alvarez

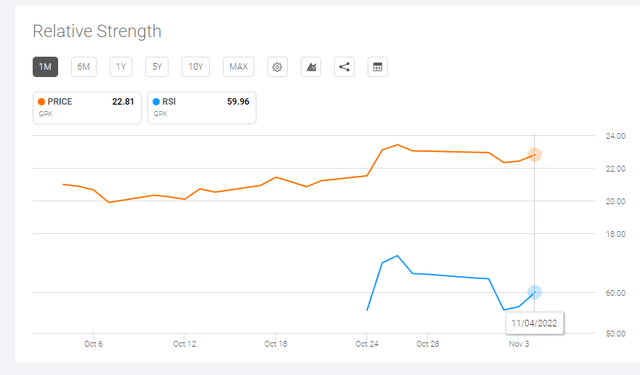

I did my due diligence. Graphic Packaging Holding Company (NYSE:GPK) deserves a hold recommendation from yours truly. My rating is contrary to the buy recommendations of other SA authors, Wall Street analysts, and Seeking Alpha Quant AI. My takeaway is that swing traders should cash out that 10.77% 1-month gain of GPK.

Seeking Alpha

You can do whatever you want. Seeking Alpha Quant AI says GPK still has a bullish 59.56. This is much lower than the oversold level of 70. RSI’s bullish indicator is a valid reason to ignore my hold recommendation for GPK.

Seeking Alpha Premium

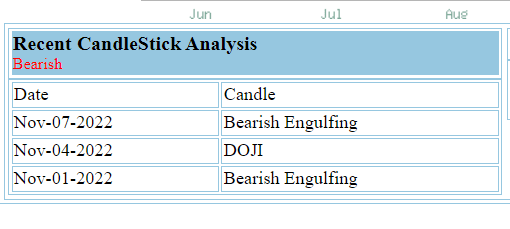

My hold recommendation is because I heed candlestick patterns. The bearish engulfing alert that GPK posted yesterday is partly why I cannot rate GPK as a buy.

StockTA

Holding on is Justified

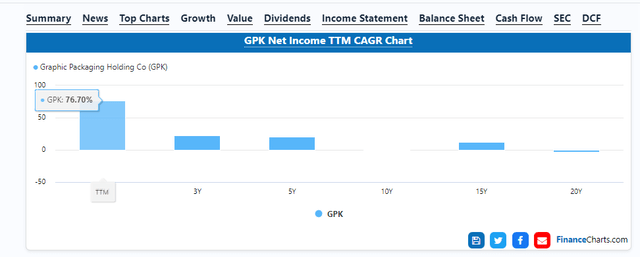

Those who are long-term loyal holders of GPK may opt to stay long or even average up. The recent rise of GPK is likely due to the excellent Q3 earnings report it issued on October 25. The non-GAAP EPS of $0.67 in the third quarter beats expectations by $0.10. The revenue of $2.45 billion was $120 million greater than estimated. Q3 revenue was also +37.6% Y/Y. This strong quarter is enough of an excuse to hold on to your GPK shares. GPK’s TTM revenue CAGR is now 76.70%. Its 2021 revenue growth was 32.58%. Both percentiles are greater than Graphic Packaging’s 5-year average revenue growth of 12.33%.

FinanceCharts.com

The double-digit revenue CAGR of GPK is impressive. The $917 billion global packaging industry is only growing at a 2.8% CAGR. The $215.34 billion paper packaging industry’s anticipated CAGR is only 3.3%. Graphic Packaging therefore is growing faster than the industry it is engaged in.

The other reason you can remain long on GPK is its fair valuation. The +15.57% YTD gain has not made GPK relatively overvalued. The forward GAAP P/E is only 13.47x. GPK could be a growth-at-a-reasonable-price long term investment.

