Up to date on April fifteenth, 2022 by Josh Arnold

Mergers and acquisitions happen fairly often within the capital markets, however when it comes to scale, media protection, and significance for dividend buyers, the now-completed transaction between AT&T (T) and Discovery (DISCA) is likely one of the largest in current reminiscence. The brand new, mixed firm is known as Warner Bros. Discovery, and trades with the ticker WBD.

AT&T unwound a few of the merger exercise it accomplished previously decade and making an attempt to refocus its enterprise. Previous to the merger, AT&T was a Dividend Aristocrat due to its 30+ years of rising dividends.

The Dividend Aristocrats are a bunch of 66 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase.

You possibly can obtain an entire checklist of all 66 Dividend Aristocrats (plus vital monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink under:

Warner Bros. Discovery isn’t paying a dividend straight away, which is typical for such a transaction. That is notably true given Discovery didn’t pay a dividend as a standalone firm to the merger.

On this article, we’ll check out the transaction itself, what the addition of WarnerMedia means to Discovery’s outlook, and whether or not or not we would see the corporate pay a dividend sooner or later.

Transaction Overview

Let’s start with the phrases of the deal, and as we are able to see under, the businesses have elected to make use of a Reverse Morris Belief transaction. Primarily, the sort of transaction permits AT&T to create a tax-free spinoff of WarnerMedia by instantly merging it into Discovery.

Supply: Investor presentation, slide 5

WarnerMedia was spun off into a brand new firm, which then instantly merged with the prevailing Discovery enterprise with the latter’s shareholders proudly owning 29% of the brand new firm, and AT&T shareholders taking the remaining 71%.

Consequently, AT&T acquired $43 billion of money and equivalents as a part of the deal, which quantities to compensation for shareholders for the WarnerMedia enterprise.

Associated: To see an in depth evaluation of the merger from the angle of AT&T, click on right here.

The aim of this transaction is to take the content material and media portion of AT&T’s present enterprise that doesn’t essentially match strategically with the rest of the enterprise, and permit AT&T to refocus its enterprise on telecom and broadband, whereas Discovery enormously expands its content material library.

We see the transfer as favorable for each firms, and we expect Discovery’s development prospects are much-improved following completion of the transaction, which closed in early-April 2022.

