Gold exchange-traded funds (ETFs) have grown in recognition as a method for buyers to realize publicity to gold with out proudly owning the metallic bodily. They commerce on main inventory exchanges like common shares and supply the power to purchase and promote rapidly throughout market hours. Gold ETFs are engaging as a result of they get rid of the necessity for safe storage, insurance coverage, and verification of authenticity.

Along with comfort, gold ETFs supply liquidity and a comparatively low value of entry in comparison with shopping for bodily gold. This makes them accessible to each seasoned buyers and freshmen seeking to diversify their portfolios. In response to the U.S. Division of the Treasury, gold performs a major position in sustaining financial stability, making it a precious hedge for buyers.

What to Search for When Selecting the Greatest Gold ETF

When evaluating gold ETFs, think about the next components:

- Expense ratios: Decrease charges can enhance your web returns over time.

- Backing kind: Bodily-backed ETFs maintain gold in safe vaults, whereas artificial ETFs use derivatives to trace gold costs.

- Liquidity: Larger buying and selling volumes usually imply tighter bid-ask spreads and simpler execution.

- Monitoring accuracy: Search for funds that carefully comply with the spot worth of gold with minimal deviation.

Taking these components under consideration will assist you to discover an ETF that matches your threat tolerance, funding targets, and time horizon.

Understanding Completely different Sorts of Gold ETFs

Gold ETFs are available a number of sorts, every serving a distinct function in a portfolio.

Commonplace Gold ETFs

These ETFs are backed by bodily gold saved in safe vaults. Examples embrace SPDR Gold Shares (GLD) and iShares Gold Belief (IAU). They goal to reflect the value of gold and are usually utilized by long-term buyers as a hedge towards inflation or market volatility.

Leveraged Gold ETFs

Leveraged gold ETFs use monetary derivatives to amplify the each day motion of gold costs, usually by 2x or 3x. They will generate bigger short-term beneficial properties but additionally carry larger threat. Due to the compounding impact, they’re finest suited to short-term merchants who actively monitor their positions.

Present Promotion: get your Free Gold IRA Information At present!

Inverse Gold ETFs

Inverse gold ETFs are designed to rise in worth when the value of gold falls. These funds are sometimes utilized by merchants to hedge towards declines in gold or to invest on downward worth actions. Like leveraged ETFs, they’re usually for short-term use.

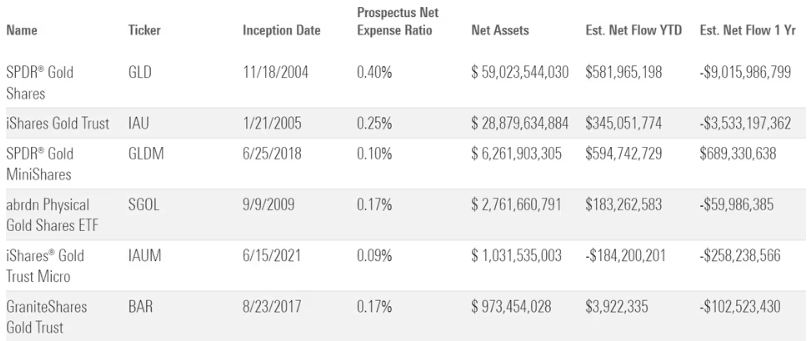

Evaluating Standard Gold ETFs

Selecting the best gold ETF could be simpler while you examine main choices side-by-side.

- SPDR Gold Shares (GLD): One of many largest and most liquid ETFs, backed by bodily gold. Expense ratio round 0.40%.

- iShares Gold Belief (IAU): Decrease expense ratio than GLD at 0.25%, making it interesting for cost-conscious buyers.

- Aberdeen Commonplace Bodily Gold Shares ETF (SGOL): Shops gold in Swiss vaults, which some buyers favor for geopolitical diversification.

- ProShares Extremely Gold (UGL): A leveraged ETF for merchants looking for 2x each day gold worth publicity.

Evaluating components like charges, vault location, and buying and selling quantity will help slim your decisions.

Shopping for Gold ETFs vs. Shopping for from the Mint

Shopping for gold from the U.S. Mint or different sovereign mints provides buyers bodily possession within the type of cash or bullion. This may be interesting for individuals who worth having tangible property. Nevertheless, bodily gold requires safe storage, insurance coverage, and will have larger transaction prices.

Present Promotion: $15,000 in Free Silver on Certified Purchases

Gold ETFs, against this, present a paper-based solution to spend money on gold that may be traded simply and with out the logistical challenges of proudly owning bullion. Some buyers select to mix each approaches, holding ETFs for liquidity and bodily gold for long-term wealth preservation.

