gorodenkoff

The SPDR S&P Biotech ETF (NYSEARCA:NYSEARCA:XBI) is a low-cost and convenient way for investors to gain exposure to the biotech sector. Historically, the biotech sector ebbs and flows with financial conditions and risk appetite. However, the most recent drawdown in the XBI ETF has been the steepest on recent record, and valuations remain historically cheap, with many biotech companies still trading for cash. I would recommend long-term investors continue to accumulate shares of the XBI ETF.

Fund Overview

The SPDR S&P Biotech ETF provides investors with a broad exposure to biotechnology companies. The fund has $7.9 billion in assets.

Strategy

The XBI ETF seeks to provide returns that correspond to the S&P Biotechnology Select Industry Index (“Index”). The Index represents the biotechnology sub-industry within the S&P Total Market Index. To qualify for the Index, companies must have market capitalization greater than $500 million and meet certain liquidity requirements. The Index is modified equal weight and is rebalanced and reconstituted quarterly.

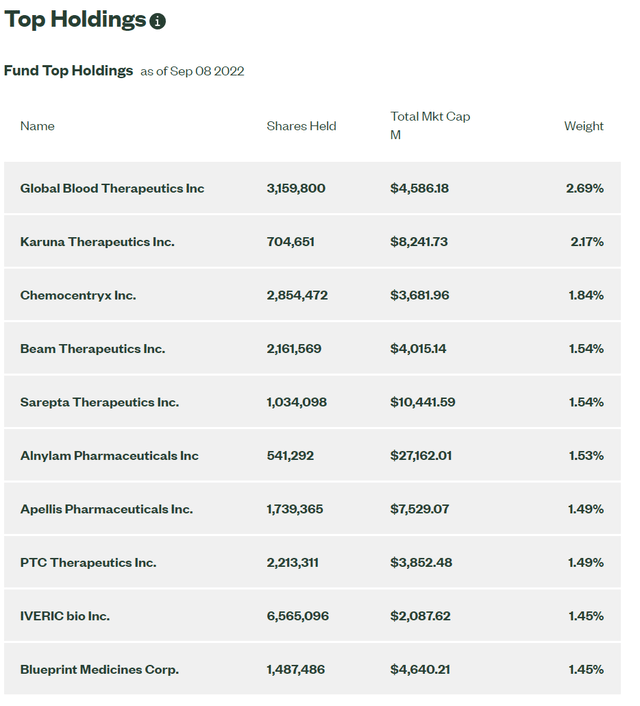

Portfolio Holdings

Due to the fact that the underlying index is modified equal weight, no single company dominates the index. The 10 largest holdings have a combined 17.2% weight, and there are 133 holdings in total in the fund (Figure 1).

Figure 1 – XBI ETF top 10 holdings (ssga.com)

Returns

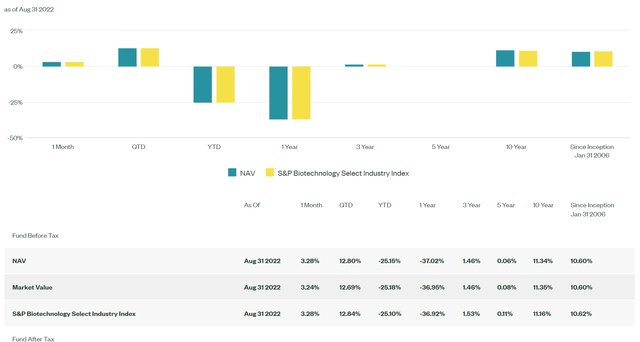

Although the long-term returns of the XBI ETF have been decent, recent results have been poor. The fund has a 10 year average return of 11.3%, while it’s 3 Yr return is only 1.5%. YTD, the XBI ETF is down 25.1% to August 31, and it is currently down 50% from the early 2021 peak.

Figure 2 – XBI ETF historical returns (ssga.com)

Distribution & Yield

The XBI ETF does not pay a distribution, as its underlying companies are mostly pre-revenue biotech companies.

Fees

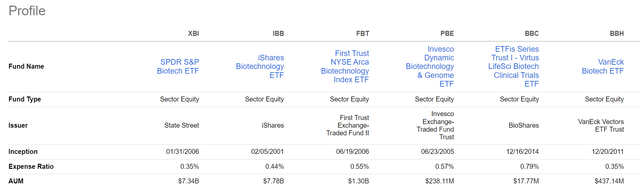

The XBI ETF is relatively low cost, with a 0.35% gross expense ratio. This is among the lowest of the peer biotech ETF funds (Figure 3).

