Published by Josh Arnold on November 11th, 2022

There are countless ways to value stocks. There are methods based on cash flow, earnings, dividend yield, revenue, and the subject of this article, book value. The concept of book value is quite simple. The company’s assets have to be valued at least quarterly on the balance sheet for investors to see, and based upon that value, investors can then compare the market value of the stock to the asset value on the balance sheet.

By doing this, one can see if a stock trades below its theoretical liquidation value, which is the net value of the company’s assets minus the net value of its liabilities. For instance, if a company has $2 billion in assets and $1 billion in total liabilities, its book value would be $1 billion. That would be the theoretical value of the company if it were to close down and liquidate its assets. If the stock had a market cap of $500 million, that would be 50% of the book value.

In doing this, we can screen for stocks that are trading quite cheaply, as most stocks never trade below book value, and for those that do, they tend not to stay there for long.

Sectors that tend to see stocks below book value are financials, utilities, and certain consumer staples. It can happen in any sector, but these are the ones that are most prone to it.

In this article, we’ll take a look at 10 stocks that are trading below book value and that also pay strong dividends.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Citigroup, Inc. (C)

Our first stock is Citigroup, one of the major money center banks based in the US. Citi had perhaps the worst time of the money center banks recovering from the financial crisis, and even though the company has made enormous progress, it continues to trade with very low valuations compared to its peers. The bank offers a full suite of financial products and services to individuals, corporations, municipalities, and others all around the world. It has a large credit card business, traditional banking business, as well as wealth management, investment banking, and more.

The company was founded in 1812, generates $75 billion in annual revenue, and trades with a market cap of $88 billion.

