The dividend yield on these secure shares ought to assist Looking for Alpha readers discover peaceable revenue.

Pogonici/iStock by way of Getty Pictures

Prepare for charts, pictures, and tables as a result of they’re higher than phrases. The scores and outlooks we spotlight right here come after Scott Kennedy’s weekly updates within the REIT Discussion board. Your continued suggestions is tremendously appreciated, so please go away a remark with options.

The previous few weeks have been so wild that I have been a bit behind on publishing content material for all our followers on the general public facet. To hurry it up, I’ll embrace a number of extra shares than normal. This text comes from a current Most popular Share Replace on The REIT Discussion board.

Be suggested that share costs are always altering, so it is good to examine the newest costs earlier than putting a commerce or following a ranking. I attempt to incorporate share costs straight in my commentary, so you will know what the value was after I made the assertion.

That is notably vital as there could be a delay between writing and publishing as typically issues merely come up. Additionally it is related to examine ex-dividend dates.

NLY-G vs AGNCP vs All Different Threat Ranking 1 Most popular Shares

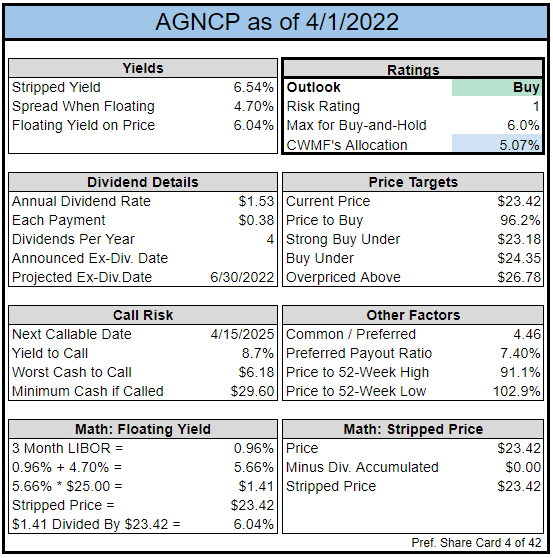

Beforehand, I highlighted two shares within the threat ranking 1 class:

AGNCP (AGNCP) and NLY-G (NLY.PG)

I stated AGNCP was probably the most engaging for fundamentals whereas NLY-G was one of the best for technical components and might be performed for a fast bounce. The bounce for NLY-G occurred as predicted. As of Friday afternoon, among the many threat ranking 1 most popular shares, AGNCP is probably the most engaging primarily based on fundamentals AND primarily based on technical components. Anybody allocating to the AGNC or NLY most popular shares could be smart to choose AGNCP at $23.47.

Observe: These feedback had been ready previous to the ex-dividend date. Since AGNCP’s quarterly dividend is about $.38, the value of $23.47 is corresponding to $23.11 at this time.

The REIT Discussion board

AGNCP is one among our largest high-yield positions with an allocation over 5%.

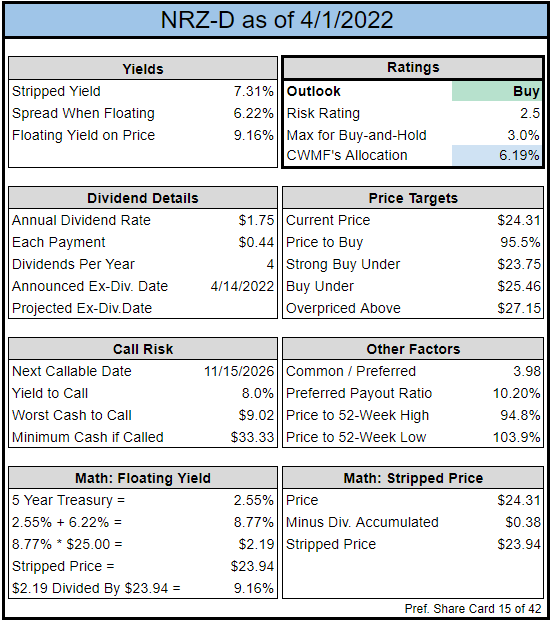

NRZ Most popular Shares

Our view is identical at this time because it was within the replace from Wednesday (3/23/2022). No main swings in relative costs to vary our prime picks right here. NRZ-D (NRZ.PD) at $24.22 stays engaging because it has recurrently been.

Utilizing the next costs:

- NRZ-A (NRZ.PA) at $25.09

- NRZ-B (NRZ.PB) at $24.29

- NRZ-C (NRZ.PC) at $21.53

Now we have NRZ-C as a transparent winner. As at all times, costs will change over time. The rationale costs are acknowledged so explicitly on this article is to account for the truth that costs change. If NRZ-C was $22.53 as a substitute of $21.53, it might get a materially weaker endorsement. Choosing one of the best share at any given level will depend on the share costs.

Observe: We mentioned NRZ-C and NRZ-D extra in yesterday’s public most popular share article. The NRZ most popular shares are anticipated to go ex-dividend on 4/14/2022.

The REIT Discussion board

NRZ-D is one other one among our largest high-yield positions at greater than 6% of our portfolio.

