alicat/E+ by way of Getty Pictures

Earnings of Wintrust Monetary Company (NASDAQ:WTFC) will likely dip this 12 months attributable to increased provisioning bills for mortgage losses amid a excessive interest-rate surroundings. Alternatively, respectable mortgage development and margin growth will possible raise earnings. Total, I am anticipating Wintrust Monetary to report earnings of $7.03 per share for 2022, down 7% year-over-year. In comparison with my final report on Wintrust Monetary, I’ve barely revised upwards my earnings estimate as a result of I’ve revised upwards each my web curiosity margin and my noninterest revenue estimates. The year-end goal value suggests a excessive upside from the present market value. Subsequently, I am upgrading Wintrust Monetary to a purchase score.

Rise in Curiosity Charges Might Improve Credit score Prices

Progress in provisioning for anticipated mortgage losses will possible be the chief contributor to an earnings decline this 12 months. I am anticipating higher-than-normal provisioning within the 12 months forward due to the faster-than-expected financial tightening. Debtors who have been already stretched to the restrict attributable to inflation might begin defaulting following the rate of interest hikes.

The Federal Reserve initiatives the goal Federal Funds charge, which is at the moment 1.50% – 1.75%, to achieve round 3.0% – 3.5% this 12 months. The final time the federal funds charge was increased than 2.0% (from 3Q 2018 to 3Q 2019), Wintrust Monetary’s nonperforming loans made up 0.44% – 0.55% of whole loans (supply: outdated 10-Q Submitting). Compared, nonperforming loans made up simply 0.16% of whole loans on the finish of March 2022, as talked about within the earnings presentation. The probabilities of nonperforming loans nearly tripling from the present stage might push Wintrust Monetary to considerably add to its reserves.

The concern of a recession may set off increased provisioning for anticipated mortgage losses. Furthermore, additions to the mortgage portfolio would require additional provisioning. I’ve mentioned my mortgage development assumptions in additional element under.

Contemplating the components talked about above, I am anticipating the supply expense, web of reversals, to make up 0.22% of whole loans in 2022. Compared, the online provision expense averaged 0.16% of whole loans from 2017 to 2019, and 0.20% of whole loans within the final 5 years. In my final report on Wintrust Monetary, I estimated a web provision expense of $60 million for 2022. I’ve now revised upwards my web provision estimate to $84 million.

Excessive-Single-Digit Mortgage Progress Potential

Wintrust Monetary’s mortgage portfolio grew by 1.4% within the first quarter of 2022 (5.7% annualized), which missed my expectations. The administration talked about within the newest convention name that it expects mid-to-high single-digit mortgage development for this 12 months.

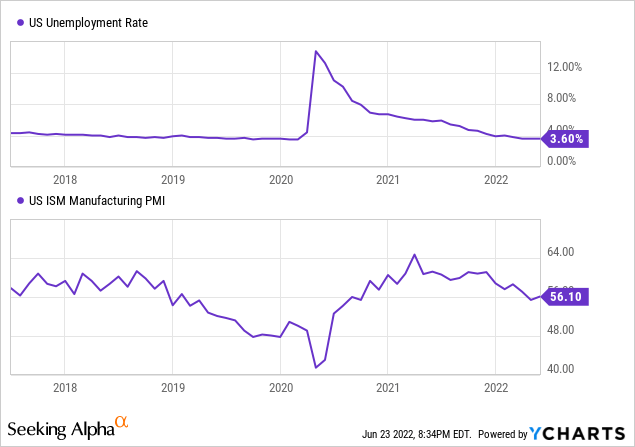

In my view, mortgage development will possible speed up from the primary quarter’s stage as a result of the pipelines have grown, as talked about within the convention name. Furthermore, sure financial components, just like the robust job market and manufacturing exercise, as measured by the PMI, bode properly for mortgage development.

Contemplating these components, I am anticipating the mortgage portfolio to extend by 2.25% in every of the final three quarters of 2022, resulting in full-year mortgage development of 8.4%. In comparison with my final report on Wintrust Monetary, I’ve not modified my mortgage development estimate for the final three quarters of this 12 months. Nonetheless, as a result of mortgage development missed my expectations within the first quarter, my full-year mortgage development estimate is now decrease than earlier than.