What Discovery Seems Like Publish-Merger

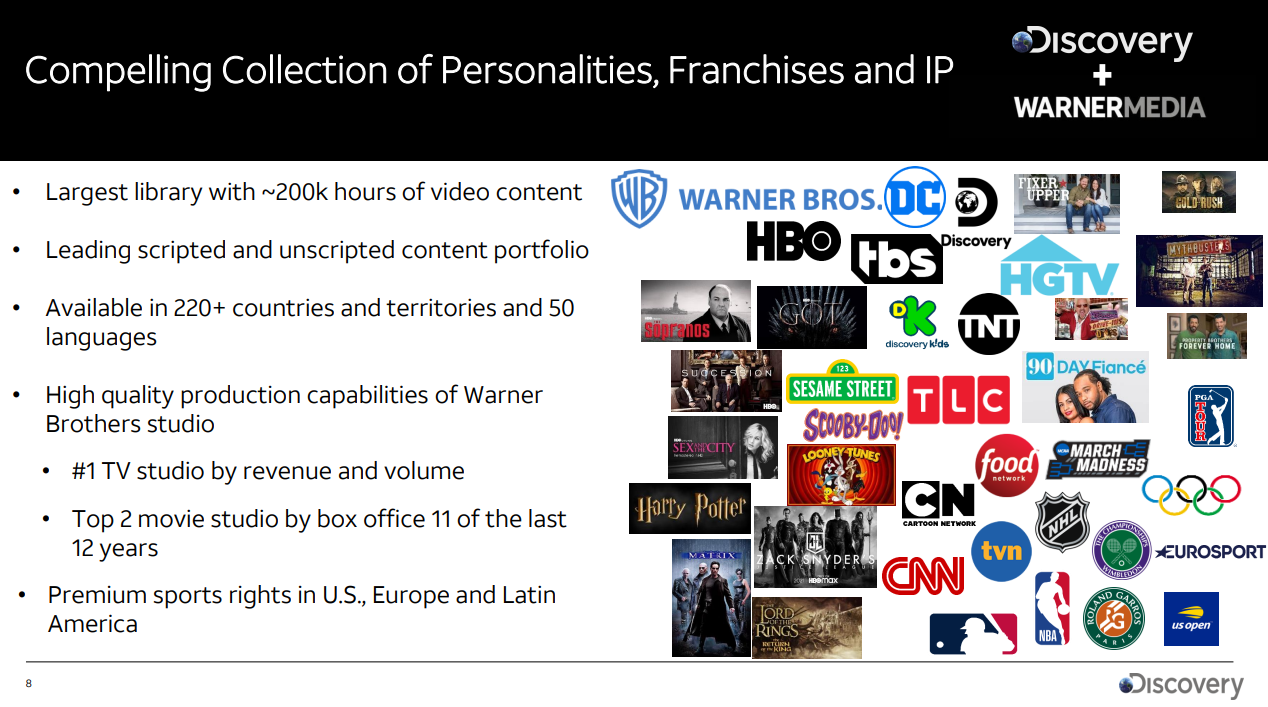

By consummating this transaction, Discovery’s content material library strikes from what’s extraordinarily reliant upon actuality and documentary-style content material to including profitable franchises like Warner’s film enterprise, HBO, TBS, Harry Potter, Lord of the Rings, and way more.

Supply: Investor presentation, slide 8

Discovery instantly strikes into the highest spot when it comes to TV income and quantity, and turn into a large participant in scripted content material, the place it had little or no earlier than the merger. Films are one other means Discovery stands to profit from the merger, as Warner’s film studio owns profitable legacy franchises, but additionally creates new content material commonly.

Lastly, Discovery picked up a large reside sports activities portfolio, and we expect the addition of those traces of enterprise might see Discovery with extra steady income and earnings, and stronger, extra diversified development potential than the legacy Discovery portfolio.

Development Prospects

We estimated Discovery might develop earnings at about 5% per yr previous to the merger, however with the addition of the previous WarnerMedia enterprise, we expect the mixed entity might attain a sustainable double-digit development fee within the years to come back. Discovery+, the corporate’s comparatively new however extremely profitable streaming service, along with licensing offers and widespread franchises from Warner Bros. might see the mixed firm develop fairly strongly.

That features Warner’s large portfolio of TV properties the place it’s an trade chief. Discovery now stands to profit from that regular and rising income stream within the years to come back.

Warner Bros. Discovery’s income is about to leap from $12 billion final yr to about $50 billion this yr, multiplying the dimensions of the corporate instantaneously.