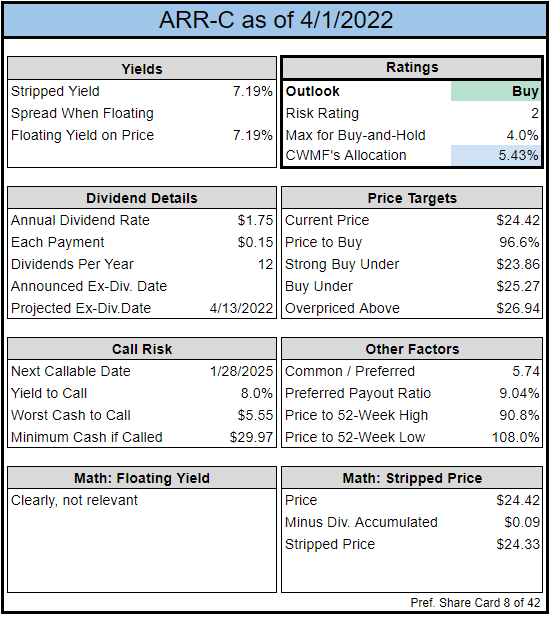

PMT-A vs PMT-B vs PMT-C vs ARR-C

Nonetheless favoring PMT-C (PMT.PC) right here. PMT-B (PMT.PB) is OK and may very well supply a materially greater yield than PMT-C after PMT-B’s name safety ends. The issue is that the decision threat stays elevated with PMT-B buying and selling at $25.61. PMT-A (PMT.PA) at $26.38 stays laughably overpriced.

The rationale some traders might cross on PMT-C is the mounted dividend fee. In comparison with ARR-C (ARR.PC), PMT-C provides traders a bit extra yield and way more upside to name worth.

Observe: None of those 4 shares has gone ex-dividend since our commentary was ready. The closest is ARR-C, which pays month-to-month and may go ex-dividend roughly across the center of April.

The REIT Discussion board

With an allocation larger than 5%, ARR-C additionally lands as a spot as one among our largest positions.

Conclusion

- AGNCP wins out over different shares with a threat ranking of 1 (from AGNC and NLY).

- NRZ-C and NRZ-D beat NRZ-B and NRZ-A.

- PMT-C and ARR-C supply fixed-rate shares with fairly good yields and comparatively low-risk scores. PMT-B is okay, however not nice (at present valuation). PMT-A is horribly overvalued.

Observe: Earlier than sending this text public I reviewed my commentary from earlier this week to confirm that each one elements are nonetheless related. Every of the related rankings stays correct. I eliminated some sections as a result of they already performed out. The volatility has been wild with costs typically adjusting inside a day or two. That is very uncommon for this sector, the place we frequently see very secure costs for the popular shares.

The remainder of the charts on this article could also be self-explanatory to some traders. Nevertheless, when you’d wish to know extra about them, you’re inspired to see our notes for the collection.

Inventory Desk

We are going to shut out the remainder of the article with the tables and charts we offer for readers to assist them monitor the sector for each widespread shares and most popular shares.

We’re together with a fast desk for the widespread shares that might be proven in our tables:

Let the photographs start!

