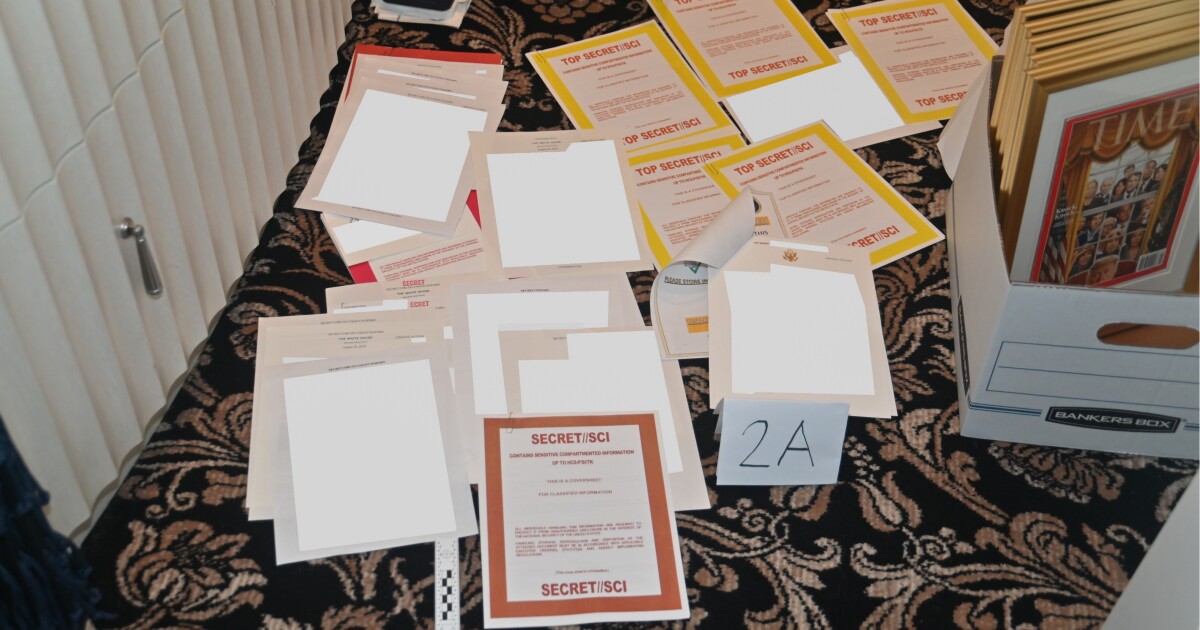

Biscut/iStock by way of Getty Pictures

By Chris Turner

Yen loses its protected haven shine

With USD/JPY buying and selling above 140 and monetary belongings beneath strain, one might suppose that the yen is shedding its standing as a protected haven foreign money. The information help that concept. In 2020, when the world was rocked by the pandemic, USD/JPY had a 0.35 optimistic correlation with the MSCI World fairness benchmark. That meant that when equities fell, the JPY sometimes outperformed towards the greenback – i.e., JPY as a perceived protected haven. This 12 months, the USD/JPY correlation with equities is now zero, suggesting the JPY has misplaced some protected haven properties. Why?

I’d say it’s down to 2 foremost components: a) the character of the disaster, and b) the juxtaposition of the US and Japanese macrofinancial insurance policies.

On the previous, the conflict in Ukraine has seen power costs surge. On condition that Japan imports all its fossil gasoline power, Japan’s phrases of commerce have collapsed – that’s, the worth Japan receives for its exports versus what it pays for its imports. That could be a giant unfavourable revenue shock. That has been most seen in Japan’s commerce account. Final summer time, Japan was incomes JPY6trn a 12 months on commerce. During the last 12 months, that commerce surplus has swung to a JPY6trn deficit on greater power payments. A protected haven foreign money sometimes must be backed by a powerful commerce surplus, such that there’s a pure demand for a foreign money in a disaster. The JPY has misplaced that backing from commerce.

On the US-Japan story, the US Federal Reserve and the Financial institution of Japan (BoJ) are nearly as far aside as you will get. The hawkish Fed has raised charges aggressively this 12 months and guarantees to do extra. The BoJ is likely one of the only a few dovish central banks within the work (joined just lately by the Individuals’s Financial institution of China). It’s nonetheless participating in quantitative easing. In apply, this now signifies that holding a 3m USD deposit pays 3% each year. Maintain a 3m JPY deposit and you’ll nonetheless be charged 0.10% for the pleasure. This 3%+ unfold in charges actually raises the bar for the JPY to outperform as a protected haven foreign money.

