Up to date on Could 2nd, 2022 by Bob Ciura

Spreadsheet knowledge up to date every day

The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

The downloadable Dividend Kings Spreadsheet Record beneath comprises the next for every inventory within the index amongst different necessary investing metrics:

- Payout ratio

- Dividend yield

- Worth-to-earnings ratio

You’ll be able to see the total downloadable spreadsheet of all 44 Dividend Kings (together with necessary monetary metrics similar to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink beneath:

The Dividend Kings checklist contains current additions similar to Tennant Firm (TNC), PepsiCo (PEP), Kimberly-Clark (KMB), Abbott Laboratories (ABT), AbbVie (ABBV), Leggett & Platt (LEG), and W.W. Grainger (GWW).

Every Dividend King satisfies the first requirement to be a Dividend Aristocrat (25 years of consecutive dividend will increase) twice over.

Not all Dividend Kings are Dividend Aristocrats.

This sudden result’s as a result of the ‘solely’ requirement to be a Dividend Kings is 50+ years of rising dividends.

Alternatively, Dividend Aristocrats will need to have 25+ years of rising dividends, be a member of the S&P 500 Index, and meet sure minimal dimension and liquidity necessities.

Desk of Contents

How To Use The Dividend Kings Record to Discover Dividend Inventory Concepts

The Dividend Kings checklist is a superb place to search out dividend inventory concepts. Nonetheless, not all the shares within the Dividend Kings checklist make an excellent funding at any given time.

Some shares could be overvalued. Conversely, some could be undervalued – making nice long-term holdings for dividend development traders.

For these unfamiliar with Microsoft Excel, the next walk-through reveals learn how to filter the Dividend Kings checklist for the shares with probably the most engaging valuation based mostly on the price-to-earnings ratio.

Step 1: Obtain the Dividend Kings Excel Spreadsheet.

Step 2: Comply with the steps within the tutorial video beneath. Notice that we display for price-to-earnings ratios of 15 or beneath within the video. You’ll be able to select any threshold that finest defines ‘worth’ for you.

Alternatively, following the directions above and filtering for greater dividend yield Dividend Kings (yields of two% or 3% or greater) will present shares with 50+ years of rising dividends and above-average dividend yields.

In search of companies which have an extended historical past of dividend will increase isn’t an ideal approach to establish shares that can improve their dividends yearly sooner or later, however there’s appreciable consistency within the Dividend Kings.

The 5 Finest Dividend Kings In the present day

The next 5 shares are our top-ranked Dividend Kings right this moment, based mostly on anticipated annual returns over the subsequent 5 years. Shares are ranked so as of lowest to highest anticipated annual returns.

Whole returns embrace a mix of future earnings-per-share development, dividends, and any adjustments within the P/E a number of.

