spooh

As I contemplate my upcoming retirement in a number of years, I’m keen on creating an revenue stream that pays common excessive yield distributions (ideally >8% annual yield). There are a lot of choices obtainable to long-term traders and relying in your danger tolerance and time-frame, some alternate options could make extra sense than others. Some excessive yield revenue investments that I personal embrace BDCs, REITs, and CEFs of varied flavors, together with bond funds, fairness funds, and a few which are a mix of every.

One other asset class that provides a excessive yield revenue steam can come from MLPs (Grasp Restricted Partnerships), that are most frequently pipeline corporations that transport oil or pure fuel. Pipeline MLPs have typically regular revenue streams that supply traders a excessive yield distribution. Most (however not all) MLPs are within the oil and fuel transport trade as a result of adjustments to the tax code in 1986 enabled them to construction as partnerships. This tax construction additionally affords advantages to traders who maintain MLPs in taxable accounts. Unit holders in MLPs obtain a Ok-1 type at tax time that reveals the tax construction of the distributions they obtained in the course of the earlier 12 months.

Why put money into MLPs now?

The vitality sector has carried out one of the best of any sector within the S&P 500 for the reason that begin of 2022. Though the S&P 500 Vitality Sector index (XLE) is down -18% since June 1 (in comparison with a -6% decline within the total S&P 500 index), the vitality sector remains to be the highest performing one this 12 months and the one sector to point out a achieve. Oil provides are tight due to the Russian invasion of Ukraine and for a wide range of different causes that you could learn extra about right here. The worth of oil is more likely to stay excessive within the short-term and though demand could pullback considerably, the longer-term outlook for demand is predicted to extend once more as the worldwide economic system resumes its restoration.

Vitality demand continues to rebound post-Covid as extra individuals are travelling and returning to the workplace. However, fears of recession and demand destruction from inflation and better fuel costs has had a bearish influence on the sector. For my part, which is backed up by Goldman Sachs, fears of a recession are overblown and already priced in.

“We consider it’s untimely for commodities to succumb to recession issues when the worldwide economic system remains to be rising and markets stay in deficit on robust demand,” stated Goldman Sachs Group Inc. analysts, together with Jeffrey Currie, in a notice to shoppers.

Why Purchase a CEF of MLPs?

There are some benefits to buying MLPs through the use of a CEF (closed finish fund) that holds them. A kind of benefits is that there aren’t any pesky Ok-1s at tax time, and no UBTI, which makes them extra applicable to be held in tax-exempt accounts like an IRA. Additionally, MLPs fluctuate within the quantity and frequency of distributions that they pay out. A CEF can use leverage and alter the holdings in its portfolio to clean out these variations to pay an everyday regular (usually quarterly or typically month-to-month) distribution.

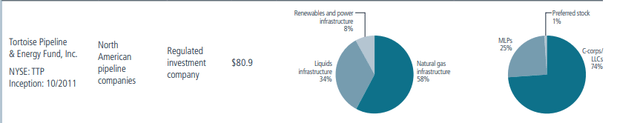

In looking for a CEF that holds MLPs as an funding car in my IRA, I made a decision to check out a number of totally different ones to check and distinction earlier than deciding on Tortoise Pipeline & Vitality Fund (NYSE:TTP). At present, the distribution yield for TTP is 9% and the fund is buying and selling at a reduction of -15%. The YTD worth efficiency is 13.59% and the 1-year worth efficiency is 10.7%.

TTP overview (fund web site)

MLPs additionally have a tendency to supply some safety from inflation as defined within the 2021 annual report for Tortoise Ecofin funds:

With inflation rising all year long, many traders started to acknowledge midstream as an asset class with inflation safety. Pipelines usually have long-term contracts with inflation safety from regulated tariff escalators. Moreover, tariffs on regulated liquid pipelines usually embrace an inflation escalator. This enables will increase aligned with the Producer Value Index (PPI) providing some safety from inflation. Via November 2021, the PPI elevated by 9.0% from the prior 12 months which could possibly be a fabric driver of money flows in 2022.

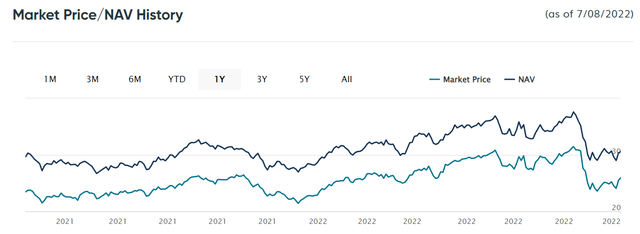

One more reason to contemplate a CEF with MLP holdings is as a result of the funds usually commerce at a reduction to NAV, whereas the underlying holdings if bought individually wouldn’t present that further cushion within the worth to ebook worth. For TTP, the low cost to NAV has been hovering across the -15% low cost degree for many of the previous 12 months.

