Hong Kong’s implementation of draconian COVID insurance policies threatens its standing as a global monetary hub. That is seen by means of Hong Kong Chief Govt Carrie Lam’s execution of Chinese language President Xi Jinping’s ‘Zero-Covid’ coverage amid crippling financial pressure and a fifth wave of COVID-19 infections. Lam’s pandemic technique, compounded with issues over the Nationwide Safety Legislation (NSL), undermines the liberties that Hong Kong is thought for.

Hong Kong as an Worldwide Monetary Hub

Sturdy authorized protections for buyers are essential for monetary development. Hong Kong maintains considerably extra investor protections and freedoms than does mainland China. After the 1997 handover, the Chinese language and British allowed the town’s democratic and capitalist system to persist autonomously from mainland China’s socialist system. This institutional framework is called the ‘One Nation, Two Techniques’ precept. Hong Kong’s preexisting liberal establishments and business-friendly insurance policies, like judicial integrity, rule of regulation, and personal property proceed to bolster its financial enchantment.

Hong Kong additionally possesses distinctive financial benefits. Not like different Chinese language cities, Hong Kong maintains a low tax regime, numerous monetary markets, and free-flowing capital. It’s an investor’s gateway into mainland China’s stringently managed capital markets. The Council on International Relations’ Eleanor Albert notes that its “capitalist options have made Hong Kong one of many world’s most tasty markets and set it aside from mainland monetary hubs.”

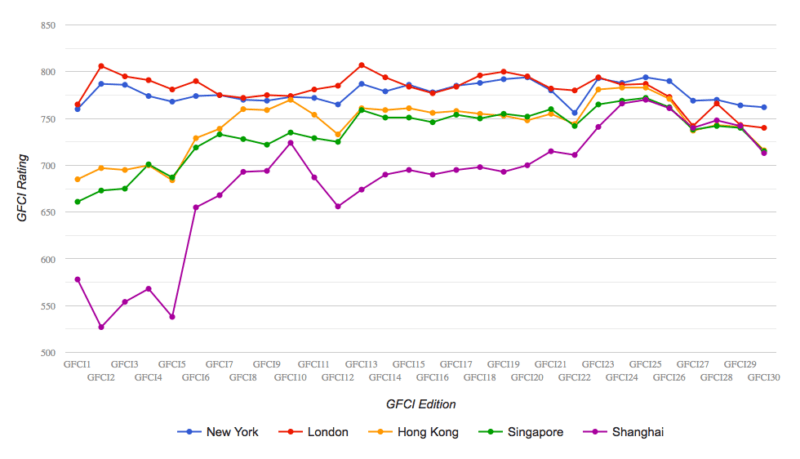

Hong Kong attracts multinational firms with its pro-business setting. It constantly ranks among the many high 5 worldwide monetary facilities, in response to the International Monetary Facilities Index (GFCI) knowledge. The graph under shows the highest 5 monetary facilities’ GFCI rankings since 2012, by which Hong Kong steadily rivals its friends. Its excessive GFCI ranking signifies its aggressive monetary infrastructure, authorized protections, and open market norms.

Liberty Below Assault

Liberal values and financial insurance policies assist Hong Kong’s attract to companies. The implementation of the Nationwide Safety Legislation (NSL) and the enforcement of ‘Zero-Covid’ insurance policies undermine the liberties international companies have loved in Hong Kong. The NSL criminalized vaguely outlined acts of “seccession, subversion, terrorism, and collusion.” This crackdown laid the muse for worldwide companies’ skepticism and concern over continued operations in Hong Kong. The influence of its COVID-19 technique has related outcomes.

The ‘Zero-COVID’ plan makes an attempt to cease the unfold of COVID-19 by means of strict border restrictions, social distancing guidelines, necessary testing and vaccination, and prolonged quarantine instances. Chief Govt Lam asserted that “current legal guidelines wouldn’t stand in the way in which” of their pandemic technique, however this relentless pursuit to eradicate COVID hinders fundamental freedom of motion and disrupts enterprise operations. In the meantime, company leaders and workers query if Hong Kong remains to be a lovely metropolis by which to do enterprise.

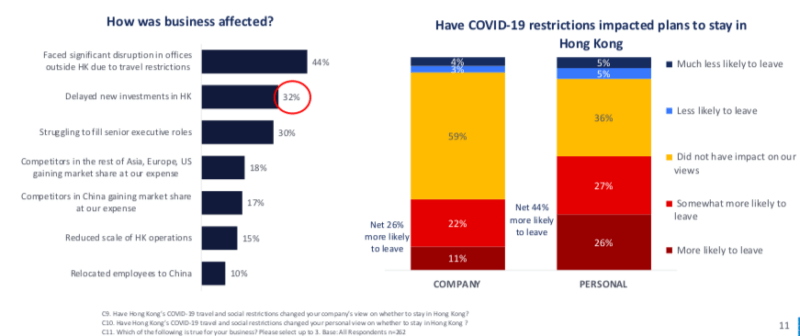

In accordance with the Hong Kong American Chamber of Commerce’s (HK AmCham) 2022 Enterprise Sentiment Survey Report, COVID-related journey restrictions and quarantine guidelines “weighed closely on each firm and private sentiment.” Enterprise sentiment soured as restrictions hampered operations, investments, and hiring. Particular person pessimism aligned with enterprise attitudes as greater than 50 % of respondents thought of leaving Hong Kong.

