Monoliza21/iStock via Getty Images

Co-produced with Beyond Saving

Today I want to talk about a bias that has been part of the investing world for decades: Income investing is for “old” people.

There are numerous variations of this. Some financial advisors will tell you that you should take greater risks when you’re younger and that you should increase your bond holdings only when you get older. They tell you that you should invest one way your entire working career, and then when you retire, suddenly adopt an entirely different investing method.

I disagree. Why do more experienced investors turn to income investing? Because they are wiser. The most frequent comment I get from HDO members is, “I wish I would have discovered income investing earlier”.

They learned from the brutal University of Hard Knocks. No, you shouldn’t take on “more risk” just because you are younger. If a risk is unacceptably high when you are 65, it is unacceptably high when you are 40. An investment portfolio should not be treated like a casino, making big bets and hoping to get lucky. An investment portfolio should methodically increase your wealth in any economic condition. You should be able to chart a path so that you know you will have enough to retire on your target day. Every single year you’ll know whether you are on target, ahead of target, or behind.

I don’t use the Income Method because I am “old”. I’m not old, I’m experienced. I use the Income Method because I believe it is the most effective approach to the market to achieve my goals. I believe income investing is a very effective strategy for people to achieve their retirement goals in a low-risk and methodical manner.

Prices Are Fickle

Every investment advisor knows a dirty little secret that none of them want to admit. I’ll tell you that secret:

The value of your portfolio will fall 20% or more multiple times.

Sure, numerous folks claim otherwise. They will say that they’ve been investing X years and never had a loss. I also have a very wealthy uncle I never met who is just itching to share his multi-million dollar lottery win with me, he e-mails me every day.

When we invest in the “stock market”, we usually invest in “common equities”. This is the most volatile, highest-risk portion of the capital stack. Equities are the last to get paid, and when things go wrong, they have very few legal protections and are the last in line at bankruptcy proceedings.

Let’s get one thing straight, the minute you decide to invest in the stock market, you are taking on risk. Investment advisors love to talk about the upside potential. I love to talk about the upside potential, the upside is fun. Investing in the U.S. stock market has been one of the greatest wealth generators in the history of the world, and it is easily accessible to anyone with a bank account.

When you are saving for retirement and then being retired, you could be talking about being invested in the market for 50 years or more. Over the course of 50 years, the market will collapse numerous times. You will see several “black swans”, you will see economic turmoil, panic, prices of individual companies falling 70%+, and you will get caught owning a few companies that implode. When you invest in common equities, the lowest portion of the capital stack, prices will change radically. Sometimes for good reasons, sometimes for no reason.

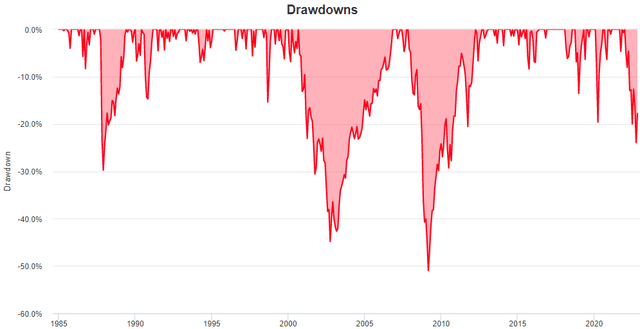

Here is a look at drawdowns in the stock market over the past 36 years as measured by the Vanguard 500 Index Fund Investor (VFINX), which tracks the S&P 500. (Source)

Portfolio Visualizer

As you can see, more often than not, the value of the fund was less than the peak price. Every few years, it was down 10% or more. About once every ten years, it declined by more than 30%. Sometimes, it took several years to get back to even.

Waiting several years isn’t a problem if you are 40 and don’t plan on retiring anytime soon. In that case, those declines are actually very beneficial because you are contributing new capital and buying more stocks at those low prices. Low prices always benefit the buyer.

One day, you intend on retiring, right? Will the market be on an upswing or a downswing that day? Yeah, I don’t know either.

How Much Do You Need To Retire?

Go to a retirement advisor, and they will ask a bunch of questions about your desired retirement lifestyle. They will plug some numbers into a spreadsheet, and they will give you a number. This big number is allegedly the number you need that will be enough to support you in retirement.