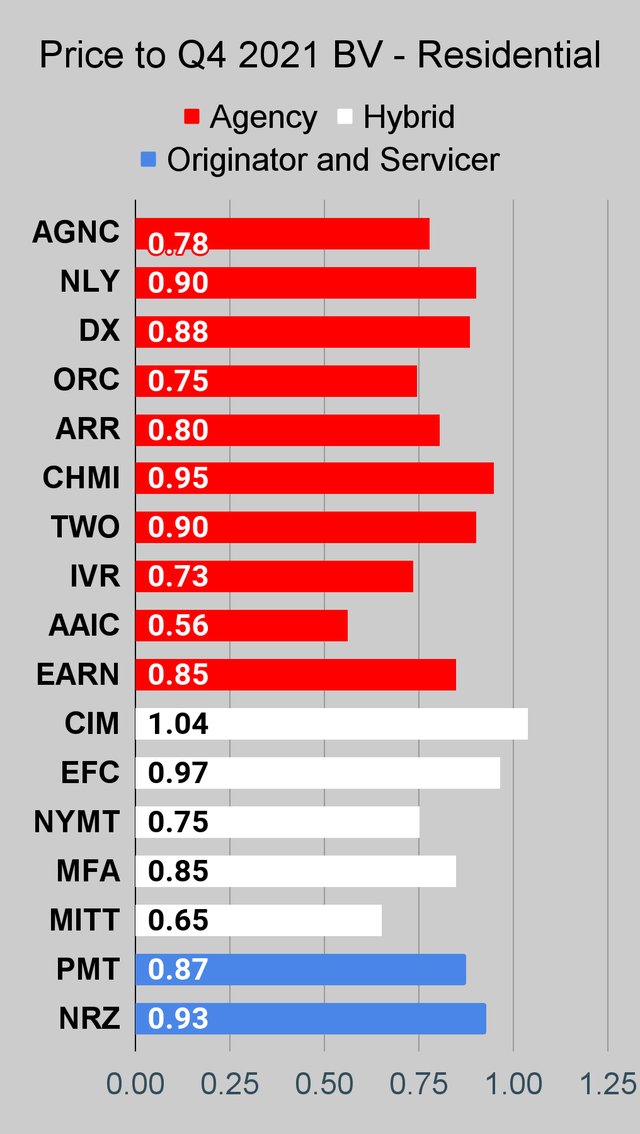

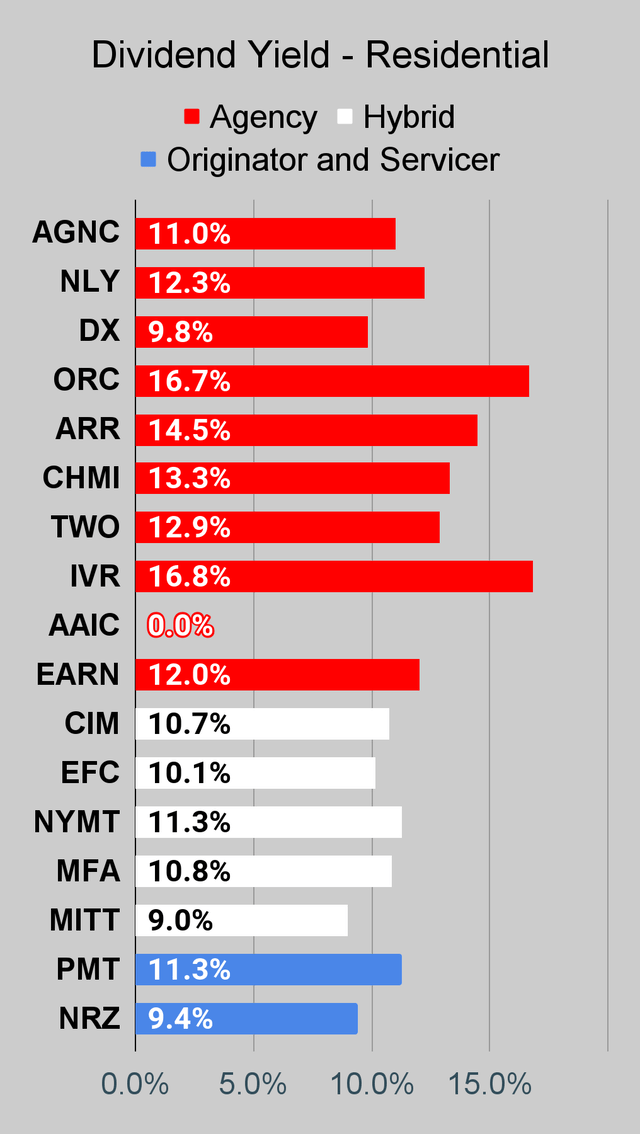

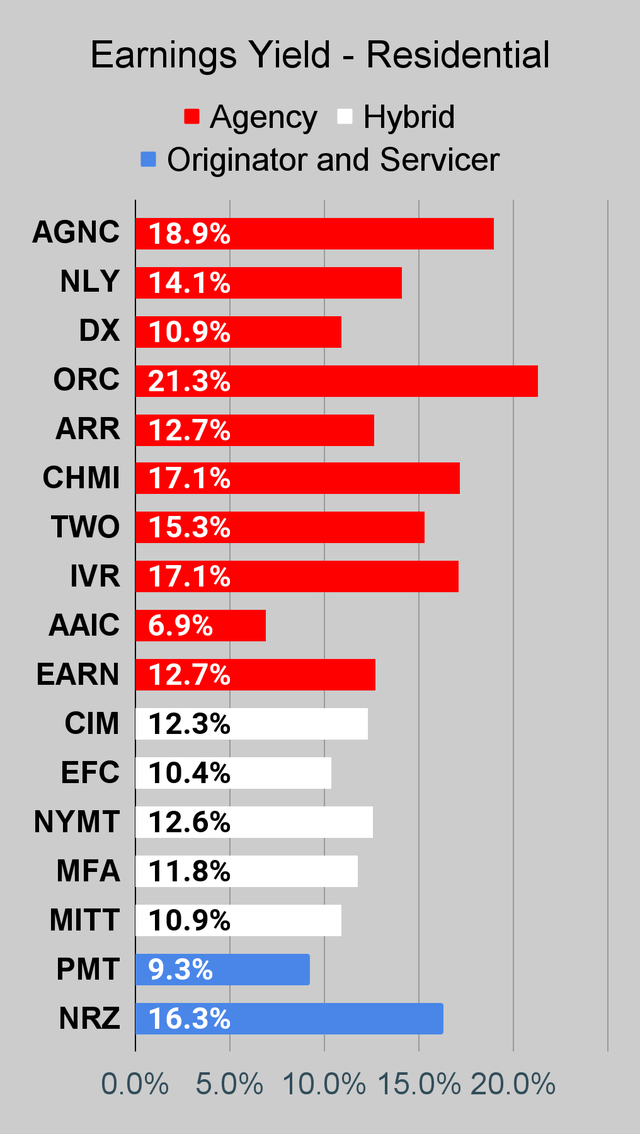

Residential Mortgage REIT Charts

Observe: We’re modeling some vital modifications to BV since 12/31/2021 and a few administration groups have already publicly indicated a fabric change in BV per share. The chart for our public articles makes use of the guide worth per share from the newest earnings launch. Present estimated guide worth per share is utilized in reaching our targets and buying and selling selections. It is accessible in our service, however these estimates should not included within the charts under.