TTP Value/NAV historical past (TTP fund web site)

Peer Comparability

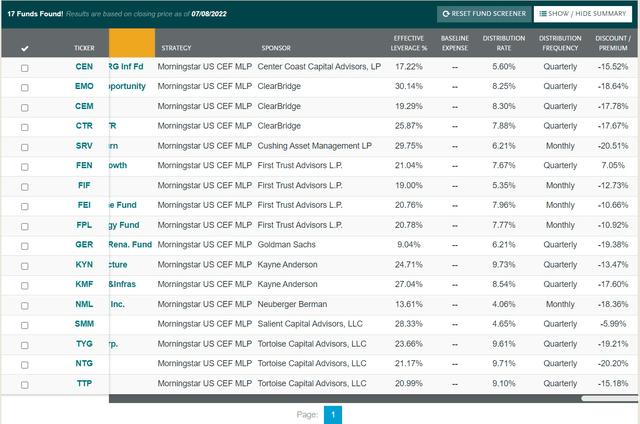

In accordance with a fund screener that I used on CEFConnect.com to establish CEFs that maintain pipeline MLPs, there are presently 17 to select from.

MLP funds from fund screener (CEFConnect)

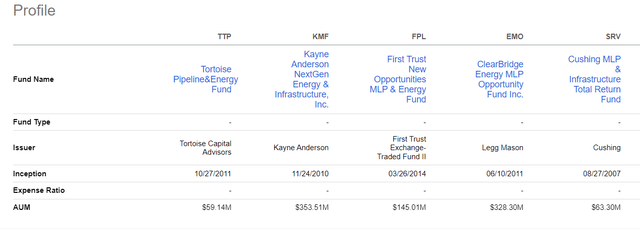

Of these 17, I selected 4 to check to TTP, every of which is from a special sponsor. For functions of this comparability, I wished excessive yield distributions of no less than 6% and an analogous measurement (below $350M in AUM) to TTP. The 4 that I selected to check embrace ClearBridge Vitality MLP Alternative Fund Inc. (EMO), Cushing MLP & Infrastructure Complete Return Fund (SRV), First Belief New Alternatives MLP & Vitality Fund (FPL), and Kayne Anderson NextGen Vitality & Infrastructure, Inc. (KMF).

Comparability of 5 MLP funds (Looking for Alpha)

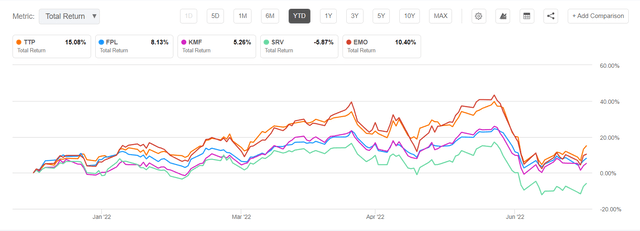

Out of those 5, the YTD and 1-year worth efficiency of TTP was one of the best (and beat a pair others that I additionally checked out). Going again multiple 12 months the efficiency for TTP was not pretty much as good, however I’m sooner or later, not the previous in terms of investing.

YTD Complete Return comparability (Looking for Alpha)

Primarily based on the S&P MLP Index, the 1-year complete return as of July 8, 2022 was about 13%. For TTP as of July 8 the overall return sits at about 19%. MLPs usually observe the worth of oil (which is a proxy for vitality demand) so over the previous few weeks the NAV and market worth of TTP have retreated, providing a shopping for alternative for traders.

As vitality demand picks up once more with summer season journey season and pent-up leftover post-pandemic exercise ramping up, the vitality sector is benefiting. That development will be seen over the previous 12 months, except for a month-long retreat in June as recession fears and the influence of upper fuel costs put a dent in vitality demand.

Oil worth and vitality demand (Looking for Alpha)

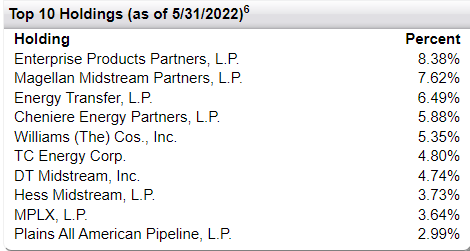

The highest 10 holdings for every of the 5 funds are considerably related. Listed below are the highest 10 holdings for TTP as of three/31/22. You will notice many of those additionally seem as prime 10 holdings in every of the opposite 4 funds.