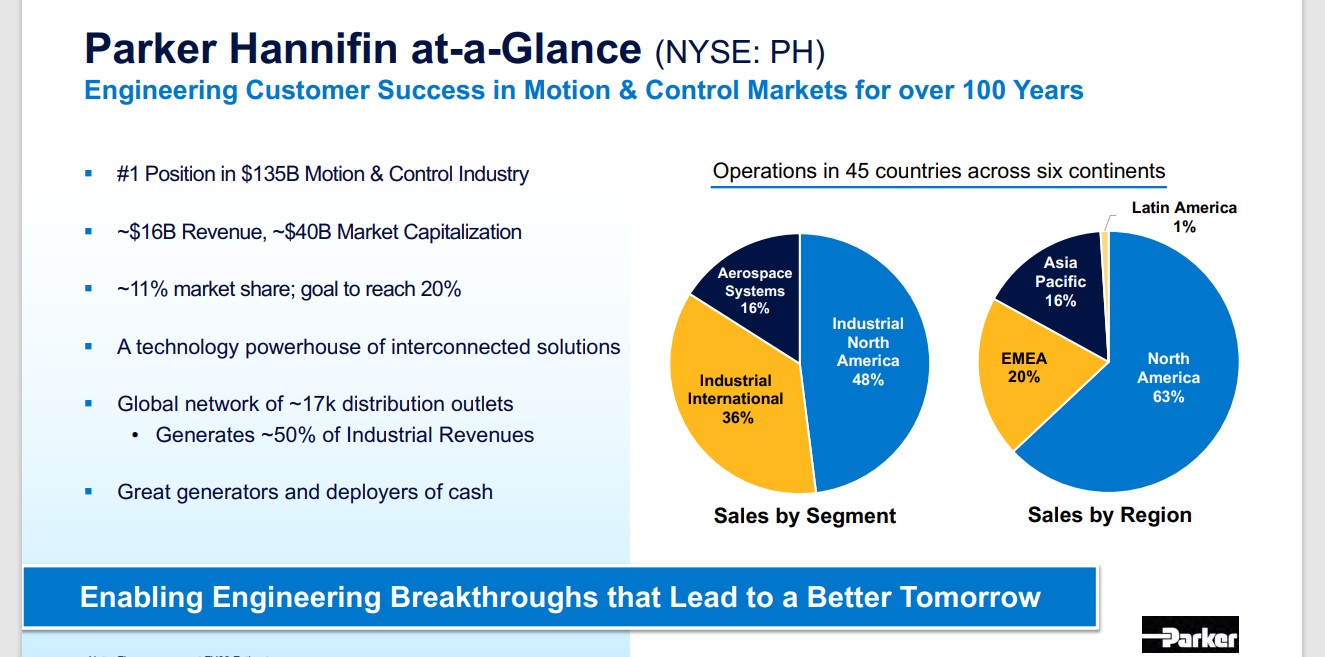

Dividend King #5: Parker-Hannifin (PH)

- 5-Yr Annual Anticipated Returns: 13.0%

Parker-Hannifin is a diversified industrial producer specializing in movement and management applied sciences. The corporate was based in 1917 and has annual revenues of over $14 billion.

Supply: Investor Presentation

Parker-Hannifin has paid a dividend for 71 years and has elevated that dividend for a exceptional 65 consecutive years.

Notably Parker-Hannifin has exceeded analysts’ EPS estimates for 26 consecutive quarters. In the newest quarter, web gross sales and natural gross sales grew 12% and 13%, respectively, over the prior 12 months’s quarter and adjusted earnings-per-share grew 29%, due to robust demand in almost all markets.

It additionally raised its steering for natural gross sales development in fiscal 2022 from 7%-10% to 10%-12% and adjusted earnings-per-share from $16.95-$17.65 to $17.80-$18.30.

We count on complete returns of 13% per 12 months, pushed by 9% EPS development, the two% dividend yield, and a 2% annual increase from a rising P/E ratio.

Click on right here to obtain our most up-to-date Positive Evaluation report on Parker-Hannifin (preview of web page 1 of three proven beneath):

