Up to date on July twenty first, 2022 by Bob Ciura

The enchantment of progress shares is that they’ve the potential for big returns. Contemplate the large rally by Tesla, Inc. (TSLA); in simply the previous three years, the inventory has returned over 1,300% to shareholders. That’s a lifetime of returns and extra for a lot of traders, and Tesla has completed this in a really brief time period.

The draw back of progress shares after all, is that volatility can work each methods. Tesla has lately grow to be persistently worthwhile, however that was definitely not at all times the case. And the corporate faces a mounting debt load, along with share issuances that dilute shareholders to assist progress. Progress shares can generate sturdy returns, but additionally carry the burden of excessive expectations attributable to their sky-high valuations, and Tesla is definitely no totally different.

Plus, Tesla doesn’t pay a dividend to shareholders, which can also be an vital issue for earnings traders to think about. Because of this, we consider earnings traders in search of decrease volatility ought to take into account high-quality dividend progress shares, such because the Dividend Aristocrats.

The Dividend Aristocrats are a gaggle of 66 shares within the S&P 500 Index with 25+ consecutive years of dividend progress. You may obtain an Excel spreadsheet of all 66 (with metrics that matter reminiscent of dividend yield and P/E ratios) by clicking the hyperlink beneath:

Over time, any firm – even Tesla – may make the choice to begin paying dividends to shareholders, if it turns into worthwhile sufficient. Previously decade, different expertise firms reminiscent of Apple, Inc. (AAPL) and Cisco Programs (CSCO) have initiated quarterly dividends. These have been as soon as quickly rising shares that matured, and Tesla may try this someday.

Nevertheless, the power for an organization to pay a dividend is dependent upon its enterprise mannequin, progress prospects, and monetary place. Even with Tesla’s big run-up in share worth, whether or not an organization pays a dividend is dependent upon the underlying fundamentals. Whereas many progress shares have made the transition to dividend shares in recent times, it’s uncertain Tesla will be a part of the ranks of dividend-paying shares any time quickly.

Enterprise Overview

Tesla was based in 2003 by Elon Musk. The corporate began out as a fledgling electrical automotive maker however has grown at a particularly excessive fee up to now a number of years. Tesla has a present market capitalization above $700 billion, making it a mega-cap inventory.

Amazingly, Tesla’s present market capitalization is greater than seven occasions the mixed market caps of auto trade friends Ford Motor (F) and Common Motors (GM).

Tesla has a rising lineup of various fashions and worth factors and is trying into increasing that lineup additional to grow to be a full-line automaker. Since going public in 2010 at simply $17 per share, Tesla has produced excellent returns for shareholders on hopes of large future progress.

Since then, it has grown into the chief in electrical automobiles, and it additionally has enterprise operations in renewable power. Tesla is slated to supply about $83 billion in income in 2022.

Tesla is off to an excellent begin to 2022.

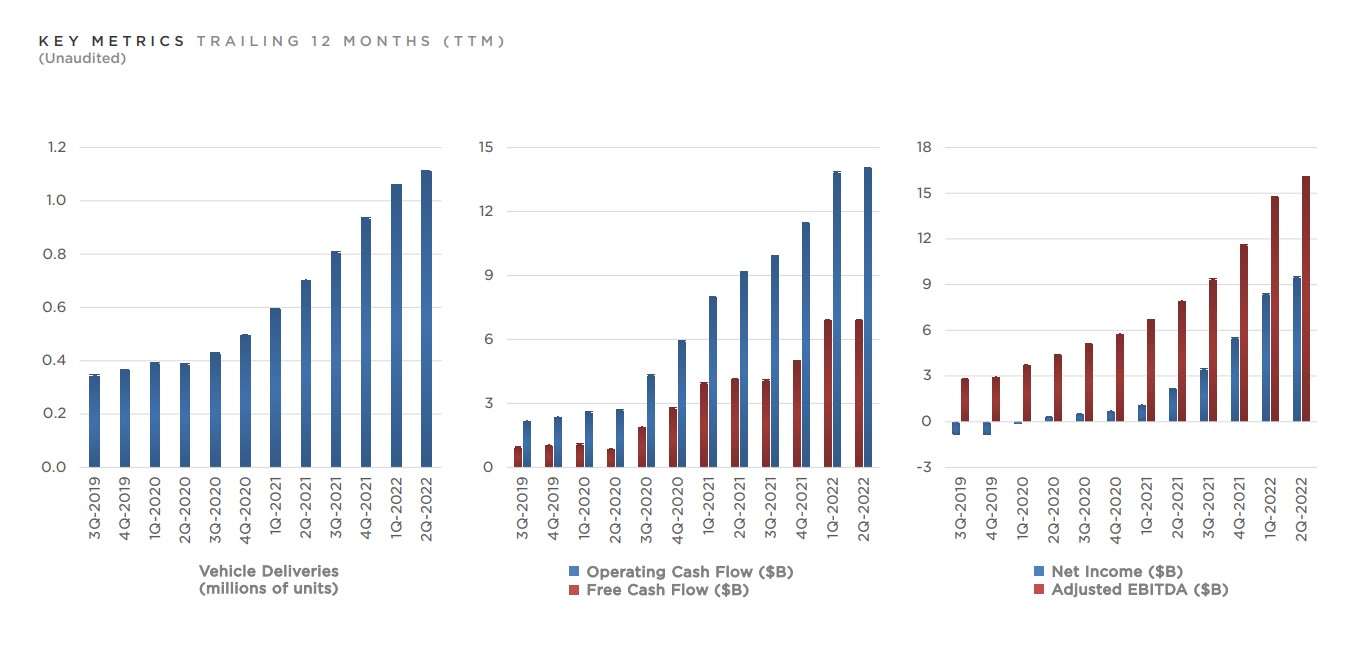

Supply: Investor Replace

On July twentieth, the corporate reported better-than-expected adjusted earnings-per-share of $2.27 within the second quarter. This beat expectations of $1.81 per share. Nevertheless, quarterly income of $16.93 billion got here in barely wanting expectations, which referred to as for $17.1 billion. Nonetheless, income elevated 42% year-over-year.