TTP prime 10 holdings (TTP fund truth sheet)

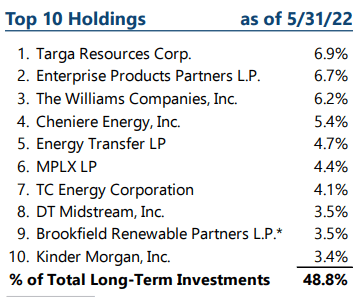

Listed below are the highest 10 for FPL:

FPL prime 10 holdings (FPL fund web site)

That is the KMF prime 10:

KMF prime 10 holdings (fund truth sheet)

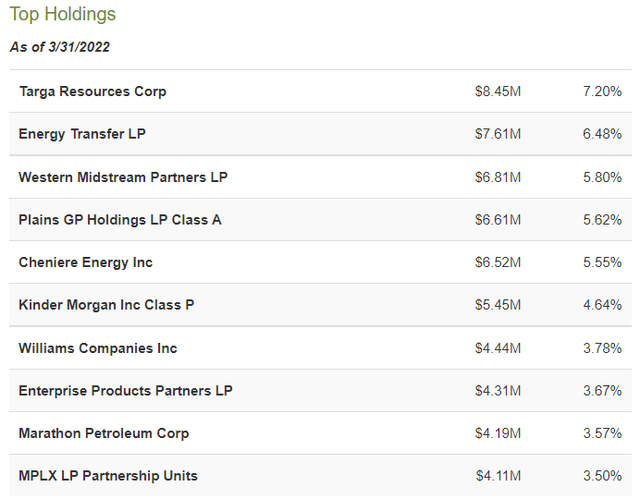

The highest 10 for EMO:

EMO prime 10 holdings (CEFConnect)

The highest 10 holdings in SRV:

SRV prime 10 holdings (CEFConnect)

The ONEOK (OKE) and Enbridge (ENB) holdings are two of the highest 10 holdings that stand out as differentiators for TTP. EMO is the one different fund of the 5 that I in contrast that features ENB as a prime 10 holding. Not one of the different 4 apart from TTP embrace OKE in its prime 10. OKE is likely one of the oldest midstream corporations within the US and is likely one of the finest for producing long-term constant returns in accordance with this latest article.

TTP Property and Protection

As of June 30, 2022, the TTP fund had $89 million in unaudited complete belongings, and the overall asset worth was $67.4M or $30.26 per share. Efficient leverage for the fund is 23.3% as of seven/1/22. The asset protection ratio is required to be no less than 300% for senior secured debt and as of seven/1/22 that protection ratio is 602%. For most popular inventory (together with debt and most popular) that protection ratio should exceed 225% and as of seven/1/22 is 427%.

The fund invests 58% in pure fuel pipelines, 34% in liquids, and eight% in renewables.

TTP portfolio combine (2021 Annual Report)

Again in November 2020, SA contributor Stanford Chemist penned an article concerning a proposed merger between TTP and one other Tortoise fund, NDP, which might have modified the portfolio combine. Apparently, that merger was by no means accomplished and the TTP fund’s efficiency has improved significantly within the 18 months or so since then.

Distributions

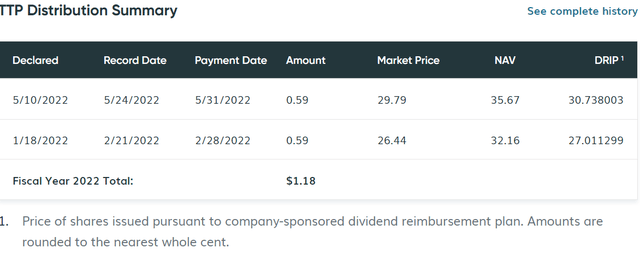

TTP distributes a hard and fast quantity quarterly, presently $0.59 per widespread share. The distribution in January of this 12 months was raised to $0.59 from the earlier quarter when the quantity distributed was $0.37, amounting to a virtually 60% improve over the earlier quarter. The twond quarter distribution of $0.59 was paid on Might 31. Beneath the corporate’s DRIP plan, these distributions have been reinvested at costs beneath NAV.

TTP Distributions (fund web site)

Abstract

The inclusion of an MLP-based fund in a tax-exempt portfolio equivalent to an IRA is a helpful consideration for these traders in search of long-term sustainable high-yield revenue, particularly nowadays. With the latest pullback in oil costs and fears of a doable recession impacting vitality demand within the short-term, there’s a shopping for alternative in MLP funds like TTP. The underlying belongings proceed to generate distribution yields in extra of 6% whereas the market costs have come down. Vitality demand continues to enhance as the worldwide economic system recovers from a post-pandemic world whereas vitality provides stay tight.

As a result of shifting insurance policies associated to fossil fuels and excessive capital expenditures required to extend vitality provides utilizing pipelines, there’s some draw back danger to investing in MLPs, nevertheless, I consider that the long-term potential for progress on account of a resurgence in vitality demand outweighs the dangers. The TTP fund from Tortoise Ecofin is likely one of the finest CEFs that holds pipeline MLPs as its core holdings for producing excessive yield distributions for these traders in search of revenue.