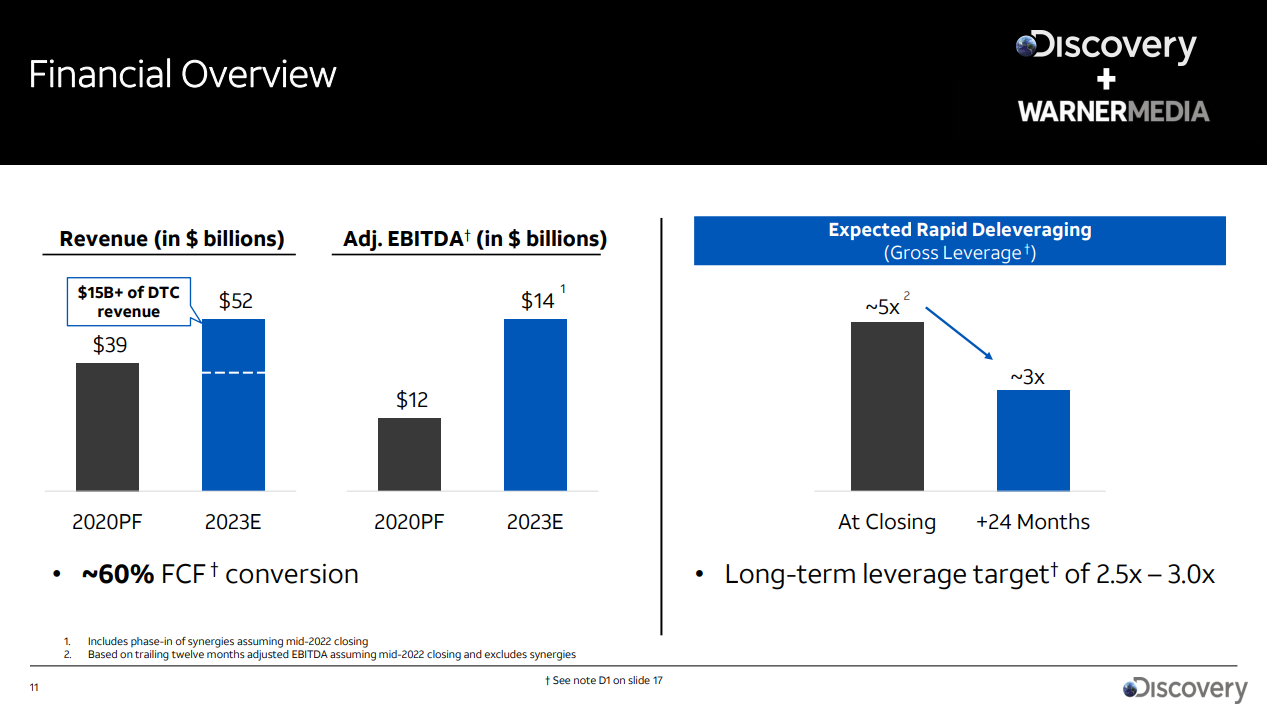

Supply: Investor presentation, slide 11

We are able to see that pro-forma income for Warner Bros. Discovery would have been about $39 billion in 2020, and that administration believes it may be $52 billion by the top of subsequent yr, a quantity that we expect has some upside potential. That displays the large content material library that Discovery is gaining, and it means whole income might ~4X within the subsequent 18 months or so.

That’s spectacular development, and it implies that the mixed entities would see one thing like low double-digit annual development in income on a pro-forma foundation from 2020 to 2023.

The corporate’s main platforms for streaming – Discovery+ and HBO Max – have 22 million and 74 million subscribers, respectively. Warner Bros. Discovery goes to work on the following leg of development partly by bundling.

Adjusted EBITDA is slated to develop at a slower fee, with projections of the mixture rising from an estimated $12 billion in 2020 to $14 billion in 2023, however we nonetheless see Warner Bros. Discovery’s post-merger earnings development alternative as significant.

That is notably true as a result of Warner Bros. Discovery ought to have the ability to considerably deleverage post-transaction. The corporate is about to have a leverage ratio of about 5X at closing, however expects to see it at 3X or much less two years after. That won’t solely present the corporate with extra monetary flexibility, however may even cut back the burden of curiosity expense on the corporate’s earnings.

Mixed, we see Warner Bros. Discovery’s earnings development profile as enhanced following this era of deleveraging, which can then permit additional content material growth funding within the firm’s numerous content material properties.

Along with that, Discovery and WarnerMedia need to save at the least $3 billion yearly in presently redundant prices, which can accrue important advantages over time to the corporate’s margin profile.

These advantages received’t possible be seen till at the least 2023, however we see this as one other important tailwind for not solely earnings development, however free money circulation era that can be utilized for content material funding or additional deleveraging. We see development as front-loaded for income, however with the margin advantages of price financial savings and working expense leverage as accruing a bit later down the highway. Each will assist drive earnings-per-share development.

Dividend Prospects & Valuation

Warner Bros. Discovery doesn’t presently pay a dividend, however we consider that might change following the merger. The legacy Discovery produced important free money circulation, which it used to put money into new content material, servicing debt, and shopping for again its personal inventory to cut back the float.

Whereas the corporate hasn’t elected to instantly pay a dividend following the merger, we consider that after the deleveraging course of is properly underway, which shouldn’t take greater than two years, the corporate shall be very well-positioned to start returning money to shareholders by way of dividends.

Given the hesitancy to pay a dividend up so far, we consider Warner Bros. Discovery would begin with a small dividend, however its free money circulation era post-merger shall be greater than enough to help a significant dividend fairly shortly.

On the present market capitalization of $60 billion, Warner Bros. Discovery is buying and selling for lower than 5X 2023 EBITDA. As soon as the market sees that deleveraging and price financial savings are accruing and boosting margins, all whereas income rises, there might be valuation upside.

As an example, AT&T traded for simply over 8X EBITDA previous to the spin-off, and we see AT&T as a lower-growth proposition than Warner Bros. Discovery. Finally, with a model new inventory, one has to attend and see how it’s valued by the market. Nevertheless, early indications are that Warner Bros. Discovery is kind of cheaply valued.

Ultimate Ideas

Whereas the transaction that noticed Discovery take over WarnerMedia’s enterprise is considerably uncommon and sophisticated, we just like the deal from the acquirer’s perspective. The WarnerMedia enterprise offers the brand new firm a really robust current portfolio of profitable properties, and provides it an instantaneous management place in reside sports activities and scripted content material, the place legacy Discovery was uncompetitive.

Warner Bros. Discovery ought to have about $50 billion annual income to start out, and will present strong price synergies that can assist with earnings development within the coming years. Lastly, the deleveraging that administration has dedicated to will increase the corporate’s flexibility, and afford it the power to start paying a dividend within the years to come back.

Given all of those components, together with the enticing valuation, we just like the inventory as a purchase now that the merger is full and Warner Bros. Discovery is buying and selling by itself.

If you’re keen on discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases shall be helpful:

The most important home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them commonly:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].