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

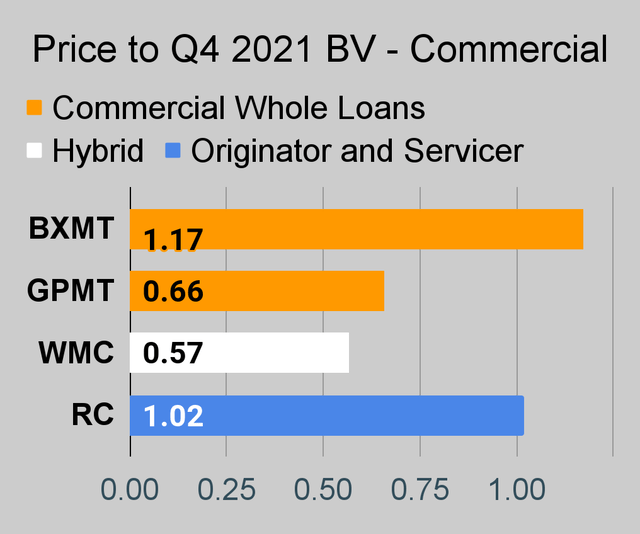

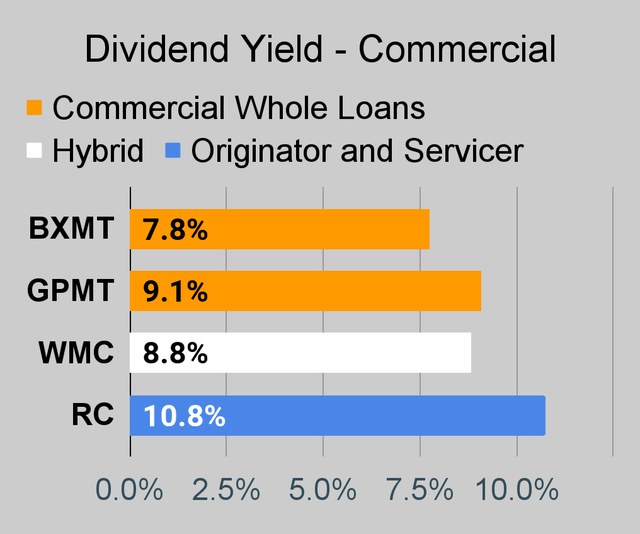

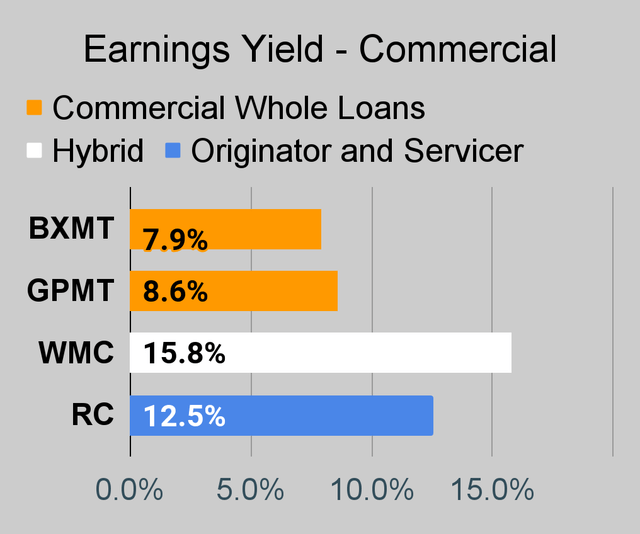

Industrial Mortgage REIT Charts

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

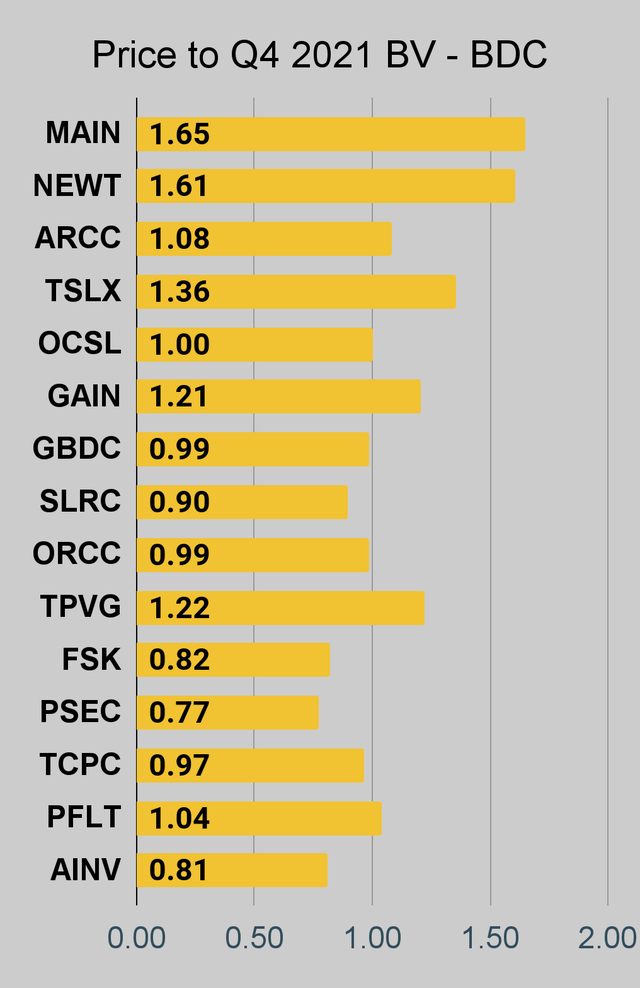

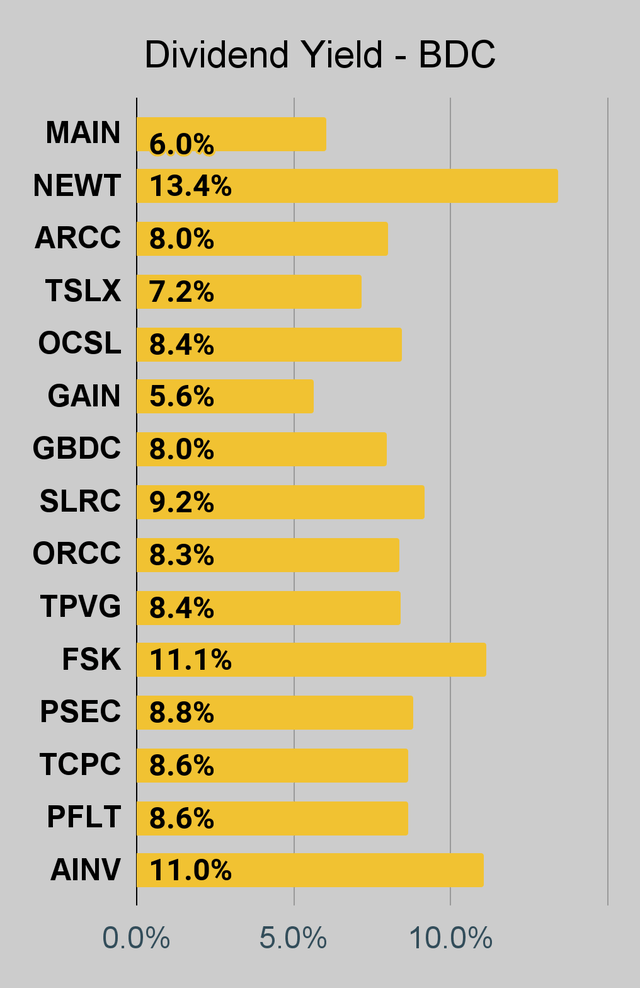

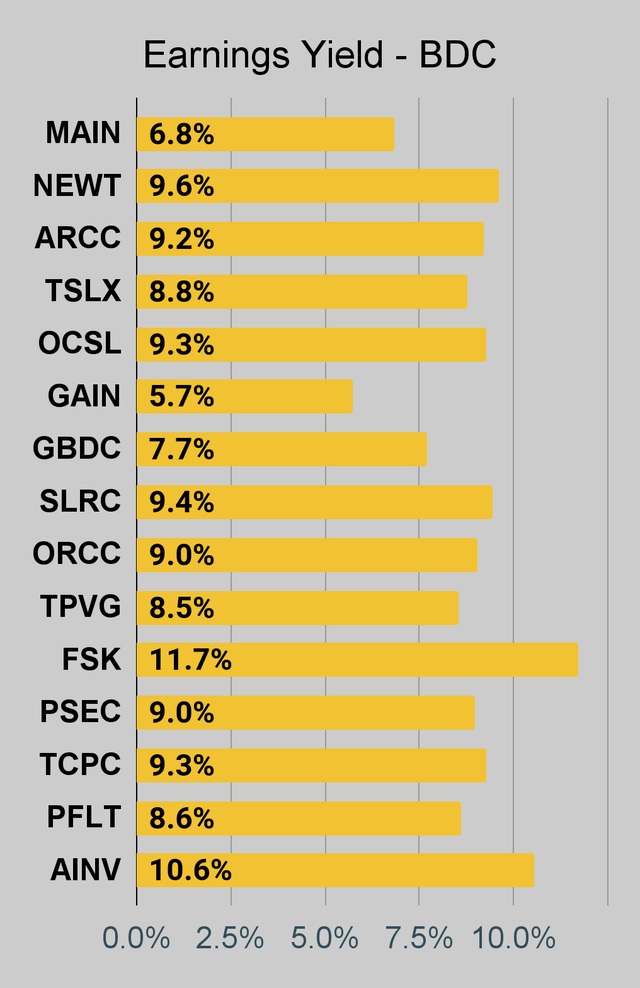

BDC Charts

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

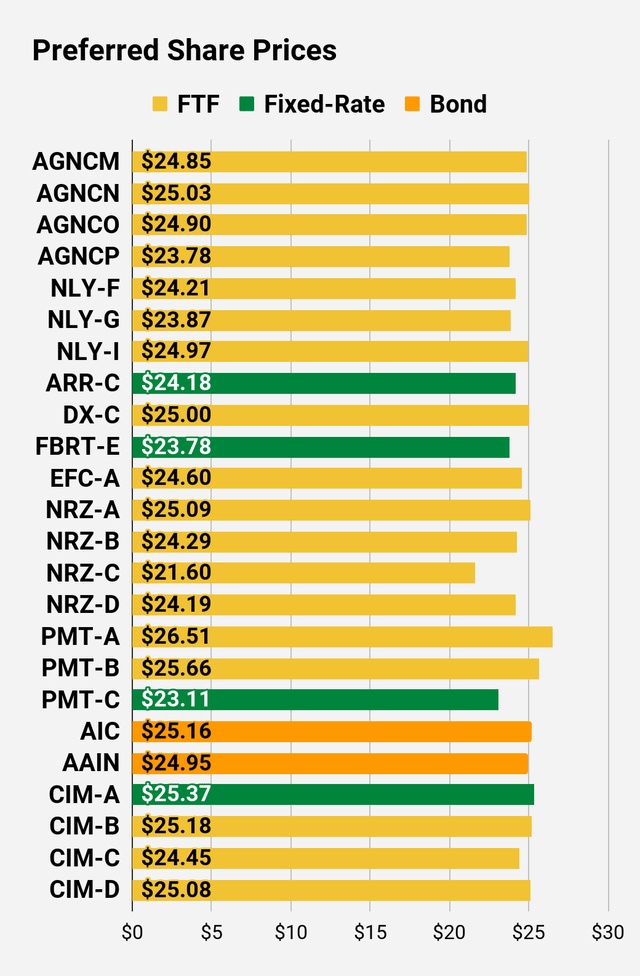

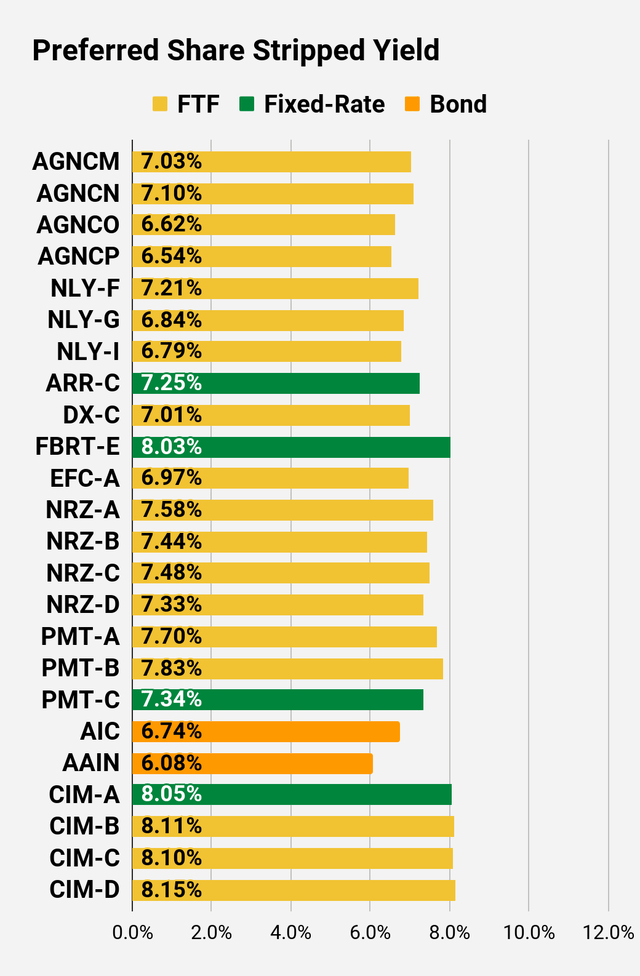

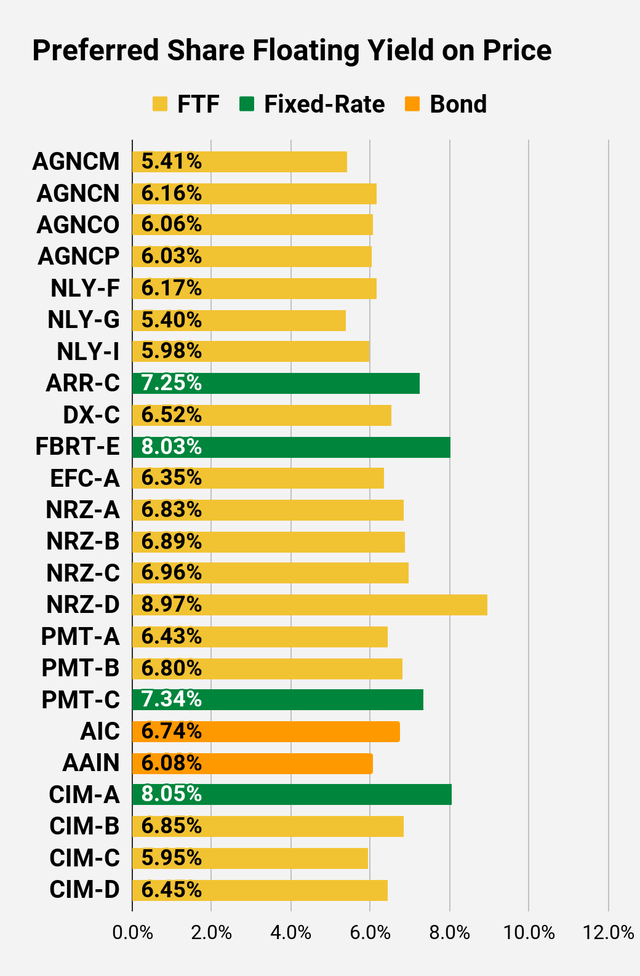

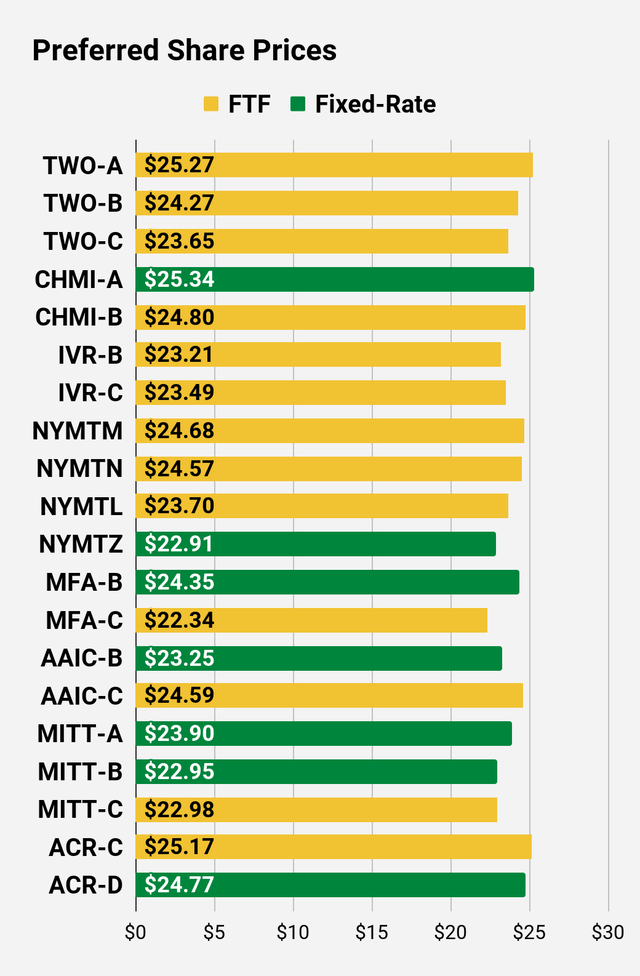

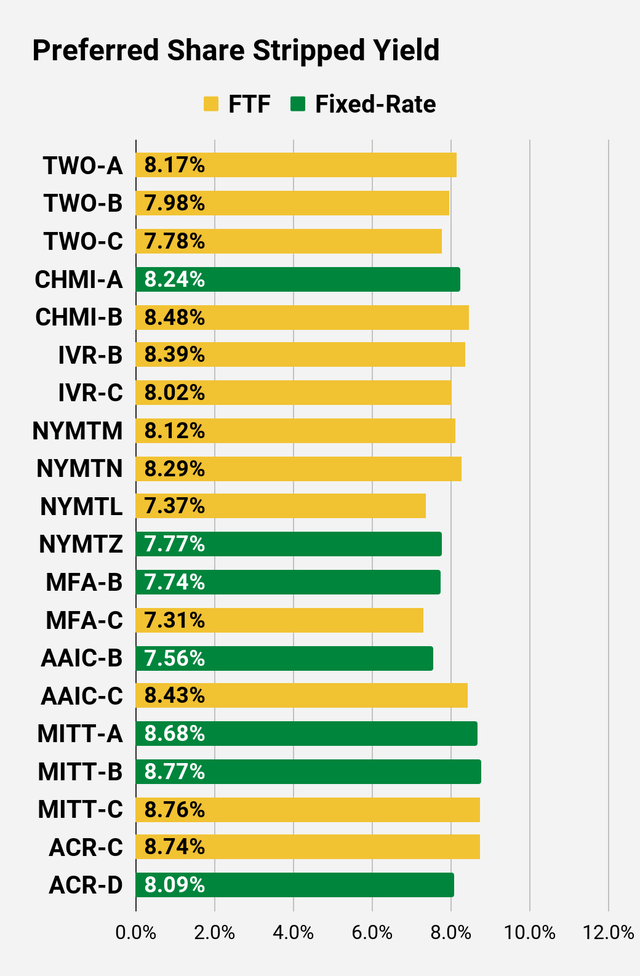

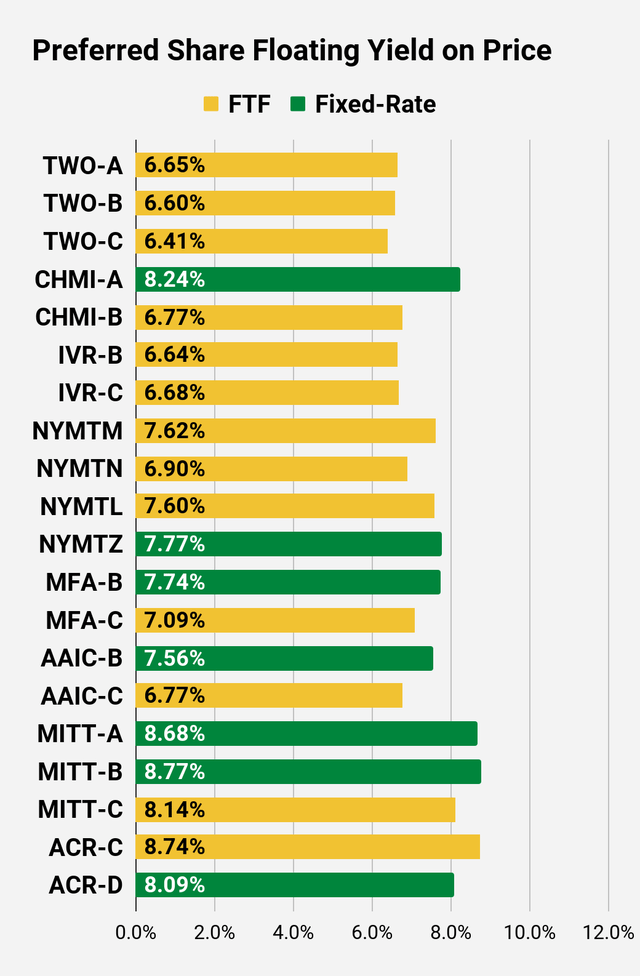

Most popular Share Charts

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

