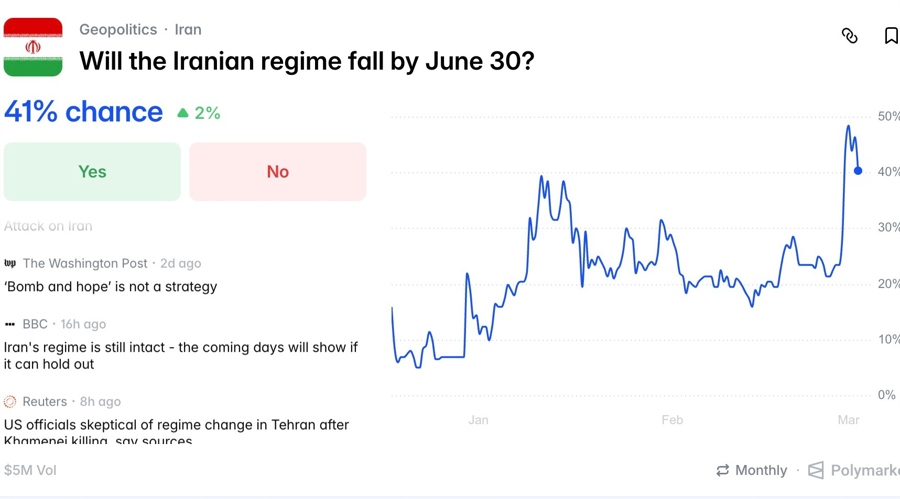

The price of Bitcoin continues to grind slowly to the downside while other major digital assets follow. The market is moving in tandem with the legacy financial sector, pricing in a higher terminal rate for 2023.

As of this writing, Bitcoin trades at $16,600 with sideways movement in the last 24 hours. In the previous week, the cryptocurrency is recording a 3% loss. Previous outperformers, such as Dogecoin, Polygon, and Ethereum, are seeing heavy losses on similar timeframes.

Bitcoin Likely To Bounce Back In The Coming Days?

The number one crypto is trending to the downside after the U.S. Federal Reserve (Fed) Chairman Jerome Powell spoke about the current macroeconomic conditions. During last week’s Federal Open Market Committee, the Fed Chair highlighted his objective to continue fighting inflation.

This decision might lead to lower interest rates in the short term, but the Fed targets a higher terminal rate, the percentage at which the institution will finally pivot, in the long term. The market is reacting to this new reality.

According to several reports, market participants were expecting a terminal rate of around 5%, which increased to 5.5%. Interest rates could remain this high until 2024. Several Fed representatives echoed the same hawkish message. New York Fed President John Williams said:

(…) we’re going to have to do what’s necessary” to get inflation back to the Fed’s 2% target… (terminal or peak rate) could be higher than what we’ve written down.

As the Fed gave its message, Bitcoin saw a clean rejection from the 50-day Simple Moving Average (SMA). If the cryptocurrency can breach this level, it might begin shifting the bearish trend and reclaim previously lost territory.

BTC is battling with the loss in bullish momentum and seems at risk of returning to its yearly lows. Bulls must hold the line at around $16,200 to $16,500 to prevent further downside.

Data from Material Indicators point to a spike in volatility for the coming week. On Thursday, the U.S. will publish data on its job market. If this country’s economy remains strong, the Fed will have the support it needs to continue hiking interest rates.

Therefore, vital economic data will remain a bearish indicator for Bitcoin and traditional equities. Conversely, Material Indicators record a long signal on their Trend Precognition indicator. This signal might hint at a BTC price recovery for the short term.

2/6 On the 2Day & 3Day TFs, the predictive A1 Slope Line is indicating that bullish momentum may continue for #BTC into Tuesday but it starts fading by mid week.

Keep in mind, the A1 Slope Line is a real time indicator so it can and will change if detects a shift in momentum. pic.twitter.com/GaEEKf2U2A

— Material Indicators (@MI_Algos) December 19, 2022

Is this indicator hinting at favorable volatility for the bulls after the upcoming jobless report? Remains to be seen.

![[Forbes] Are we in a recession? [Forbes] Are we in a recession?](https://external-preview.redd.it/4ZdB99iZZtB7VK_JgEvnXDmBTEJEMNXMR1FR4NNsuus.jpg?auto=webp&s=be52ef4d4487892e67bacf0e34488fdc2cf3d602)