Jason Shapiro, an skilled dealer and writer of the Crowded Market Report, revealed that the inventory market wouldn’t yield any long-term positive factors over the following decade. Shapiro additionally believes that the chances of a continued Bitcoin rally are very low.

Jason additionally reveals that the lows for crypto will not be but in and that crypto will decline considerably near the September FOMC assembly.

In line with him, any money-making alternative would come up from figuring out short-term value actions, somewhat than long-term holdings.

The Idea Of Contrarian Buying and selling

Jason Shapiro is thought for his contrarian buying and selling. In line with him, top-of-the-line indicators for long-term value evaluation is knowing the crowdedness of lengthy and quick positions on any inventory. He believes that more often than not, the inventory will transfer in the other way of the frequent consensus.

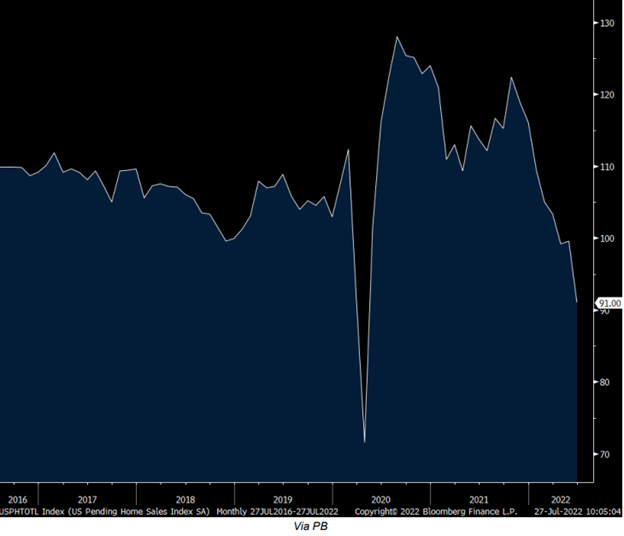

Within the present market situation, Jason believes that the sort of cash within the inventory market doesn’t usually result in long-term development. Citing the instance of the Tokyo inventory market Nikkei, Shapiro reveals that a whole lot of the time markets proceed to function in long-term losses. He believes that the US inventory market will meet the same destiny.

Why A Bitcoin Rally Is Unlikely

Jason Shapiro revealed a sequence of charts that spotlight that industrial merchants are hedging Ethereum greater than Bitcoin. In line with him, it’s not a superb signal for a continued Bitcoin rally. He additionally revealed that whereas the variety of those that have been lengthy on BTC on the high of the bull market has decreased, the vast majority of persons are nonetheless lengthy on BTC.

In line with his precept of contrarian buying and selling, he believes that holding BTC is not going to end in any long-term achieve.

Shapiro can also be one of many many specialists who consider that the Federal Reserve won’t be able to pivot on a fast foundation. Many additionally consider that the longer term inflation numbers will do little to ease the Quantitative Tightening coverage by the Fed. If the September FOMC assembly leads to one other unusually giant hike, it may very well be unhealthy information for the crypto business.

The introduced content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.