Automotive gross margin of 27.9% represented a decline from 32.9% within the earlier quarter, and 28.4% within the year-ago quarter. Margin contraction was due principally to value inflation.

Progress Prospects

Tesla’s main progress catalyst is to increase gross sales of its core product line, in addition to generate progress from new automobiles. The corporate’s S/X platform that gave it the primary bout of sturdy progress has light in recognition, and Tesla is as a substitute centered on ramping its 3/Y platform.

Certainly, the three/Y platform accounted for about 99% of all deliveries in the newest quarter. Along with that, Tesla is constant to develop new fashions, with a pickup truck rumored, a semi truck, and even a less expensive, extra attainable mannequin than the three.

Tesla is investing closely in strategic progress, via acquisitions in addition to inside funding in new initiatives. First, Tesla acquired SolarCity in 2016 for $2.6 billion. Tesla can also be ramping up car manufacturing. Tesla now operates “Gigafactories” in Berlin, Austin, and Shanghai, with extra to come back to assist its burgeoning demand.

Tesla’s progress in income per share has been nothing wanting excellent. It produced greater than 2 hundred occasions extra income per share final 12 months than 2010, the 12 months it got here public. That degree of progress is tough to seek out anyplace, and it’s why Tesla’s shares have carried out so nicely. Whether or not Tesla can proceed to take care of its excessive fee of progress is one other query.

Will Tesla Pay A Dividend?

Tesla has skilled speedy progress of cargo volumes and income up to now a number of years. However in the end, an organization’s potential to pay dividends to shareholders requires success on the underside line as nicely. Whereas Tesla has been the epitome of a progress inventory via its top-line progress and big share worth features, its profitability remains to be diminutive in relation to its market cap.

With out reaching regular profitability, an organization merely can’t afford to pay a dividend to shareholders. In actual fact, persistently dropping cash means an organization could have hassle preserving its doorways open, if losses persist over time. Nevertheless, whereas this was a difficulty for Tesla, these points appear to have been mounted by ever-rising supply volumes.

Supply: Investor Replace

Tesla misplaced cash because it turned publicly traded again in 2010, up till 2020. It goes with out saying {that a} money-losing firm has to lift capital to proceed to fund operations. To that finish, Tesla has bought shares and issued debt to cowl losses and fund growth in recent times, each of which make paying a dividend much more tough.

Nevertheless, since 2020, Tesla has quickly expanded its profitability, and produced virtually $6 billion in internet earnings in 2021. The corporate additionally produced practically that a lot in free money stream, making it a lot simpler to service its debt obligations, in addition to keep away from future dilutive share issuances.

We see the sizable enchancment in profitability and free money stream, in addition to the improved steadiness sheet as supportive of the corporate’s potential to finally pay a dividend.

Nevertheless, Tesla remains to be very a lot in hyper-growth mode, and we anticipate any dividend that could be paid to be a few years away.

Tesla’s Inventory Dividend

Tesla’s well-known CEO, Elon Musk, mentioned lately that he needs Tesla to “enhance within the variety of licensed shares of frequent inventory … with a view to allow a inventory break up of the Firm’s frequent inventory within the type of a inventory dividend.”

Primarily, a inventory dividend is the place an organization splits its inventory, and the affect on shareholders is that the worth of the corporate doesn’t change, however the share worth is decrease as a result of there are extra shares excellent.

For instance, Tesla trades for $815 right now, so if it enacted a inventory dividend of 4 shares for each share of Tesla right now, the excellent share depend would rise from 1.155 billion right now, to 4.6 billion post-stock dividend. That might imply the share worth would want to replicate the dividend, so every share would then be value one-fifth its present worth, or roughly $204.

A inventory dividend just isn’t essentially a fabric occasion for shareholders, as a result of their relative stake within the firm stays the identical; they simply have extra shares at a cheaper price. Nevertheless, traders are likely to view inventory dividends and splits as bullish occasions, and so they can set off rallies within the share worth.

Remaining Ideas

Tesla has been among the many market’s hottest shares because the begin of the pandemic, producing an enormous rally that has taken it above a trillion {dollars} in market cap. Shareholders who had the foresight to purchase Tesla close to the 2019 lows have been rewarded with huge returns via a hovering share worth.

Nevertheless, traders in search of dividends and security over the long term ought to most likely proceed to take a cross on Tesla inventory. The corporate wants to make use of all of the money stream at its disposal to enhance its operations’ profitability, and put money into progress initiatives. Whereas there’s at all times a chance that Tesla’s large share worth rally may proceed, it is usually doable the inventory may fall. Buyers ought to do not forget that volatility can work each methods, and certainly, Tesla shareholders have been reminded of this in early-2022.

Extra defensive traders reminiscent of retirees, who’re primarily involved with safety of principal and dividend earnings, ought to as a substitute deal with high-quality dividend progress shares such because the Dividend Aristocrats. It’s unlikely Tesla will ever pay a dividend, or at the very least, not for a few years.

See the articles beneath for evaluation on whether or not different shares that at the moment don’t pay dividends will someday pay a dividend:

- Will Amazon Ever Pay A Dividend?

- Will Shopify Ever Pay A Dividend?

- Will PayPal Ever Pay A Dividend?

- Will Superior Micro Units Ever Pay A Dividend?

- Will Chipotle Ever Pay A Dividend?

If you’re fascinated by discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases might be helpful:

The key home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].