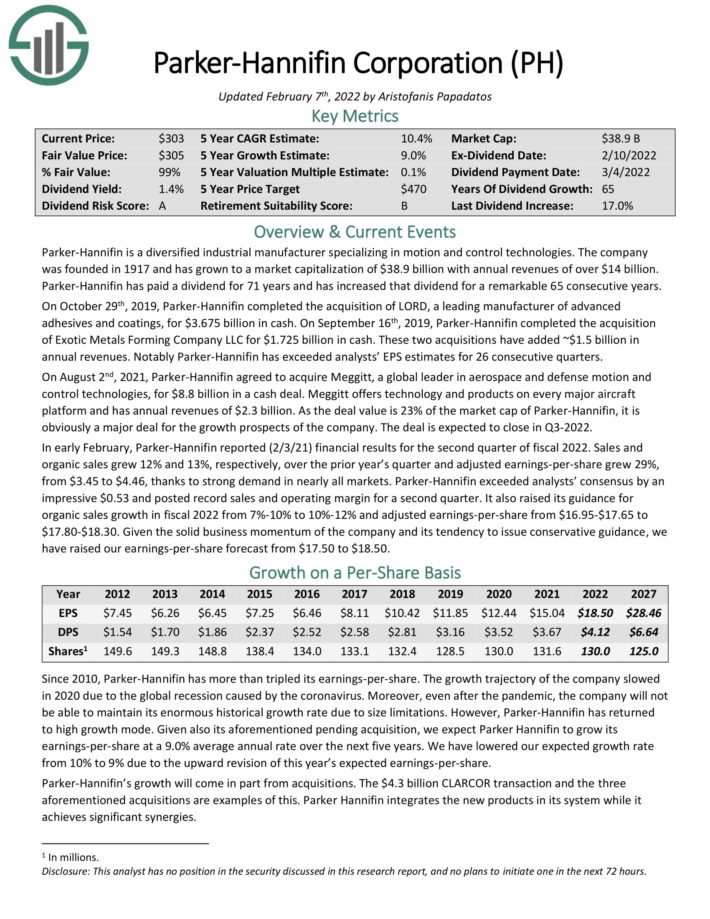

Dividend King #4: Lowe’s Corporations (LOW)

- 5-Yr Annual Anticipated Returns: 14.3%

Lowe’s Corporations is the second-largest house enchancment retailer within the US (after Dwelling Depot). Lowe’s operates or services greater than 2,200 house enchancment and {hardware} shops within the U.S. and Canada.

Lowe’s reported fourth quarter and full 12 months outcomes on February 23rd . Total gross sales for the fourth quarter got here in at $21.3 billion in comparison with $20.3 billion in the identical quarter a 12 months in the past. Comparable gross sales elevated 5%, whereas U.S. house enchancment comparable gross sales elevated 5.1%. Internet earnings of $1.2 billion rose from $978 million in 4Q 2020. Diluted earnings per share of $1.78 was a 35% improve from $1.32 a 12 months earlier.

For the total fiscal 12 months, Lowe’s generated diluted EPS of $12.04. The corporate repurchased 16.3 million shares in 2021 for $13.1 billion. Moreover, they paid out $2 billion in dividends. The corporate stays in a powerful liquidity place with $1.1 billion of money and money equivalents.

The corporate supplied a fiscal 2022 outlook and believes they will obtain diluted EPS within the vary of $13.10 to $13.60 on complete gross sales of roughly $98 billion. Lowe’s expects to repurchase $12 billion price of frequent shares in 2022.

The mix of a number of enlargement, 6% anticipated EPS development and the 1.5% dividend yield result in complete anticipated returns of 14.3% per 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Lowe’s (preview of web page 1 of three proven beneath):

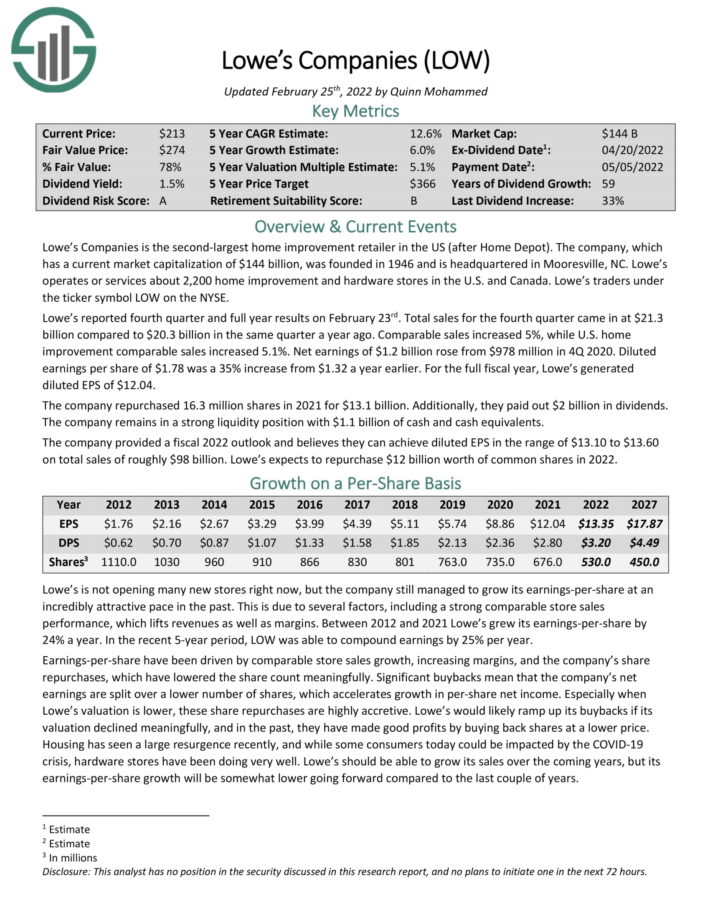

Dividend King #3: 3M Firm (MMM)

- 5-Yr Annual Anticipated Returns: 15.7%

3M sells greater than 60,000 merchandise which are used day by day in houses, hospitals, workplace buildings and colleges across the world. It has about 95,000 staff and serves prospects in additional than 200 nations.