In the meantime, I am anticipating deposit development to nearly match mortgage development within the final 9 months of the 12 months. The next desk reveals my steadiness sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Monetary Place | |||||||||

| Web Loans | 21,503 | 23,668 | 26,643 | 31,760 | 34,541 | 37,448 | |||

| Progress of Web Loans | 9.5% | 10.1% | 12.6% | 19.2% | 8.8% | 8.4% | |||

| Different Incomes Property | 4,098 | 4,685 | 6,935 | 9,801 | 12,252 | 12,836 | |||

| Deposits | 23,183 | 26,095 | 30,107 | 37,093 | 42,096 | 45,134 | |||

| Borrowings and Sub-Debt | 1,218 | 1,213 | 1,783 | 2,638 | 2,426 | 2,581 | |||

| Widespread fairness | 2,852 | 3,143 | 3,566 | 3,703 | 4,086 | 4,308 | |||

| Guide Worth Per Share ($) | 50 | 55 | 62 | 64 | 71 | 74 | |||

| Tangible BVPS ($) | 41 | 44 | 50 | 52 | 59 | 62 | |||

Supply: SEC Filings, Creator’s Estimates (In USD million until in any other case specified) | |||||||||

Mortgage Combine Makes the Topline Fairly Charge-Delicate

Wintrust Monetary’s web curiosity margin is kind of delicate to rate of interest hikes. This sensitivity is generally attributable to the well-positioned mortgage portfolio. Round 53.6% of whole loans will re-price inside three months and an extra 26.4% of whole loans will re-price inside 4 to 12 months of an rate of interest hike, as talked about within the presentation. Altogether, a whopping 80% of the entire mortgage portfolio will re-price within the 12 months following the speed hike.

Additional, Wintrust Monetary has excessive ranges of money and money equivalents which give the corporate the pliability to rapidly profit from rate of interest hikes. As talked about within the presentation, the administration has deliberately maintained a excessive stage of interest-bearing money to restrict locking in low rates of interest. Curiosity-bearing deposits with different banks, which is the largest money part, made up 8.5% of whole incomes property on the finish of March 2022.

Alternatively, the big securities portfolio will maintain again the common incomes asset yield as rates of interest enhance. Funding securities made up 14% of whole incomes property on the finish of March 2022. Furthermore, round 58.6% of the deposit guide will re-price quickly after each charge hike, which is able to harm the online curiosity margin. Within the final rate of interest hike cycle, which was from the third quarter of 2015 to the second quarter of 2019, Wintrust Monetary had fairly a excessive deposit beta of 44%, as talked about within the presentation. Which means that each 100-basis factors enhance in rates of interest elevated the deposit prices by 44 foundation factors.

The administration’s interest-rate sensitivity evaluation given within the 10-Q submitting reveals {that a} 200-basis factors gradual enhance in rates of interest might increase the online curiosity revenue by 11.2% over twelve months. Contemplating these components, I am anticipating the margin to extend by 40 foundation factors within the final three quarters of 2022, from 2.6% within the first quarter of the 12 months. It will end result within the common margin for 2022 being 20 foundation factors increased than the common margin for 2021. In my final report on Wintrust Monetary, I estimated the margin for 2022 to be 15 foundation factors increased than final 12 months. I’ve revised upwards my margin estimate largely due to the most recent Federal Reserve projection which is extra hawkish than I anticipated.

Anticipating Earnings to Dip by 7%

The expansion in provisioning will possible drag earnings this 12 months relative to final 12 months. Furthermore, the noninterest revenue will possible be decrease this 12 months as a result of increased rates of interest will finish the good thing about mortgage refinancing. In comparison with my final report on Wintrust Monetary, I’ve revised upwards my noninterest revenue estimate as a result of the mortgage banking revenue for the primary quarter of the 12 months exceeded my expectations.

The anticipated mortgage development and margin growth will possible assist the underside line. Total, I am anticipating the corporate to report earnings of $7.03 per share in 2022, down 7% year-over-year. The next desk reveals my revenue assertion estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Earnings Assertion | |||||||||

| Web curiosity revenue | 832 | 965 | 1,055 | 1,040 | 1,125 | 1,340 | |||

| Provision for mortgage losses | 30 | 35 | 54 | 214 | (59) | 84 | |||

| Non-interest revenue | 320 | 356 | 407 | 604 | 586 | 555 | |||

| Non-interest expense | 732 | 826 | 928 | 1,040 | 1,133 | 1,221 | |||

| Web revenue – Widespread Sh. | 248 | 335 | 347 | 272 | 438 | 408 | |||

| EPS – Diluted ($) | 4.40 | 5.86 | 6.03 | 4.68 | 7.58 | 7.03 | |||

Supply: SEC Filings, Creator’s Estimates (In USD million until in any other case specified) | |||||||||

In my final report on Wintrust Monetary, I estimated earnings of $6.81 per share for 2022. I’ve revised upwards my earnings estimate partly due to my web curiosity margin estimate revision. Additional, I’ve revised upwards the noninterest revenue estimate following the primary quarter’s shock.