JPY would rally if equities fell exhausting sufficient…

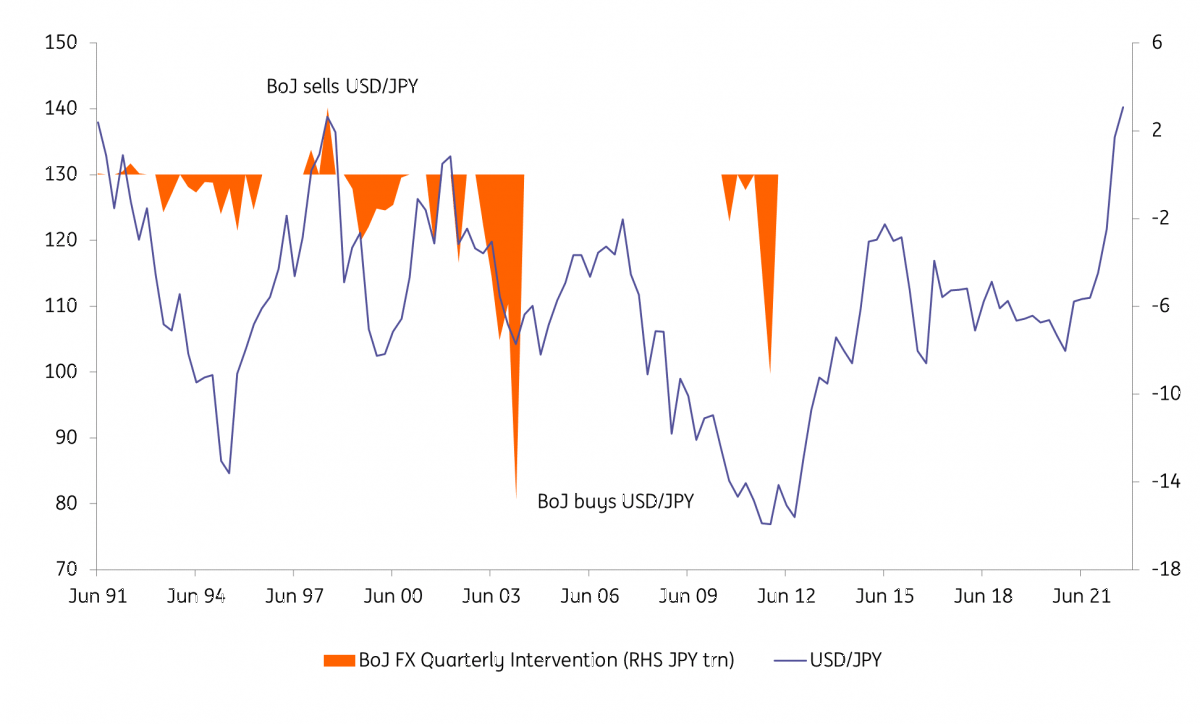

Two ultimate factors – I think that if US equities fell exhausting sufficient that the Fed tightening cycle was considerably re-priced decrease (and we haven’t seen an excessive amount of of that this 12 months), the JPY would outperform once more and USD/JPY would drop. I additionally suspect USD/JPY is transferring right into a zone the place Japanese policymakers will present extra overt concern – they intervened to promote USD/JPY again at these ranges within the late Nineties.

However equally, we’re a great distance from a Nineteen Eighties Plaza-type accord to weaken the greenback basically. That might require the Fed needing to chop charges (extremely unlikely this 12 months) or the BoJ to hike charges (once more unlikely). So given the way in which issues are going this 12 months, a transfer to 150 actually can’t be dominated out.

USD/JPY And BoJ Intervention Ranges. BoJ Bought USD/JPY Above 140 In The Late ’90s (Japanese Ministry of Finance, ING)

Content material Disclaimer

This publication has been ready by ING solely for info functions no matter a specific consumer’s means, monetary state of affairs or funding aims. The data doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra.

Authentic Publish