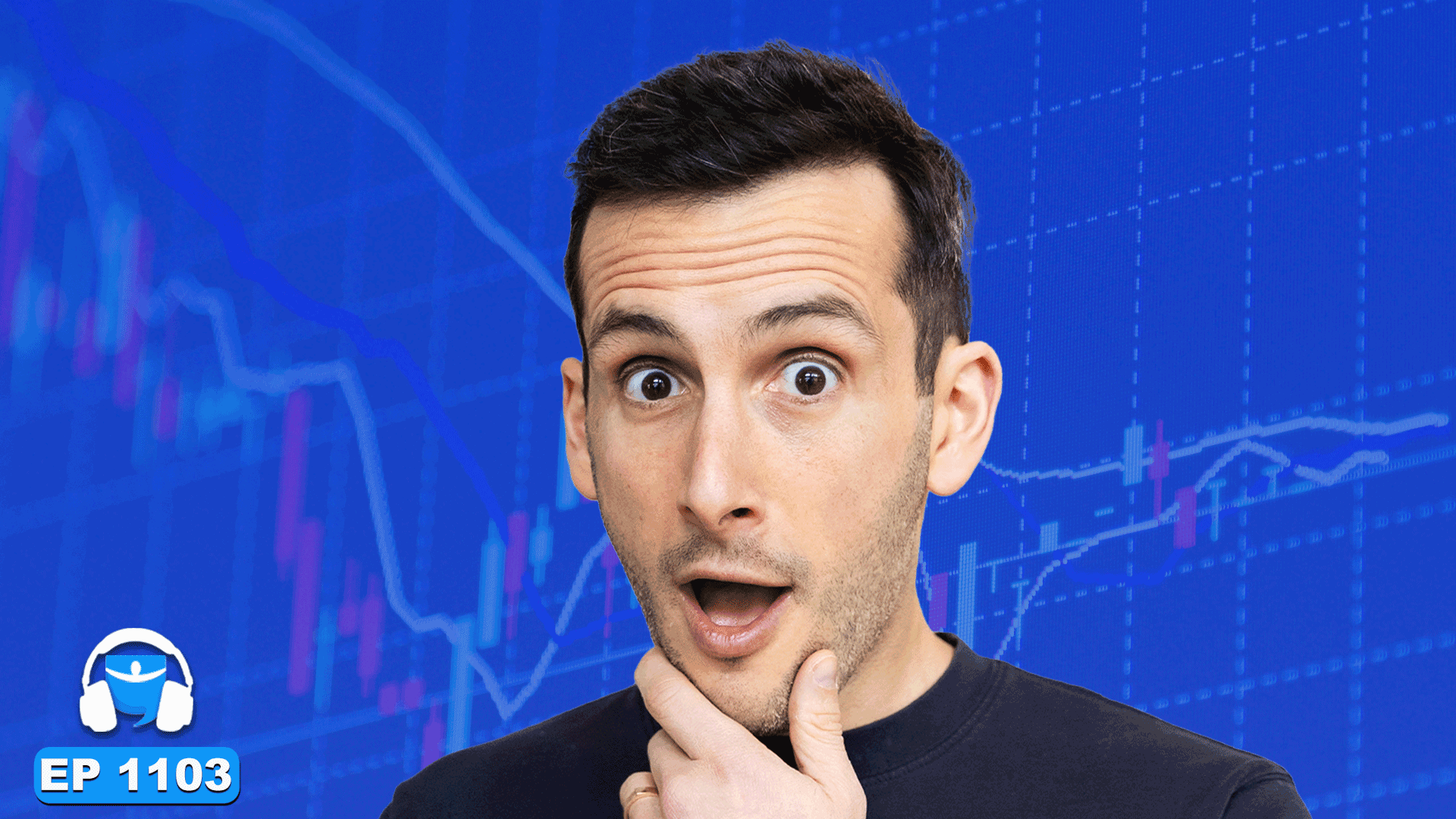

We can see Citi’s mix of assets below and how its book value was derived.

Source: Investor presentation

Book value has been pretty steady the past few quarters at around $93, and it ended the most recent quarter there as well.

Shares trade for just $48 today, which means the stock is trading at just 52% of book value. That’s an extremely low value against books for any sector and any stock, so Citi is quite cheap.

We see the stock as trading at just 63% of fair value and therefore see an upside potential of about 10% annually from the valuation alone.

The stock also sports a yield of 4.2%, which is outstanding against the S&P 500 but also against other banks. Since recovering from the financial crisis, Citi has become a very strong dividend stock.

We are cautious about the bank’s ability to grow from very high levels of earnings in the years to come and assess earnings change at -1% annually. However, with a big yield and a 10% tailwind from the valuation, we think Citi can provide total annual returns of better than 12% in the years to come.

Click here to download our most recent Sure Analysis report on Citigroup, Inc. (preview of page 1 of 3 shown below):

British American Tobacco p.l.c. (BTI)

Our next stock is British American Tobacco, which is a tobacco and nicotine products company that operates globally. It is perhaps best known for its Lucky Strike, Newport, and Camel cigarette brands, but it also offers heated tobacco, nicotine, and vaping products.

The company was founded in 1902, generates $32 billion in annual revenue, and trades with a market cap of $87 billion.

The stock’s book value has increased in recent quarters to nearly $40 per share, and given it trades for under $38, British American Tobacco’s book value sneaks in the right under 100%.

We see the stock priced at 94% of fair value, which could drive a ~1% tailwind to total returns in the coming years.

However, the stock pays a staggering 7.3% dividend yield, making it a rare company. Growth is pegged at 3% annually, so combining these factors gives us expected annual returns of just over 10%.

Click here to download our most recent Sure Analysis report on British American Tobacco p.l.c. (preview of page 1 of 3 shown below):

Mercedes-Benz Group (MBGAF)

Next up is Mercedes-Benz, the famous automaker based in Germany. The company has undergone transformations over the decades, but today, it offers Mercedes-branded cars, trucks, and vans across the world.

The company was founded in 1886, making it the world’s oldest automaker. It produces about $144 billion in annual revenue and trades with a market cap of $69 billion.

The stock ended the most recent quarter with a book value of about $75 per share, and it trades today with a value of less than $65. That puts it at about 85% of book value and just 65% of where we see the fair value. That could drive a 9%+ tailwind to total returns in the coming years, significantly adding to projected returns.

In addition, the stock yields more than 8%, so it is cheap and offers an enormous dividend yield.

We see growth at -4% annually, given 2022’s earnings base is quite high, but even so, we believe the stock can offer ~11% total returns in the years to come.

Click here to download our most recent Sure Analysis report on Mercedes-Benz Group (preview of page 1 of 3 shown below):

The Kraft Heinz Company (KHC)

Our next stock is Kraft Heinz, the maker of food and beverage products that are on shelves across the world. Kraft Heinz offers a wide array of dairy products, condiments and sauces, beverages, meats, dressings, and much more.

The company was founded in 1869, generates $26 billion in annual revenue, and trades with a market cap of $46 billion.