How Gold ETFs Carry out in Completely different Market Circumstances

Gold ETFs usually behave in a different way relying on the financial setting.

- Throughout inflationary intervals: Gold ETFs could rise as buyers search a hedge towards foreign money devaluation.

- In occasions of market uncertainty: Demand for gold as a protected haven can improve, lifting ETF costs.

- Throughout sturdy fairness markets: Gold ETFs could underperform as buyers shift towards riskier property.

Understanding these patterns will help you determine when and how you can regulate your gold ETF holdings.

Evaluating the Greatest Gold ETFs for Value and Efficiency

When researching the very best gold ETFs, you will need to examine their expense ratios, values, and monitoring accuracy. The bottom expense ratio can have a significant affect on long-term returns, particularly in a diversified portfolio. Most of the finest gold ETFs observe the spot gold worth carefully, providing publicity with out the storage prices of bodily gold bullion.

The biggest gold ETF by property, SPDR Gold Shares, has been a go-to for a lot of buyers over the previous yr, whereas iShares Gold Belief provides a decrease expense ratio for cost-conscious consumers. Mutual funds that spend money on gold may also be an choice, although they usually carry larger charges and fewer intraday liquidity in comparison with ETFs.

When defining your funding targets, think about whether or not you might be looking for short-term beneficial properties, a protected haven throughout market volatility, or a gentle hedge towards inflation. Choosing the correct mixture of gold ETFs and different asset lessons will help guarantee your portfolio stays balanced by means of altering market circumstances.

Understanding Gold ETF Construction and Market Function

Gold ETFs observe the value of gold by means of completely different mechanisms, with physically-backed funds holding bullion and artificial funds utilizing derivatives. For these looking for the most secure choices, physically-backed ETFs that retailer gold in safe vaults supply peace of thoughts. Storage prices are constructed into the fund’s expense ratio, so it’s value evaluating the full value of possession.

Buyers could favor ETFs that present direct publicity to the gold market with out the dangers of energetic administration. A number of the best-performing funds over the previous yr have been these with a transparent mandate to reflect the spot gold worth. In constructing a diversified portfolio, gold ETFs can act as a counterbalance to equities and bonds. They’re usually used as a protected haven in turbulent markets, serving to to protect capital.

Understanding a fund’s construction, web asset calculation, and the potential for monitoring error can information your choice. Whether or not selecting the biggest gold ETF for its liquidity or a smaller fund with a novel vaulting technique, aligning your selection along with your monetary targets and threat tolerance is crucial.

How Gold Bullion and Funds Complement Every Different

Whereas gold ETFs supply comfort and liquidity, some buyers nonetheless favor the tangible safety of gold bullion. Bodily gold can present a way of stability throughout market turbulence, whereas the very best gold ETFs ship simpler buying and selling and portfolio rebalancing. One of the best gold ETFs usually function a complement to bodily holdings, giving buyers flexibility to regulate publicity with out promoting their tangible property.

Mutual funds that spend money on gold-related corporations can additional diversify a portfolio, capturing progress from mining operations and associated industries. Nevertheless, not like ETFs, mutual funds are usually not traded intraday, so buyers ought to plan for much less quick liquidity. By mixing bodily gold, the very best gold ETFs, and mutual funds, buyers can create a resilient construction that aligns with long-term targets and responds successfully to altering market dynamics.

Highlight on Hamilton Gold Group

Hamilton Gold Group is thought for offering each bodily gold funding choices and schooling for these serious about gold ETFs. They provide sources to assist buyers perceive the advantages and dangers of every technique and help in creating balanced treasured metals methods. By combining bodily gold and ETFs, buyers can take pleasure in each safety and adaptability.

Present Promotion: Unconditional Purchase Again Assure

Widespread Errors When Investing in Gold ETFs

- Overlooking expense ratios, which may erode returns over time.

- Misunderstanding the dangers related to leveraged or inverse ETFs.

- Concentrating all gold publicity in a single ETF with out diversification.

- Failing to plan for tax implications.

Avoiding these errors can result in extra constant efficiency and higher alignment along with your monetary targets.

Methods for Utilizing Gold ETFs in Your Portfolio

Gold ETFs can be utilized in a number of methods:

- Lengthy-term hedge: Commonplace gold ETFs can function safety towards inflation and foreign money devaluation.

- Brief-term trades: Leveraged and inverse ETFs could also be appropriate for tactical market strikes.

- Diversification device: Combining gold ETFs with shares, bonds, and different property can cut back portfolio volatility.

- Rebalancing mechanism: Use gold ETFs to regulate your portfolio allocation effectively.

