Sakorn Sukkasemsakorn

At the end of 2022, ClearSign Technologies (NASDAQ:CLIR), an emerging supplier of emission-control technologies, closed at 50 cents. Tax-loss sellers who gave up on the stock and re-entered their positions re-captured a triple return. Why CLIR stock closed at $1.50 recently is likely based on management’s commentary on its first-quarter conference call.

ClearSign is a pre-revenue firm. It posted a loss in the first quarter on revenue that beat expectations by $0.28 million.

ClearSign Q1/2023 Updates

Buyers picked up CLIR stock when the company Chief Executive Officer, Jim Deller, announced multiple sales of ClearSign’s boiler burners in two key markets. Sales in California and Texas are a good starting point to reverse the stock’s downtrend that began in 2021 and ended in late 2022.

The sales traction, combined with another multi-heat order from a repeat customer, suggests that the business is transitioning into the commercialization phase.

In Q1, the company received an Engineering Order and Follow on order for Two Multi Burner Heaters. The 13-burner order is worth anywhere from $1.3 million to $3.25 million. On the conference call, CEO Deller said that burner prices range from $100,000 to $250,000. Orders that include accompanying engineering and testing will have revenue in the $250,000 ballpark.

In the quarter, the company completed its phase 1 testing of the Ultra-Low NOx 100% Hydrogen Burner. It submitted a follow-up proposal for testing and industry support documentation. This is required for the Phase 2 grant, worth up to $1.6 million over two years.

ClearSign entered the Texas market when a global chemical company purchased its burner. The firm said the customer would install this boiler burner into a process heater. This replaces an existing heater and Selective Catalytic Reduction system. ClearSign will install the boiler in the third quarter of 2023.

The deals added $900,000 to the company’s revenue in Q1.

Profitability Assessment

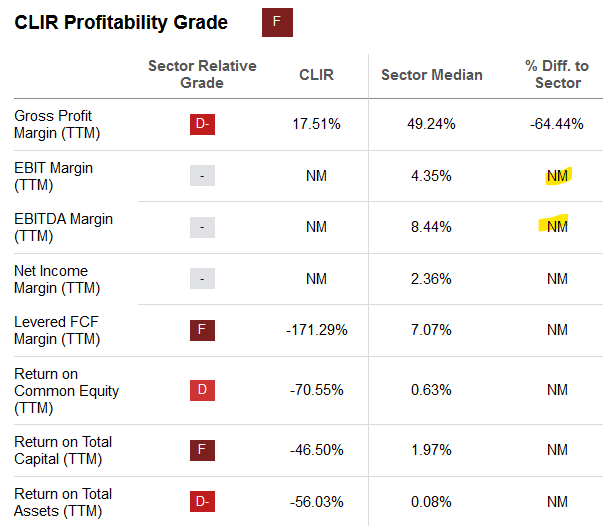

ClearSign has enough cash on hand. IT ended Q1/2023 with $8.5 million in cash, cash equivalents, and short-term investments. However, among the three grades from Seeking Alpha quant scores, its profitability is the weakest with an “F.”

Seeking Alpha Premium

The company needs more customer orders. Until then, investors compare ClearSign to the sector.

Seeking Alpha Premium

Opportunity

Markets already priced in the prospects of ClearSign entering the commercialization phase of its business. Since CEO Deller said the company is in the early stages, its stock price risks pulling back from here. To sustain its uptrend, ClearSign needs a substantial uptick in orders. Shareholders should expect this would increase its quarterly revenues, albeit in a lumpy pattern.

Cautious investors may wait for the company to announce an increase in reservations first. To date, the pre-order volumes have yet to appear. Until ClearSign announces high volumes from its first order, investors should continue to treat the stock as highly speculative.

Once ClearSign books orders, it is in a better position to plan its commercial operations. The firm is asset-light. This enables it to leverage its technology while limiting its capital expenditure. For example, the company has alliance partners like Zeeco. Founded in 1979, Zeeco is the second-largest global combustion equipment manufacturer. It may rely on Zeeco’s sales team initially. If sales gain momentum, ClearSign may develop its sales team to expand margins.

Current Liquidity Position

Readers may quickly review the balance sheet trends on the bar charts here. Since Sept. 2020, cash and equivalents trended lower. Shareholders expect declining cash levels for a clean energy firm in the pre-revenue phase.

Seeking Alpha Premium

The company ended the quarter with $8.5 million as of March 31, 2023. It incurred $1.81 million in operating expenses. After adding other income that included interest, government assistance, and a gain from the sale of assets, the company lost $1.43 million.

The last quarter’s cash burn suggests that ClearSign will not need to raise liquidity for nearly six quarters. This base case assumes the company sells a negligible number of boilers to customers in the validation phase of the product.

Speculators are treating ClearSign as a lower-risk nano-cap firm. Its operating cash outflow reduction buys the company time to win initial orders from its long-time prospective customers. Once it signs a large deal, other energy firms will notice. They, too, will consider putting orders for ClearSign’s boilers.

Balance Sheet Health

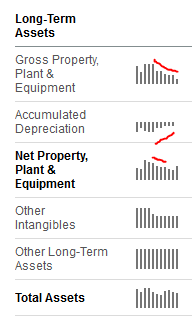

To minimize its cash burn rate, ClearSign lightened its asset load since 2020. It reduced its assets, especially equipment. This decreased its accumulated depreciation. This lowered risks to its balance sheet since the company will not have such large expenses.

Seeking Alpha

Net debt is negligible. Total debt fell from $700,000 in Sept. 2020 to $300,000 in the last quarter.

Risks

ClearSign’s partnership with manufacturers in China is the biggest risk. The company partnered with a Chinese firm in the country, Jiangsu Shuangliang Boiler Co. last year. Its partner provided all the costs. Although it certified the 125 horsepower burner, it is waiting for the 500 horsepower boiler burner certification.

Investors will need to patiently wait for this venture to pay off. The certification uncertainty could weigh heavily on shares.

Your Takeaway

ClearSign’s progress in California and Texas is a positive inflection point. Its exposure at the American Petroleum Institute Conference should raise awareness of its boilers. It is in a low-risk position to ramp up its product in the commercialization phase, thanks to Zeeco.

Any positive press releases of vendors ordering ClearSign’s boilers could send shares higher.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.