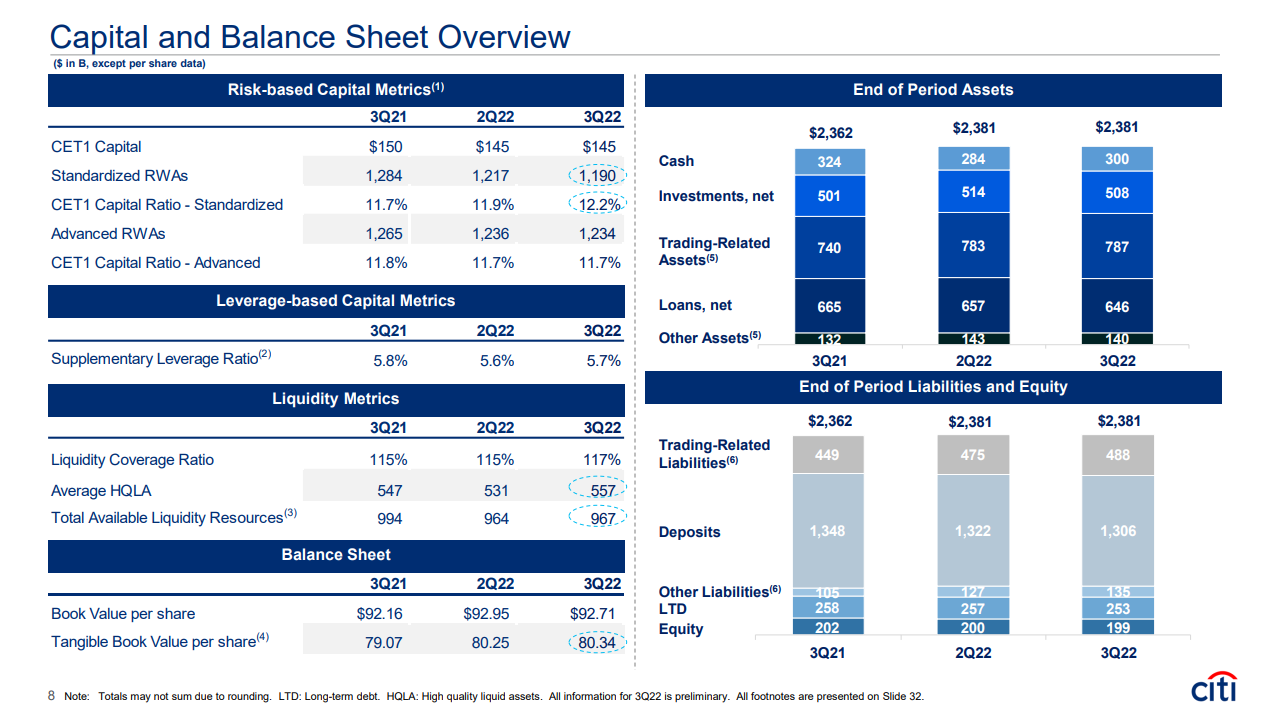

Source: Investor presentation

Kraft Heinz is not a high-growth company, but we can see it expects high single-digit organic sales growth this year, which is outstanding for a consumer staples company. Much of that is driven by pricing increases to combat inflation, but it also stands that its position in the marketplace is such that it can command higher prices.

The stock ended the most recent quarter with a book value of just over $39 per share, and it trades today at about 97% of that value. We see the stock as slightly overvalued despite it trading just under book value but expect a modest headwind from the valuation.

Shares yield a very nice 4.2% today, so Kraft Heinz is a strong income stock. We project growth at 2% annually, so combining all of these factors nets just over 4% of total annual returns in the years to come.

Click here to download our most recent Sure Analysis report on The Kraft Heinz Company (preview of page 1 of 3 shown below):

Invesco Ltd. (IVZ)

Our next stock is Invesco, a publicly-owned investment manager. The company provides investment products and services to institutions, individuals, funds, and pension funds. Invesco offers a wide variety of stocks, bonds, and related funds for customers to choose from.

Invesco was founded in 1935, should produce about $4.6 billion in revenue this year, and has a market cap of $7.2 billion.

The stock has a current book value of about $24 per share, so its price-to-book value is 78%. We see shares trading at 72% of fair value today, which means we could see a nearly-7% tailwind to total returns in the years to come from the expanding valuation.

Invesco also has a very strong yield of 4% today. We see growth at a modest 2%, but even so, the combination of the low valuation and strong yield has us estimating nearly 12% total annual returns in the years to come.