3M is now composed of 4 separate divisions. The Security & Industrial division produces tapes, abrasives, adhesives, and provide chain administration software program in addition to manufactures private protecting gear and safety merchandise.

The Healthcare phase provides medical and surgical merchandise in addition to drug supply methods. The Transportation & Digitals division produces fibers and circuits with a purpose of utilizing renewable power sources whereas lowering prices. The Client division sells workplace provides, house enchancment merchandise, protecting supplies, and stationary provides.

On April twenty sixth, 2022, 3M reported first quarter earnings outcomes for the interval ending March thirty first, 2022. Income fell 0.3% to $8.8 billion, however was $50 million higher than anticipated. Adjusted earnings-per-share of $2.65 in comparison with $2.77 within the prior 12 months, however was $0.34 above estimates. Natural development for the quarter was 2%.

Security & Industrial grew 0.5% as a consequence of power in industrial adhesives and tapes, abrasives, and masking methods, although private security declined. Transportation & Electronics decreased by 0.3%. Industrial options development was offset by a decline in transportation and security. Well being Care grew 4.7%. Client was greater by 3.4% as demand for house care, stationery and workplace and residential enchancment merchandise continues to be robust.

3M supplied an up to date outlook for 2022, with the corporate now anticipating adjusted earnings-per-share of $10.75 to $11.25. Whole returns are anticipated to achieve 15.7% per 12 months over the subsequent 5 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on 3M (preview of web page 1 of three proven beneath):

Dividend King #2: Tennant Firm (TNC)