Most popular Share Information

Past the charts, we’re additionally offering our readers with entry to a number of different metrics for the popular shares.

After testing out a collection on most popular shares, we determined to strive merging it into the collection on widespread shares. In spite of everything, we’re nonetheless speaking about positions in mortgage REITs. We don’t have any want to cowl most popular shares with out cumulative dividends, so any most popular shares you see in our column may have cumulative dividends. You possibly can confirm that by utilizing Quantum On-line. We’ve included the hyperlinks within the desk under.

To higher arrange the desk, we wanted to abbreviate column names as follows:

- Worth = Current Share Worth – Proven in Charts

- BoF = Bond or FTF (Fastened-to-Floating)

- S-Yield = Stripped Yield – Proven in Charts

- Coupon = Preliminary Fastened-Price Coupon

- FYoP = Floating Yield on Worth – Proven in Charts

- NCD = Subsequent Name Date (the soonest shares might be known as)

- Observe: For all FTF points, the floating fee would begin on NCD.

- WCC = Worst Money to Name (lowest web money return attainable from a name)

- QO Hyperlink = Hyperlink to Quantum On-line Web page

Second Batch:

Technique

Our objective is to maximize whole returns. We obtain these most successfully by together with “buying and selling” methods. We recurrently commerce positions within the mortgage REIT widespread shares and BDCs as a result of:

- Costs are inefficient.

- Lengthy-term, share costs usually revolve round guide worth.