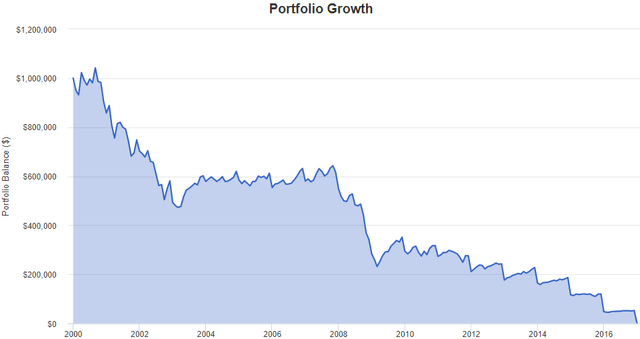

In the year 2000, $1 million was a very popular target. That was an amount that most people believed was “enough” to support themselves indefinitely. Was it? (Source)

Portfolio Visualizer

If you achieved that lofty $1 million goal in January 2000, you might have been excited to retire. Yet taking out a mere $50,000/year and your retirement would have hit $0 by 2017 invested in an S&P 500 index fund. You would have been better off just putting $1 million in your checking account.

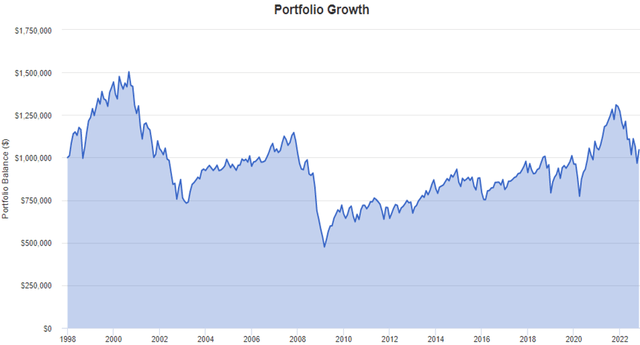

Of course, if you had $1 million and retired in 1998, you would have been just fine. You would still have around $1 million today.

Portfolio Visualizer

Having $1 million in 1998 and $1 million in 2000 were completely different things. Is the year you retire going to be more like 1998 or 2000? How do you know? You can’t. By the time you know, you are already retired, and you can’t do a thing about it except go back into the workforce, where you are unlikely to get your old job back. Most likely, you’ll go back to the bottom of the ladder and get a job that pays a fraction of your old income.

You Don’t Need $1 Million

Don’t listen to anyone who tells you that you need to work until you have a certain amount in your 401k, they don’t know how much you need. At best, they can make an educated guess. They don’t know if the five years following your retirement will be a bull market or a bear market. Nobody can have certainty about what the market will do next year, let alone 5, 10, or 15 years from now.

When you retire, you aren’t going to take a million out of your 401k and throw it in a checking account. Your money is going to remain invested. This means prices will continue to change every day, and the value of your retirement account will swing up and down routinely.

What do we really need when we retire? An income. That’s what we are giving up when we tell our co-workers adios and ride into the sunset. You have a paycheck, and then it stops.

This is where the Income Method comes in. You can’t know how much you need in your 401k, because stock prices change every day. Every day the market is open, the value of your retirement changes. Sometimes by a meaningful amount.

The dividends that companies pay change much more rarely. Companies will announce their dividends once a quarter. That is four opportunities for the dividend to change each year, as opposed to the approximately 252 days each year that share prices will change.

Even when there is a bear market raging, dividends frequently climb. This year, the indexes are down 20-30%, and our income is up with 43 dividend raises in our portfolio and six dividend reductions year-to-date.

You don’t know how much you need to save to have enough for the rest of your life, but you know exactly how large of an income you need to replace. You don’t need to guess when you can retire, you can look at how much income your portfolio is generating and know if that is enough to replace the income from your job. Many investors who adopted income investing early have been able to retire earlier than they planned.

One of the greatest strengths of an income investing strategy is the ability to create clear and certain goals that are not reliant on market sentiment.