- 5-Yr Annual Anticipated Returns: 16.2%

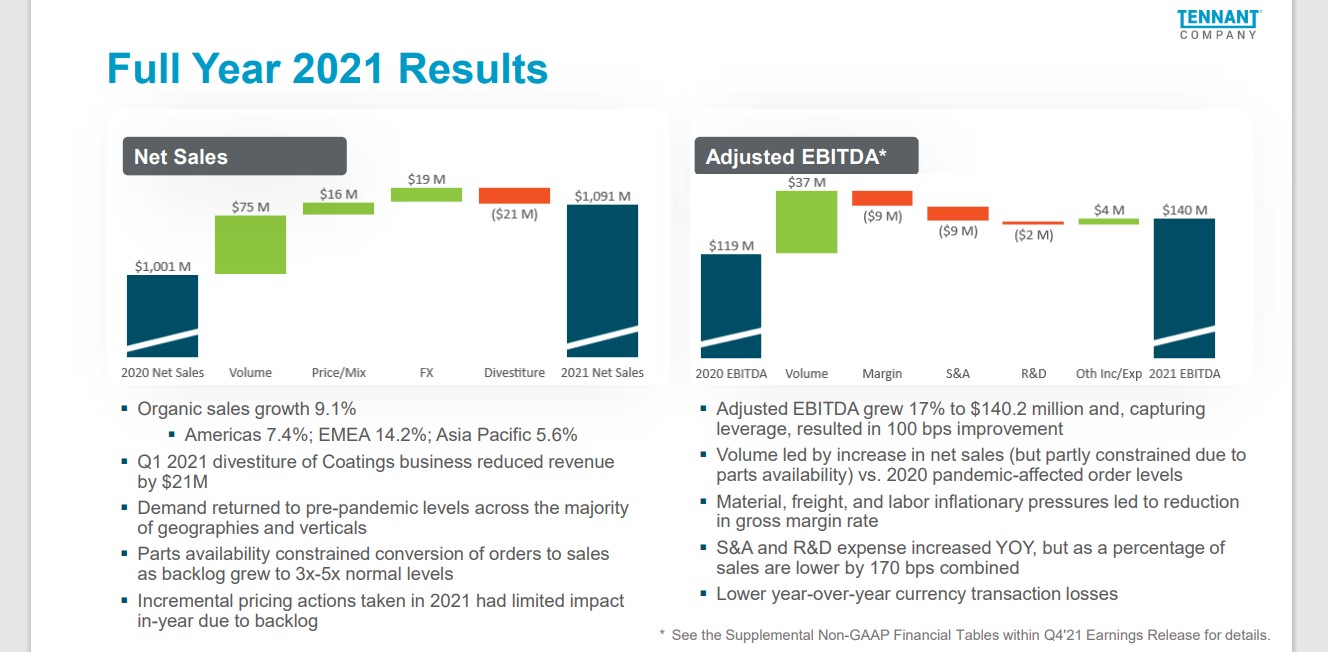

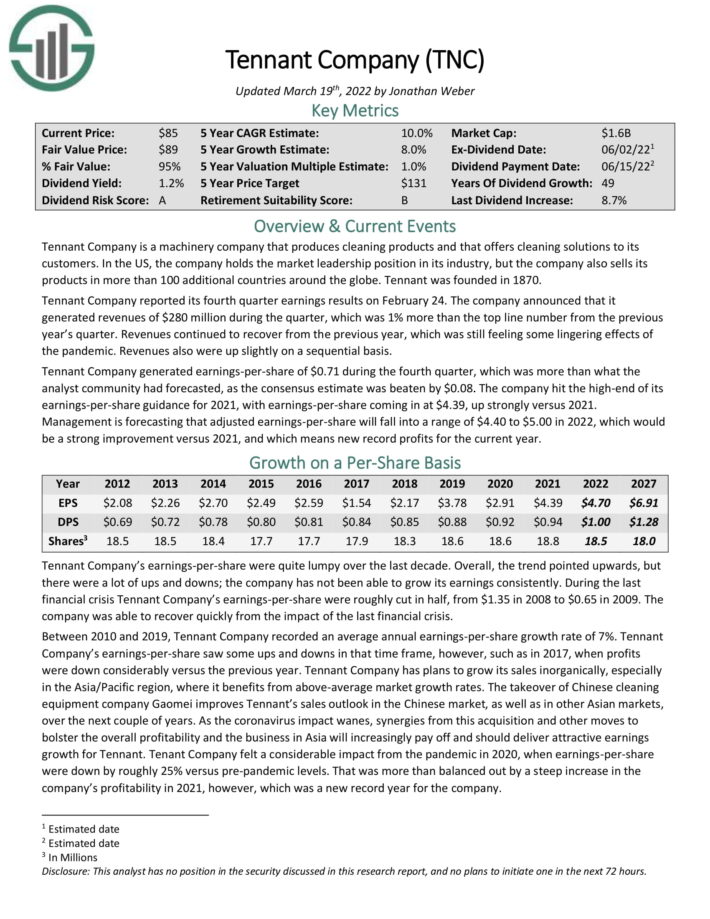

Tennant Firm is a equipment firm that produces cleansing merchandise and that gives cleansing options to its

prospects. Within the US, the corporate holds the market management place in its business, however the firm additionally sells its merchandise in additional than 100 further nations across the globe. Tennant was based in 1870.

Tennant Firm reported its fourth quarter earnings outcomes on February 24. The corporate introduced that it generated revenues of $280 million through the quarter, which was 1% greater than the highest line quantity from the earlier 12 months’s quarter. Revenues continued to get better from the earlier 12 months, which was nonetheless feeling some lingering results of the pandemic. Revenues additionally had been up barely on a sequential foundation.

Supply: Investor Presentation

Tennant Firm generated earnings-per-share of $0.71 through the fourth quarter, which was greater than what the analyst group had forecasted, because the consensus estimate was overwhelmed by $0.08. The corporate hit the high-end of its earnings-per-share steering for 2021, with earnings-per-share coming in at $4.39, up strongly versus 2021.