Click here to download our most recent Sure Analysis report on Invesco Ltd. (preview of page 1 of 3 shown below):

Manulife Financial Corporation (MFC)

Our next stock is Manulife Financial, a company that provides financial products and services to customers all over the world. It offers wealth and asset management services and insurance and annuities as its primary lines of business.

Manulife traces its roots to 1887, produces about $55 billion in annual revenue, and has a market cap of $31 billion today.

The stock ended the most recent quarter with a book value of about $21 per share, and it trades at just 82% of that value today. We see the stock as about 14% lower than fair value and a commensurate 3% tailwind to total annual returns as a result.

The current yield is outstanding at 6%, which is about four times that of the S&P 500. In addition, we see 5% growth in the years ahead as Manulife is poised for strong revenue and margin expansion.

Overall, we believe the stock could offer 13% total annual returns in the coming years.

Click here to download our most recent Sure Analysis report on Manulife Financial Corporation (preview of page 1 of 3 shown below):

Hewlett Packard Enterprise Company (HPE)

Our next stock is Hewlett Packard Enterprise Company, a firm that helps companies capture, analyze, and act upon their data. HPE has customers all over the world and was spun out of the former Hewlett-Packard conglomerate in 2016.

The company traces its roots to 1939, generates about $28 billion in annual revenue, and trades with a market cap of just over $18 billion.

Shares ended the last quarter with a book value of about $16, and shares trade about 7% below that today. We believe the stock is fairly valued at the current price, so we see essentially no impact on returns from the valuation.

HPE pays a dividend worth 3.2% today, about double the S&P 500. Further, we see 3% annual growth, helping to drive total annual returns of just over 6%.

Click here to download our most recent Sure Analysis report on Hewlett Packard Enterprise Company (preview of page 1 of 3 shown below):

Molson Coors Beverage Company (TAP)

Next up is Molson Coors, a beverage company that manufactures, sells, and distributes beer and other malt beverages throughout the world. The company’s portfolio focuses on beer, including its namesake Molson and Coors brands, but has recently diversified some.

Molson Coors traces its roots to 1774, generates almost $11 billion in annual revenue, and has a market cap of the same.