The Magic Of Compounding Isn’t Magic, It’s Math

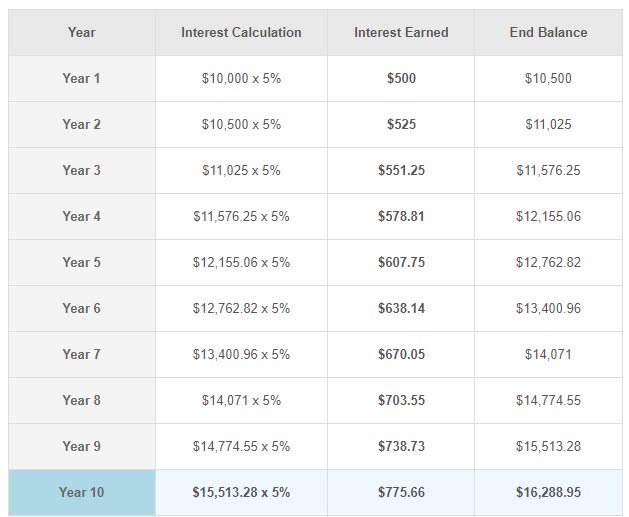

The math of compounding is straightforward and typically applied to interest. You have an original principal that earns a return in year one. Then in year two, your original principal keeps earning a return, while the interest earned in year one also earns a return. In other words, even if the return remains the same, your earnings increase because you have more capital that is earning interest.

It looks something like this: (Source)

The Calculator Site

Note that this example is not assuming any additional investment. It simply assumes that the interest can be reinvested at the same return as the original principal. By year 10, the annual interest earned increases from $500 to $775.66. A 55% increase, despite no additional investment.

Many investors try to apply this idea to investing, and you will find hundreds of investment sites offering calculators for you to plug in your savings assumptions, and they will tell you what the balance will be. That’s great if you are investing in bonds. But as we noted above, prices in the market are fickle. The prices of stocks do not move up in an even and predictable manner.

How do you know if you are on track to reach your goals? You don’t. You cross your fingers and hope.

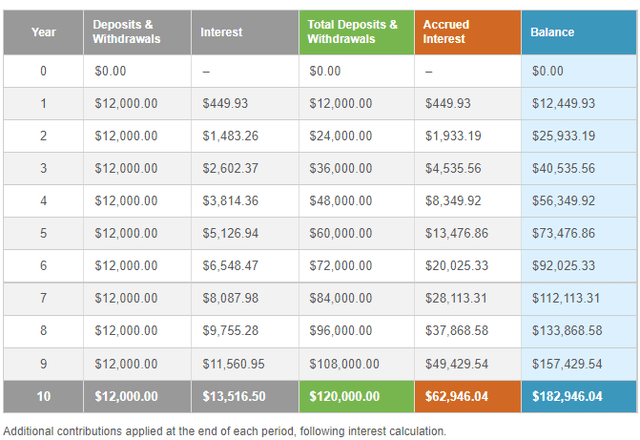

What if we focus on income? We can run the calculator assuming deposits of $1,000/month for 10 years, invested at an average yield of 8% and reinvested at 8%.

The Calculator Site

Ignore the “balance” column. We have no way of knowing that, and we have no way of controlling that. Prices will change, and that is ok. Focus on the “interest” column.

Remember, you are investing in risk assets, so there are no guarantees. So these calculators are not going to foretell your future. However, it does help provide you with clear goals to measure your actual experience and tell you if you are ahead or behind. If by year 3, your income was only $2,200, it is much easier to catch up early by investing just a little extra than if you wait until year 10.

When you are still in your working years, the math of compounding works in your favor because you are reinvesting 100% of dividends. The earlier you start developing streams of income, the better.

Compounding will grow your income, even if there are periods during your working life when you aren’t investing as much as you should. Let’s face it, we can create all the beautiful plans we want, but they rarely survive contact with the real world. You aren’t the only one who invested a bit less and redirected cash elsewhere, lost your job, or had another life event that put your retirement investing on the back burner.

Replace Your Income, Build In Excess

Once you retire and start withdrawing income from your portfolio, the benefits of compounding are greatly diminished. That does not mean you need to surrender them entirely.

When determining how much income you need to retire, make sure you build in some excess. Typically, I suggest planning on reinvesting at least 25% of your dividends, even after you retire. This provides several benefits.

- It protects your income: While rarer than falling prices, dividends do get cut. You can protect yourself by having excess built-in so that it does not put at risk your ability to withdraw the income you need at.

- It grows your income: Reinvesting 25% of your dividends, as a rule, will allow you to continue to benefit from compounding. Inflation doesn’t stop the day you retire, you want to ensure your portfolio’s income keeps growing.

- Build a perpetual income machine: How long are you going to need income in retirement? Unlike eggs, humans don’t come with an expiration date stamped on them. You need to know that your retirement fund will last the rest of your life, which is an unknown amount of time. Reinvesting 25% of your dividends will help ensure that your portfolio lasts forever.

