The inventory of Ola Electrical Mobility (Ola) has run up over 45 per cent over the previous 30 days and about 50 per cent from its 52-week low in mid-July. The bullish sentiment displays the optimism surrounding the inventory. Good ends in Q1 FY26 and its Auto enterprise approaching free cash-flow (FCF) neutrality seem like the first causes. Right here, we dissect what works for the inventory.

Enterprise declines

Because the e-two-wheeler (e-2W) market enters consolidation after a section of excessive development by early adopters, Ola moved to a balanced worthwhile strategy from the sooner aggressive one. This meant decrease sale volumes. Income in Q1 FY26 fell 50 per cent to ₹828 crore. With friends launching new fashions/variants, intense competitors, too, performed its half. Nevertheless, the outlook for FY26 and past seems higher.

Margin to enhance

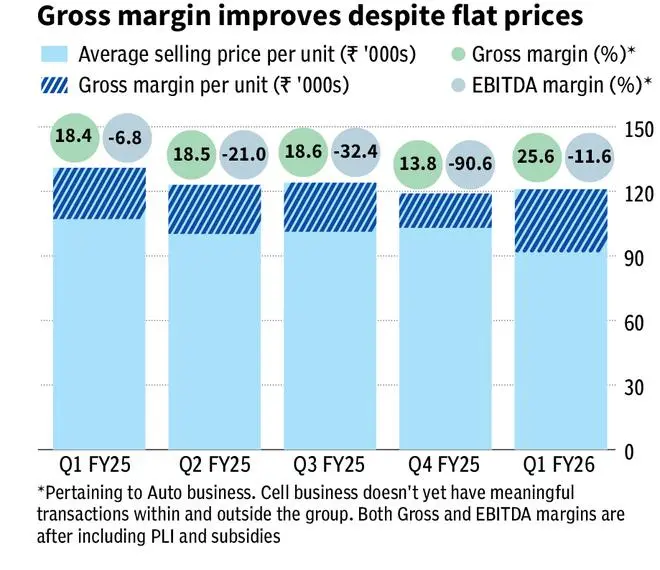

Ola has two companies/verticals – one which manufactures and sells e-2Ws (Auto enterprise), and the opposite that manufactures cells for battery packs (Cell enterprise). Q1 FY26 noticed substantial enchancment in gross margin from 18 per cent in FY25. Within the month of June, the Auto enterprise even turned EBITDA-positive, per the administration. As might be seen from the chart, worth or realisation hasn’t performed a significant function in margins bettering. What in actual fact has, is the BoM (invoice of supplies) value discount, because of greater share of in-house components.

The recently-launched Gen-3 scooter is an improved product with greater content material of in-house components resembling motors. This meant decrease failure charges, guarantee claims and better margin. This product made 80 per cent of quantity offered in Q1 FY26. Ola additionally has a value discount road-map in place, whereby working bills within the Auto enterprise will likely be stored right down to ₹100 crore monthly from ₹178 crore on a mean in FY25.

Additional, within the current quarter, PLI advantages and subsidies made simply 2.5 per cent of Auto income, versus a mean of 10 per cent in FY25. The Gen-3 scooter has been licensed for PLI profit just lately and going forward, PLI profit will circulation via to margins. Given this, the administration is taking a look at an FY26 exit gross margin of 35-40 per cent.

Equally, the recently-launched e-bike ‘Roadster’ can also be to be probably authorised for PLI within the coming quarters. Margin-wise, the bike is anticipated to earn as a lot because the Gen 3 scooter. Distribution, too, will likely be ramped as much as all Ola shops from September-end; it’s at the moment accessible in 200-odd shops.