Precise earnings might differ materially from estimates due to the dangers and uncertainties associated to inflation, and consequently the timing and magnitude of rate of interest hikes. Additional, the specter of a recession can enhance the provisioning for anticipated mortgage losses past my expectation.

Upgrading to a Purchase Ranking

Wintrust Monetary is providing a dividend yield of 1.7% on the present quarterly dividend charge of $0.34 per share. The earnings and dividend estimates recommend a payout ratio of 19% for 2022, which is well sustainable and near the five-year common of 17%. Subsequently, the outlook of an earnings dip presents no menace to the dividend stage.

I’m utilizing the historic price-to-tangible guide (“P/TB”) and price-to-earnings (“P/E”) multiples to worth Wintrust Monetary. The inventory has traded at a mean P/TB ratio of 1.49 previously, as proven under.

| FY17 | FY18 | FY19 | FY20 | FY21 | Common | |

| T. Guide Worth per Share ($) | 41.1 | 44.0 | 48.5 | 52.1 | 58.9 | |

| Common Market Worth ($) | 74.6 | 85.8 | 69.3 | 47.9 | 78.2 | |

| Historic P/TB | 1.81x | 1.95x | 1.43x | 0.92x | 1.33x | 1.49x |

| Supply: Firm Financials, Yahoo Finance, Creator’s Estimates | ||||||

Multiplying the common P/TB a number of with the forecast tangible guide worth per share of $62.5 offers a goal value of $92.9 for the tip of 2022. This value goal implies an 18.3% upside from the June 23 closing value. The next desk reveals the sensitivity of the goal value to the P/TB ratio.

| P/TB A number of | 1.29x | 1.39x | 1.49x | 1.59x | 1.69x |

| TBVPS – Dec 2022 ($) | 62.5 | 62.5 | 62.5 | 62.5 | 62.5 |

| Goal Worth ($) | 80.4 | 86.7 | 92.9 | 99.2 | 105.4 |

| Market Worth ($) | 78.5 | 78.5 | 78.5 | 78.5 | 78.5 |

| Upside/(Draw back) | 2.4% | 10.4% | 18.3% | 26.3% | 34.2% |

| Supply: Creator’s Estimates |

The inventory has traded at a mean P/E ratio of round 12.7x previously, as proven under.

| FY17 | FY18 | FY19 | FY20 | FY21 | Common | |

| Earnings per Share ($) | 4.40 | 5.86 | 6.03 | 4.68 | 7.58 | |

| Common Market Worth ($) | 74.6 | 85.8 | 69.3 | 47.9 | 78.2 | |

| Historic P/E | 17.0x | 14.7x | 11.5x | 10.2x | 10.3x | 12.7x |

| Supply: Firm Financials, Yahoo Finance, Creator’s Estimates | ||||||

Multiplying the common P/E a number of with the forecast earnings per share of $7.03 offers a goal value of $89.5 for the tip of 2022. This value goal implies a 14.0% upside from the June 23 closing value. The next desk reveals the sensitivity of the goal value to the P/E ratio.

| P/E A number of | 10.7x | 11.7x | 12.7x | 13.7x | 14.7x |

| EPS 2022 ($) | 7.03 | 7.03 | 7.03 | 7.03 | 7.03 |

| Goal Worth ($) | 75.4 | 82.5 | 89.5 | 96.5 | 103.5 |

| Market Worth ($) | 78.5 | 78.5 | 78.5 | 78.5 | 78.5 |

| Upside/(Draw back) | (4.0)% | 5.0% | 14.0% | 22.9% | 31.9% |

| Supply: Creator’s Estimates |

Equally weighting the goal costs from the 2 valuation strategies offers a mixed goal value of $91.2, which means a 16.1% upside from the present market value. Including the ahead dividend yield offers a complete anticipated return of 17.9%.

In my final report as properly, I made up my mind a goal value of $91.2 per share for December 2022. On the time my final report was issued, the market value was fairly near the goal value. Subsequently, I adopted a maintain score on Wintrust Monetary. Since then, the market value has plunged leaving the next implied value upside. Because of this, I am upgrading Wintrust Monetary to a purchase score.