So if your goal is to have $75,000/year from your portfolio for your retirement budget, then you want to target $100,000/year in dividend income.

Create Realistic Targets

The retirement plan for too many people is to throw money in the market and hope that they have enough. I think a major reason for that is retirement planners will frequently throw out huge numbers. “You need $2 million”, which is an amount that most people simply can’t wrap their heads around. They put a few thousand in the market, get excited when it goes up a lot, and then panic when it goes down. The end goal is so far out of sight that they don’t make a real attempt to achieve it. As a result, they don’t.

The heart of the Income Method is the idea that you don’t need to focus on that big, seemingly unattainable number. Instead, focus on generating an income that is similar to the income you are earning right now. Your income is a number you are familiar with, you see it every year!

Set your goals to replace that income. Adjust for social security, any pension that you have, etc. Then use a compound interest calculator to estimate how much you need to invest to achieve that goal. At HDO, we focus on identifying investments with an average yield of 8-10%. When the market is down, like now, it is averaging closer to 10%. To be conservative, I would assume an average investment/reinvestment at an 8% yield.

Then take the results of that calculator to create your income targets. Don’t focus on what you need 20 years from now. Focus on beating the target this year. Beat your income goals, one year at a time. If you find that you are missing your goals, make an adjustment. Maybe you need to invest more money, maybe your goals were too ambitious for your income level. Each year, you have the opportunity to evaluate and adjust your goals. If you are hitting your goals easily, consider setting them higher. Goals should be challenging.

As you knock out your small goals year-to-year, you will find that the big goal that looked impossible is achieved. As your income climbs yearly, you will look at your account one day and see that million-dollar number that so many strive for. Remember, accumulating a big number in your portfolio is not the goal. The goal is to obtain income, and the capital in your portfolio is the means to achieve that end.

Shutterstock

Conclusion

Are you “too young” to start dividend investing? Of course not! (Though if you are under 18, you will have to get your parents or grandparents to set up a brokerage account!)

The earlier you start, the better. You can start building an income stream today. Focus on growing it larger, using the power of compounding to reinvest and watch your income grow faster. I’ve been income investing my entire career. I’ve seen my peers become irrationally exuberant when the bull market is roaring, and I’ve seen them hang their heads in defeat when the bear market rolls in.

Meanwhile, I busied myself with growing my income stream regardless of what mood the market was in. In reality, growing my income in bear markets is much easier because I can invest at higher yields!

I created the Income Method because I believe that it is the best investing method for me, and it is easily adapted to the needs of others. Among the many benefits:

- It helps you deal with the emotional roller-coaster of the market. Share prices change daily, and it is only human for us to get nervous when 20%+ of our retirement fund disappears. When we are emotional, most of us make poor decisions. Focusing on the income gives us a less volatile and more objective view of the actual income production potential of our portfolio.

- We can see the actual income we can draw from when we retire. There is no guessing. Every month, I know exactly how much income my portfolio produced, and I have a very good estimate of what it will produce in the future.

- We can set objective goals. A set amount of income that you need is much more tangible than a set amount of value. The stock market is down 20%+ in value year-to-date. If you hit your retirement value goal in January, you are now 20% or more below that! Do you go back to work? Or do you live tight and hope it recovers next year?

- Income is ultimately what we need. You don’t need a lump sum the day you retire, you need income for the rest of your life. Since income is what you need, why wouldn’t income be your goal? If my goal was to lose 20 pounds, I would not measure my progress by counting the miles I walk. Walking is the tool I might use to lose weight, but I will measure my progress by standing on a scale. Walking two miles a day might be sufficient to achieve that goal, or it might not. Until I stand on a scale, I would only be guessing at the progress I made. Too many investors confuse the tool (capital) with the goal (income). Maybe you need more capital, or maybe you don’t need as much – until you look at the income it produces, you have no way of knowing.

So start building your income stream early. You might discover you don’t have to work as long as you thought. When retirement approaches, you will be prepared. You won’t have to adjust your entire portfolio, hoping that the capital you built up is enough to produce the income you need. You will know by the day you retire how much income your portfolio is producing.

Ask an income investor. Odds are, they will tell you that they wished they had started investing in income investments earlier. As we age, we learn from our mistakes and get wiser. If you are still in your 20s, 30s, or 40s, you are lucky, you can start building your income stream earlier!