Administration is forecasting that adjusted earnings-per-share will fall into a variety of $4.40 to $5.00 in 2022, which might be a powerful enchancment versus 2021, and which suggests new file income for the present 12 months

By way of an increasing valuation a number of, 4% anticipated development and dividends, we count on complete returns of 16.2% per 12 months over the subsequent 5 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on Tennant (preview of web page 1 of three proven beneath):

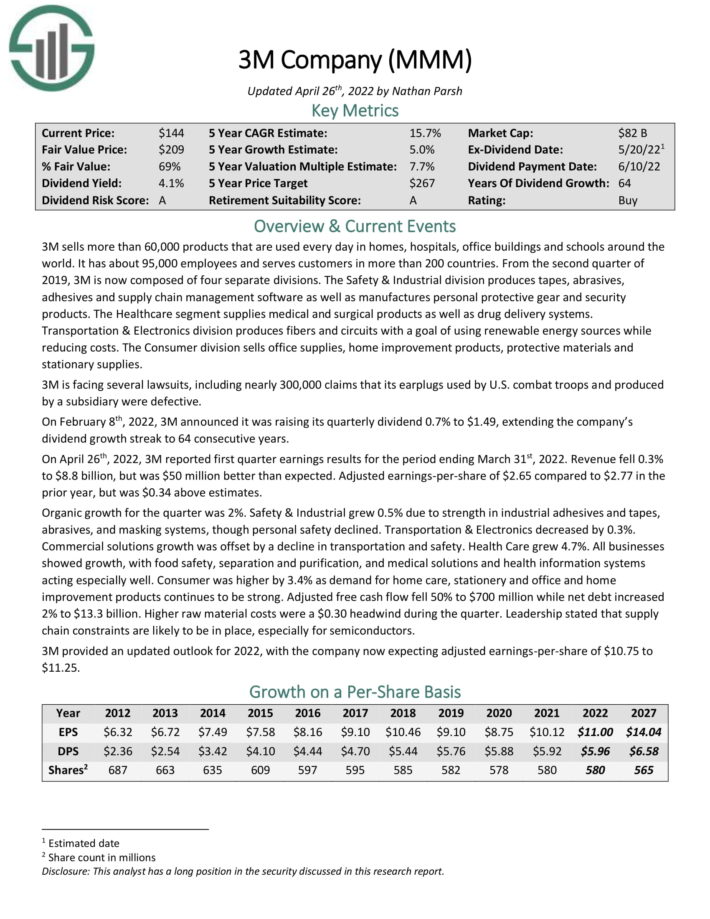

Dividend King #1: Stanley Black & Decker (SWK)