- Quick-term, price-to-book ratios can deviate materially.

- E book worth isn’t the one step in evaluation, however it’s the cornerstone.

We additionally allocate to most popular shares and fairness REITs. We encourage buy-and-hold traders to think about using extra most popular shares and fairness REITs.

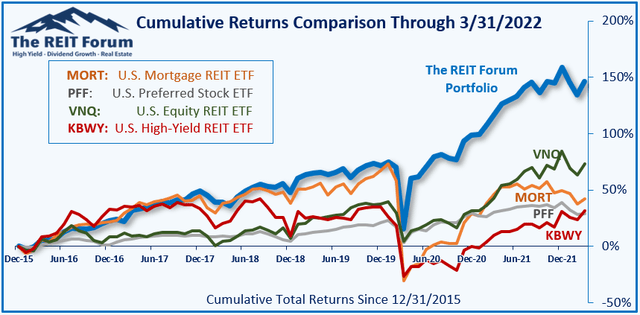

Efficiency

We evaluate our efficiency towards 4 ETFs that traders may use for publicity to our sectors:

The REIT Discussion board

The 4 ETFs we use for comparability are:

|

Ticker |

Publicity |

|

MORT |

One of many largest mortgage REIT ETFs |

|

PFF |

One of many largest most popular share ETFs |

|

VNQ |

Largest fairness REIT ETF |

|

KBWY |

The high-yield fairness REIT ETF. Sure, it has been dreadful. |

When traders assume it isn’t attainable to earn stable returns in most popular shares or mortgage REITs, we politely disagree. The sector has loads of alternatives, however traders nonetheless should be cautious of the dangers. We are able to’t merely attain for yield and hope for one of the best. Relating to widespread shares, we should be much more vigilant to guard our principal by recurrently watching costs and updating estimates for guide worth and worth targets.

Scores:

- AGNCP wins out over different shares with a threat ranking of 1 (from AGNC and NLY).

- NRZ-C and NRZ-D beat NRZ-B and NRZ-A.

- PMT-C and ARR-C supply fixed-rate shares with fairly good yields and comparatively low-risk scores. PMT-B is okay, however not nice (at present valuation). PMT-A is a nasty deal.