luza studios/E+ through Getty Photos

Final December, we highlighted Micron (NYSE: NASDAQ:MU) was getting costly, as the corporate’s share worth moved in direction of $100 / share. In April, at $75 / share, we wrote buyers ought to start to take a glance, stating “…implying a $54-61 per share vary to start investing”. As we’ll see via this text, with the latest worth weak point, we advocate buyers start investing in Micron.

Micron Market Alternative

There is not any denying that Micron operates in a large and modernizing market.

World Reminiscence Consumption – Micron Investor Presentation

Supply

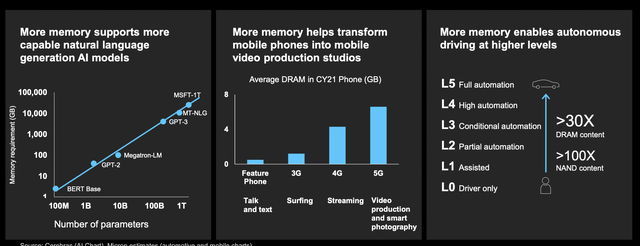

Reminiscence consumption throughout practically each use case is rising exponentially. Pure language fashions in AI are utilizing terabytes of reminiscence to assist their operations. Cell phones needing to assist 5G and different intensive operations and information based mostly actions are seeing DRAM averages enhance considerably.

Self driving vehicles require 100s of instances as a lot compute as your normal automotive which already has a big variety of electronics. DRAM and NAND bit demand is anticipated to develop by the double-digits % yearly, and from a income perspective, the DRAM+NAND market income is anticipated to greater than double from 2021-2030.

Trade Consolidation

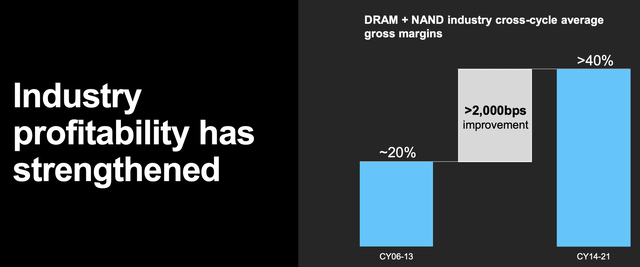

On the identical time, DRAM, an {industry} whose capital necessities historically recurrently brought about bankruptcies, has seen huge consolidation forming an oligopoly of kinds.

DRAM+NAND Margins – Micron Investor Presentation

Cross-cycle common gross margins for the {industry} have doubled for the CY2014-2021 interval versus the place they have been within the CY2006-2013 interval. In the identical timeframe, wafer fab gear spend as a % of EBITDA has been lower in half virtually to latest ranges of roughly 30%. That has enabled firms to enhance their steadiness sheets significantly.

In true oligopolist trend, the few remaining reminiscence producers don’t need this to alter. Micron has guided to proceed rising provide in step with demand development versus trying to achieve market share, and its rivals are lining up. These industry-wide enhancements in a rising {industry} are a bedrock of the thesis for a long-term funding in Micron.

Micron Capital Necessities

Micron already has a troublesome to duplicate portfolio of property. The corporate has estimated the substitute worth of its property at roughly $100 billion with 50,000 patents to guard these spectacular property.

Micron Investor Presentation

Nevertheless, ramping to new merchandise, bettering know-how, and scaling bit development are all costly. The corporate expects that to take care of provide development in step with {industry} demand (i.e. preserve its market share) it will have to speculate $15 billion in capital expenditures yearly. That is substantial for an organization with $30 billion in TTM income.

Nevertheless, it is price noting by the top of the last decade, that ought to develop in direction of $60 billion given the corporate maintains the identical market share within the rising market. Which means going ahead, the corporate will proceed to pay the most important share of its earnings in direction of capital expenditures, proscribing its theoretical money stream.

On the brilliant aspect, the oligopolistic nature of the reminiscence market means the corporate is prone to obtain its purpose of sustaining market share and the accompanying income.

Micron Shareholder Return Potential

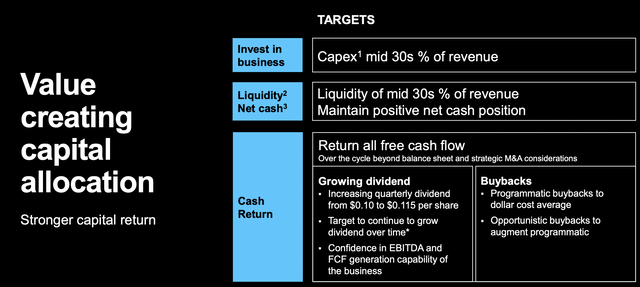

With minimal debt, we anticipate Micron to have the ability to generate modest and dependable shareholder returns over the approaching years. The corporate lately introduced a rise in its dividend in direction of roughly 1%, forming the premise of its money stream.

Micron Investor Presentation

Supply

Micron has offered steerage that helps us predict the corporate’s shareholder returns. The corporate expects $150 billion in capital spending over the subsequent decade with a goal for that to be ~35% of income. That means roughly $430 billion in income over the subsequent decade, though like capex, we anticipate it to be again weighted.

The corporate has additionally introduced a goal for a >10% FCF yield as a % of income. That signifies that on the decrease finish the corporate ought to see (as a mean) roughly $4.5 billion in FCF yearly, implying a roughly 8% FCF yield throughout the last decade. That may appear merely like market common, nonetheless we expect there’s two different benefits right here.

First the corporate will proceed rising. It will not end the last decade as a stagnant firm perpetually doomed to return 8% in FCF, nevertheless it’ll see that quantity proceed ticking up in the long term. Second, the corporate, particularly as present ranges, we anticipate to be aggressively shopping for again shares. The much less shares excellent early on the upper the top of the last decade returns are.

Present ranges signify roughly the place we advocate to start investing in Micron, and we prefer it at present ranges or decrease.

Thesis Danger

The biggest threat to our thesis is the volatility of the reminiscence markets. Even with decrease competitors, and fewer of a construct in any respect prices mentality, the {industry} nonetheless stays capitally intensive with commodity-like pricing as demand varies. Fluctuating costs might place robust restrictions on the corporate’s capacity to drive continued shareholder returns.

Conclusion

Micron has seen its share worth undergo, nonetheless, the corporate is lastly positioned at what we view as honest worth, which can allow it to proceed offering shareholder returns. The corporate is a purchase at these ranges and a robust purchase if costs drop going ahead, with the power to drive excessive single-digit shareholder returns.

The corporate expects to proceed sustaining its market energy, with substantial capital funding. The market is a unstable market however the elevated consolidation and bankruptcies in prior many years, means we anticipate the growth and bust cycles to taper. Micron itself is not chasing shareholder returns.

We advocate investing within the firm as a gentle dependable funding on the premise of its high-single digit returns, and talent to make the most of that money to generate extra long-term shareholder rewards in a rising {industry}.