- 5-Yr Annual Anticipated Returns: 16.9%

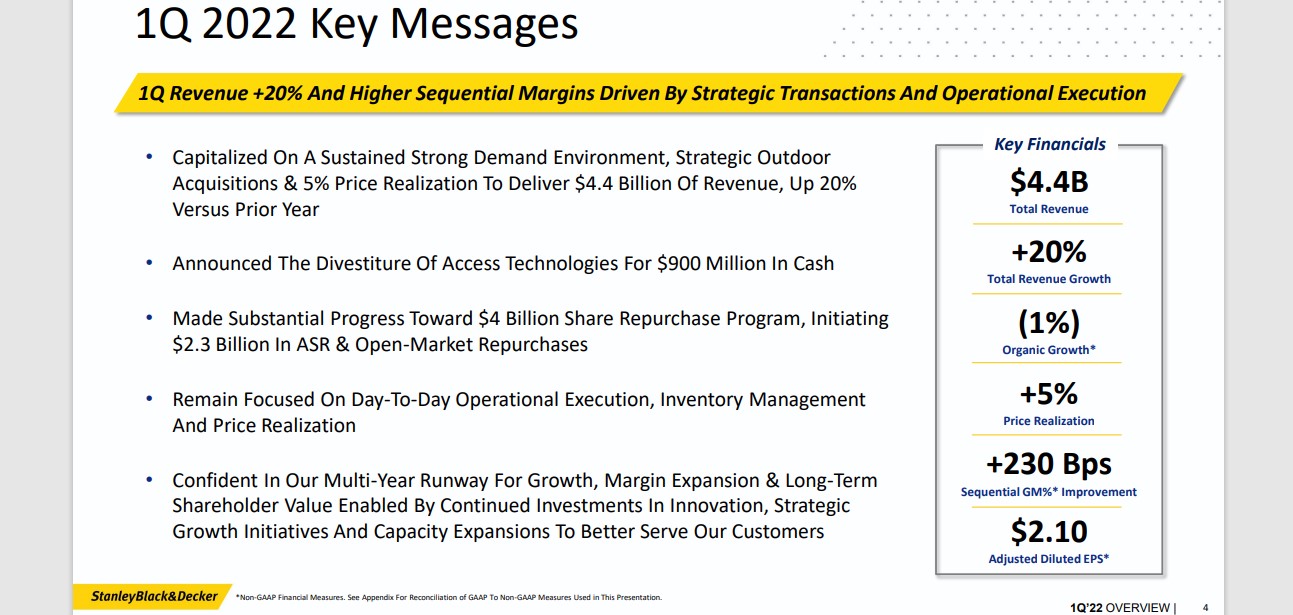

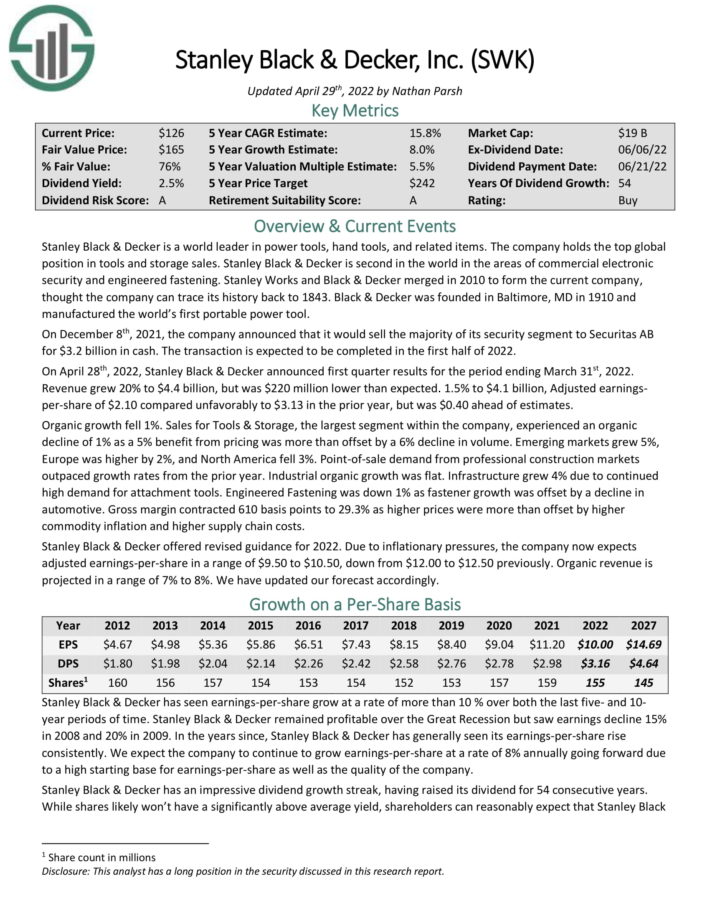

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated gadgets. The corporate holds the highest world place in instruments and storage gross sales. Stanley Black & Decker is second in the world within the areas of economic digital safety and engineered fastening.

You’ll be able to see an outline of the corporate’s 2022 first-quarter efficiency within the picture beneath:

Supply: Investor Presentation

On April twenty eighth, 2022, Stanley Black & Decker introduced first quarter outcomes. Income grew 20% to $4.4 billion, however was $220 million decrease than anticipated. Adjusted earnings-per-share of $2.10 in contrast unfavorably to $3.13 within the prior 12 months, however was $0.40 forward of estimates. Natural development fell 1%.

Stanley Black & Decker supplied revised steering for 2022. Resulting from inflationary pressures, the corporate now expects adjusted earnings-per-share in a variety of $9.50 to $10.50, down from $12.00 to $12.50 beforehand. Natural income is projected in a variety of seven% to eight%.