Cell enterprise outlook

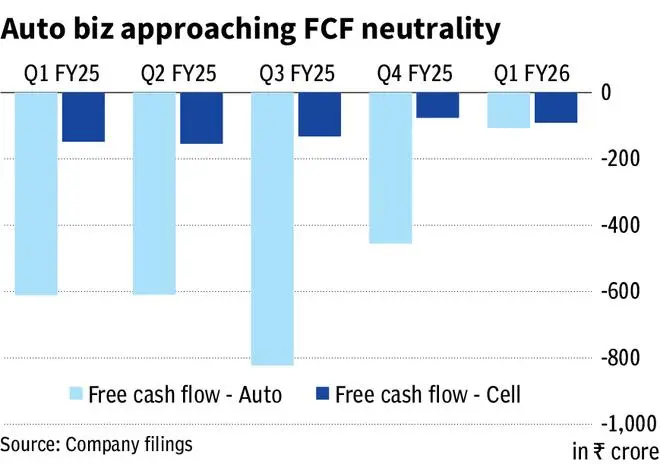

Ola’s cell Gigafactory is budgeted to value about ₹2,800 crore. That is to construct a capability of 5 GWh, which roughly means about 12 lakh autos might be outfitted with a battery pack of 4 kWh. For context, about 11.5 lakh e-2Ws have been offered within the nation in FY25. The plant already has a capability of 1.4 GWh and Ola has spent about ₹1,500 crore on it. The capex projection for FY26, for constructing the remainder of the capability, is about ₹1,000 crore; the stability could be made within the subsequent 12 months. Therefore, the Cell enterprise received’t change into FCF impartial within the close to time period.

Nevertheless, the Auto enterprise — having seen sufficient capability buildouts — will now transfer in direction of FCF neutrality. The administration expects it to change into FCF optimistic by FY26-end. The in-house cells will likely be utilized in a few fashions delivery this quarter, whereas the remaining proceed to be shipped with imported cells. That is one other margin lever.

Although the manufacturing of cells is a capital-intensive enterprise, Ola assesses that advantages resembling a dependable provide, arbitrage with imported cells from import obligation and value benefit from proudly owning the know-how outweigh the prices. Even when working at 1.4-GWh capability, Ola hopes it will lower your expenses on the gross margin stage. With the excess capability, the corporate seems to faucet alternatives within the BESS (battery vitality storage system) area and even provide to different OEMs.

The cells are additionally eligible for PLI. The situations require Ola to construct capability of as much as 20 GWh by FY27. Nevertheless, for the reason that administration deems the present capability ample for the following 3-5 years, it has been factoring a most penalty of ₹100 crore per quarter within the P&L.

Positives priced in

Although there are these positives, execution just isn’t a given. Guarantee value (at 12 per cent of FY25 income) is to be intently monitored. In This fall FY25, the corporate made a one-time extra provision of ₹250 crore (5.5 per cent of FY25 income) in direction of guarantee claims from clients of the older Gen-1 and -2 scooters. Now, 70 per cent of Gen-1 scooters have handed the guarantee interval and the remaining is anticipated to cross within the subsequent 12 months. The recently-launched Gen-3 scooter doesn’t have sufficient classic to show it would save on guarantee.

Competitors is one thing that Ola can’t merely ignore. Legacy OEMs resembling Bajaj and TVS are nicely on monitor in direction of profitability of their electrical portfolios. Hero, with its Vida choices, has almost doubled its FY25 market share to about 9 per cent now. Peer Ather is engaged on a brand new versatile, cost-effective platform. Whereas the intent is to maintain working bills (38 per cent of income in Q1 FY26) in test, tackling competitors may imply greater promotional expenditure. Additionally, with new launches sooner or later, R&D prices may very well be buoyant.

Regardless of boasting an in-house cell facility, Ola will nonetheless be weak to volatility in enter costs. Lithium Carbonate costs have rallied over 10 per cent in current weeks. Contemplating the above components, the inventory with its present valuation of 5.7 instances EV/income seems priced to perfection, leaving no margin for error. Therefore, traders can wait and watch till there may be higher readability on the corporate’s execution.

Revealed on September 6, 2025