Tax Issues for Gold ETF Buyers

In america, most gold ETFs that maintain bodily bullion are taxed as collectibles. This implies long-term beneficial properties could also be topic to a most federal tax fee of 28%, in comparison with decrease charges for shares. Brief-term beneficial properties are taxed as peculiar revenue. Buyers ought to issue taxes into their total technique and think about consulting a tax skilled.

Sensible Steps, International Insights, and Key Issues for Gold ETF Buyers

Investing in gold ETFs could be enhanced by following a sequence of sensible steps and understanding the worldwide market panorama. Earlier than making purchases, buyers ought to overview fund particulars and the supplier’s web site to make sure accuracy and reliability. The variety of ounces every share represents, the fund’s historic returns, and its funding standards are important to check.

In markets resembling India, the place gold has been valued for many years as a retailer of wealth, ETFs present a regulated, trendy various to bodily possession. Worldwide exchanges just like the BSE listing a number of gold ETF merchandise, giving retail buyers and establishments a wide range of choices. Submitting a request for detailed fund knowledge in accordance with regulatory our bodies, together with SEBI, will help in evaluating transparency.

Key takeaways for buyers embrace contemplating staff experience, studying all accessible content material and proposals, and utilizing instruments resembling a inventory screener to observe efficiency. Take note of worldwide competitors for gold provide, as it will probably affect costs and have an effect on returns. Aug developments within the spot market can present well timed indicators, whereas understanding the primary issue driving demand, resembling industrial purposes or foreign money fluctuations, is essential.

Sustaining an excellent funding order inside your portfolio, whether or not allocating a certain quantity to gold ETFs or balancing towards different asset lessons, can cut back losses and align along with your monetary state of affairs. Tables and knowledge evaluating merchandise side-by-side can make clear variations in AUM, charges, and previous efficiency. Lastly, partnering with a educated advisor and persevering with to observe matters related to gold demand will assist be certain that investments stay consistent with your long-term targets.

Conclusion

One of the best gold ETF for you’ll rely in your targets, threat tolerance, and funding technique. Commonplace physically-backed ETFs like GLD and IAU are fashionable decisions for long-term buyers. Extra superior merchants could think about leveraged or inverse ETFs for short-term methods. Understanding the variations and realizing how every kind suits into your total plan is the important thing to creating the correct selection.

Interested in shopping for treasured metals as part of your portfolio allocation? Take a look at our new learn: How you can spend money on gold and silver!

FAQs

The most secure gold ETFs are usually physically-backed funds from well-established issuers. Examples embrace SPDR Gold Shares (GLD) and iShares Gold Belief (IAU). These ETFs maintain allotted gold in safe vaults and are audited recurrently to make sure transparency.

Sure, most main brokerage corporations permit gold ETFs in conventional and Roth IRAs. This supplies a simple solution to acquire gold publicity inside a tax-advantaged account with out coping with the storage guidelines that include bodily gold in a self-directed IRA.

Leveraged gold ETFs are usually not really helpful for freshmen. They’re designed for short-term buying and selling and might lose worth rapidly attributable to each day compounding results. Novices are often higher served with customary, physically-backed gold ETFs.

Gold ETFs supply liquidity, decrease transaction prices, and no want for bodily storage. Proudly owning gold cash supplies tangible possession, which some buyers favor for long-term wealth preservation or as a hedge towards excessive market occasions. Many buyers select to carry each for diversification.

In america, most gold ETFs that maintain bodily bullion are taxed as collectibles, with a most federal tax fee of 28% on long-term beneficial properties. That is larger than the long-term capital beneficial properties fee for shares, which may make tax planning an necessary a part of gold ETF investing.

Prime U.S. Brokers of 2025

★ ★ ★ ★ ★

Options:

✅ U.S. shares, ETFs, choices, and cryptos

✅ Now 23 million customers

✅ Money mgt account and bank card

Signal-up Bonus:

Free inventory as much as $200 with new account, plus as much as $1,500 extra in free inventory from referrals

Be taught extra

★ ★ ★ ★ ★

Options:

✅ Free Degree 2 Nasdaq quotes

✅ Entry to U.S. and Hong Kong markets

✅ Instructional instruments

Signal-up Bonus:

Deposit $100, get $20 in NVDA inventory; Deposit $2,000, get $50 in NVDA inventory; Deposit $10,000, get $300 in NVDA inventory; Deposit $50,000, get $1,000 in NVDA inventory

Be taught extra

★ ★ ★ ★ ☆

Options:

✅ Entry 150+ world inventory exchanges

✅ IBKR Lite & Professional tiers for all

✅ SmartRouting™ and deep analytics

Signal-up Bonus:

Refer a Buddy and Get $200

Be taught extra