The inventory has a 2.6% dividend yield, and we count on 8% annual EPS development. With a ~6.3% annual increase from an increasing P/E a number of, complete returns are anticipated to achieve 16.9% per 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on SWK (preview of web page 1 of three proven beneath):

Evaluation Stories On All 44 Dividend Kings

All 44 Dividend Kings are listed beneath by sector. You’ll be able to entry detailed protection of every by clicking on the title of every Dividend King. Moreover, you may obtain our latest Positive Evaluation Analysis Database report for every Dividend King as nicely.

Fundamental Supplies

Client Cyclical

Client Staples

Power

Monetary Companies

Healthcare

Industrial

Actual Property

Expertise

Utilities

Efficiency Of The Dividend Kings

The Dividend Kings outperformed versus the S&P 500 ETF (SPY) in April 2022. Return knowledge for the month is proven beneath:

- Dividend Kings April 2022 complete return: -2.3%

- SPY April 2022 complete return: -3.4%

Secure dividend growers just like the Dividend Kings are likely to underperform in bull markets and outperform on a relative foundation throughout bear markets.

The Dividend Kings should not formally regulated and monitored by anybody firm. There’s no Dividend King ETF. Which means monitoring the historic efficiency of the Dividend Kings will be tough. Extra particularly, efficiency monitoring of the Dividend Kings typically introduces important survivorship bias.

Survivorship bias happens when one appears at solely the businesses that ‘survived’ the time interval in query. Within the case of Dividend Kings, which means that the efficiency research doesn’t embrace ex-Kings that decreased their dividend, had been acquired, and so forth.

However with that mentioned, there’s something to be gained from investigating the historic efficiency of the Dividend Kings. Particularly, the efficiency of the Dividend Kings reveals that ‘boring’ established blue-chip shares that improve their dividend year-after-year can considerably outperform over lengthy durations of time.

Notes: S&P 500 efficiency is measured utilizing the S&P 500 ETF (SPY). The Dividend Kings efficiency is calculated utilizing an equal weighted portfolio of right this moment’s Dividend Kings, rebalanced yearly. Resulting from inadequate knowledge, Farmers & Retailers Bancorp (FMCB) returns are from 2000 onward. Efficiency excludes earlier Dividend Kings that ended their streak of dividend will increase which creates notable lookback/survivorship bias. The information for this research is from Ycharts.

Within the subsequent part of this text, we’ll present an outline of the sector and market capitalization traits of the Dividend Kings.

Sector & Market Capitalization Overview

The sector and market capitalization traits of the Dividend Kings are very totally different from the traits of the broader inventory market.

The next bullet factors present the variety of Dividend Kings in every sector of the inventory market.

- Client Staples: 11

- Industrials: 11

- Utilities: 5

- Client Discretionary: 4

- Well being Care: 4

- Financials: 3

- Supplies: 3

- Actual Property: 1

- Power: 1

- Expertise: 1

The Dividend Kings are obese within the Industrials, Client Staples, and Utilities sectors. Apparently, The Dividend Kings have only one inventory from the Data Expertise sector, which is the most important element of the S&P 500 index.

The Dividend Kings even have some attention-grabbing traits with respect to market capitalization. These tendencies are illustrated beneath.

- 6 Mega caps ($200 billion+ market cap; ABBV, ABT, JNJ, PEP, PG, and KO)

- 19 Giant caps ($10 billion to $200 billion market cap)

- 13 Mid caps ($2 billion to $10 billion)

- 6 Small caps ($300 million to $2 billion)

Apparently, 19 out of the 44 Dividend Kings have market capitalizations beneath $10 billion. This reveals that company longevity doesn’t need to be accompanied by large dimension.

Remaining Ideas

Screening to search out the perfect Dividend Kings isn’t the one approach to discover high-quality dividend development inventory concepts.

Positive Dividend maintains related databases on the next helpful universes of shares:

There may be nothing magical about investing within the Dividend Kings. They’re merely a bunch of high-quality companies with shareholder-friendly administration groups which have robust aggressive benefits.

Buying companies with these traits at honest or higher costs and holding them for lengthy durations of time will seemingly end in robust long-term funding efficiency.

Essentially the most interesting a part of investing is that you’ve limitless selection. You should purchase into mediocre companies, or simply the superb corporations.

As Warren Buffett says:

“After we personal parts of excellent companies with excellent managements, our favourite holding interval is ceaselessly.”

– Warren Buffett

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].