MO)

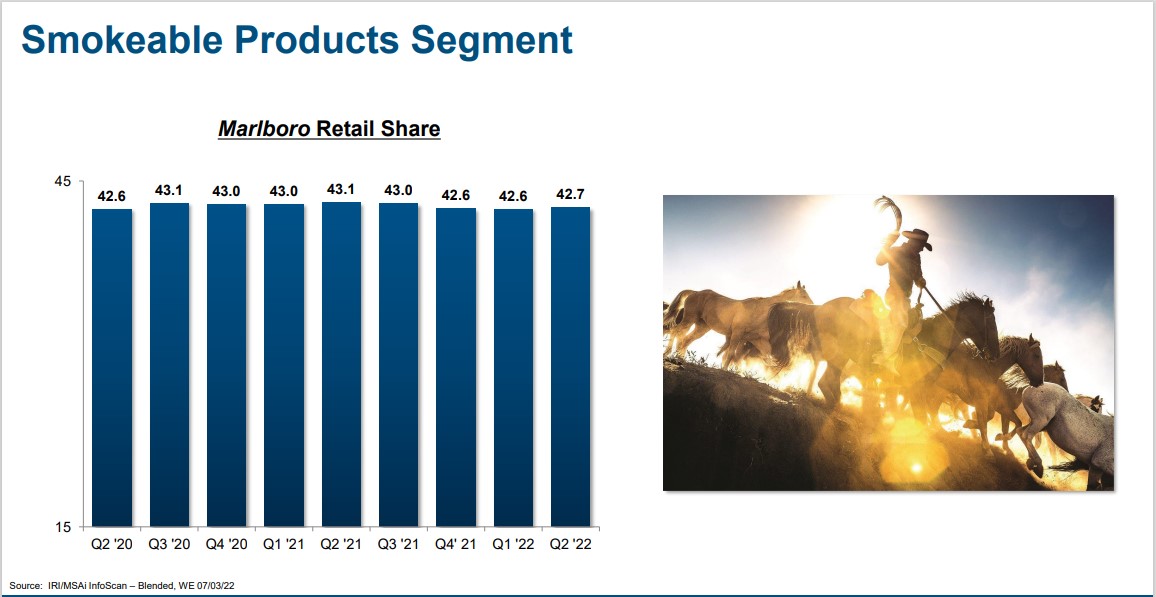

Altria Group was founded by Philip Morris in 1847. Today, it is a consumer staples giant. It sells the Marlboro cigarette brand in the U.S. and a number of other non-smokeable brands, including Skoal and Copenhagen.

The flagship brand continues to be Marlboro, which commands over 40% retail market share in the U.S.

Source: Investor Presentation

Altria also has a 10% ownership stake in global beer giant Anheuser-Busch InBev, in addition to large stakes in Juul, a vaping products manufacturer and distributor, as well as cannabis company Cronos Group (CRON).

On 7/28/22, Altria reported second quarter FY22 results. Revenue of $5.37 billion declined by 4% and missed estimates by $50 million. Adjusted earnings-per-share of $1.26 beat estimates by a penny.

The company also reaffirmed full-year 2022 adjusted diluted earnings-per-share guidance of $4.79-$4.93. The range represents 4%-7% growth for the full year.

Altria has increased its dividend for over 50 years, placing it on the exclusive Dividend Kings list. It is also a Dividend Champion.

Click here to download our most recent Sure Analysis report on Altria Group (preview of page 1 of 3 shown below):

Final Thoughts & Additional Reading

The 7 high dividend stocks analyzed above all have dividend yields of 5% or higher. And importantly, these securities generally have better risk profiles than the average high-yield stock.

That said, a dividend is never guaranteed, and high dividend stocks are potentially at risk of dividend reductions or suspensions if a recession occurs in the near future.

Investors should continue to monitor each stock to make sure their fundamentals and growth remain on track, particularly among stocks with extremely high dividend yields.

Additionally, the following Sure Dividend databases contain the most reliable dividend stocks in our investment universe:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].