Figure 3 – Peer biotech funds (Seeking Alpha)

Biotech Returns Are Highly Dependent On Financial Conditions And Risk Appetite

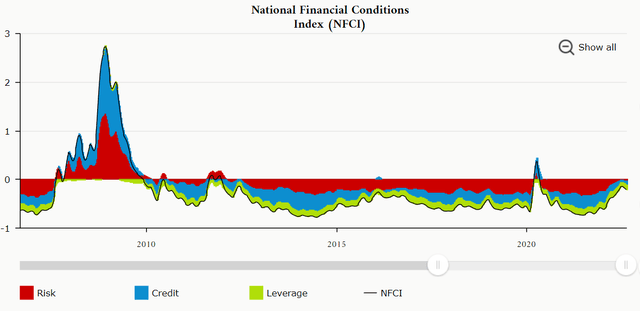

Looking at Figure 4 and 5 together, we see that when financial conditions tighten (like 2008-9, 2011, 2015-2016, and 2020), the XBI ETF usually takes a tumble. This is because biotech companies are usually pre-revenue hyper-growth companies and are dependent on well-functioning capital markets and loose risk-appetites to finance their operations. When financial conditions tighten, equity financing becomes scarce and biotech stocks suffer.

Figure 4 – XBI historical periods of weakness (Author created with price chart from stockcharts.com) Figure 5 – National Financial Conditions Index (chicagofed.org)

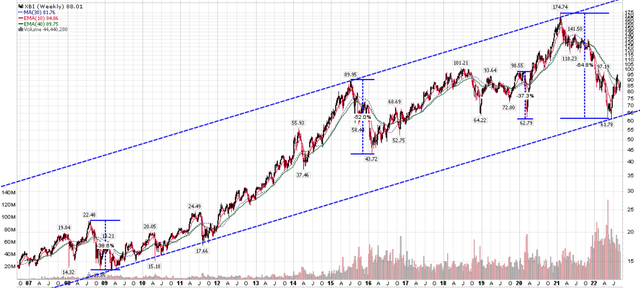

2021-2022 Largest Drawdown On Record

The 2021 to May/2022 drawdown in the XBI ETF is the largest on record. From peak to trough, the XBI ETF was down an incredible 65%, as risk appetites were slashed and investors dumped growth stocks. This was more extreme than the 2008/2009 drawdown, when XBI had a 39% drawdown, the 2015/2016 global growth scare when XBI had a 52% drawdown, and the COVID pandemic, when the XBI had a 37% drawdown (Figure 6).

Figure 6 – XBI reached bottom end of long-term channel (Author created with price chart from stockcharts.com)

In the depths of the recent drawdown, I tweeted that the XBI had reached the bottom end of a 16 year channel and risk/reward was favorable. That turned out to be prescient, as the XBI has since rebounded almost 40% from the date of my tweet (May 11th, 2022), vs. 2% for the S&P 500 (Figure 7).

Figure 7 – XBI returns from May 11th (Seeking Alpha)

Risk/Reward Remains Favorable

Looking forward, I think the risk/reward in biotech stocks and the XBI ETF is still favorable. While the Federal Reserve continues to tighten financial conditions with quantitative tightening expanding to $100 billion per month, markets seem to be taking the Fed’s actions in stride. The S&P 500 had recovered to as high as 4,300 in August, before the latest pullback. Inflation seems to be easing, which may allow the Fed to slow the pace of their rate hikes.

Most importantly, a lot of froth has been taken out of the biotech sector and valuations are now quite cheap. For example, there are still lots of biotech companies like Kodiak Sciences (KOD), Decibel Therapeutics (DBTX) and Tango Therapeutics (TNGX), just to name a few, that are trading at low or negative Enterprise Value, meaning they are essentially trading at the value of the cash on their balance sheets.

Conclusion

The SPDR S&P Biotech ETF is a low-cost and convenient way for investors to gain exposure to the biotech sector. Historically, the biotech sector ebbs and flows with financial conditions and risk appetite. However, the most recent drawdown in the XBI ETF has been the steepest on recent record, and valuations remain historically cheap, with many biotech companies still trading for cash. I would recommend long-term investors continue to accumulate shares of the XBI ETF.