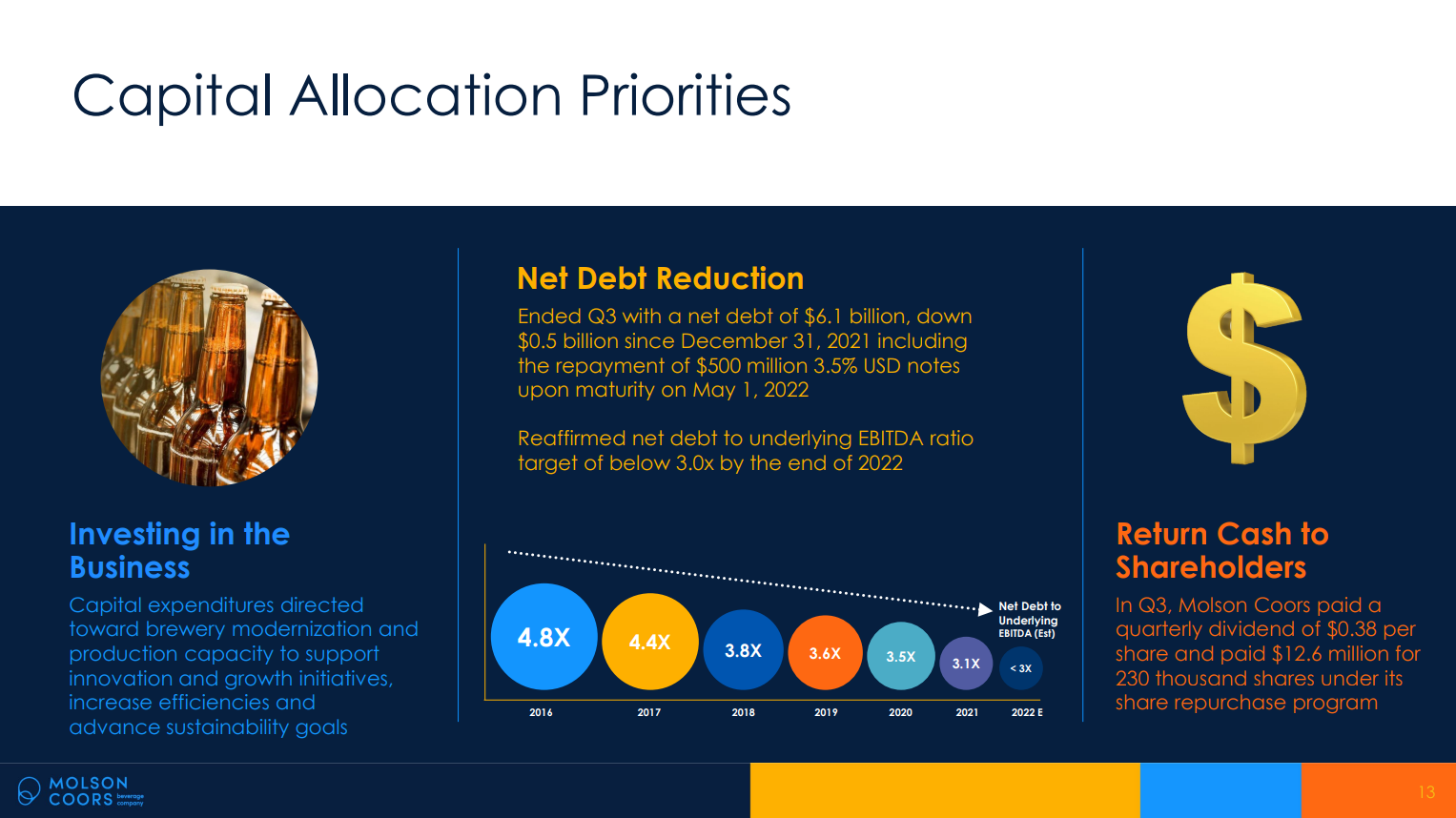

Source: Investor presentation

This slide highlights the company’s commitment to shareholders in that it has three capital allocation priorities. First, it invests in the business. Second, it seeks to reduce debt, as it has done for years. And third, it returns cash to shareholders via dividends and buybacks. All are relevant to the book value discussion in one way or another.

The stock’s book value ended the most recent quarter at $61, and it trades for a discount of about 15% to that value today. We see the stock as about 7% undervalued, driving a potential tailwind of just over 1%.

The dividend yield is 3% today as well, meaning that the stock is strong from an income perspective despite the dividend not being the top capital allocation priority. Growth could come in at 4% annually, and we see 8% expected annual returns to shareholders.

Click here to download our most recent Sure Analysis report on Molson Coors Beverage Company (preview of page 1 of 3 shown below):

Fresenius Medical Care (FMS)

Fresenius is up next, a company that provides dialysis care, primarily in Germany and the US. It offers a network of almost 4,200 clinics across the world, making it one of the largest companies of its type.

Fresenius was founded in 1996, generates about $19.5 billion in annual revenue, and trades with a market cap of just under $11 billion.

The stock ended the most recent quarter with a book value near $41, but the stock trades for less than $15 today. That puts it at less than 40% of book value, and we see it as about 30% undervalued. That could drive a 7%+ tailwind to total returns in the years to come.

The yield is also excellent at nearly 5%, and we see a 3% annual growth for the stock. Combining these factors means we project ~14% of total annual returns to shareholders in the coming years.

Click here to download our most recent Sure Analysis report on Fresenius Medical Care (preview of page 1 of 3 shown below):

WestRock Company (WRK)

Our final stock is WestRock, a packaging solutions company that operates globally. The company makes a wide variety of boxes, linerboards, tubing, and other kinds of packaging for a huge array of customers.

The company produces about $22 billion in annual revenue and has a market cap of $8.8 billion.

Shares ended the last quarter at a book value of $45 per share, about 25% higher than the current share price. We see the stock as more than 30% undervalued at present, with that helping to drive a potential ~8% tailwind to total returns.

The dividend yield is nice at 3%, but we see growth as modest at a potential 2% per year. All told, mostly due to the valuation, we project better than 12% total annual returns in the coming years.

Click here to download our most recent Sure Analysis report on WestRock Company (preview of page 1 of 3 shown below):

Final Thoughts

While there is a wide variety of ways to value stocks, one way we like is to consider the company’s market value against its book value. This helps guard against overpaying for expensive stocks, and above, we noted ten stocks we like under book value today that also pay strong dividends.

Each has its unique combination of value, dividend yield, and growth; most are buy-rated based on total return potential.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].