I opine that the well-diversified packaging products/solutions of Graphic Packaging holding can help it sustain its double-digit revenue growth. The diversified product did not cause GPK to be inefficient. This company’s Piotroski F-score is still 6, indicating that it is still efficient and fairly valued.

Unattractive Attributes

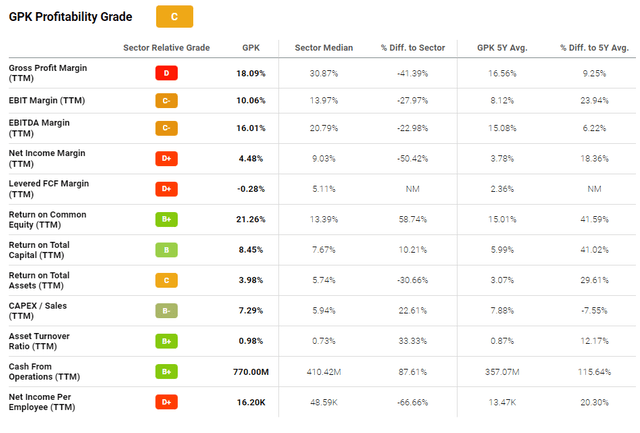

The high growth CAGR is probably why GPK is handicapped by a TTM net income margin of 4.48%. My takeaway is that GPK is making greater sales at the expense of margins. I can understand this marketing strategy. I hope it’s not a permanent thing.

Seeking Alpha Premium

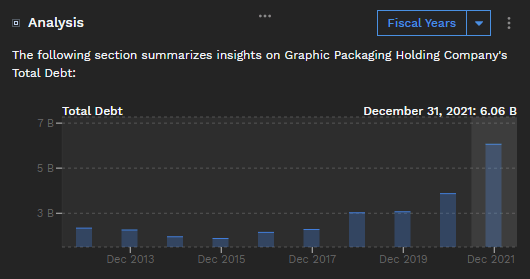

My problem with the high-growth and very low net income margin approach is that it’s not sustainable. This is especially true for companies with large debts. Graphic Packaging Holding Company is a hold because of its $5.5 billion debt and low net income margin. Couple this with GPK’s tiny $82 million cash reserve and you will understand my position.

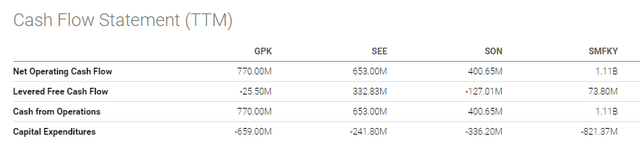

The combination of these three factors explains why GPK has a dangerous Altman Z-score of 1.77. Cash flow is particularly important for companies and individuals. I cannot endorse GPK because of its –$25.50 million levered free cash flow. A negative FCF denotes a company is having a tough time meeting its debt and other financial obligations.

Seeking Alpha Premium

The obvious risk now is that a prolonged negative levered free cash flow and low net income margin could eventually worsen GPK’s flat dividend history.

My Verdict

This is not a bearish assessment for Graphic Packaging Holding Company. This is just me telling Seeking Alpha loyalists to be prudent on stocks with low net income, low cash reserves, negative levered cash flow and that also happens to have a huge debt. You can defy this article’s neutral thesis at your own discretion.

Motek Moyen VIP Account @Finbox.io

The recent high YoY revenue growth could also be attributed to GPK buying AR Packaging last year. The chart above hints that the AR Packaging acquisition contributed to the debt load. You should ask the management why they did not just go for an all-stock deal.

I hope the revenue boost from this acquisition will eventually result in stronger profitability. Only better margins can help this company reduce its huge debt load. The $5.5 billion debt is also unattractive to much bigger packaging companies that might consider buying GPK. Do not expect a takeover of GPK soon.

There are other packaging-related stocks with better fundamentals and aren’t saddled with too much debt. My verdict is that the low forward GAAP P/E valuation of GPK might be because many still view it as a debt-handicapped value trap.