The pessimism over restrictions underpins the resultant mind drain as high enterprise leaders depart Hong Kong. Former HK AmCham President Tara Joseph resigned in 2021, as tightened journey restrictions and quarantine necessities gained traction. Enterprise executives attributed “journey restrictions and COVID quarantines” to creating Hong Kong uncompetitive, whereas hiring and retention challenges exacerbated their disdain. The ensuing exodus of international expertise was keenly felt within the banking sector. JP Morgan and Citigroup Inc.’s senior departures, V.F. Company’s operations relocation, and workers departures from Mandarin Oriental, Financial institution of America, and Pernod Ricard have every taken a toll.

Hong Kong’s COVID insurance policies threaten a elementary pillar of the worldwide monetary middle: liberty. Constraints on the “free motion of individuals and concepts” intensify enterprise operational difficulties and, extra broadly, isolate Hong Kong from the world. If monetary hubs forestall people from touring freely, then firms and people won’t return, or they are going to merely relocate to Hong Kong’s extra free Asian rival, Singapore.

Singapore is a well-liked different monetary middle to Hong Kong. In distinction to Hong Kong’s anti-business COVID technique, Singapore permits quarantine-free entries from designated international locations and is “transitioning to dwelling with the virus.” Bloomberg economists Tamara Mast Henderson and Eric Zhu compiled knowledge displaying that companies “weary of stringent quarantine guidelines and the shortcoming to journey freely,” are relocating from Hong Kong to Singapore.

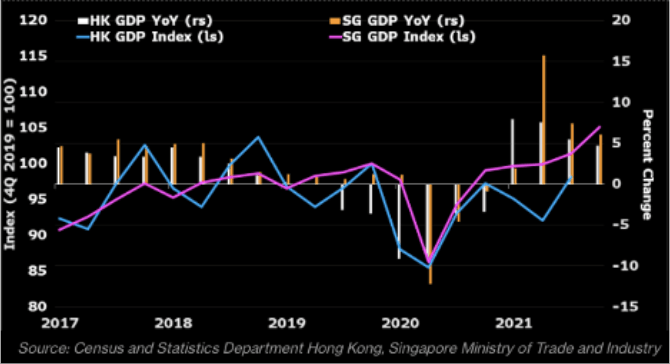

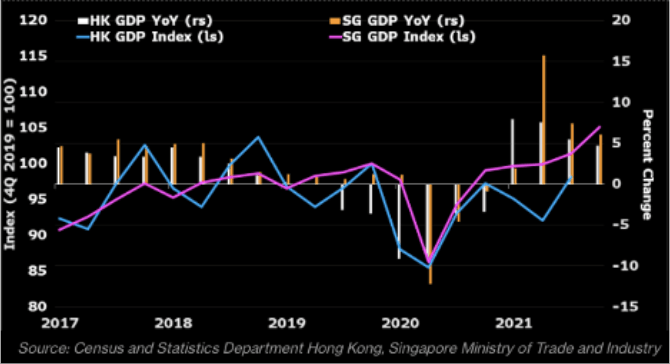

In accordance with the info under, Singapore’s GDP development from 2020 into 2021 outpaced that of Hong Kong’s. Whereas each finance hubs applied harsh COVID restrictions methods, Singapore was the primary to calm down journey restrictions and social distancing guidelines.

Essentially the most tell-tale signal of enterprise choice for Singapore is financial institution deposits. Henderson and Zhu’s evaluation present Hong Kong’s deposit development “roughly halved within the final three years,” and Singapore’s deposits grew “about double the tempo” in the identical period of time.

What this implies for Hong Kong

Though its ‘Zero-COVID’ technique drove international expertise and firms to Singapore and locals to to migrate, Hong Kong nonetheless possesses three distinctive benefits that solidify its place as a finance powerhouse.

First, there’s a deep, indigenous expertise pool that may change expats who left. Hong Kong and mainland Chinese language expertise can fill vacated expats’ roles within the finance sector.

Second, Hong Kong’s geographic proximity and monetary interconnectedness with mainland China is unmatched. Though Singapore is a detailed competitor, it enjoys neither Hong Kong’s degree of financial integration with the mainland, nor Chinese language clientele belief.

Third, Hong Kong’s success is backed by mainland China. Regardless of crackdowns on civil liberties, its financial insurance policies had been untouched, and Chinese language buyers strongly supported its inventory markets throughout downturns. Nonetheless, a caveat, as Asia Enterprise Council government director Mark Clifford assesses, is that “Hong Kong should succeed on Beijing’s phrases.” To this point, Beijing believes that it might probably thrive within the absence of liberty.

A former financial institution chief government at one in every of Hong Kong’s largest banks noticed, “Hong Kong’s worth won’t be zero, however will probably be totally different.” It’s nonetheless the principle gateway into China. Nonetheless, its liberty purge spoiled enterprise confidence, and the long-term results of ongoing geopolitical tensions are but to be seen.