magnez2

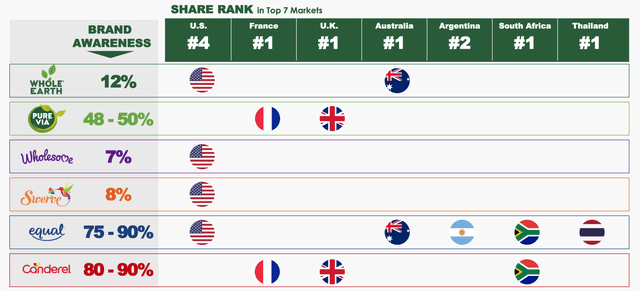

Since the last time I wrote about the sugar alternatives company Whole Earth Brands (NASDAQ:FREE), its share price is up by a huge 38%. This wasn’t quite what I had expected, going by its numbers. And I maintain that. In other words, it’s possible that the run-up is driven largely by sentiment, which can change on a dime. This is not to say that it’s a bad company. Not in the least, in fact, it has an impressive presence in the sweetener market (see chart below). Only that there aren’t enough fundamental reasons to justify the extent of price increase right now.

Source: Whole Earth Brands

Change of guard

Let’s get to the updates since. The latest one came in in early December 2022, as the company appointed a new CEO, Michael Franklin, who took the reins from 2023 onwards. Franklin, who was already on the company’s Board of Directors, is also a partner at the investment firm Mariposa Capital. He takes over from Albert Manzone, who was CEO for the past seven years. In Franklin’s role at Mariposa Capital he supports operations and M&A could be significant to FREE, which has been on an acquisition drive, buying out companies like Swerve and Wholesome Sweeteners.

Investors didn’t respond much to the news though. In fact, the stock was already falling when the development was announced, and it continued to fall even after, only picking up speed once more in the last ten days of December. It’s worth pointing out that this was the second big personnel for FREE in 2022. Early in the year, it had replaced its then CFO too. Whether these changes imply any strategic developments in the near future, however, remains to be seen.

Growth looks alright

The other update since I last covered FREE is its third-quarter result. At least as far as growth is concerned, Whole Earth Brands has done fine so far this year. Its revenues have risen by 10.6% at market exchange rates and 13.2% at constant currency for the first nine months of 2022 (9M 2022). This is higher than its initial revenue guidance of 7-10% growth for the full year 2022. In fact, it has now upgraded its guidance more towards the top end of the range to 8-10%.

If you are wondering why it’s expecting lower growth in the final quarter of the year, the answer is already there in the third quarter (Q3 2022) figures. The company reported just 4.9% growth during the quarter, though at constant currency it did better with an 8.1% increase. The weakness compared to 9M needs to be seen in the context of a high base following acquisitions last year, which resulted in a bump up in revenue figures. In Q3 2021, FREE’s revenues had grown by 92.4%. This indicates that there’s no fundamental slowing down in growth. In fact, nowhere does the company allude to a decline in consumer demand on weakening economic conditions, which is common in these times.

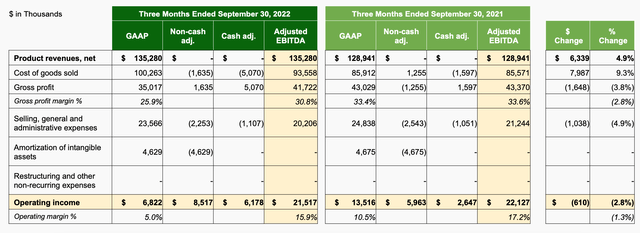

Income Statement (Source: Whole Earth Brands)

Weakening in earnings

However, inflation is impacting FREE. Its gross profits declined in Q3 2022 as the cost of goods sold rose by 9.3%, exceeding revenue growth. In explaining this, the company mentions saying it was “largely driven by cost inflation”. Though there were other reasons like a supply chain reinvention project as well as non-recurring accounting adjustments related to inventories. Its gross margin declined as a result to 25.9% down from 33.4% last year.

Similarly, operating profits and margins have dropped too. In fact, its operating margin has more than halved to 5% in Q3 2022. For 9M 2022 too, the margin figures don’t look much better, with the gross margin down to sub-30% levels and operating margins just a shade better than those in the latest quarter. This weakness in margins is important to note right now. Even though the recent inflation prints have started showing a come-off, which looks like a positive for the future, it still remains high by historical standards and going by forecasts, this softening is not going to last.

As a result of the fall in operating earnings and also higher interest expenses, Whole Earth Brands’ has reported a net loss in the latest quarter. This brings me to its interest coverage ratio. The last time, I had flagged it as not being ideal, since at 1.2x it was less than the 2x that would make it healthy. Now, it has fallen even lower to 0.8x, which is one indicator of a company being unable to pay for its expenses. This isn’t as dire as it sounds though, the company still has a healthy current ratio and for 9M 2022, its net change in cash and cash equivalents is also a positive figure.

What the market multiples say

A decline in earnings can be one reason for a dip in the company’s price. But here, it has risen despite a net loss. As a result, the price-to-earnings (P/E) ratio is at 157.2x, compared to 21x for consumer staples. This indicates that FREE’s price is due for a correction. But here’s another multiple, the price-to-sales (P/S), which actually is much lower at 0.34x compared to consumer staples at 1.13x, which indicates substantial potential for increase. This kind of price increase can take it back to the highs of mid-2021.

What next?

But 2023 is not likely to be anything like 2021, which saw a rally as the world got out of lockdowns. In fact, it’s expected to be quite the opposite, weighed down by a recession and consumers watching their wallets as prices stay high. While consumer staples are a defensive investment, if bearishness sets in again, companies with stable financials and revenue visibility are likely to do well.

While Whole Earth Brands is a company with leading sweetener brands in its portfolio, it doesn’t have the history of sustained growth and earnings that bigger companies do. This can make its price susceptible to declines in the event of any adverse market conditions. It doesn’t help that its recent financials show some weakness too. There can be an upside, going by its P/S, the current positive mood of the market and a decline in inflation, which if sustained, could be a positive for FREE. I’d hold for now.